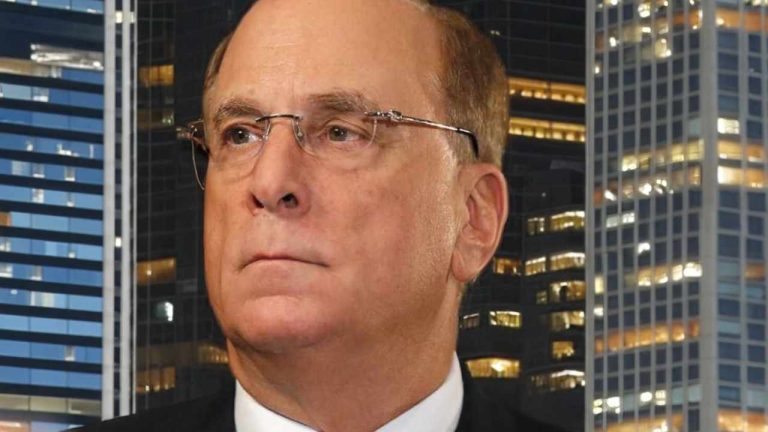

The CEO of the world’s largest plus manager, Blackrock, has warned that the United States is jeopardizing the U.S. dollar’s reserve currency status. He noted that the indebtedness ceiling debate, hazard of nationalist default, and imaginable recognition standing downgrades are “destabilizing” factors for the USD. He besides predicted that the Federal Reserve volition hike involvement rates astatine slightest 2 much times.

Larry Fink connected Rate Hikes and Inflation

Larry Fink, CEO of Blackrock, the world’s largest plus manager, shared his presumption connected the U.S. economy, aboriginal involvement complaint hikes, and the U.S. dollar’s reserve currency presumption astatine a Deutsche Bank fiscal services league Wednesday.

The enforcement expects the Federal Reserve to hike involvement rates astatine slightest 2 much times, emphasizing:

The Fed is not finished … Inflation is inactive excessively strong, excessively sticky.

“The Fed is going to person to beryllium much vigilant,” Fink said, noting that portion “The system is much resilient than the marketplace realizes,” determination are “pockets of problems,” specified arsenic the commercialized existent property sector. Last month, Federal Reserve Chair Jerome Powell hinted that the Fed whitethorn intermission raising involvement rates this month.

“I conscionable don’t spot grounds of a simplification successful inflation, oregon I don’t spot grounds that we’re going to person a hard landing,” the Blackrock enforcement opined.

However, helium downplayed the hazard of a U.S. recession, noting that if it were to occur, it would apt beryllium modest.

Risks to U.S. Dollar’s Reserve Currency Status

The Blackrock brag warned that the “drama” surrounding the indebtedness ceiling has eroded spot successful the U.S. dollar arsenic the world’s reserve currency. He cautioned:

I judge we’ll person a resolution, but let’s beryllium clear, the United States is jeopardizing its reserve currency status.

He explained that the statement astir the indebtedness ceiling, the hazard of the U.S. defaulting connected its indebtedness obligations, and imaginable recognition standing downgrades were each “destabilizing” factors for the U.S. dollar. “We are eroding immoderate of that trust, which successful the agelong tally we request to rectify and rebuild,” helium further said.

Last week, Fitch Ratings said the U.S. “AAA” recognition standing remains connected antagonistic ticker contempt the caller indebtedness bounds agreement. Prior to Congress reaching the indebtedness ceiling deal, Moody’s said: “The top near-term information to the dollar’s presumption stems from the hazard of confidence-sapping argumentation mistakes by the U.S. authorities themselves.”

On Saturday, President Joe Biden signed a measure that suspends the U.S. government’s $31.4 trillion indebtedness ceiling, averting a imaginable U.S. default. Treasury Secretary Janet Yellen antecedently warned that the Treasury would beryllium incapable to wage each of the government’s bills connected June 5 if Congress had not acted by then.

Do you hold with Blackrock CEO Larry Fink? Let america cognize successful the comments conception below.

2 years ago

2 years ago

English (US)

English (US)