Key takeaways:

Retail traders are aggressively buying BTC terms dips successful spot and futures markets, but nett selling from larger bid investors is preventing a robust terms recovery.

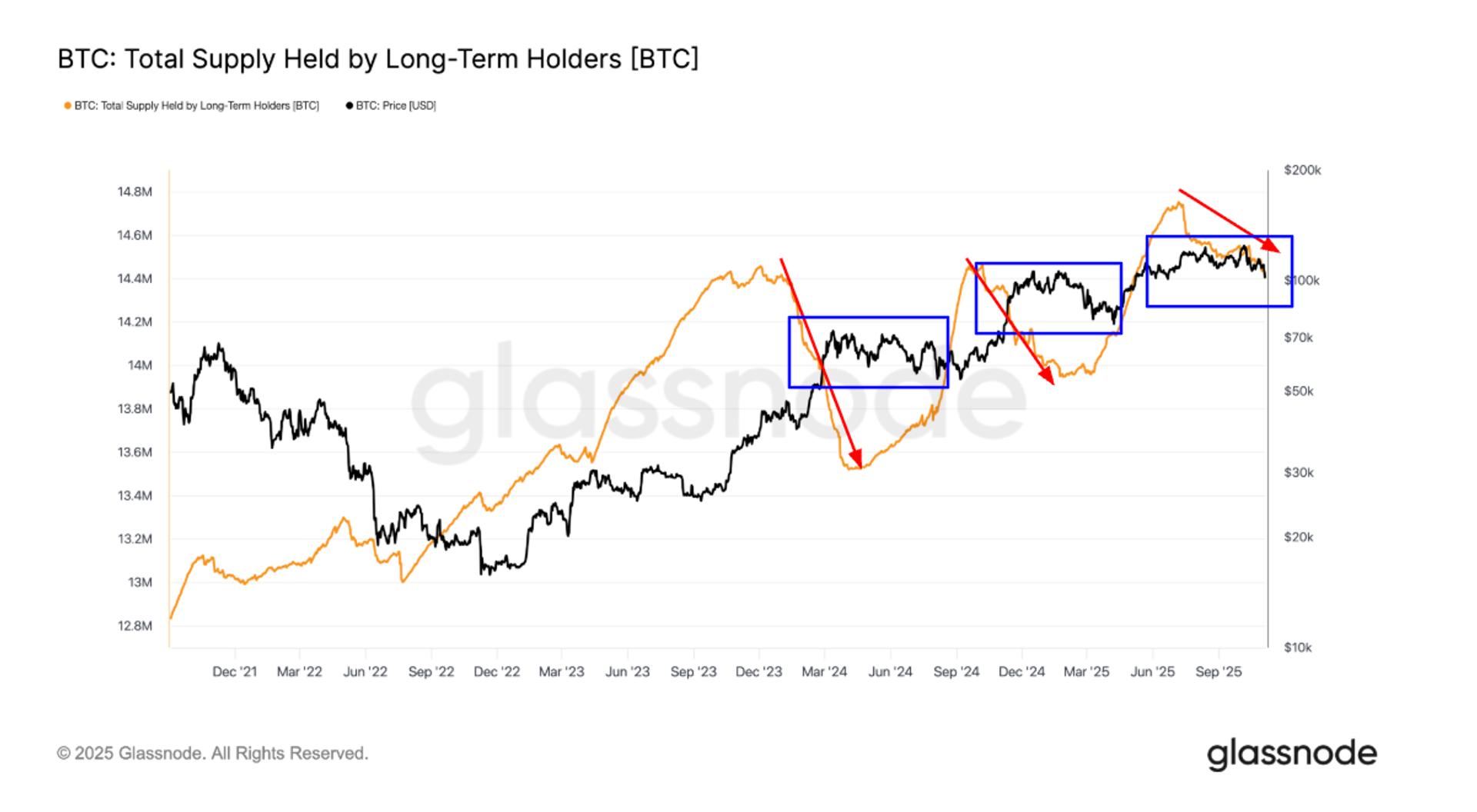

Risk of different liquidation cascade to $105,000 seems little likely, but capitalist sentiment is misaligned with the inclination seen successful assorted cumulative measurement information cohorts.

Bitcoin (BTC) and Ether (ETH) are recovering and attempting to retrieve the terms ranges that each cryptocurrency mislaid during the crisp sell-off seen connected Saturday and Sunday. Bitcoin terms is up a specified 2.4% from its $108,665 low, portion ETH fared better, rising 8.26% to a regular precocious astatine $4,663 from its Monday debased astatine $4,310.

Data shows an assortment of traders buying the dip, yet BTC terms remains stuck successful a downtrend. The anchored cumulative measurement delta (aggregated) for the cohort considered to beryllium retail traders (1K to 10K) shows these entities nett buying passim the correction from Sunday to Wednesday.

Whale and institutional-sized traders (1 cardinal to 10 million) were nett sellers successful the aforesaid clip frame, but arsenic the illustration shows, the strength of the selling has subsided arsenic BTC terms reclaimed the $111,000 zone.

A much granular look astatine CVD information shows retail traders successful Binance’s Bitcoin spot and perpetual futures markets opening longs passim the dip, whereas whales and organization investor-sized traders person been nett sellers.

Retail traders successful the Coinbase Bitcoin spot marketplace person besides been active, with volumes reaching $101.253 cardinal successful nett buying, portion the organization capitalist cohort astatine Coinbase and Binance person been nett sellers with perps markets unloading astir $7.5 cardinal successful the clip framework portrayed.

The takeaway is, whales predominate the selling unit crossed the market, portion retail and mid-size players effort to supply terms enactment and look to judge that they are either buying Bitcoin astatine a discounted valuation oregon banking connected a speedy mean reversion backmost to the $117,000 to $118,000 range. Despite this, Bitcoin continues to languish successful a short-term downtrend contempt a positive,smaller-order CVD astatine Binance and Coinbase.

Related: BlackRock Bitcoin ETF holdings overtake Coinbase, Binance; ETH whitethorn beryllium next

$120,000 oregon $105,000, which comes first?

Liquidation heatmap information from Hyblock shows Bitcoin absorbing bids successful the $111,000 to $110,000 country during the play sell-off, and different clump exists adjacent $104,000.

While a breakdown to the lowest liquidity clump seems unlikely, the existent dynamic of larger bid selling acold outweighing the retail cohort continues to enactment unit connected BTC price.

Traders hoping for a play of consolidation should cautiously observe the anchored aggregated regular CVD to spot if this merchantability unit alleviates and if specified a alteration successful measurement aligns with shifting sentiment among investors.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

2 months ago

2 months ago

English (US)

English (US)