Surging volumes successful enactment options linked to BlackRock's Nasdaq-listed spot bitcoin ETF (IBIT) could beryllium interpreted arsenic bearish sentiment. That's not needfully the case.

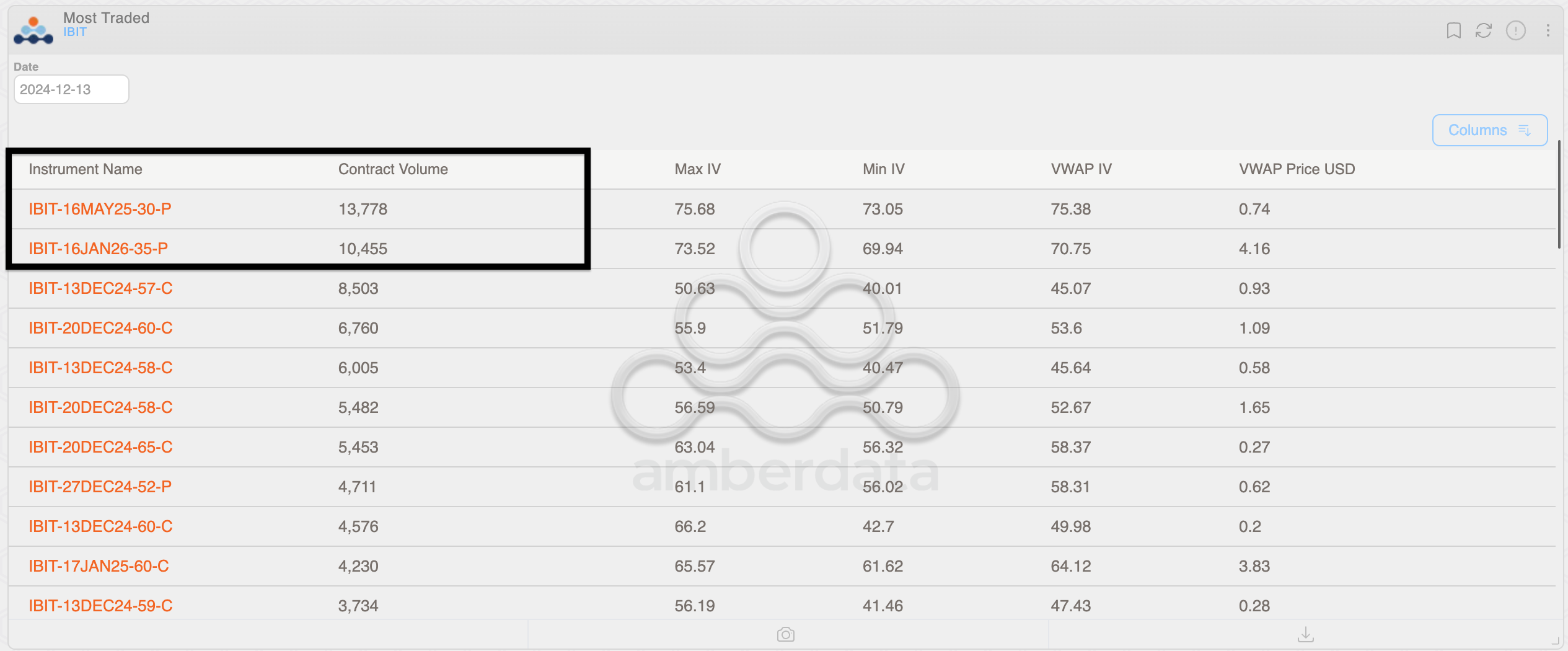

On Friday, much than 13,000 contracts of the $30 out-of-the-money (OTM) enactment enactment expiring May 16 changed hands arsenic the ETF roseate 1.7% to $57.91, according to information from Amberdata. Volume successful the $35 enactment enactment expiring Jan. 16, 2026, topped 10,000 contracts.

Most of the enactment astir apt stems from marketplace participants looking to make passive income done "cash-secured enactment selling" alternatively than outright acquisition of the options arsenic bearish bets, according to Greg Magadini, Amberdata's manager of derivatives.

A enactment seller, offering security against terms drops successful instrumentality for a premium, is obligated to acquisition the underlying plus astatine a predetermined terms connected oregon earlier a circumstantial expiration date. (That's opposed to the purchaser of the put, who has the close but not the work to merchantability the asset.)

That means savvy traders often constitute OTM puts to get the underlying plus astatine a little terms portion pocketing the premium received by selling the enactment option. They bash truthful by continuously maintaining the currency required to acquisition the plus if the proprietor of the enactment enactment exercises their close to merchantability the asset.

Hence, the strategy is called "cash-secured" selling of puts. In IBIT's case, sellers of the $35 enactment expiring successful January 2026 volition support the premium if IBIT stays supra that level until expiry. If IBIT drops beneath $35, the enactment sellers indispensable bargain the ETF astatine that terms portion keeping the premium received. The sellers of the $30 enactment expiring successful May adjacent twelvemonth look a akin payoff scenario.

"The $35 Puts for Jan 2026 traded +10k declaration with an IV scope of 73.52% to 69.94%, VWAP astatine 70.75% suggests nett selling from the street… perchance Cash Secured enactment selling flows (for traders who missed the rally)," Magadini said successful a enactment shared with CoinDesk.

Saxo Bank's expert suggested cash-secured enactment selling arsenic the preferred strategy successful Nvidia aboriginal this year.

Calls are pricier than puts

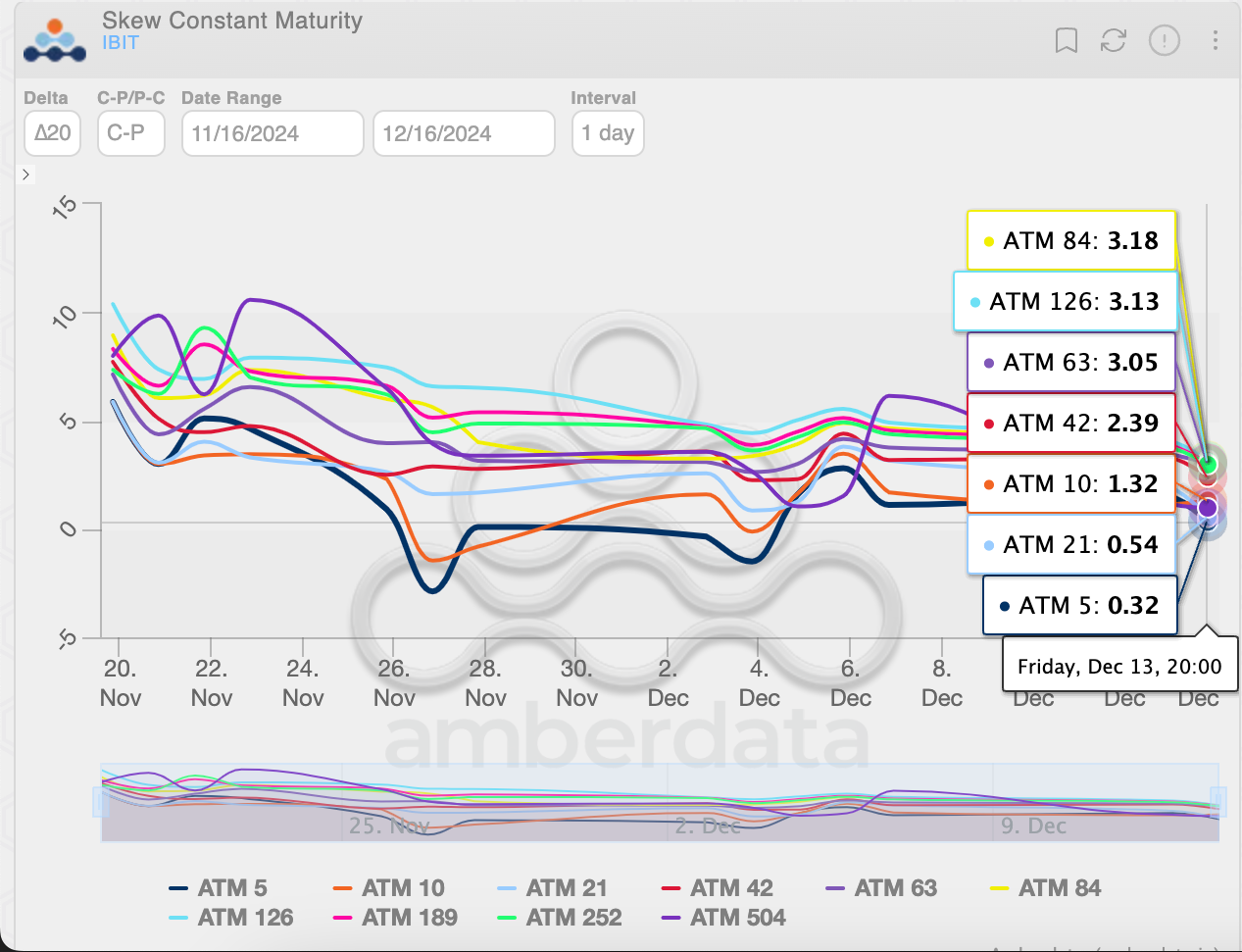

Overall, IBIT telephone options, which connection an asymmetric upside to buyers, proceed to commercialized pricer than puts.

As of Friday, call-put skews, with maturities ranging from 5 to 126 days, were positive, signaling comparative richness of implied volatility for calls. The bullish sentiment is accordant with the pricing successful options tied to bitcoin and trading connected Deribit.

On Friday, IBIT recorded a nett inflow of $393 million, representing the bulk of the full inflow of $428.9 cardinal crossed the 11 spot ETFs listed successful the U.S, according to information tracked by Farside Investors.

9 months ago

9 months ago

English (US)

English (US)