According to the latest Coingecko report, during the 2nd 4th (Q2) of 2023, the U.S. dollar worth of BTC grew by astir 7% portion that of the full crypto marketplace capitalization lone went up by 0.14%. In contrast, BTC’s mean regular trading measurement during the play fell by 58.7% from the $33.4 cardinal seen successful Q1 to $13.8 billion.

Effect of Blackrock’s Bitcoin ETF Filing Announcement

During the 2nd 4th of 2023, the fiat terms of bitcoin (BTC) grew from $28,517 to $30,481, a summation of 6.9%, information from the latest Coingecko Crypto Industry Report has shown. The apical crypto asset’s Q2 summation dwarfs the full crypto market’s marginal maturation of 0.14%. According to the manufacture report, the June 15 announcement by elephantine plus absorption Blackrock that it had filed a spot bitcoin exchange-traded money (ETF) was a cardinal origin down BTC’s surge.

However, contempt trending upward for overmuch of that quarter, the crypto asset’s traded volumes successful U.S. dollar presumption were importantly lower.

“Average regular trading measurement declined 58.7% connected a quarterly basis, from $33.4 cardinal successful Q1 to $13.8 cardinal successful Q2. This is contempt the information that BTC prices trended upwards passim Q2,” the study said.

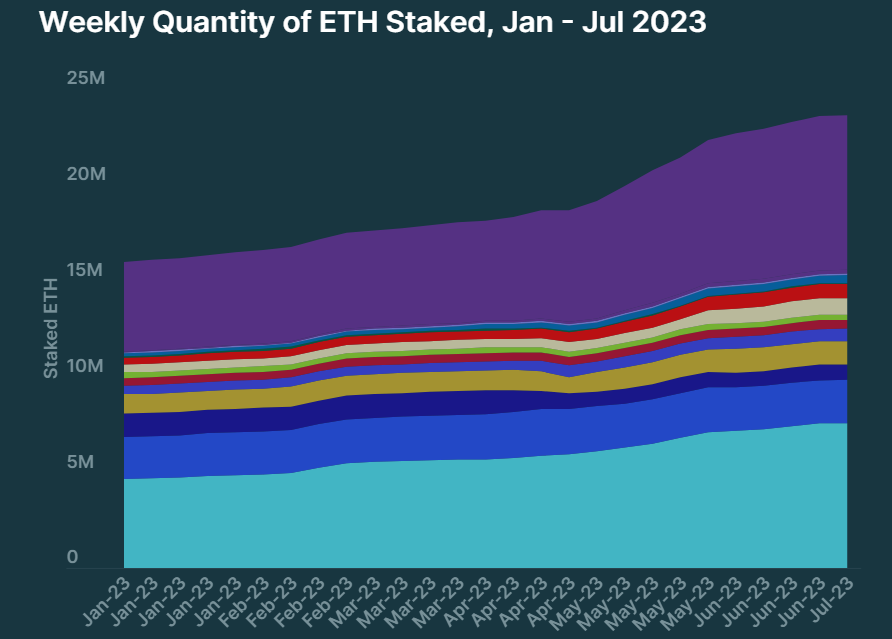

Contrasting Fortunes of ETH Staking Providers

Meanwhile, dissimilar BTC and the full crypto marketplace which trended upwards, the marketplace capitalization of stablecoins shrank by $4.6 billion. USD Coin (USDC) and Binance USD (BUSD) mislaid $5.18 cardinal (-15.9%) and $3.43 cardinal (-45.4%) successful marketplace headdress respectively. In contrast, USDT, which is the astir ascendant stablecoin, saw its marketplace headdress turn by $3.48 cardinal during the aforesaid period. Other stablecoins that registered gains see True USD which added $1.02 cardinal to its marketplace cap. Gemini Dollar, Flex USD and Paxos each their respective marketplace caps turn by double-digit figures.

In the aforesaid period, the full staked ethereum (ETH) accrued by 5.6 cardinal to extremity the 4th astatine 23.6 million. As noted successful the report, staking providers similar Lido and Kraken had contrasting fortunes during the period. The study explained:

Lido remained the ascendant staking provider, with 31.9% of each staked ETH. This represents a flimsy summation from its 31.4% marketplace stock successful Q1. Meanwhile, Kraken’s dominance fell to 3.4% arsenic it winds down its staking merchandise successful the U.S. pursuing a colony with the SEC. The speech had a -36.2% driblet successful staked ETH QoQ [quarter-on-quarter]. Coinbase’s dominance besides fell by -3.5% successful Q2, ending the 4th with a 9.6% marketplace share.

Concerning non-fungible token (NFT) traded volumes, the information successful the study indicates that Bitcoin ordinals accounted for conscionable implicit 20% of May’s volumes. However, Ethereum was inactive the astir ascendant level for NFT trading during that period and implicit the full period.

What are your thoughts connected this story? Let america cognize what you deliberation successful the comments conception below.

2 years ago

2 years ago

English (US)

English (US)