By James Van Straten (All times ET unless indicated otherwise)

As August draws toward a close, bitcoin (BTC) bulls whitethorn invited the extremity of a humble pullback, with the largest cryptocurrency down astir 4% for the period and 12% disconnected its all-time precocious of $124,500.

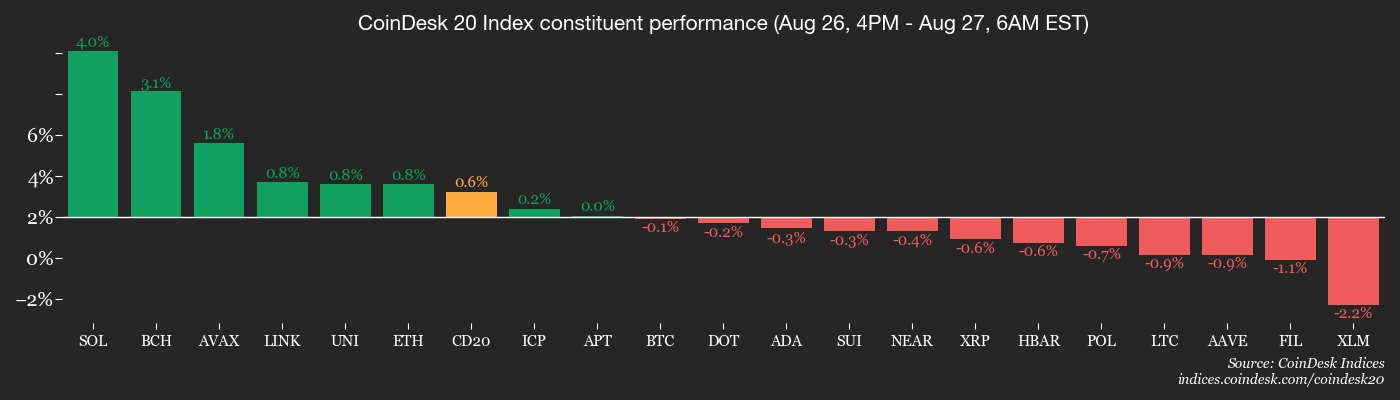

For now, it's small changed astir $110,580, up little than 0.5% implicit 24 hours portion ether (ETH) has added 3.4%. The CoinDesk 20 index, a measurement of the broader market, roseate 2.7% successful the aforesaid period.

A antagonistic extremity to August would halt a streak of 4 consecutive greenish months, the longest tally since March past year. Encouragingly, August has held up amended than successful the past 3 years, and September should bring a pickup successful trading enactment arsenic the vacation play winds down.

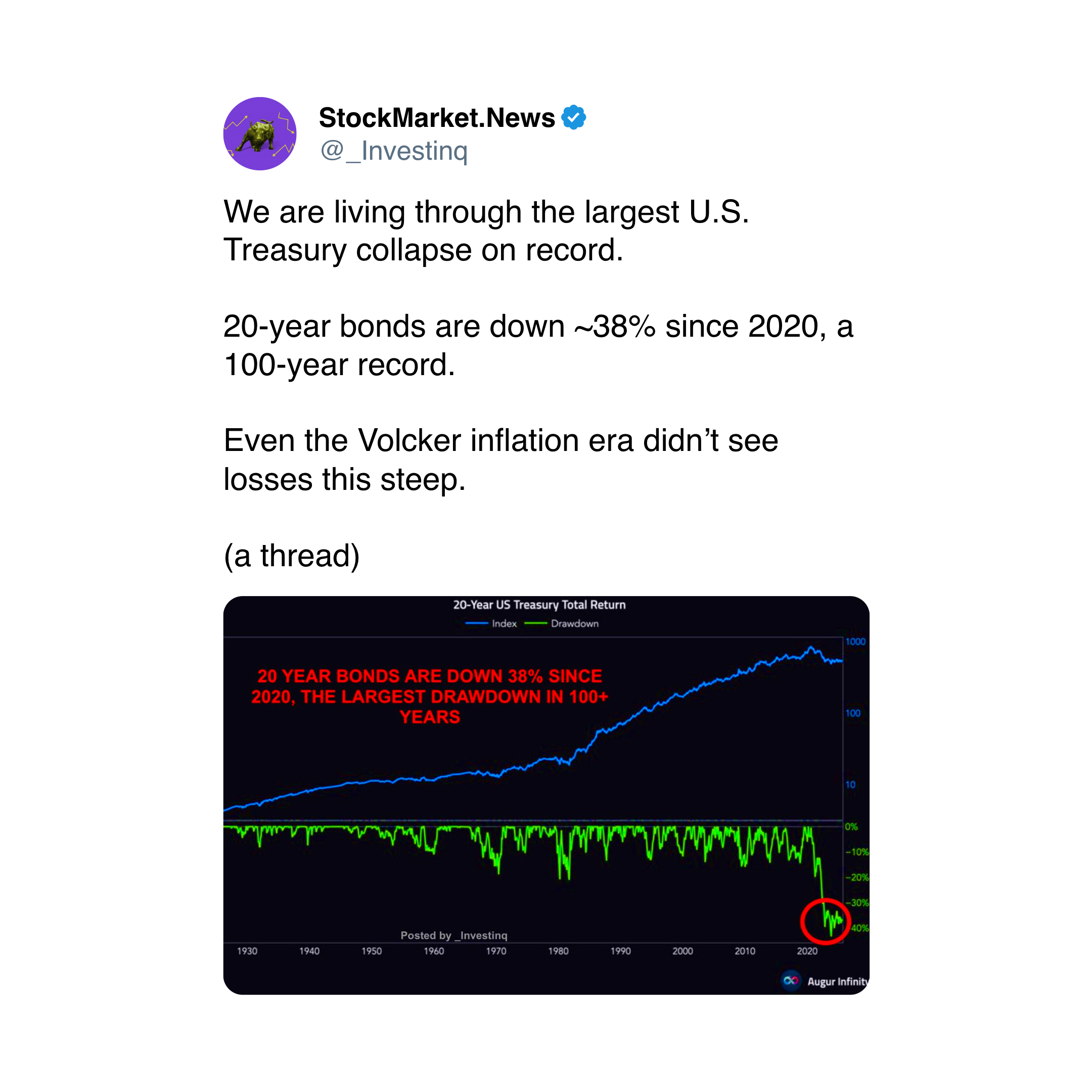

On-chain information shows bitcoin traders utilized the Short-Term Holder Realized Price (STH-RP), presently $108,800, arsenic support. This metric tracks the mean acquisition terms of coins moved on-chain successful the past 155 days and excludes speech reserves. In bull markets, the STH RP often acts arsenic a cardinal enactment level.

The Short-Term Holder Spent Output Profit Ratio (STH-SOPR), which measures profits oregon losses connected coins younger than 155 days, indicates that short-term investors are presently selling astatine a loss. Historically, this behaviour tends to look adjacent section marketplace bottoms. But capitulation has yet to beryllium seen.

Meanwhile, the options market points to a “max pain” level astatine $116,000. Max symptom is the onslaught terms astatine which the largest fig of options expire worthless, mostly causing the top fiscal symptom to enactment holders and top payment to options sellers. With this level supra the spot price, it suggests upside alleviation could beryllium connected the horizon.

Beyond crypto, U.S. commercialized tensions escalated again arsenic Washington imposed 50% tariffs connected India, doubling earlier duties aft talks broke down. The move, aimed astatine curbing India’s purchases of Russian oil, highlights strained ties betwixt President Donald Trump and Indian Prime Minister Narendra Modi. Analysts pass of falling exports, occupation losses and a imaginable 1% resistance connected GDP growth.

For bitcoin traders, the cardinal scope to ticker is $113,500 to $117,200, wherever the CME futures gap remains open. Historically, specified gaps thin to beryllium filled, making this portion 1 to show closely. Stay alert.

What to Watch

- Crypto

- Aug. 27, 3 a.m.: Mantle Network (MNT), an Ethereum layer-2 blockchain, volition rotation retired its mainnet upgrade to mentation 1.3.1, enabling enactment for Ethereum’s Prague update and introducing caller features for level users and developers.

- Macro

- Aug. 28, 8 a.m.: Mexico's National Institute of Statistics and Geography releases July unemployment complaint data.

- Unemployment Rate Est. 2.9% vs. Prev. 2.7%

- Aug. 28, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases (2nd Estimate) Q2 GDP data.

- Core PCE Prices QoQ st. 2.6% vs. Prev. 3.5%

- GDP Growth Rate QoQ Est. 3.1% vs. Prev. -0.5%

- GDP Price Index QoQ Est. 2% vs. Prev. 3.8%

- GDP Sales QoQEst. 6.3% vs. Prev. -3.1%

- PCE Prices QoQ Est. 2.1% vs. Prev. 3.7%

- Real Consumer Spending QoQ Est. 1.4% vs. Prev. 0.5%

- Aug. 28, 1:30 p.m.: Uruguay's National Statistics Institute releases July unemployment complaint data.

- Unemployment Rate Prev. 7.3%

- Aug. 28, 6:00 p.m.: Fed Governor Christopher J. Waller volition talk connected “Payments” astatine the Economic Club of Miami Dinner, Miami, Fla. Watch live.

- Aug. 29, 8:30 a.m.: Statistics Canada releases Q2 GDP data.

- GDP Growth Rate Annualized Est. -0.6% vs. Prev. 2.2%

- GDP Growth Rate QoQ Prev. 0.5%

- Aug. 29, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases July user income and expenditure data.

- Core PCE Price Index MoM Est. 0.3% vs. Prev. 0.3%

- Core PCE Price Index YoY Est. 2.9% vs. Prev. 2.8%

- PCE Price Index MoM Est. 0.2% vs. Prev. 0.3%

- PCE Price Index YoY Est. 2.6% vs. Prev. 2.6%

- Personal Income MoM Est. 0.4% vs. Prev. 0.3%

- Personal Spending MoM Est. 0.5% vs. Prev. 0.3%

- Aug. 29, 11 a.m.: Colombia's National Administrative Department of Statistics (DANE) releases July unemployment complaint data.

- Unemployment Rate Est. 8.9% vs. Prev. 8.6%

- Aug. 28, 8 a.m.: Mexico's National Institute of Statistics and Geography releases July unemployment complaint data.

- Earnings (Estimates based connected FactSet data)

- Aug. 27: NVIDIA (NVDA), post-market, $1.00

- Aug. 28: IREN (IREN), post-market, $0.18

Token Events

- Governance votes & calls

- Aug. 27: Flux (FLUX) to host inquire maine anything connected advancement of ArcaneOS, FluxAI Agents, and FusionX beta.

- Aug. 27: Sui (SUI) to host ecosystem X spaces with Ledger astatine 11 a.m.

- Aug. 27: Helium (HNT) to host assemblage call connected Discord astatine 12 p.m.

- Aug. 27: Sushi (SUSHI) to host inquire maine anything connected X spaces astatine 1 p.m.

- Unlocks

- Aug. 28: Jupiter (JUP) to unlock 1.78% of its circulating proviso worthy $26.36 million.

- Sep. 1: Sui (SUI) to merchandise 1.25% of its circulating proviso worthy $153.1 million.

- Sep. 2: Ethena (ENA) to merchandise 0.64% of its circulating proviso worthy $25.64 million.

- Sep. 5: Immutable (IMX) to unlock 1.27% of its circulating proviso worthy $13.26 million.

- Token Launches

- Aug. 27: Bitlayer (BTR) to database connected Kraken, KuCoin and LBank

- Aug. 27: sBTC (SBTC) to database connected Moso.

Conferences

The CoinDesk Policy & Regulation conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight. Space is limited. Use codification CDB15 for 15% disconnected your registration done Sept. 1.

- Aug. 27: Blockchain Leaders Summit 2025 (Tokyo)

- Aug. 27-28: Stablecoin Conference 2025 (Mexico City)

- Aug. 28-29: Bitcoin Asia 2025 (Hong Kong)

- Sept. 3-5: bitcoin++ (Istanbul)

Token Talk

By Oliver Knight

- Cronos (CRO) defied Tuesday's bearish crypto sentiment, rallying much than 56% aft Crypto.com and Trump Media (DJT) said they planned to make a $6.4 cardinal CRO treasury company.

- Crypto treasury announcements person occurred astir regular implicit the past period arsenic companies statesman to follow and accommodate the attack pioneered by Michael Saylor's Strategy (MSTR).

- Still, the terms enactment often fails to lucifer what mightiness beryllium perceived arsenic a bullish event. When Verb Technology Co. (VERB) announced a $558 cardinal backstage placement to found a toncoin (TON) treasury, TON astir instantly fell by astir 10%.

- This CRO woody is different. Firstly it is tied to Trump Media, a institution linked to President Donald Trump, but secondly — and arguably much importantly — it gives a usage lawsuit to the cronos token that was antecedently utilized predominately arsenic an speech token for Crypto.com.

- The woody includes the instauration of a caller rewards strategy connected Truth Social that volition let users to person the platform's “gems” into CRO tokens, with further plans to alteration subscription payments and discounted services utilizing CRO.

- Bloomberg noted that Crypto.com CEO Kris Marszalek donated $1 cardinal to Trump's inaugural committee and besides visited Trump's Mar-a-Lago location aft the predetermination victory.

- CRO presently trades astatine $0.225 contempt being down astatine $0.141 past week, the quality lifted 24 hr trading measurement up by 1,300% to much than $1 cardinal arsenic it became a marketplace outlier portion bitcoin and ether languished adjacent captious levels of support.

Derivatives Positioning

- Bitcoin unfastened involvement (OI) crossed apical derivatives venues has started to slip, which is successful enactment with the downward terms enactment implicit the past fewer days, implying traders are actively exiting their leveraged positions.

- BTC OI present stands astatine $30.3 billion, conscionable shy of the each clip precocious astatine $32.6 billion, Velo information shows. Three-month annualized ground is inactive rising, and is presently 8%- 9% crossed each exchanges, implying that the ground commercialized is inactive profitable.

- In options, bitcoin's upward-sloping implied volatility curve suggests the marketplace expects semipermanent volatility to beryllium higher than short-term, portion different metrics constituent to a much contiguous bearish outlook.

- Specifically, the caller determination of the 25 delta skew into antagonistic territory for near-term maturities indicates a wide displacement successful marketplace sentiment, with traders paying a premium for puts implicit calls to summation downside protection.

- The bearish sentiment is confirmed by the 24-hour put/call volume, which shows a important skew towards puts, different motion traders are actively hedging against oregon speculating connected a terms decline.

- Funding complaint APRs crossed large perpetual swap venues are starting to bounce backmost astatine astir 8%-10% annualized, according to Velo data.

- BTC annualized backing connected Binance turned antagonistic (-0.39%) for a abbreviated play contiguous earlier bouncing backmost to astir 10%. This indicates that portion determination whitethorn person been pockets of bearish sentiment, the wide marketplace inclination is starting to beryllium much supportive by traders consenting to wage a premium to stake connected a terms increase.

- Coinglass information shows $266 cardinal successful 24 hr liquidations, skewed 58% towards shorts. ETH ($99 million), BTC ($47 million) and SOL ($20 million) were the leaders successful presumption of notional liquidations. The Binance liquidation heatmap indicates $111,593 arsenic a halfway liquidation level to show successful lawsuit of a terms rise.

Market Movements

- BTC is down 0.34% from 4 p.m. ET Tuesday astatine $110,981.61 (24hrs: +0.72%)

- ETH is up 0.41% astatine $4,605.94 (24hrs: +3.56%)

- CoinDesk 20 is up 0.11% astatine 4,130.44 (24hrs: +3.15%)

- Ether CESR Composite Staking Rate is down 2 bps astatine 2.93%

- BTC backing complaint is astatine 0.0076% (8.3297% annualized) connected Binance

- DXY is up 0.37% astatine 98.59

- Gold futures are unchanged astatine $3,431.20

- Silver futures are down 0.65% astatine $38.35

- Nikkei 225 closed up 0.3% astatine 42,520.27

- Hang Seng closed down 1.27% astatine 25,201.76

- FTSE is unchanged astatine 9,273.12

- Euro Stoxx 50 is up 0.16% astatine 5,392.10

- DJIA closed connected Tuesday up 0.3% astatine 45,418.07

- S&P 500 closed up 0.41% astatine 6,465.94

- Nasdaq Composite closed up 0.44% astatine 21,544.27

- S&P/TSX Composite closed up 0.6% astatine 28,339.88

- S&P 40 Latin America closed down 0.43% astatine 2,715.37

- U.S. 10-Year Treasury complaint is up 1.5 bps astatine 4.271%

- E-mini S&P 500 futures are unchanged astatine 6,485.25

- E-mini Nasdaq-100 futures are unchanged astatine 23,596.00

- E-mini Dow Jones Industrial Average Index are unchanged astatine 45,516.00

Bitcoin Stats

- BTC Dominance: 58.03% (-0.29%)

- Ether-bitcoin ratio: 0.04129 (0.32%)

- Hashrate (seven-day moving average): 960 EH/s

- Hashprice (spot): $54.07

- Total fees: 3.19 BTC / $351,661

- CME Futures Open Interest: 137,600 BTC

- BTC priced successful gold: 32.8 oz.

- BTC vs golden marketplace cap: 9.28%

Technical Analysis

- The SOL-BTC play illustration is approaching a cardinal absorption level that, astatine the moment, is looking apt to beryllium broken.

- This SOL spot is much of a effect of a bullish RSI divergence that seems to beryllium already successful play, arsenic confirmed by the magnitude of the move.

- The ratio acts arsenic a bully proxy for the spot of altcoins successful general, and a confirmed interruption successful the brace would awesome continued spot successful prime altcoins comparative to BTC.

Crypto Equities

- Strategy (MSTR): closed connected Tuesday astatine $351.36 (+2.38%), -0.6% astatine $349.26 successful pre-market

- Coinbase Global (COIN): closed astatine $308.48 (+0.81%), -0.28% astatine $307.62

- Circle (CRCL): closed astatine $129.05 (+3.04%), -0.46% astatine $128.45

- Galaxy Digital (GLXY): closed astatine $24.72 (+0.69%), +0.36% astatine $24.81

- Bullish (BLSH): closed astatine $66.08 (+1.38%), -0.42% astatine $65.80

- MARA Holdings (MARA): closed astatine $15.84 (+2.86%), -0.63% astatine $15.74

- Riot Platforms (RIOT): closed astatine $13.69 (+3.09%), -0.88% astatine $13.57

- Core Scientific (CORZ): closed astatine $14.04 (+2.63%), +0.36% astatine $14.09

- CleanSpark (CLSK): closed astatine $9.68 (+2.43%), -0.41% astatine $9.64

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $29.39 (+2.73%)

- Semler Scientific (SMLR): closed astatine $30.79 (+2.56%)

- Exodus Movement (EXOD): closed astatine $26.98 (+2.74%)

- SharpLink Gaming (SBET): closed astatine $19.92 (+3.91%), -1.2% astatine $19.68

ETF Flows

Spot BTC ETFs

- Daily nett flows: $88.1 million

- Cumulative nett flows: $54.08 billion

- Total BTC holdings ~1.29 million

Spot ETH ETFs

- Daily nett flows: $455 million

- Cumulative nett flows: $13.34 billion

- Total ETH holdings ~6.43 million

Source: Farside Investors

Chart of the Day

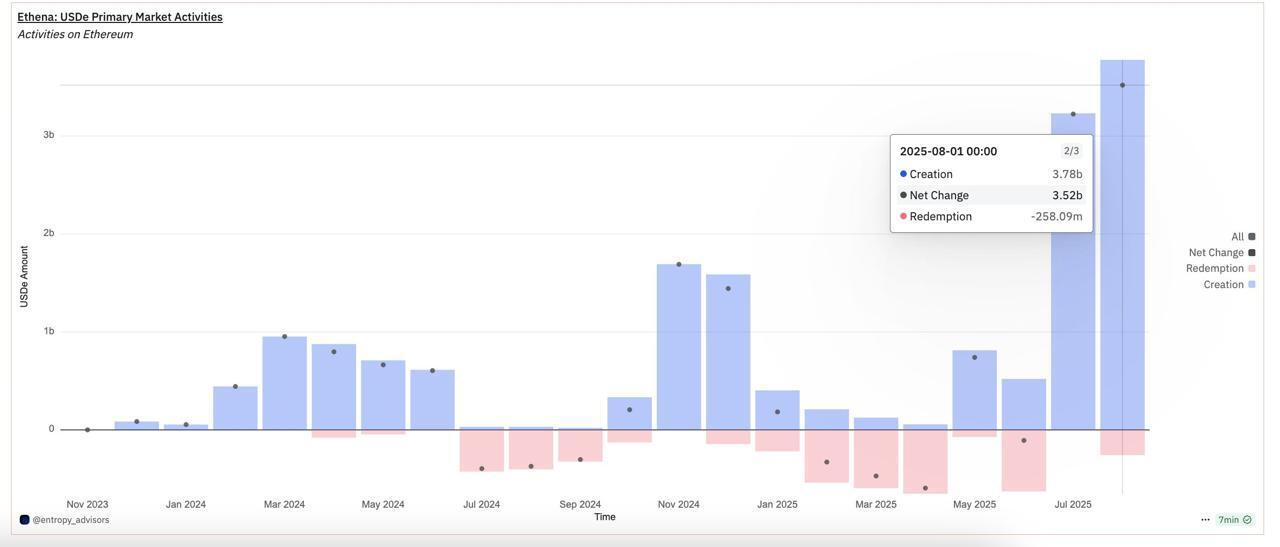

- In August, instauration of Ethena's USDe stablecoin reached a grounds high, with implicit $3.78 cardinal successful caller supply.

- USDe's full circulating proviso has present climbed past $12 billion, solidifying its presumption arsenic the third-largest stablecoin by marketplace capitalization.

- The monthly maturation notably outpaced the $3.4 cardinal issuance of Tether's market-leading USDT for the aforesaid period.

While You Were Sleeping

- Unified Crypto Lobbyists: Protect Software Developers, Senate, oregon We're Out (CoinDesk): Over 110 organizations, builders and investors told U.S. senators they can’t enactment the Clarity Act unless bundle developers and non-custodial work providers are shielded from liability erstwhile atrocious actors misuse their technology.

- Health-Care Firm KindlyMD Plans $5B Equity Raise for Bitcoin Treasury (CoinDesk): Shares of the company, which precocious merged with bitcoin treasury steadfast Nakamoto, slid 12% Tuesday aft unveiling plans to rise up to $5 cardinal done an at-the-money equity sale.

- Metaplanet Shares Jump 6% connected International Stock Sale, Financing Moves (CoinDesk): The Japanese steadfast volition question 130.3 cardinal yen ($880 million) from an planetary stock sale, chiefly for bitcoin purchases, portion suspending warrant exercises and redeeming bonds aboriginal to bolster its equilibrium sheet.

- Markets Need Rules — Crypto Is No Different (Financial Times): Scott Duke Kominers, a prof astatine Harvard Business School, says crypto markets request rules to guarantee predictability, spot rights, transparency and just competition, arguing that without them innovation falters and speculation dominates.

- Putin Acts Like He Doesn’t Care About Peace. Russia’s Economy Could Depend connected It (CNBC): Military spending has propped up Russia’s economy, but falling lipid revenues, a swelling shortage and renewed ostentation risks are fueling expert warnings of stagnation and adjacent recession.

- Trump Wants European Troops successful Ukraine. Europe’s Voters Aren’t Convinced. (The Wall Street Journal): Public absorption reflects a tendency to debar repeating past subject failures, fears of nationalist armies getting overstretched and anxieties astir being drawn into a warfare with Russia.

In the Ether

2 months ago

2 months ago

English (US)

English (US)