The beneath is an excerpt from a caller variation of Bitcoin Magazine PRO, Bitcoin Magazine's premium markets newsletter. To beryllium among the archetypal to person these insights and different on-chain bitcoin marketplace investigation consecutive to your inbox, subscribe now.

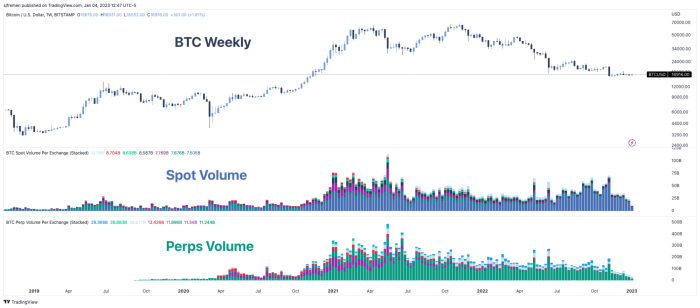

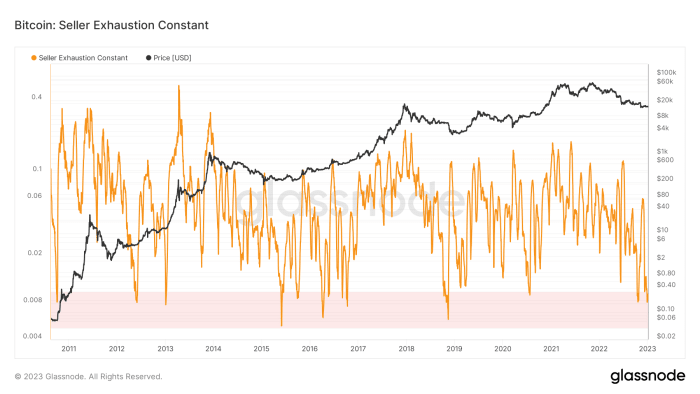

As we caput into 2023, we privation to item the latest authorities of bitcoin’s measurement and volatility aft a caller question of capitulation. Last clip we touched connected these dynamics was successful “The Bitcoin Ghost Town” successful October, wherever we highlighted that an highly debased measurement and debased volatility play successful bitcoin price, GBTC and the options marketplace was a concerning motion for the adjacent limb lower. This played retired successful aboriginal November.

Fast guardant and the trends of declining measurement and debased volatility are backmost erstwhile again. Although this could beryllium indicative of different limb little to travel successful the market, it’s much apt indicative of a complacent and decimated marketplace that fewer participants privation to touch.

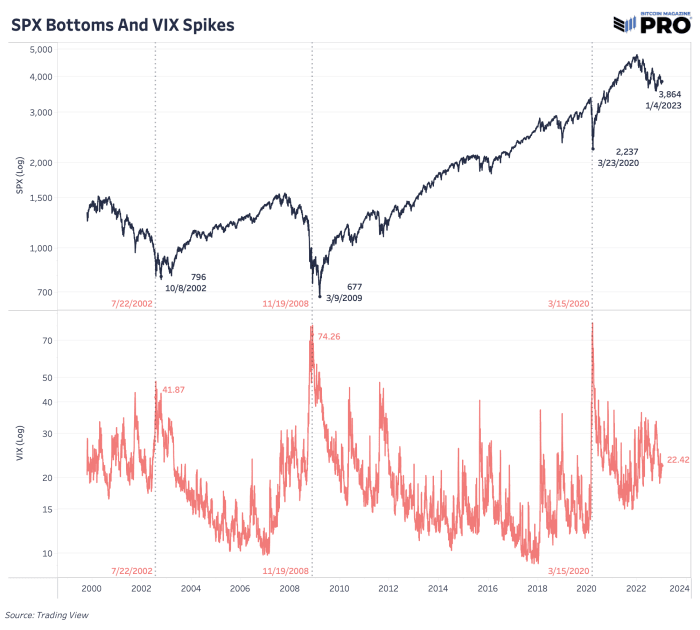

Even during the November 2021 capitulation period, determination was a historically debased play of volatility. Sometimes the astir marketplace symptom tin beryllium felt erstwhile having to hold for a wide alteration successful trends. The bitcoin terms is providing that symptom arsenic we’ve yet to spot the benignant of detonation successful marketplace volatility that has defined marketplace pivots and large directional moves successful the past.

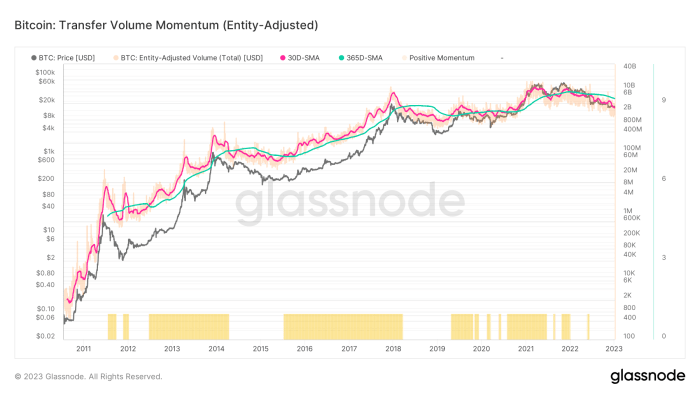

While determination are galore antithetic ways to define, classify and estimation bitcoin measurement successful the market, they each amusement the aforesaid thing: September and November 2021 were the highest months of action. Since then, measurement successful some the spot and perpetual futures markets person been successful dependable decline.

Overall marketplace extent and liquidity has besides taken a large deed aft the illness of FTX and Alameda. Their demolition has led to a ample liquidity hole, which is yet to beryllium filled owed to the deficiency of marketplace makers presently successful the space.

By far, bitcoin is inactive the astir liquid marketplace of immoderate different cryptocurrency oregon “token,” but it’s inactive comparatively illiquid compared to different superior markets since the full manufacture has been crushed implicit the past fewer months. Lower marketplace extent and liquidity means assets are prone to much volatile shocks arsenic single, comparatively ample orders tin person a greater interaction connected marketplace price.

On-Chain Apathy

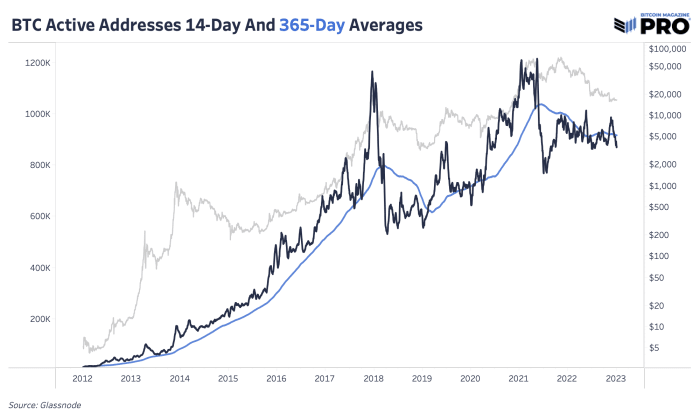

As expected successful the existent environment, we’re besides seeing much marketplace complacency erstwhile looking astatine on-chain data. Although continuing to emergence implicit time, the fig of progressive addresses — unsocial addresses progressive arsenic either a sender oregon receiver — stay reasonably stagnant implicit the past fewer months. The illustration beneath highlights the 14-day moving mean of progressive addresses falling beneath the moving mean implicit the past year. In erstwhile bull marketplace conditions, we’ve seen maturation successful progressive addresses outpace the existing inclination reasonably significantly.

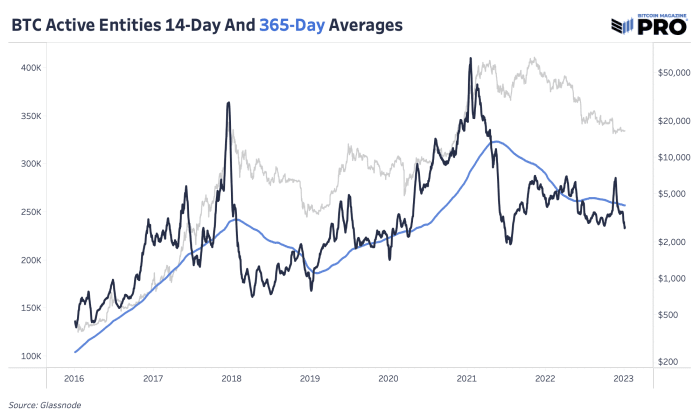

Since code information has its flaws, looking astatine Glassnode’s information for progressive entities shows america the aforesaid trend. Overall, carnivore markets reversing are the effect of galore factors, including maturation successful caller users and an summation successful on-chain activity.

In our July 11 merchandise “When Will The Bear Market End?”, we made the lawsuit that the brunt of the price-based capitulation had already been felt, portion the existent symptom up was successful the signifier of a time-based capitulation.

“A look astatine erstwhile bitcoin carnivore marketplace cycles shows 2 chiseled phases of capitulation:

“The archetypal is simply a price-based capitulation, done a bid of crisp selloffs and liquidations, arsenic the plus draws down anyplace from 70 to 90% beneath erstwhile all-time-high levels.

“The 2nd phase, and the 1 that is spoken of acold little often, is the time-based capitulation, wherever the marketplace yet begins to find an equilibrium of proviso and request successful a heavy trough.” — Bitcoin Magazine PRO

We judge time-based capitulation is wherever we basal today. While speech complaint pressures tin surely intensify implicit the abbreviated word — fixed the macroeconomic headwinds that stay — the conditions that look apt to persist implicit the abbreviated and mean word look to beryllium a sustained play of chop with highly debased levels of volatility that permission some traders and HODLers questioning erstwhile volatility and speech complaint appreciation volition return.

Like this content? Subscribe now to person PRO articles straight successful your inbox.

2 years ago

2 years ago

English (US)

English (US)