While bitcoin (BTC) continues to scope caller beingness highs, the latest options marketplace inclination indicates that traders aren't chasing the uptrend with the aforesaid zeal arsenic before.

On Monday, BTC's terms roseate supra $107,000, surpassing the erstwhile highest connected Dec. 5 and taking the cumulative post-U.S.-election summation to implicit 50%, CoinDesk information show.

The rally follows President-elect Donald Trump's assurance that the U.S. volition physique a bitcoin strategical reserve akin to its strategical lipid reserve. Analysts expect the winning streak to proceed adjacent year, with prices ranging betwixt $150K to $200K by the extremity of the pursuing year.

However, the existent pricing of options trading connected Deribit indicates that traders aren't chasing the rally similar they utilized to, signaling a much cautious outlook for the abbreviated term.

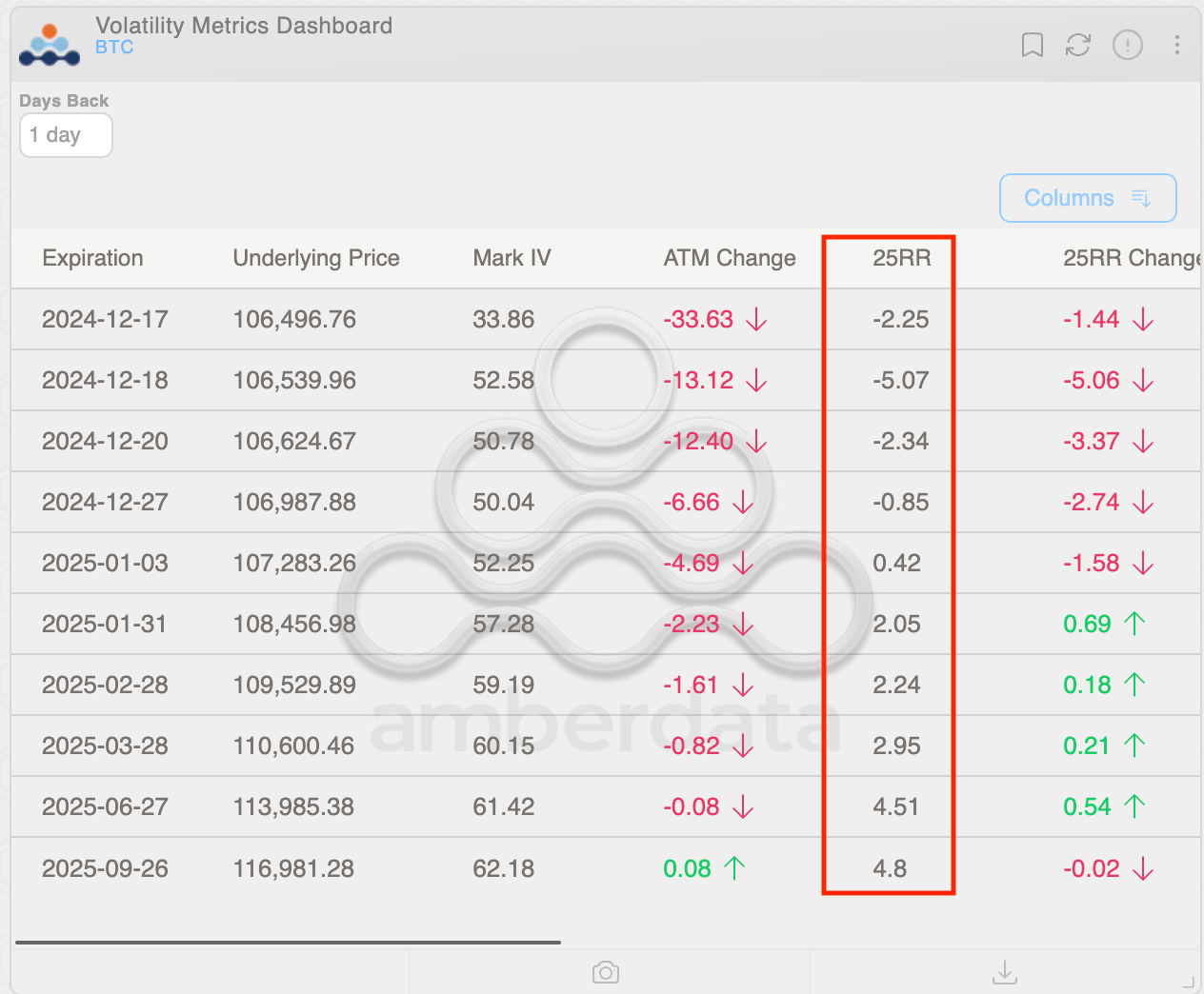

At property time, the 25-delta hazard reversal for options expiring connected Friday was negative, indicating the comparative richness of enactment options that supply extortion against terms drops. Puts expiring connected Dec. 27 were trading astatine a flimsy premium to calls, portion the hazard reversals extending to the extremity of March extremity expiry demonstrated a telephone bias of little than 3 volatility points.

That starkly contrasts the inclination we've observed implicit the past fewer weeks, wherever traders aggressively chased caller terms peaks, driving short-term and semipermanent telephone biases to implicit 4 oregon 5 volatility points. In fact, short-term hazard reversals often displayed a stronger telephone bias than their longer-term counterparts.

The latest artifact trades coming done connected Deribit, arsenic tracked by Amberdata, besides amusement a bearish lean. The apical commercialized truthful acold contiguous has been a abbreviated presumption successful the Dec. 27 expiry telephone astatine the $108,000 onslaught followed by agelong positions successful the $100,000 onslaught puts expiring connected Dec. 27 and Jan. 3.

The cautious sentiment could beryllium owed to concerns that connected Wednesday the Federal Reserve will signal less oregon slower complaint hikes for 2025 portion delivering the wide expected 25 ground points complaint cut. Such an result could accelerate hardening of the enslaved yields, strengthening the dollar and denting the lawsuit for investing successful riskier assets. Perhaps, blase BTC traders are positioning for a correction.

9 months ago

9 months ago

English (US)

English (US)