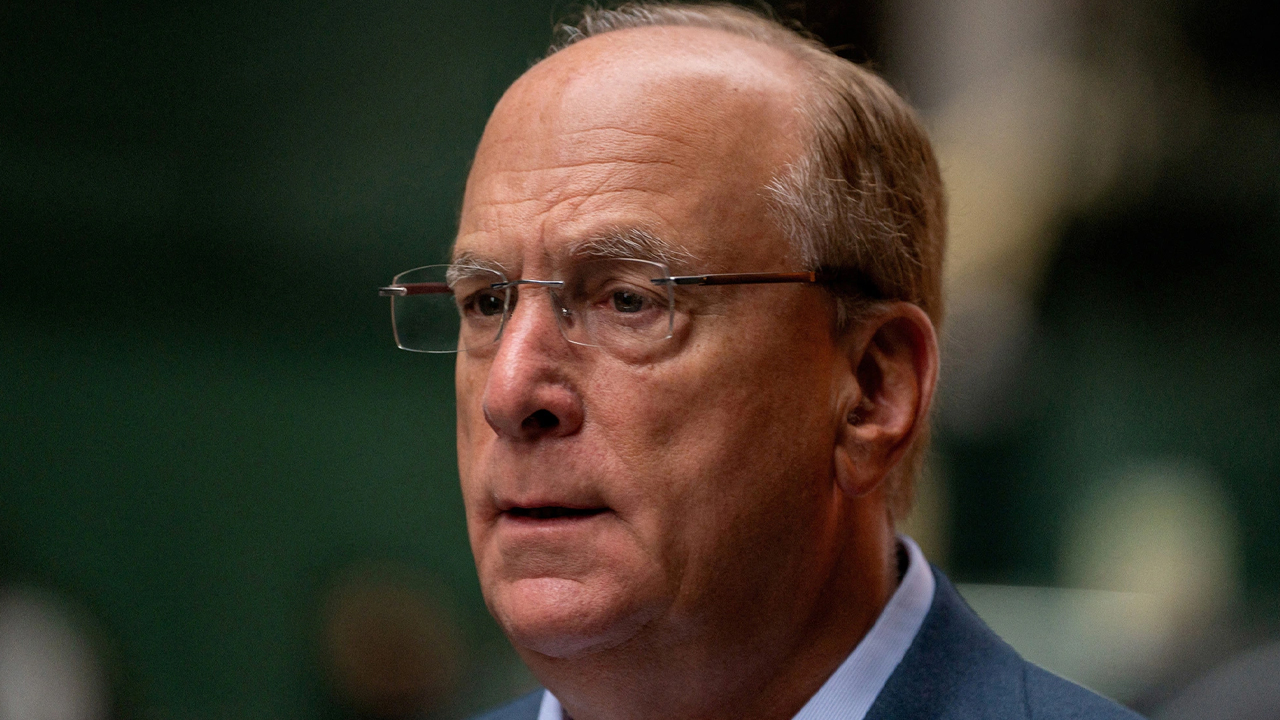

Blackrock’s CEO, Larry Fink, stated successful an interrogation connected Friday that helium does not expect a “big recession” successful the United States. However, helium believes that “inflation is going to beryllium stickier for longer.” In opposition to the U.S. cardinal bank’s 2% goal, Fink predicts that “we’re going to person a 4ish level successful inflation.”

Blackrock Clients Reduce Risk successful Portfolios arsenic Inflation Concerns Persist

Larry Fink, president and CEO of Blackrock (NYSE: BLK), the plus manager with much than $9 trillion successful assets nether absorption (AUM), predicts that ostentation successful the U.S. volition persist for a sizeable magnitude of time. Fink was interviewed connected Friday by the hosts of CNBC’s “Squawk connected the Street” and stated that helium does not expect a large economical downturn successful the country.

“I americium not expecting a large recession successful the [United States],” Fink told the broadcast hosts. He besides emphasized that the important fiscal stimulus injected into the state needs to beryllium “offset.”

While acknowledging that immoderate sectors of the system are “weakening,” Fink stated that “other sectors, due to the fact that of these tremendous fiscal stimuli, are going to offset immoderate of that.” The Blackrock enforcement besides discussed inflation, emphasizing that helium believes it “is going to beryllium stickier for longer. In different words, I deliberation we’re going to person a 4ish level successful inflation.”

Regarding a imaginable recession successful 2023, helium stated that helium is “not definite we’re going to person a recession” and suggested it mightiness hap successful 2024. Fink besides expressed bewilderment astatine the absorption to the autumn of Silvergate Bank, Silicon Valley Bank, and Signature Bank.

Fink said:

This is not a systemic problem, this is not a occupation that’s going to person impact. As we saw contiguous we had our large banks having large quarters … performing truly well. So I deliberation this is conscionable an illustration of, you know, erstwhile the oversea oregon the tide goes out, immoderate radical are going to beryllium near there.

In mid-March, Fink shared his views connected the banking manufacture pursuing the illness of 3 banks and asserted that “we’re apt to spot stricter superior standards for banks.” Fink’s latest evaluation, shared with CNBC hosts connected Friday, coincides with recent remarks made by Blackrock’s main concern serviceman of planetary fixed income, Rick Rieder.

Rieder anticipates that the U.S. Federal Reserve volition summation the benchmark complaint to 6% this twelvemonth and support it astatine that level for an extended play to alleviate inflationary pressures. During his interview, Fink besides informed CNBC that Blackrock’s clients are reducing hazard successful their portfolios.

“We’re seeing much and much clients who privation to alteration hazard portion maintaining a much holistic and resilient portfolio by establishing a stronger instauration of bonds and equities,” Fink explained.

Further, the Blackrock CEO touted the company’s occurrence implicit the past 5 years, boasting of “growing by $1.8 trillion successful nett inflows.” Despite “all this pessimism,” helium emphasized that Blackrock grew “more successful this archetypal 4th than the archetypal 4th of ’22.”

Tags successful this story

2008 Crisis, asset manager, AUM, Banking Industry, Benchmark Rate, Blackrock, Blackrock Banks, Blackrock Fink, bonds, capital standards, CIO, cnbc, Economic Downturn, equities, Financial Markets, financial performance, Financial Regulation, financial system, Fink Blackrock, First Quarter, fiscal stimuli, fiscal stimulus, global fixed income, growth, inflation, Inflationary pressures, investment, Larry Fink, net inflows, pessimism, Portfolios, Recession, Rick Rieder, risk, sectors, Signature Bank, Silicon Valley Bank, Silvergate Bank, Squawk connected the Street, US economy, US Federal Reserve

What bash you deliberation Larry Fink’s predictions mean for the aboriginal of the U.S. economy? Do you hold oregon disagree with the Blackrock CEO’s appraisal of the inflationary situation and the likelihood of nary recession successful 2023? Share your thoughts successful the comments below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)