Bitcoin (BTC) starts the past week of August acold from all-time highs arsenic traders go progressively nervous.

A immense agelong liquidation lawsuit has brought $110,000 backmost into play arsenic a caller CME spread becomes a caller anticipation for bulls.

Bitcoin whales are nether scrutiny aft a elephantine rotation from BTC into ETH.

Smaller hodlers stay successful accumulation mode, investigation reveals, dissimilar whales.

The latest BTC terms enactment has resulted successful speech of the full bull marketplace present being over.

The Fed’s “preferred” ostentation gauge is owed again arsenic markets treble down connected rate-cut bets.

BTC terms weakness sparks speech of $100,000 retest

Bitcoin is backmost astatine multi-week lows arsenic August nears its extremity — and marketplace participants are engaged drafting caller BTC terms targets.

Data from Cointelegraph Markets Pro and TradingView shows whipsaw BTC terms enactment defining the marketplace since Sunday’s flash volatility.

This took BTC/USD to $10,700 — its lowest levels since July 10 and a rude wake-up telephone for precocious longs.

Monitoring assets CoinGlass enactment 24-hour crypto agelong liquidations astatine $640 cardinal astatine the clip of writing.

Traders were divided connected the short-term outlook. While immoderate eyed a retest of aged all-time highs arsenic a bounce point, others saw a much nuanced situation.

— Crypto Tony (@CryptoTony__) August 25, 2025Popular trader Daan Crypto Trades flagged an “important retest” presently successful progress.

“$BTC Opened up with a ample CME spread today,” helium noted, referring to the play spread successful CME Group’s Bitcoin futures market.

“This is the largest we've seen successful respective weeks. We person been opening up with gaps beauteous often and astir of these person been filling connected Monday/Tuesday.”Fellow trader Jelle was among those seeing a travel to adjacent little levels.

“Bitcoin is inactive murdering leveraged traders astir the scope lows, and from the looks of it, the sharks are inactive hungry,” helium warned.

“Would truly similar terms holds this area, oregon we'll autumn backmost into the erstwhile scope which would unfastened america up to different retest of $100k.”CoinGlass speech order-book information reveals small bid enactment successful spot instantly beneath terms into the week’s archetypal Wall Street open.

Last week, Cointelegraph reported connected condemnation implicit $100,000 staying successful spot — adjacent unchallenged — arsenic support.

Bitcoin OG: Whale organisation “healthy”

Sunday’s abrupt BTC terms dive has brought Bitcoin whales backmost into focus.

Current levels, inactive wrong 10% of all-time highs, person proven charismatic to ample players seeking to instrumentality nett connected long-held coins.

The play saw 1 entity merchantability a elephantine tranche of BTC aft 7 years, tanking the marketplace $4,000 successful minutes — a driblet from which it has yet to recover.

Data from crypto quality steadfast Arkham uploaded to X by analytics relationship Lookonchain shows the entity rotating from Bitcoin into Ether.

“In the past 5 days, they’ve deposited ~22,769 $BTC($2.59B) to Hyperliquid for sale, past bought 472,920 $ETH($2.22B) spot and opened a 135,265 $ETH($577M) long,” it summarized portion relaying the BTC and ETH addresses involved.

The entity’s BTC is present worthy astir $11.4 cardinal — a nett borderline of 1,675%.

“No insubstantial BTC conspiracies are required. The terms has stalled due to the fact that a fig of whales person deed their magic fig and are unloading,” Bitcoin enthusiast Vijay Boyapati commented connected the event.

“This is steadfast - their proviso is finite and their selling is required for the afloat monetization of Bitcoin. Massive blocks of supply, with tremendous purchasing power, are being distributed into the population. This rhythm is 1 of the top monetization events successful history.”Statistician Willy Woo, who made headlines past period for his ain BTC sales, underscored the sway that the oldest whales still person connected marketplace dynamics.

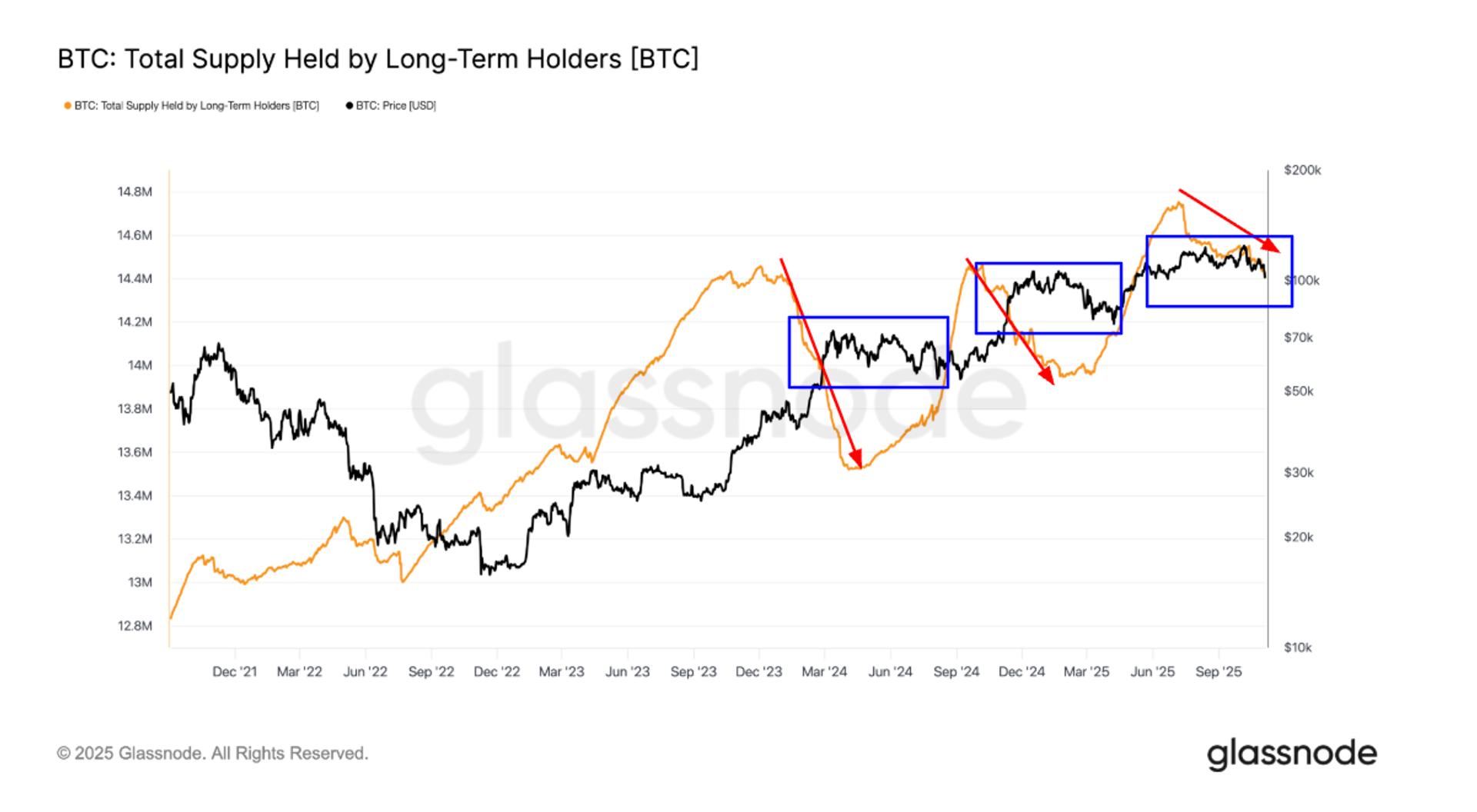

“Why is BTC moving up truthful dilatory this cycle?” helium queried alongside a chart.

“BTC proviso is concentrated astir OG whales who peaked their holdings successful 2011 (orange and acheronian orange). They bought their BTC astatine $10 oregon lower. It takes $110k+ of caller superior to sorb each BTC they sell.”As Cointelegraph reported, whale organisation has been evident passim the latest signifier of the bull run.

Data from onchain analytics steadfast Glassnode confirms that arsenic of Sunday, determination were 2,000 addresses with a equilibrium of betwixt 1,000 and 10,000 BTC — corresponding to each but the largest “mega” whales. This marked a caller August high.

Smaller Bitcoin hodlers proceed accumulating

Looking into different wallet cohorts, onchain analytics level CryptoQuant sees reasons for bulls to enactment hopeful astir a rebound.

Distribution, it warned Monday, is not yet successful afloat plaything crossed the Bitcoin capitalist spectrum.

“After reaching its ATH astatine 124K, Bitcoin has entered a pullback phase,” contributor BorisD summarized successful 1 of its “Quicktake” blog posts, predicting that the retracement whitethorn “continue for a while.”

Unlike whales, smaller hodler classes person retained an wide “accumulation” mindset. Specifically, wallets holding up to 10 BTC proceed to adhd exposure.

Conversely, those betwixt 10 and 100 BTC show organisation behavior, having shifted to profit-taking en masse arsenic the terms deed $118,000.

Between 100 and 1,000 BTC, marketplace power gains significance, BorisD says.

“While mostly successful accumulation mode, they person shown equilibrium betwixt accumulation and organisation since 105K, reflecting indecision,” helium commented.

“This level acts arsenic a captious support-turning zone.”Thanks to the comparative size of the wallets involved, CryptoQuant describes organisation arsenic present being “dominant.”

“Distribution is inactive the ascendant trend, but its strength is weakening arsenic Bitcoin pulls back,” the station concludes.

“The 105K level stands retired arsenic the strongest zone. A determination down to this portion would make important accent successful the marketplace and could trigger wide fear.”Is the bull marketplace “over” already?

For immoderate marketplace participants, determination is small crushed to expect a full-on instrumentality of the Bitcoin bull market.

Those already harboring blimpish views of aboriginal terms enactment person doubled down connected their outlook arsenic BTC/USD falls to its lowest levels since aboriginal July.

Among them is fashionable trader Roman, whose latest investigation warned that high-timeframe signals suggest that the champion of the bull tally has travel and gone.

As evidence, helium cited a caput and shoulders reversal signifier playing out, with the last 3rd “shoulder” constituent inactive to come.

“All we request is the reversal signifier setup to perchance instrumentality shorts. They’ll get caught connected the debased measurement pump erstwhile again,” helium forecast.

“The $BTC bull tally is over.”$BTC 1D

The Head & shoulders reversal AKA the bull killer.

HTF is bearish. All we request is the reversal signifier setup to perchance instrumentality shorts.

They’ll get caught connected the debased measurement pump erstwhile again. The $BTC bull tally is over. pic.twitter.com/Q3rAet5YiP

Before that, Roman and others had flagged declining volume and weakening comparative spot scale (RSI) information to enactment the thesis that Bitcoin had tally retired of steam. As terms made caller highs, RSI made little highs — a classical bearish divergence setup.

Late past week, citing Wyckoff analysis, chap trading relationship ZAYK Charts enactment the imaginable downside people for BTC/USD astatine $95,000.

“$BTC inactive moving precisely arsenic Wyckoff predicted,” it wrote successful an update.

US ostentation conflict lurks successful the background

The Federal Reserve’s “preferred” ostentation gauge is owed for merchandise astatine a captious clip for economical policy.

Related: ETH ‘god candle,’ $6K next? Coinbase tightens security: Hodler’s Digest, Aug. 17 – 23

The July people of the Personal Consumption Expenditures (PCE) Index, owed Friday, volition beryllium of cardinal value to some Fed officials and markets seeking confirmation of interest-rate cuts adjacent month.

Last week, astatine its yearly Jackson Hole symposium, Fed Chair Jerome Powell delivered a astonishment pivot connected his antecedently hawkish stance. Risk assets instantly surged arsenic hopes of a complaint chopped gained momentum.

Since then, the temper has cooled, with plentifulness of ostentation information inactive to travel earlier the complaint determination successful mid-September.

The latest information from CME Group’s FedWatch Tool puts marketplace likelihood of a 0.25% chopped astatine astir 90%.

Commenting, trading steadfast Mosaic Asset emphasized Powell’s connection and the Fed’s changing attack to its 2% ostentation target.

“If abandoning mean ostentation targeting means the Fed is becoming little tolerant of ostentation supra the 2% target, past you wouldn’t expect a dovish code retired of the Fed,” it summarized successful the latest variation of its regular newsletter, “The Market Mosaic.”

“That volition marque upcoming ostentation and payrolls reports up of September’s rate-setting gathering important datapoints for the Fed.”Mosaic said that betting connected aggregate complaint cuts mightiness beryllium “misplaced” arsenic a strategy going forward.

Elsewhere, Wednesday’s Nvidia net could inject volatility into crypto and hazard assets, with a beardown show expected.

“Nvidia is acceptable to adjacent retired an wide beardown net play with attraction shifting to the Fed,” trading assets The Kobeissi Letter summarized.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

2 months ago

2 months ago

English (US)

English (US)