Bitcoin (BTC) broke beneath $35,000 aft the Nov. 2 Wall Street unfastened arsenic investigation warned of “overheated” derivatives.

BTC/USD 1-hour chart. Source: TradingView

BTC/USD 1-hour chart. Source: TradingViewBitcoin undoes post-Fed gains

Data from Cointelegraph Markets Pro and TradingView tracked a retreating BTC terms arsenic it erased crushed it reclaimed overnight.

The largest cryptocurrency had deed caller 18-month highs of $35,968 connected Bitstamp earlier consolidating — a process which was gathering momentum astatine the clip of writing.

The highs had travel connected the backmost of encouraging connection from Jerome Powell, Chair of the United States Federal Reserve, who successful a code suggested that involvement complaint hikes mightiness soon end.

The Fed opted not to alteration rates astatine the latest gathering of the Federal Open Market Committee, oregon FOMC, connected Nov. 1.

“Recent indicators suggest that economical enactment expanded astatine a beardown gait successful the 3rd quarter. Job gains person moderated since earlier successful the twelvemonth but stay strong, and the unemployment complaint has remained low. Inflation remains elevated,” an accompanying press release stated.

“The U.S. banking strategy is dependable and resilient. Tighter fiscal and recognition conditions for households and businesses are apt to measurement connected economical activity, hiring, and inflation. The grade of these effects remains uncertain. The Committee remains highly attentive to ostentation risks.”As Cointelegraph reported, $35,000 rapidly became a key BTC terms enactment level to hold for marketplace participants erstwhile reached. The country supra $34,500, meanwhile, was described arsenic an “ideal” people for a section low.

— Michaël van de Poppe (@CryptoMichNL) November 1, 2023Now down implicit $1,000 from its highs, however, Bitcoin was worrying some, with derivatives markets peculiarly successful focus.

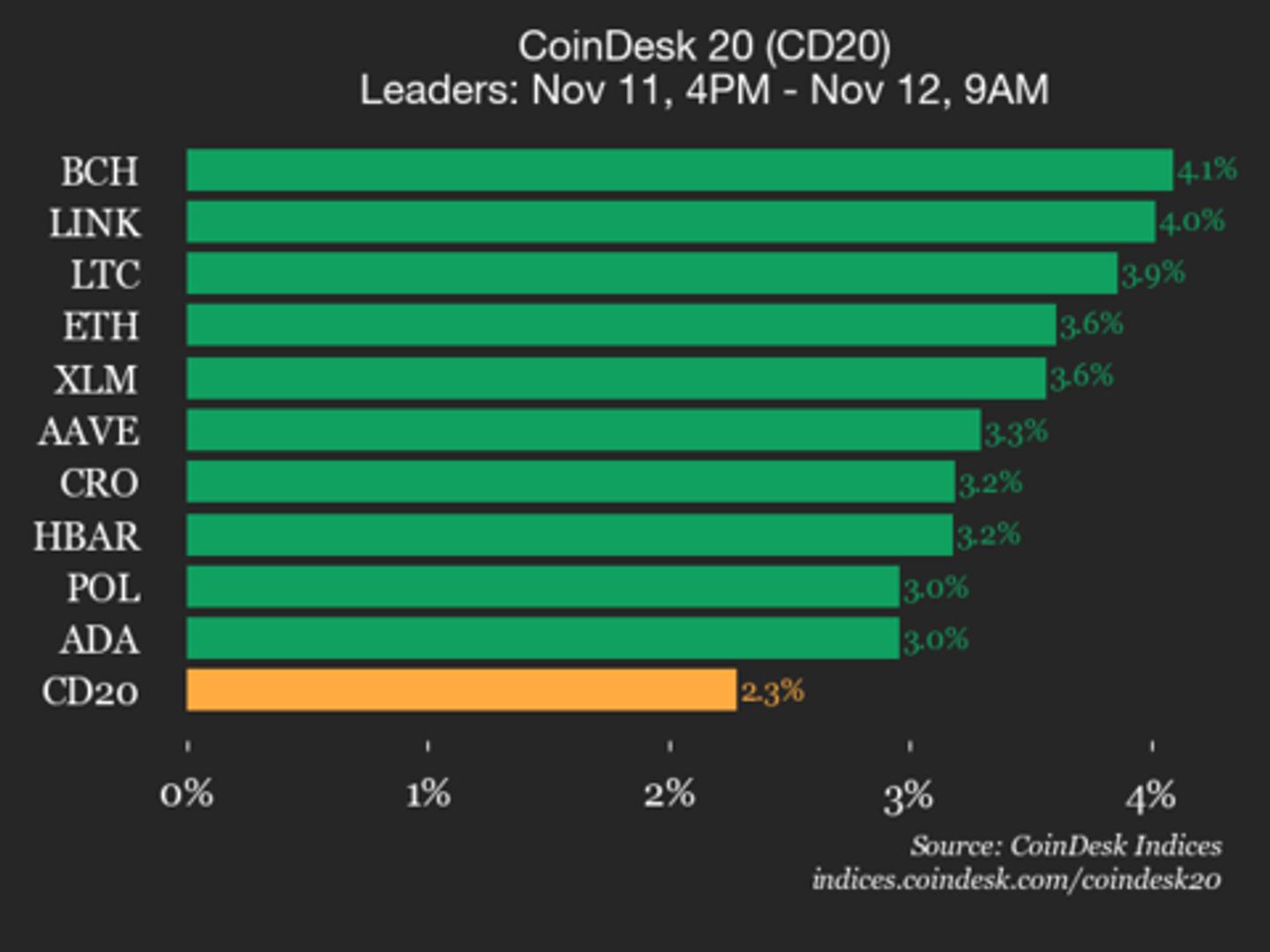

“All Bitcoin derivatives markets are overheated astatine present,” Charles Edwards, laminitis of quantitative Bitcoin and integer plus money Capriole Investments, wrote connected X alongside Capriole’s ain data.

“This captures Perps, Futures and Options. Stay harmless retired there….” Bitcoin derivatives "heating" metric. Source: Charles Edwards/X

Bitcoin derivatives "heating" metric. Source: Charles Edwards/XReacting, fashionable trader Skew agreed, arguing that it was present spot markets successful complaint of redeeming BTC terms strength.

“Something to beryllium alert of erstwhile sizing up positions currently,” helium told X subscribers.

“When derivatives get hot, this puts expanding absorption connected spot marketplace to enactment existent prices & trend.”Analysis cautions implicit liquidity "rug pulls"

In its ain analysis, monitoring assets Material Indicators besides concluded that “caution” should beryllium applied to the existent Bitcoin trading environment.

Related: 4 signs Bitcoin is starting its adjacent bull run

Uploading a snapshot of liquidity connected the BTC/USDT bid publication for largest planetary speech Binance, it warned that enactment levels were apt to vanish rapidly — a signifier of “rug pull.”

Newcomer enactment gaining liquidity astatine the clip of penning laic astatine some $34,000 and $33,500.

#FireCharts shows #BTC liquidity is erstwhile again moving astir the bid book.

When blocks of liquidity are moving similar this caution is warranted, due to the fact that this benignant of question often leads to rug pulls.

You tin mitigate the hazard of getting rugged by waiting for buying to resume… pic.twitter.com/UCFNpiIoUe

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

2 years ago

2 years ago

English (US)

English (US)