Bitcoin (BTC) volatility bulls whitethorn soon get their privation due to the fact that seasonal patterns successful Cboe's Volatility Index (VIX) suggest Wall Street is poised for accrued turbulence.

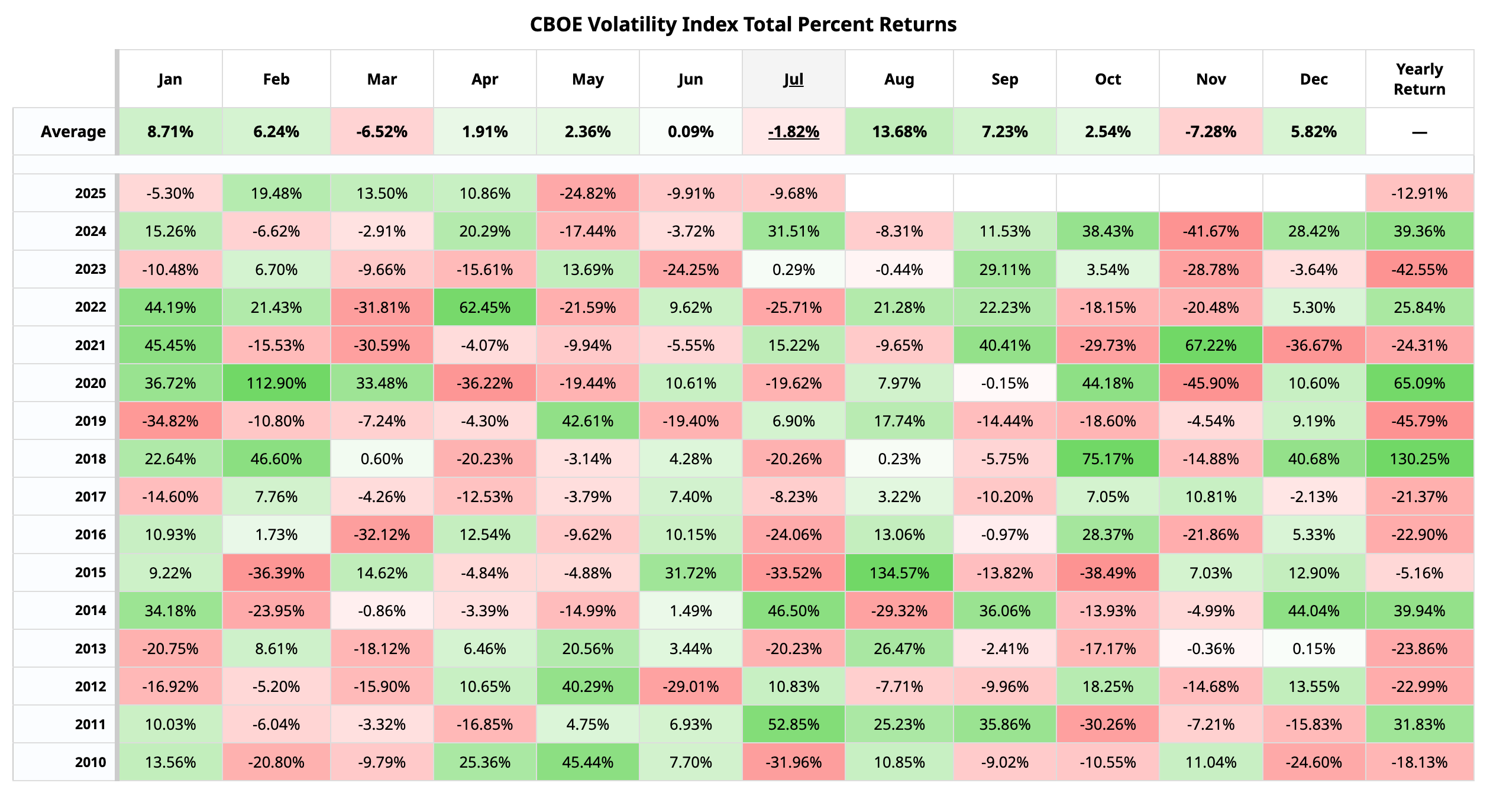

The VIX measures the anticipated 30-day swings of the S&P 500 benchmark. Its humanities pattern, according to Barchart.com, shows a predominant August surge, often preceded by a diminution successful July.

August stands retired arsenic having the highest mean monthly gain, 13.68%, implicit the past 15 years, rising successful 10 of those years, including a monumental 135% spike successful 2015.

History repeating itself?

The VIX fell for a 3rd consecutive period successful July, extending the descent from April highs. It deed a five-month debased of 14.92 connected Friday, according to information root TradingView.

If past is simply a guide, this diminution is apt mounting the signifier for the August roar successful volatility and hazard aversion connected Wall Street. The VIX, which has been nicknamed the Fear Gauge, spikes higher erstwhile banal prices diminution and falls erstwhile they rise.

In different words, the expected volatility roar connected Wall Street could beryllium marked by a banal marketplace swoon, which could spill implicit into the bitcoin market.

Bitcoin tends to way the sentiment connected Wall Street, particularly successful the exertion stocks, reasonably closely. BTC's implied volatility indices person developed a beardown affirmative correlation with the VIX, signaling a dependable improvement into VIX-like fearfulness gauges. Since November, BTC's 30-day implied volatility indices person declined sharply, ending the affirmative correlation with the spot price.

3 months ago

3 months ago

English (US)

English (US)