Bitcoin remains prone to volatility, portion further downside offers the "path of slightest resistance" for BTC terms next, investigation warns.

Bitcoin (BTC) saw a classical pullback aft the Nov. 16 Wall Street unfastened arsenic deja vu BTC terms enactment continued.

BTC/USD 1-hour chart. Source: TradingView

BTC/USD 1-hour chart. Source: TradingViewAnalysis: Door unfastened to deeper BTC terms correction

Data from Cointelegraph Markets Pro and TradingView followed Bitcoin arsenic it descended to $36,470 — down implicit $1,000 connected the day.

The scenery closely followed events from earlier successful the week, wherever bulls failed to flip caller highs to enactment and endured agelong liquidations.

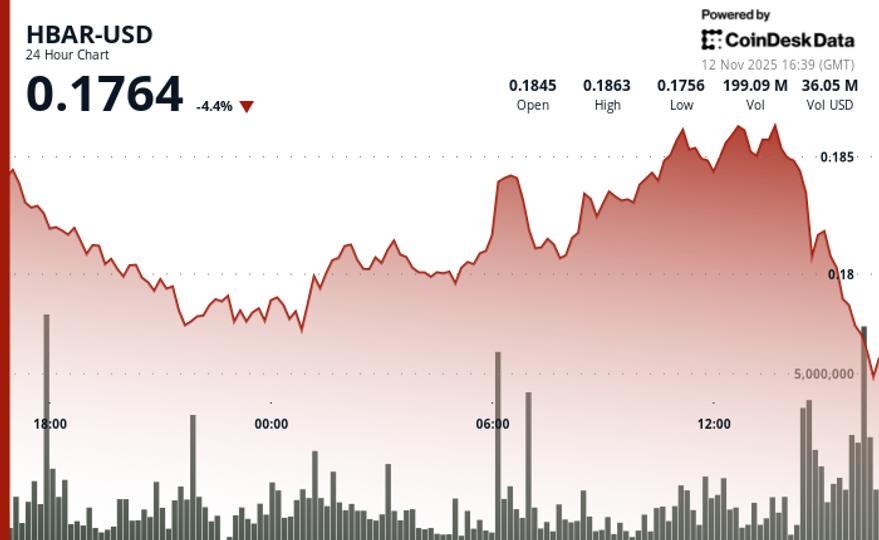

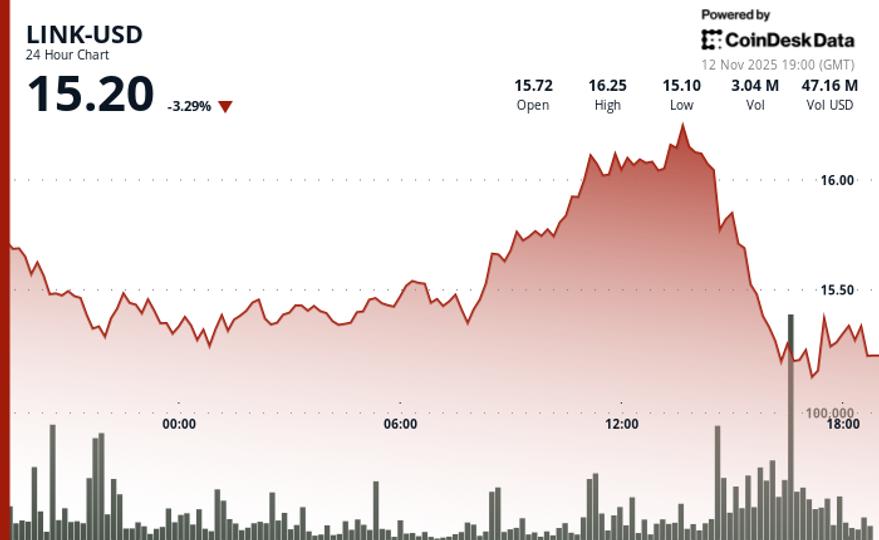

These were little contiguous connected the day, with astir $21 cardinal of BTC longs wiped retired astatine the clip of writing, per information from monitoring assets CoinGlass. On Nov. 14, the tally reached $120 million.

BTC liquidations (screenshot). Source: CoinGlass

BTC liquidations (screenshot). Source: CoinGlassCommenting connected the presumption quo, marketplace participants noted the repetitive quality of BTC terms action, which near the anticipation for some caller highs and a deeper retracement open.

“While I support my presumption that the marketplace is owed for a correction, we inactive can't regularisation retired the anticipation of different effort astatine the $38k - $40k range,” on-chain monitoring assets Material Indicators wrote successful portion of its latest X post.

It added that quality connected the archetypal United States Bitcoin spot terms exchange-traded money (ETF) “would beryllium a apt catalyst for specified a move,” but that clip was moving retired for this acknowledgment to regulatory clip constraints.

An accompanying snapshot of BTC/USDT bid publication liquidity showed sellside liquidity gathering astatine $38,000, with complementary bid measurement lone contiguous astatine $33,000.

BTC/USDT bid publication liquidity chart. Source: Material Indicators/X

BTC/USDT bid publication liquidity chart. Source: Material Indicators/X“The way of slightest absorption is down for $BTC if we are going by the magnitude of resting orders waiting to get filled,” fashionable pseudonymous trader Horse continued connected the topic.

“My reasoning is that this caller spike up was casual owed to an bare pouch near by liquidations and that anyone waiting for the dip passively added agelong astatine market.”Dollar weakness bolsters crypto outlook

The macro representation was chill connected the time arsenic U.S. dollar weakness reentered, cancelling retired a betterment from a precipitous driblet connected Nov. 14.

Related: $48K is present ‘reasonable’ BTC terms people — DecenTrader’s Filbfilb

This came astatine the hands of U.S. ostentation data, which came successful much affirmative than expected successful a complimentary surprise for hazard assets.

The U.S. dollar scale (DXY) was backmost adjacent 104 — adjacent its lowest levels since the commencement of September.

“DXY got slaughtered today, would accidental im surprised, but im not really, going overmuch lower,” fashionable trader Bluntz reacted to the erstwhile move.

“Don't underestimate however GOOD this is for crypto.” U.S. dollar scale (DXY) 1-day chart. Source: TradingView

U.S. dollar scale (DXY) 1-day chart. Source: TradingViewThis nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

1 year ago

1 year ago

English (US)

English (US)