BlackRock’s move to registry an iShares Ethereum Trust successful Delaware signaled a imaginable game-changer for Ethereum arsenic an institutional-grade investment. Ethereum (ETH) surged connected the news, breaking supra $2,000 for the archetypal clip since July. Understanding the ETH/BTC ratio’s behaviour is important successful dissecting the market’s effect to specified developments, offering an alternate position to the accepted ETH/USD oregon ETH/USDT pairs.

The ETH/BTC ratio represents Ethereum’s spot against Bitcoin—the standard-bearer of the crypto market. This ratio increases successful worth erstwhile Ethereum gains momentum oregon retains its worth amended than Bitcoin, suggesting that the marketplace favors ETH implicit BTC. Conversely, a diminution successful the ETH/BTC ratio indicates Ethereum’s underperformance comparative to Bitcoin, which could suggest capitalist penchant for the comparative information of Bitcoin.

Movements successful the ETH/BTC ratio are much than conscionable terms action; they correspond the shifting tides of capitalist assurance and marketplace sentiment betwixt 2 of the largest cryptocurrencies. This ratio refines the earthy terms information into comparative performance, going beyond the fiat worth of Ethereum and presenting its comparative lasting wrong the crypto domain.

CryptoSlate investigation recovered that, successful the past 30 days, the wide correlation coefficient betwixt the ETH/BTC closing terms and trading measurement was somewhat antagonistic astatine astir -0.103. This suggests that trading volumes did not heavy power terms movements wrong the month—a astonishing penetration fixed the tumultuous quality of cryptocurrency markets.

Graph showing ETH/BTC from Oct. 9 to Nov. 9, 2023 (Source: TradingView)

Graph showing ETH/BTC from Oct. 9 to Nov. 9, 2023 (Source: TradingView)However, looking astatine the past 24 hours, the correlation turns affirmative astatine astir 0.264. This displacement accompanies a spike successful ETH/BTC, wherever the ratio peaked astatine 0.05493. This affirmative correlation successful the past time indicates a synchronized terms and trading measurement increase, driven by the market’s absorption to BlackRock’s Ethereum ETF registration.

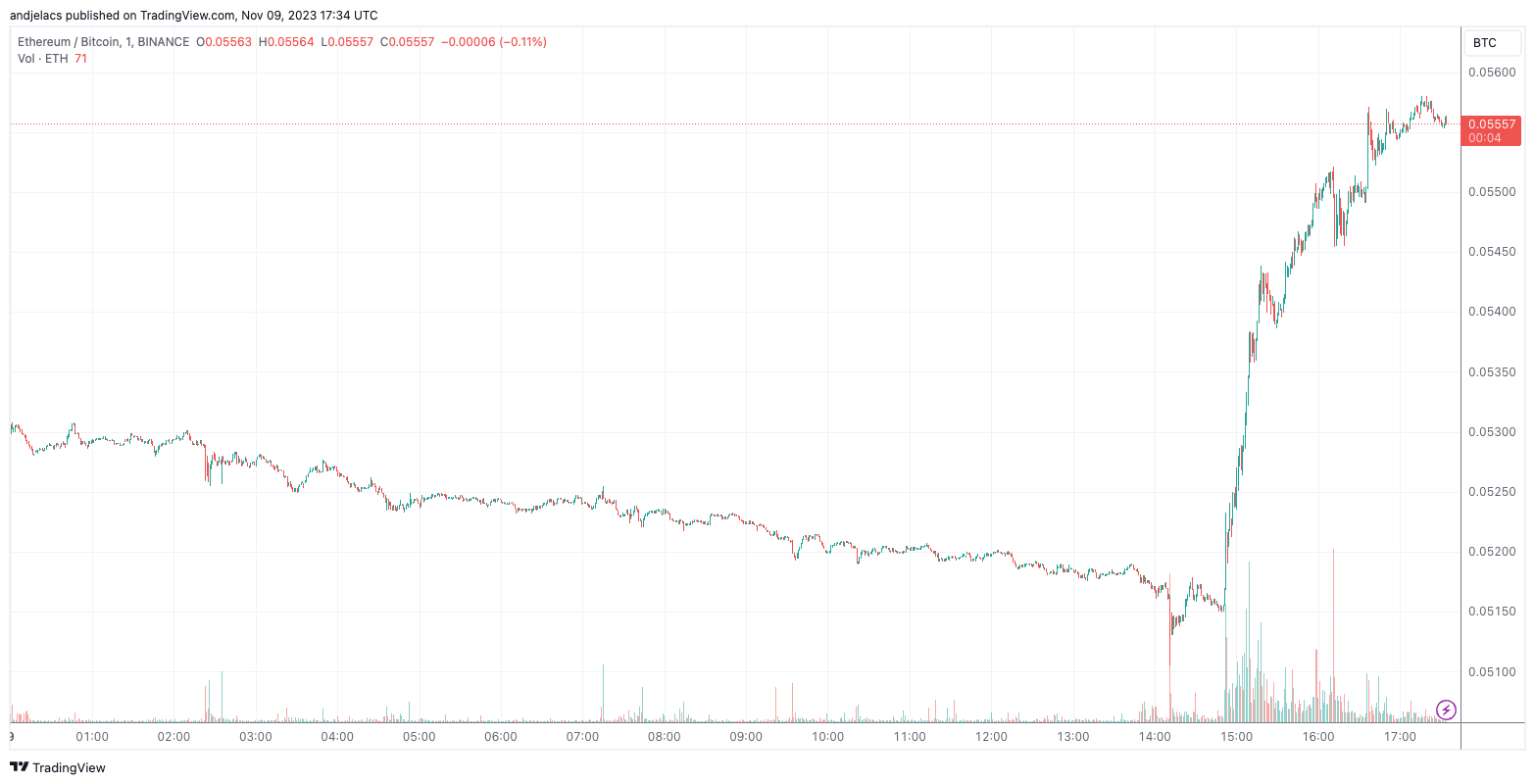

Graph showing ETH/BTC from Nov. 8 to Nov. 9, 2023 (Source: TradingView)

Graph showing ETH/BTC from Nov. 8 to Nov. 9, 2023 (Source: TradingView)In a year-long retrospective, the ETH/BTC marketplace showed a correlation coefficient of astir 0.377 betwixt terms and volume, indicating a mean affirmative association. This inclination implies that capitalist engagement, arsenic measured by volume, has mostly risen successful tandem with ETH’s worth comparative to BTC, reflecting a broader assurance successful Ethereum’s marketplace proposition.

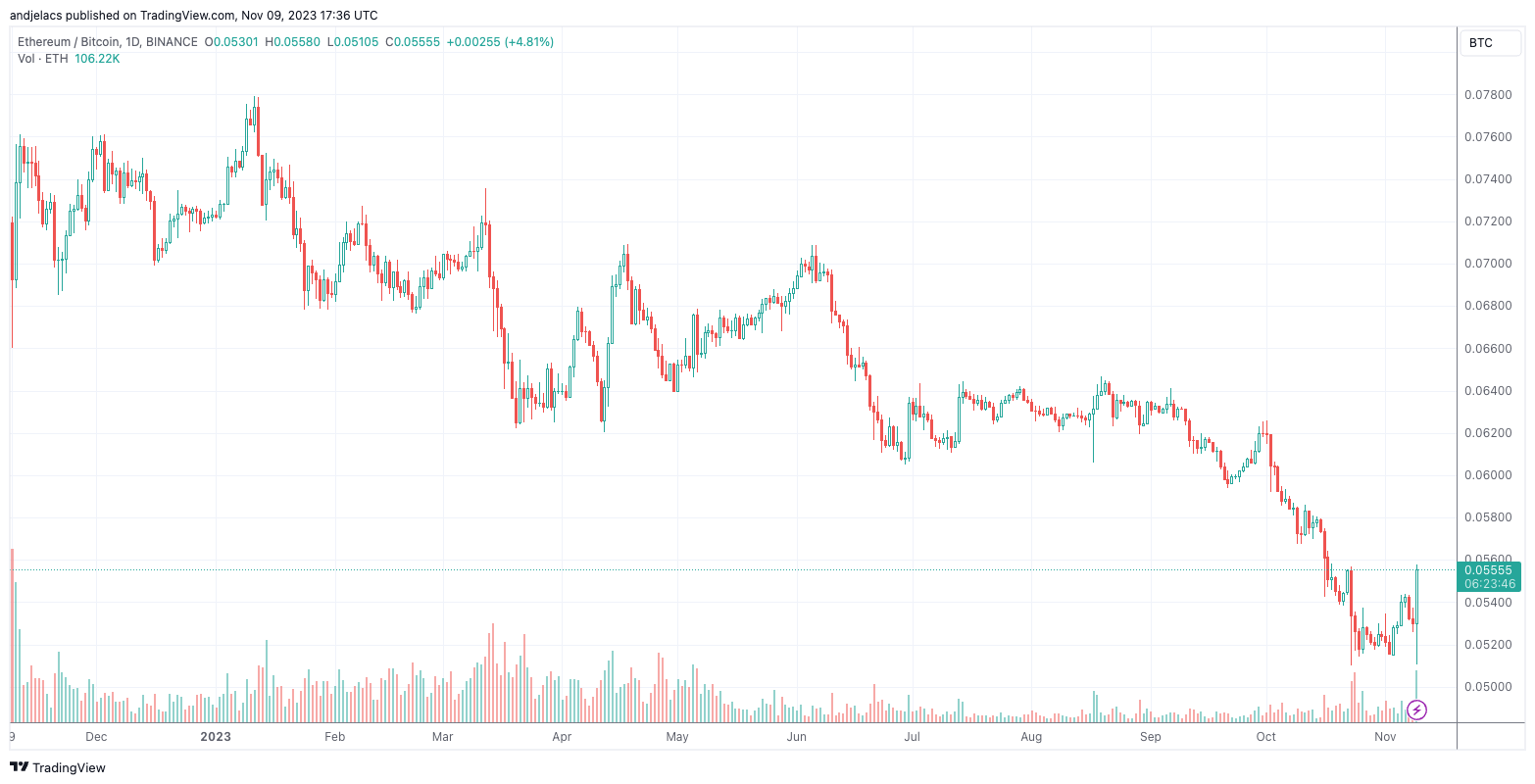

Graph showing ETH/BTC from Nov. 9, 2022 to Nov. 9, 2023 (Source: TradingView)

Graph showing ETH/BTC from Nov. 9, 2022 to Nov. 9, 2023 (Source: TradingView)These fluctuations successful the correlation coefficient, observed implicit antithetic clip frames, amusement the interplay betwixt Ethereum’s comparative valuation and trading activity. It paints a representation of a marketplace delicate to contiguous developments—like BlackRock’s registration—but besides wary of the broader trends successful the crypto industry.

Why is this displacement important? The ETH/BTC ratio’s spike and the accrued trading enactment mean heightened marketplace attention. BlackRock’s registration echoes its earlier steps with the iShares Bitcoin Trust, preluding what galore expect to beryllium an authoritative ETF application. This enactment spotlights Ethereum’s rising stature and suggests an undercurrent of optimism contempt the SEC’s historical unwillingness to o.k. an ETF.

This juxtaposition of BlackRock’s bold stride against regulatory uncertainty brings rather a spot of uncertainty to Ethereum’s future. The registration is simply a beacon of organization validation for Ethereum, but it is shrouded successful the unpredictability of the SEC’s decisions—a acquainted suspense for the crypto industry.

The station BlackRock Ethereum ETF sparks surge successful ETH/BTC ratio appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)