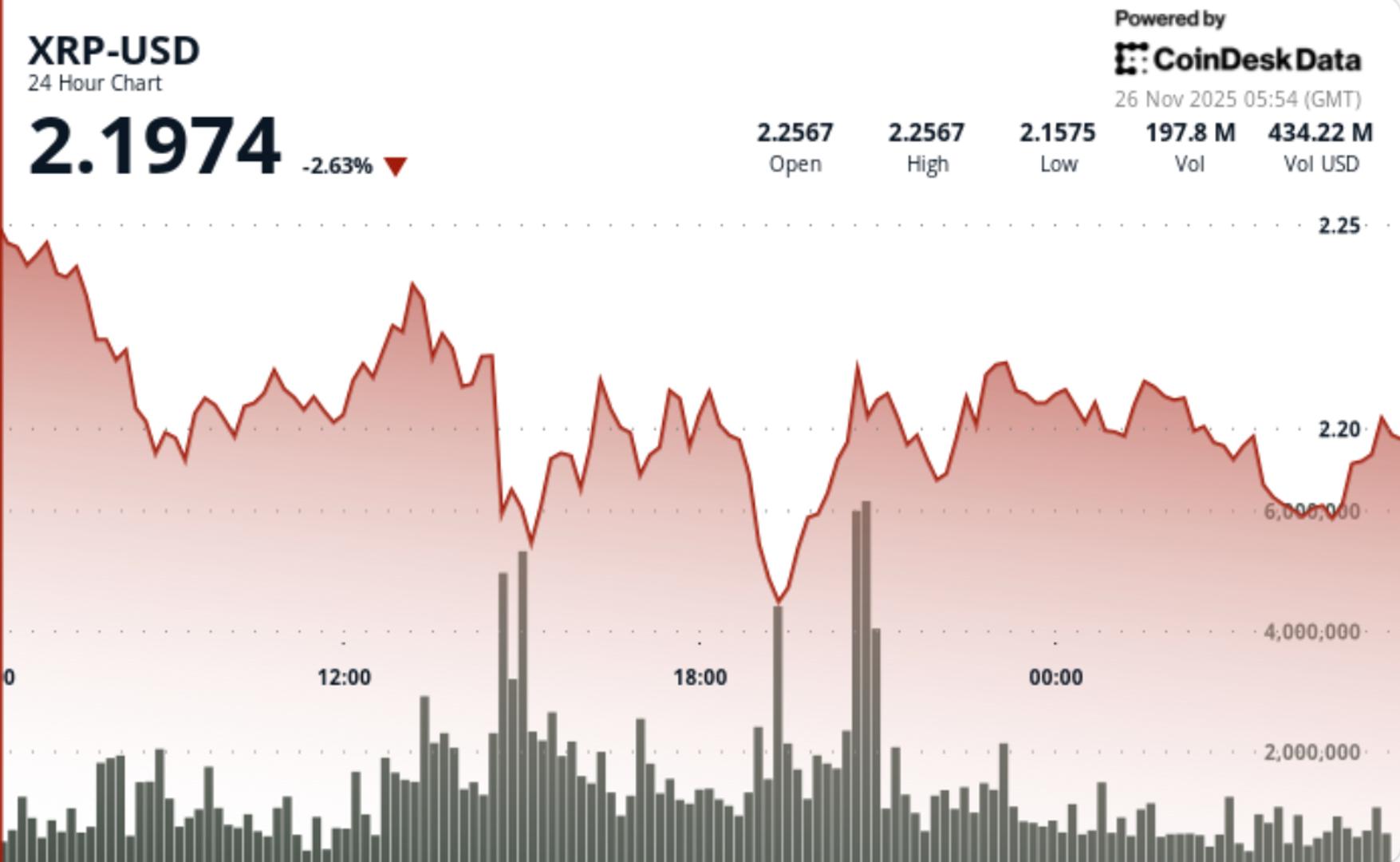

Bitcoin (BTC) reclaimed $90,000 this week, but onchain information indicated that the determination sat connected shaky grounds. Despite a beardown cost-basis cluster, demand, liquidity, and futures enactment remained thin.

Key takeaways:

The $84,000 cost-basis clump held 400,000 BTC, but spot request supra it remains shallow.

BTC liquidity signals resembled the weakness seen successful aboriginal 2022, with losses dominating caller flows.

Recent futures enactment was mostly shorts-covering, and not long-positional build-up.

BTC spot request indispensable amended supra $84,000 outgo basis

Bitcoin’s caller determination took spot astatine the backmost of a dense cost-basis clump astir $84,000. More than 400,000 BTC were acquired successful this range, forming a wide onchain “floor.”

But the contented is that contempt this dense base, spot information supra is visibly limited. Order books remained thin, and prices are moving done areas with minimal purchaser engagement. For Bitcoin to clasp supra $90,000, this dynamic indispensable displacement from passive humanities accumulation to progressive ongoing demand.

A healthier bullish operation requires much spot absorption betwixt $84,000 and $90,000, which the marketplace has yet to execute aft the caller dip.

Liquidity needs to stabilize arsenic short-term holders suffer confidence

Glassnode noted that Bitcoin continued to commercialized beneath the short-term holder (STH) outgo ground ($104,600), placing the marketplace successful a low-liquidity portion akin to the Q1 2022 post-ATH fade.

The $81,000–$89,000 compression, coupled with realized losses present averaging $403 million/day, implied that investors were exiting alternatively than buying into the strength. The STH Profit/Loss Ratio’s illness to 0.07x reinforced that request momentum has evaporated.

For the inclination to shift, realized losses indispensable statesman contracting, and STH profitability indispensable retrieve supra neutral levels. Without a liquidity reset, the marketplace remains astatine hazard of drifting toward the “True Market Mean” adjacent $81,000 again.

Related: Bitcoin bounces to seven-day highs, but tin BTC interruption $95K connected Thanksgiving?

BTC futures markets request violative bargain bids

The breakout to $91,000 has truthful acold been fueled chiefly by shorts covering, not caller agelong exposure. Open involvement continued to decline, cumulative measurement delta is flat, and shorts liquidation pockets drove the determination done $84,000, $86,000, and $90,000.

Funding rates hovering adjacent neutral bespeak a cautious derivatives environment. Leverage is bleeding retired successful an orderly fashion, but buyers aren’t stepping successful with conviction.

Thus, a supportive inclination displacement would necessitate rebuilding unfastened involvement connected the agelong side, on with sustained affirmative backing driven by existent demand, alternatively than forced abbreviated exits.

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

1 hour ago

1 hour ago

English (US)

English (US)