The world’s number-one crypto is looking much similar a mature plus people each time arsenic Bitcoin volatility continues to driblet (yes, adjacent arsenic it blasts past all-time highs and promptly retraces its steps).

Bitcoin volatility has reached a five-year low

Bitcoin has agelong been regarded arsenic 1 of the astir volatile fiscal assets; its turbulent terms fluctuations implicit the years person deterred galore investors. But what if I told you that Bitcoin is present little volatile than a blue-chip tech stock?

According to ecoinometrics, Bitcoin’s 30-day realized volatility is present astatine its lowest constituent successful astir 5 years, and it’s a inclination that has persisted adjacent done Bitcoin’s headline-making rallies and corrections implicit the past 5 years:

“Exactly what you expect from a maturing asset.”

Bitcoin volatility reaches a five-year low.

Bitcoin volatility reaches a five-year low.Since 2022, Bitcoin has often been little volatile than immoderate of Wall Street’s biggest names, including mega-cap stocks similar Nvidia. During the crisp tech assemblage swings of 2023 and 2024, Nvidia’s terms was much unpredictable than Bitcoin, an plus infamous for its hair-raising moves.

Even during this existent Bitcoin bull run, the terms swings person remained notably tamer than erstwhile cycles. Macro expert Lyn Alden precocious told CryptoSlate she believes that Bitcoin’s cycles are changing.

We should expect this 1 to beryllium longer and “less extreme” than erstwhile runs, with beardown moves upward followed by periods of consolidation, “rather than going to the satellite and collapsing.”

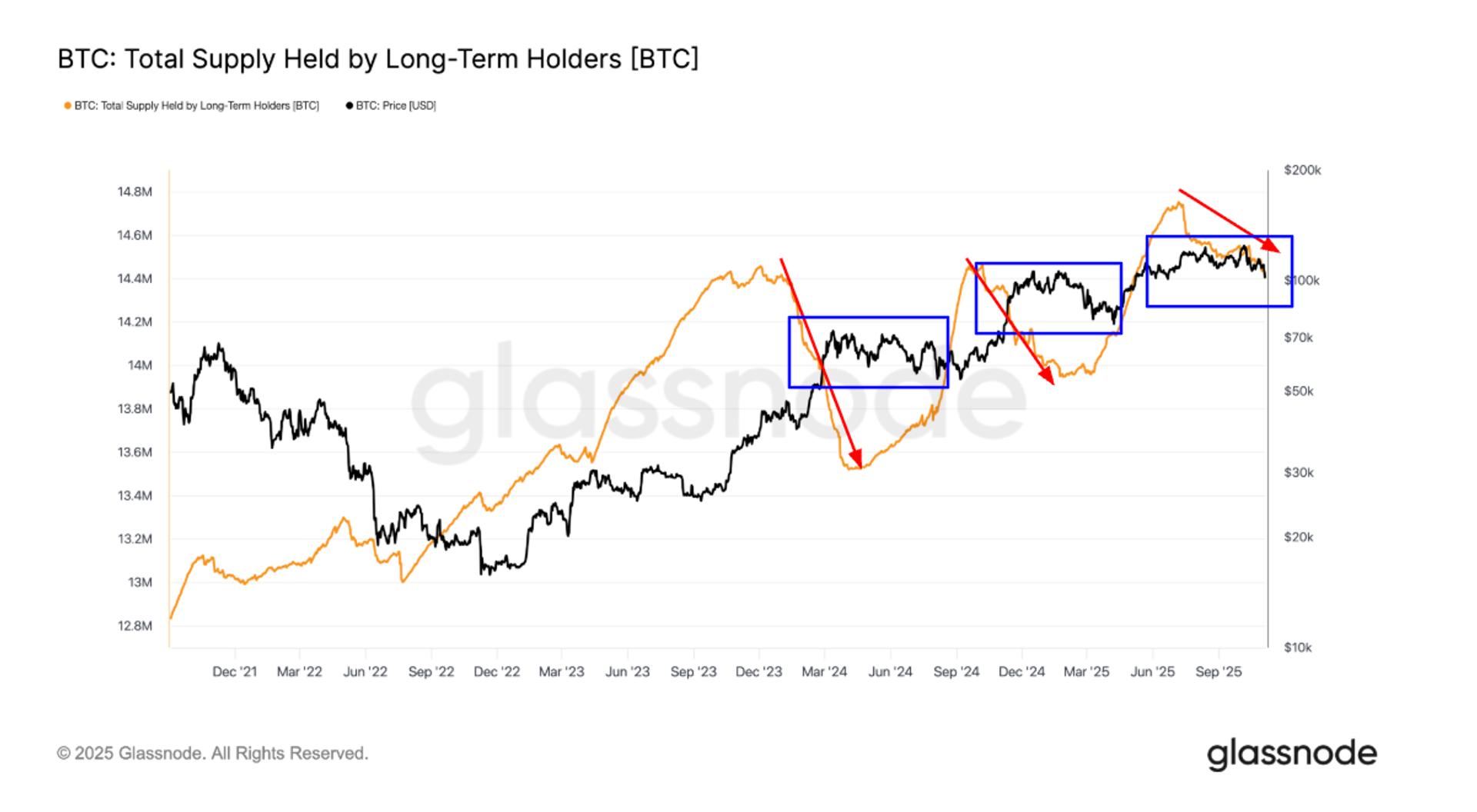

All the signs of plus people maturity

Bitcoin volatility declining is conscionable 1 marker of its increasing maturity. The motorboat of spot Bitcoin ETFs successful the U.S. successful aboriginal 2024 was a landmark event, opening up the plus to the mainstream audience.

Major plus managers similar BlackRock and Fidelity connection nonstop Bitcoin vulnerability to retail and organization investors done regulated exchange-traded products. This has introduced broader ownership and liquidity, dampening ample terms swings and integrating Bitcoin much profoundly into accepted markets.

Moreover, caller regulatory changes present let Americans to see Bitcoin successful their 401k status accounts. As diversified portfolios sorb BTC allocations, Bitcoin volatility further subsides.

Pension funds, endowments, and security companies person begun allocating to Bitcoin arsenic portion of their alternate plus strategies. This increases trading by blase investors and reduces the interaction of short-term speculative flows.

Strong-willed kids go adults who alteration the world

Increasingly, Bitcoin’s terms shows a higher correlation with broader equity markets during risk-on and risk-off periods, different motion of integration and maturity. While you tin reason whether this is what we intended for Bitcoin, it does bespeak mainstream marketplace adoption. And hey, strong-willed kids go adults who alteration the world, arsenic Bitcoin is undoubtedly doing.

For mundane investors and institutions alike, little Bitcoin volatility translates to little hazard and a smoother concern profile.

It’s besides a motion that Bitcoin is outgrowing its teen signifier of chaotic speculative swings and turbulence, and settling into its relation arsenic a morganatic subordinate of nine and staple of diversified portfolios. It’s clip to admit, our babe is afloat grown.

The station Bitcoin volatility keeps falling, and that means it’s maturing arsenic an plus class appeared archetypal connected CryptoSlate.

2 months ago

2 months ago

English (US)

English (US)