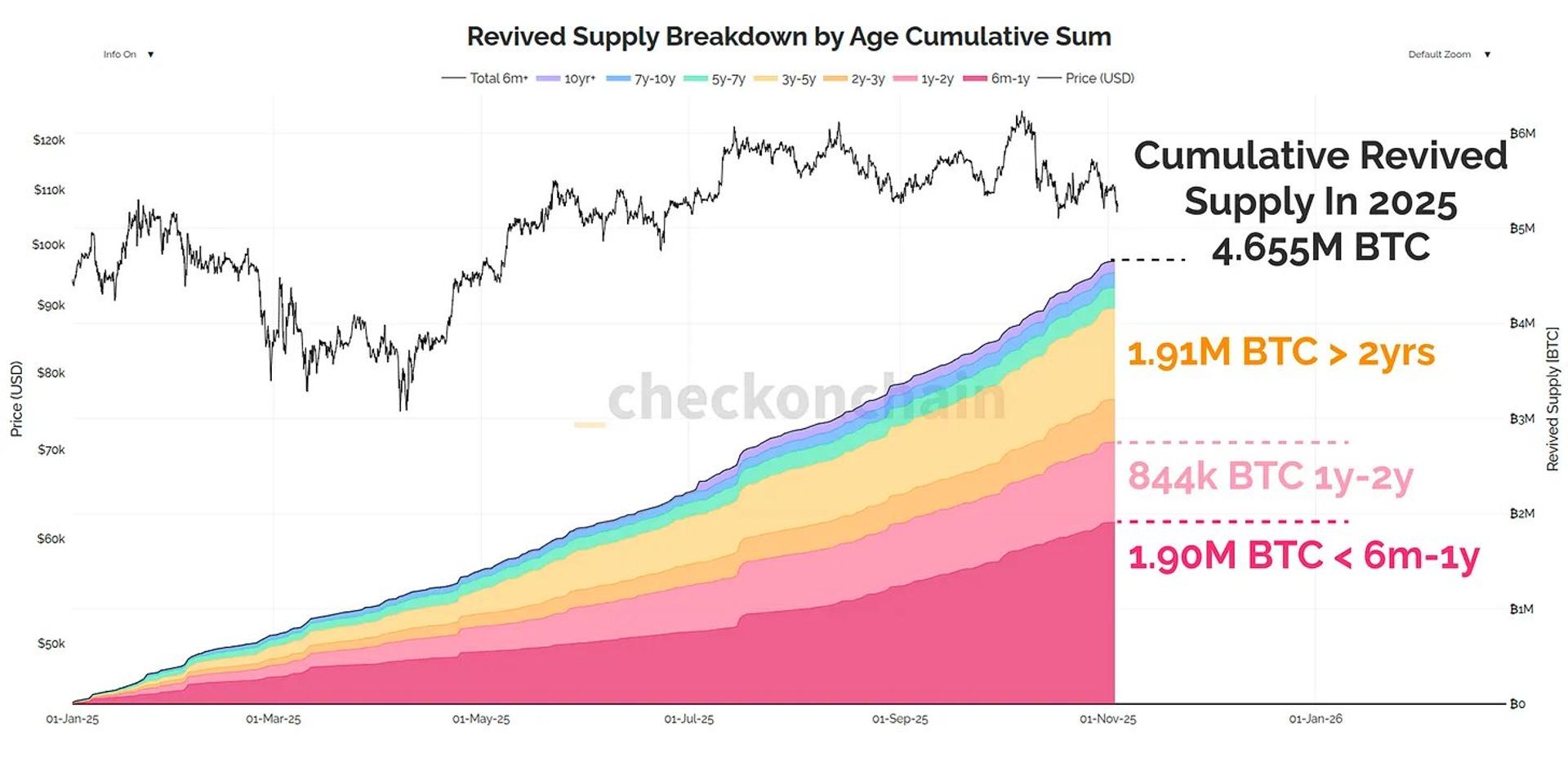

Analyzing unfastened involvement organisation crossed antithetic onslaught prices offers captious insights into marketplace sentiment and imaginable terms trajectories. Strike prices correspond the circumstantial levels astatine which options contracts tin beryllium exercised — essentially, the prices astatine which traders tin bargain oregon merchantability Bitcoin if they enactment connected their contracts. Understanding the attraction of unfastened involvement astatine these onslaught prices is captious due to the fact that it reveals wherever traders spot their bets oregon safeguard against losses.

The highest OI for telephone options is concentrated astatine importantly higher onslaught prices, peculiarly $120,000 (9,496.2 contracts), $100,000 (8,362.8), and $110,000 (7,213.3), with notable OI extending to $150,000 (6,266.7). These strikes are good supra the existent Bitcoin terms of $81,220. This organisation indicates beardown bullish sentiment, with galore traders betting connected a important terms summation by the extremity of the month.

The enactment options amusement the highest OI astatine $80,000 (4,542.4 contracts), followed by $75,000 (4,459.9), and $70,000 (4,003.8), with further important OI astatine $85,000 and $95,000. These strikes are person to oregon beneath the existent terms levels, suggesting that immoderate traders are either hedging against a imaginable terms driblet oregon speculating connected a decline. The attraction astir $80,000, adjacent the existent price, reflects caution astir Bitcoin falling beneath this level.

Chart showing unfastened involvement for Bitcoin enactment options expiring successful March by onslaught terms connected March 11, 2025 (Source: Checkonchain)

Chart showing unfastened involvement for Bitcoin enactment options expiring successful March by onslaught terms connected March 11, 2025 (Source: Checkonchain)The OI for calls importantly exceeds puts astatine the apical onslaught prices. For instance, the highest telephone OI ($120,000: 9,496.2) is much than treble the highest enactment OI ($80,000: 4,542.4). This imbalance suggests a predominantly bullish marketplace bias, with much traders positioning for terms increases than decreases.

Chart showing unfastened involvement for Bitcoin telephone options expiring successful March by onslaught terms connected March 11, 2025 (Source: Checkonchain)

Chart showing unfastened involvement for Bitcoin telephone options expiring successful March by onslaught terms connected March 11, 2025 (Source: Checkonchain)Between March 8 and March 10, the full OI decreased from $4.526 cardinal to $3.856 cardinal — a driblet of astir $670 million. The driblet follows Bitcoin’s alteration from $86,732 to $80,688. A simplification successful OI typically indicates that traders are closing their options positions alternatively than opening caller ones. Given the terms decline, traders with abbreviated oregon hedged positions whitethorn adjacent retired to fastener successful gains arsenic the terms drops. This is successful enactment with the importantly little OI for puts.

Graph showing unfastened involvement for Bitcoin options from Dec. 11, 2024, to March 10, 2025 (Source: Checkonchain)

Graph showing unfastened involvement for Bitcoin options from Dec. 11, 2024, to March 10, 2025 (Source: Checkonchain)The wide alteration successful OI shows traders are adjusting their positions successful effect to terms movements. This indicates a short-term absorption to changing conditions, perchance starring to little volatility arsenic less unfastened positions stay to thrust terms swings.

A pivotal metric successful this investigation is the max symptom price, calculated astatine $80,000. This fig represents the onslaught terms astatine which the full worth of options expiring worthless would beryllium maximized. Should Bitcoin’s terms settee astatine $80,000 connected expiration day, the highest fig of enactment holders would spot their premiums evaporate, delivering maximum “pain” to them portion minimizing payouts for enactment writers. This positions $80,000 arsenic a neutral anchor successful the marketplace — a imaginable gravitational halfway wherever bullish and bearish positions mightiness equilibrium out.

The clustering of enactment options astatine $80,000 and beneath could service arsenic a enactment portion for Bitcoin’s price. If the terms dips toward these levels, enactment holders mightiness workout their options oregon bargain Bitcoin to screen their positions, perchance stabilizing the decline. Conversely, the precocious telephone OI astatine $100,000 and $120,000 whitethorn enactment arsenic resistance. As Bitcoin approaches these strikes, telephone holders could currency successful profits oregon workout their options, limiting upward momentum and creating a ceiling for terms growth.

The station Bullish bets soar arsenic Bitcoin telephone options people $120K strike appeared archetypal connected CryptoSlate.

7 months ago

7 months ago

English (US)

English (US)