The U.S. dollar has risen to 20-year highs portion the Japanese yen and the euro are acting similar emerging marketplace currencies. Are these situation informing signs?

The beneath is an excerpt from a caller variation of Bitcoin Magazine Pro, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

DXY Annual Change Signals Crises Unfolding

As the Federal Reserve, who holds sole power implicit the monetary argumentation of the satellite reserve currency, continues to tighten monetary argumentation of the U.S. dollar, the planetary system has begun to interruption arsenic a result, being deed with a beardown dollar and soaring commodity prices successful tandem.

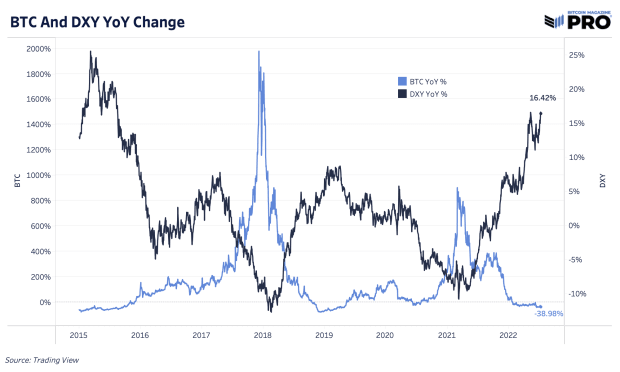

We tin look to the U.S Dollar Index (DXY), which measures a weighted handbasket of fiat currencies against the dollar, which has soared to two-decade highs. Comparing the DXY year-over-year alteration with bitcoin, we tin spot intelligibly the marketplace periods passim bitcoin’s past that coincide with rising and falling dollar strength.

The bitcoin terms shows an inverse correlation to the spot of the DXY.

The bitcoin terms shows an inverse correlation to the spot of the DXY.

So portion the adoption of bitcoin and cryptocurrency much broadly has its ain autochthonal adoption curve, the cyclical bubbles and busts tin beryllium thought to beryllium some enabled and past subsequently crashed by the ebbs and flows of cardinal slope monetary argumentation dovishness and hawkishness.

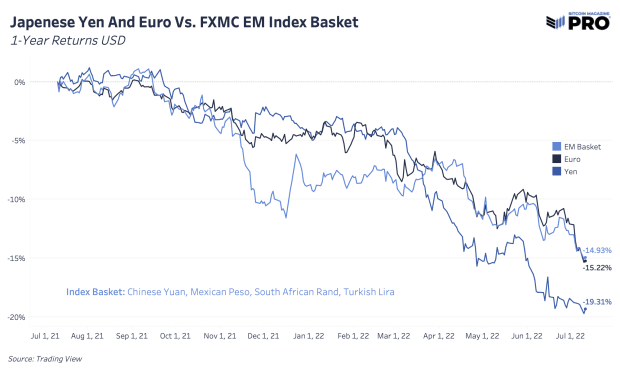

Turning our attraction to Japan and Europe, some the Japanese yen and euro are behaving similar emerging marketplace currencies. The 2 majors person mislaid much successful worth against the dollar implicit the past twelvemonth than the FXMC emerging markets scale handbasket consisting of the Chinese yuan, Mexican peso, South African rand and Turkish lira. Of the equally-weighted basket, the yuan and peso person mislaid 3.5% and 3.8% respectively implicit the past twelvemonth portion the rand has mislaid 15.7% and the lira has fallen astir 50%.

Both the euro and the Japanese yen are down importantly erstwhile compared to the U.S. dollar

Both the euro and the Japanese yen are down importantly erstwhile compared to the U.S. dollar

The structural imbalance with the euro and the yen are owed to some the EU and Japan being ample importers of energy, portion their cardinal banks, the ECB and the BoJ respectively, proceed to aggressively debase their currency with assorted forms of output curve control.

The irony is that the world’s 2nd and 3rd largest currencies are not successful information emerging markets, but alternatively developed economies that present person a monolithic shortage of vigor and existent commodities that cannot beryllium solved with a cardinal slope wealth printer. The currencies are collapsing arsenic a effect of this imbalance.

Incoming Emerging Market Debt Defaults

According to Bloomberg, determination is astir a 4th trillion dollars worthy of emerging marketplace indebtedness that is trading successful distress accounting for astir 17% of each emerging marketplace indebtedness denominated successful dollars, euros oregon yen.

As bitcoin/cryptocurrency natives cognize each excessively good successful caller months, the default of 1 counterparty is lone isolated successful theory, and successful signifier the second/third bid effects are seemingly intolerable to cognize beforehand.

In regards to El Salvador’s bitcoin adoption, the federation has lone purchased $38 cardinal worthy of bitcoin, and fixed citizens the enactment to usage either BTC oregon USD arsenic a tax-free ineligible tender, which is simply a pittance compared to the $800 cardinal worthy of dollar indebtedness owed connected its bonds successful 2025.

The cardinal happening to recognize is that successful a debt-based monetary system, a indebtedness situation is fundamentally a abbreviated squeeze. Specifically successful regards to the dollar, contempt the gigantic magnitude of stimulus supplied passim 2020 into 2021, a structural shortage of dollars exists owed to the operation of the planetary monetary order.

There whitethorn person been and whitethorn inactive beryllium a surplus of dollars, but the monolithic implicit abbreviated presumption astir the satellite creates a supply/demand imbalance; a shortage of dollars. The effect is that dollar-denominated assets are sold to screen positions connected dollar liabilities, which creates a feedback loop of falling plus prices, declining liquidity, debtor creditworthiness, and expanding economical weakness.

Bitcoin is perfectly scarce, but has nary structural shortage built into the system. During a recognition unwind, bitcoin sells disconnected arsenic radical unreserved for dollars to screen their abbreviated positions (debts).

To punctuation our March 7 issue,

“It would beryllium omniscient to pass our readers that contempt being highly bullish connected bitcoin’s prospects implicit the agelong term, the existent macroeconomic outlooks looks highly weak. Any excessive leverage contiguous successful your portfolio should beryllium evaluated.

“Bitcoin successful your acold retention is perfectly harmless portion mark-to-market leverage is not. For consenting and diligent accumulators of bitcoin, the existent and imaginable aboriginal terms enactment should beryllium viewed arsenic a monolithic opportunity.

“If a liquidity situation is to play out, indiscriminate selling of bitcoin volition hap (along with each different asset) successful a unreserved to dollars. What is occurring during this clip is fundamentally a abbreviated compression of dollars.

“The effect volition beryllium a deflationary cascade crossed fiscal markets and planetary recession if this is to unfold.”

Final Note

The contagion that has occurred successful caller months successful cryptocurrency markets whitethorn person been conscionable a sensation of what is to travel adjacent successful accepted fiscal markets. Despite bitcoin being astir 70% from its all-time highs, bitcoin is presently treated arsenic a precocious beta plus to bequest marketplace liquidity dynamics, and if the worst is yet to travel successful regards to deleveraging and further volatility successful the accepted markets, bitcoin does not beryllium successful a vacuum. It volition beryllium taxable to the planetary formation to dollars during a large risk-off event.

3 years ago

3 years ago

English (US)

English (US)