The Bitcoin terms has fallen to the little extremity of its astir one-month trading scope betwixt $29,800 and $31,300. Already yesterday, BTC concisely fell to arsenic debased arsenic $29,704, lone to retrieve to $30,306 wrong a fewer hours. At property time, BTC was again moving towards the $30,000 mark, and different autumn and liquidity drawback seems likely.

While this week the macro information releases are beauteous quiet, it’s worthy taking a look astatine what’s happening successful the Bitcoin marketplace itself.

Swissblock Insights observed a peculiar calm successful the marketplace erstwhile Bitcoin reached a caller yearly precocious of $31.840 past week. However, the momentum rapidly faded, and selling unit increased, causing BTC to driblet to the debased $30ks. They item the constrictive Bollinger Bands, stating, “The Bollinger Bands are precise narrow, with lone a 4.2% worth quality separating the precocious and little bands. A determination is brewing.”

Moreover, the analysts stress the request for a important catalyst to inject beingness into the existent lackluster scenario:

Volatility is expected to look connected the scene, although, successful the abbreviated term, we are successful nary man’s land; liquidity remains low, unfastened involvement is inactive level and shorts are obscurity to beryllium seen. There’s nary bid successful the absorption we are going, and lone a important catalyst tin spice things up successful this dull script we are in.

According to the analysts, a breakdown of the $29.650 enactment level would invalidate a agelong setup. On the different hand, a bullish limb up $31.500 could reignite momentum and surge the terms to $33,000. But for this to happen, spot request needs to reignite powerfully and longs request to participate the market, “otherwise momentum volition proceed to fading.”

Glassnode, an on-chain information provider, further illuminates the existent authorities of the Bitcoin market. Despite the impermanent yearly high, they picture the marketplace arsenic “extremely quiet”, besides pointing to the Bollinger Bands. This compression successful volatility signals a marketplace reminiscent of the calm observed successful aboriginal January, arsenic NewsBTC reported yesterday.

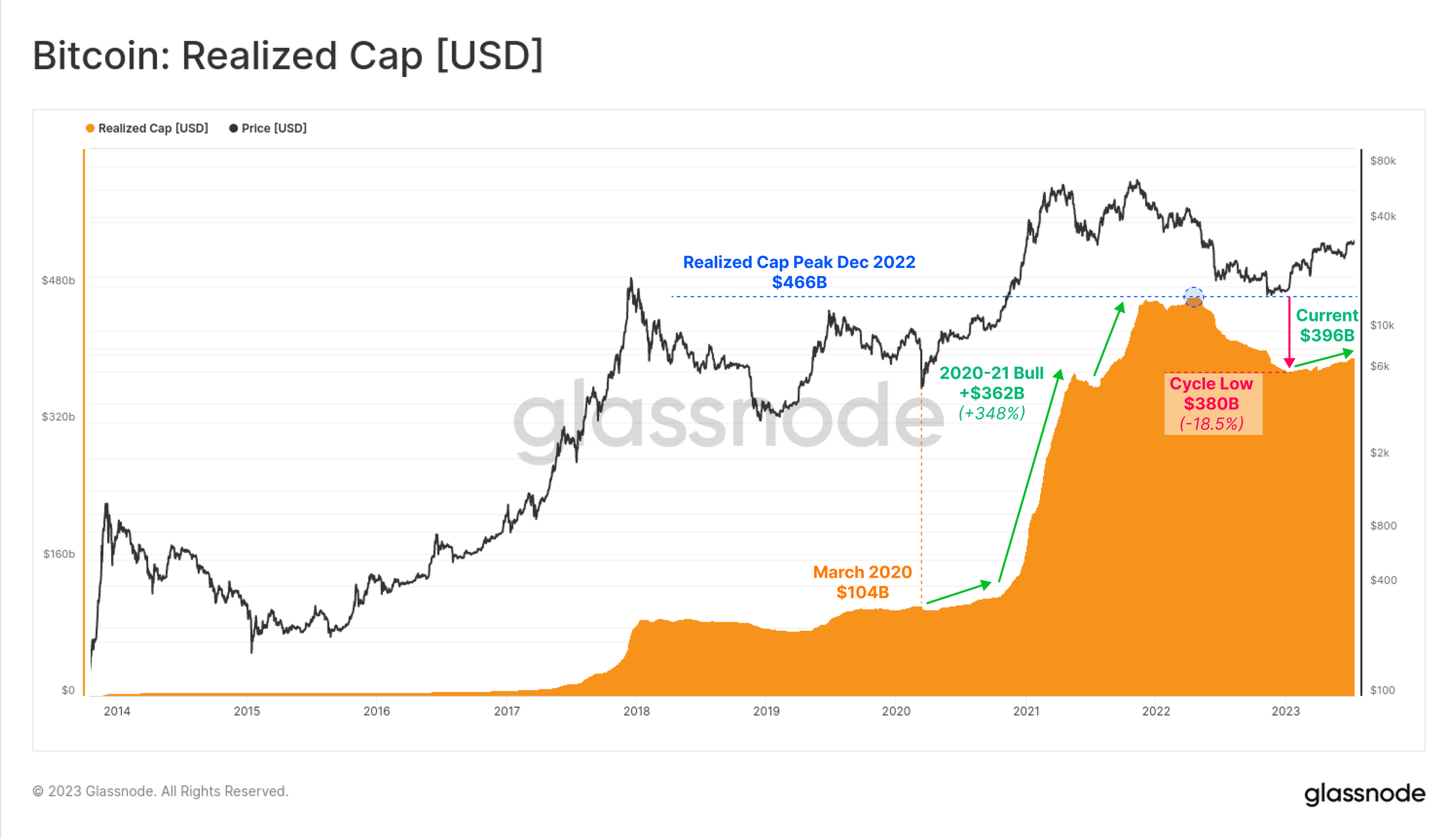

Furthermore, Glassnode’s investigation reveals a dilatory but dependable inflow of superior into Bitcoin. The Realized Cap presently sits conscionable shy astatine $396 billion. After hitting a rhythm debased astatine $380 billion, the metric indicates that a dilatory but dependable watercourse of superior is entering the marketplace passim 2023.

Bitcoin Realized Cap | Source: Glassnode

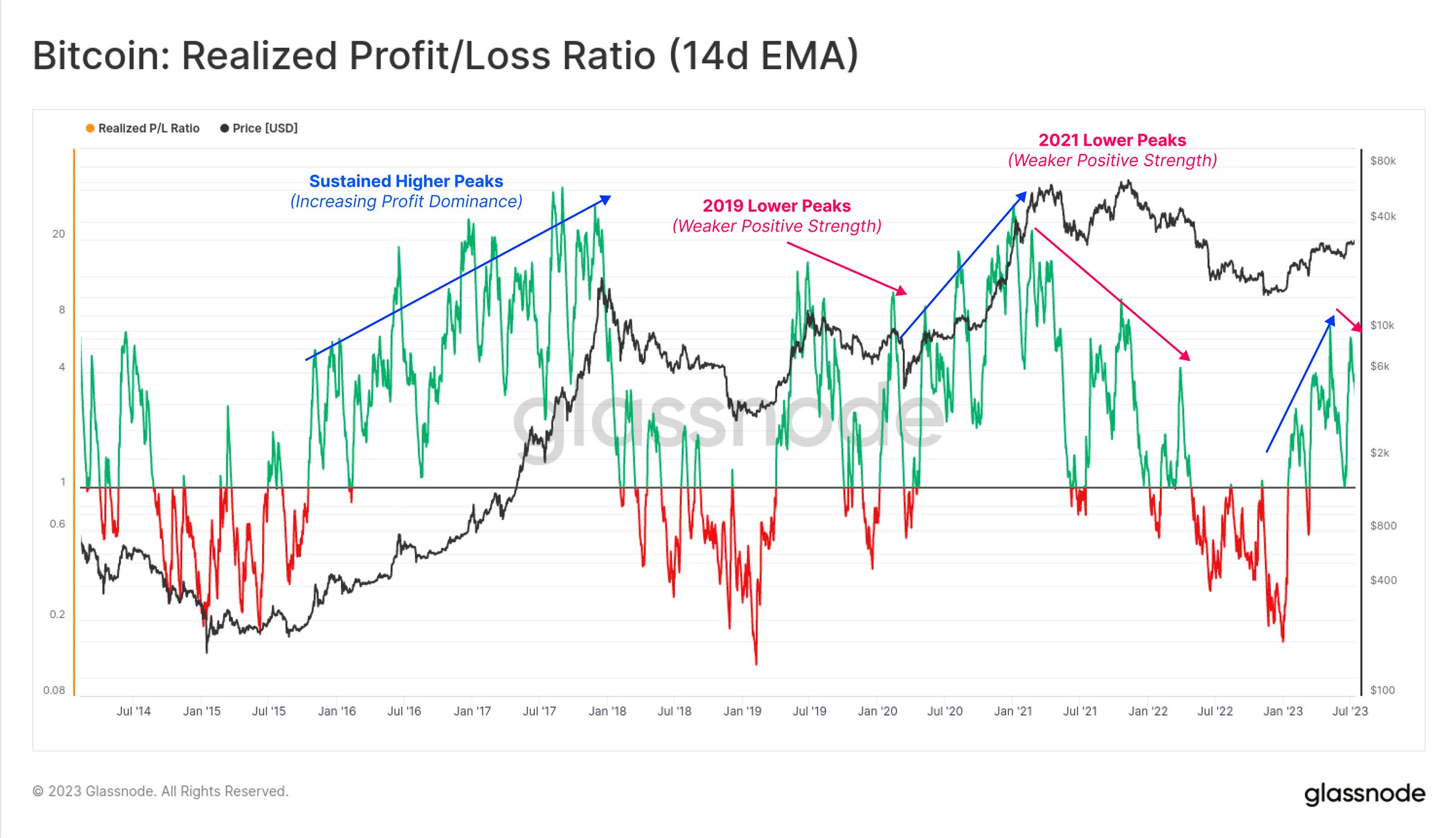

Bitcoin Realized Cap | Source: GlassnodeGlasnode besides emphasizes that investors stay unwilling to portion with their held supply, resulting successful choppy marketplace conditions akin to those seen successful 2016 and 2019-20 periods. Total realized nett and nonaccomplishment resembles the historical trend:

If we instrumentality a ratio betwixt full realized nett and loss, […] we tin besides enactment that a little precocious successful this ratio was acceptable this week. If sustained, it whitethorn allude to akin choppy marketplace conditions seen successful some 2019-20, and again successful the 2nd fractional of 2021.

Bitcoin Realized PnL Ratio | Source: Gassnode

Bitcoin Realized PnL Ratio | Source: GassnodeThe investigation besides highlights the profit-locking behaviour among Bitcoin holders, with the bulk of some short-term (88%) and semipermanent holders’ balances (73%) held successful profit. However, short-term holders are the superior entities that are progressive successful the market.

Out of the full 39.600 BTC successful regular speech inflows, 78% of this is associated with the STH cohort. This means that abbreviated word holders whitethorn person to trim their profits for the clip being earlier selling unit eases and the bulls tin instrumentality the precocious manus again.

GreekLive, an options expert, explains that the Bitcoin marketplace is inactive losing liquidity, which makes it highly susceptible to spikes and V-shaped recoveries:

Cryptocurrencies encountered a V-shaped marketplace today, with BTC falling beneath $29,700 and ETH beneath $1,875, earlier rebounding successful a V-shaped during Asian trading hours to regain the circular fig of points, but the options marketplace hardly reacted to this.

The investigation advises sellers to absorption connected static extortion and person hazard power plans for holding options until expiration. For buyers, timely profit-taking and utilizing futures to hedge options are recommended hazard absorption strategies.

At property time, BTC traded astatine $30,064.

Bitcoin drops to scope low, 4-hour illustration | Source: BTCUSD connected TradingView.com

Bitcoin drops to scope low, 4-hour illustration | Source: BTCUSD connected TradingView.comFeatured representation from iStock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)