Bitcoin’s terms experienced a crisp pullback pursuing the US Federal Reserve’s caller complaint cut, but marketplace experts similar Bitwise CIO Matt Hougan stay optimistic astir the asset’s semipermanent trajectory.

On Dec. 18, the Federal Reserve announced a 25-basis-point complaint cut, scaling backmost its outlook for 2024 to 2 cuts alternatively of the antecedently expected four.

Also, and possibly much importantly for Bitcoin, Chair Jerome Powell added that the Fed cannot clasp BTC nether existent regulations portion responding to inquiries astir President-elect Donald Trump’s strategical reserve plans.

This triggered important marketplace reactions, with Bitcoin’s terms falling to arsenic debased arsenic $98,839 earlier stabilizing astatine $101,586 earlier today. Similarly, different apical integer assets similar Ethereum, XRP, and Solana besides recorded losses of astir 5%, 5.5%, and 3%, respectively.

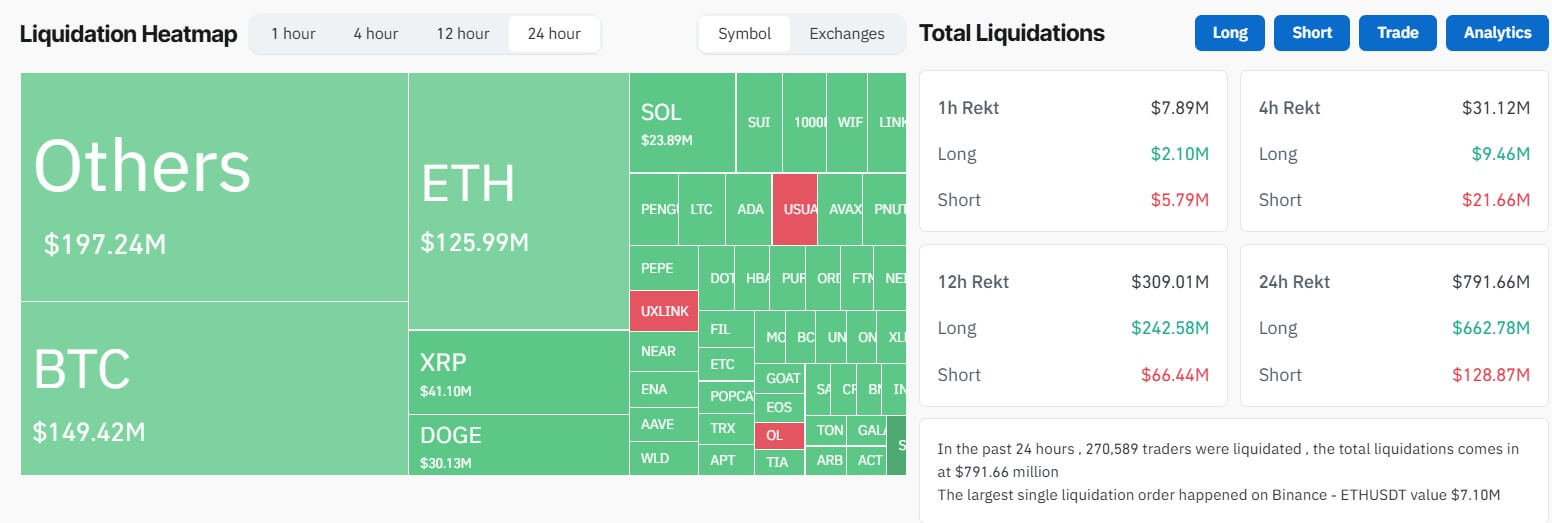

Data from CoinGlass shows that this reddish marketplace show led to astir $800 cardinal successful liquidation, impacting much than 270,000 traders. Traders speculating connected upward terms question suffered the astir losses, losing $662 cardinal during the past 24 hours.

Crypto Market Liquidation (Source: CoinGlass)

Crypto Market Liquidation (Source: CoinGlass)Beyond crypto, accepted markets similar the S&P 500 and the Russell 2000 Index experienced 3% and 4.4% declines, respectively.

Bitcoin’s semipermanent trajectory

Despite this pullback, Hougan reassured investors that Bitcoin’s fundamentals stay strong.

The Bitwise CIO explained that Bitcoin’s caller resilience stems from interior crypto-specific factors, specified arsenic increasing organization adoption, pro-crypto shifts successful US policy, and authorities and corporate Bitcoin purchases.

He besides highlighted important blockchain advancements and expanding ETF flows arsenic further drivers of marketplace strength.

Moreover, Bitcoin’s method indicators stay favorable, with its 10-day exponential moving mean ($102,000) inactive supra the 20-day exponential moving mean ($99,000). Hougan views this arsenic a bullish signal, reinforcing his content that the existent dip is simply a short-term fluctuation alternatively than the extremity of the ongoing bull market.

Despite outer pressures, Hougan predicted that Bitcoin would proceed its multi-year upward trajectory, buoyed by beardown adoption trends and technological advancements successful the crypto space.

He concluded:

“Crypto’s successful a multi-year bull market. 50bps of projected complaint cuts won’t alteration that.”

The station Bitwise CIO downplays terms ‘hiccup’ amid Bitcoin bull inclination aft FOMC shakes markets appeared archetypal connected CryptoSlate.

9 months ago

9 months ago

English (US)

English (US)