Bitcoin (BTC) surged past $91,000 connected Tuesday, climbing astir 5% amid renewed capitalist optimism and caller hopes of a thaw successful U.S.-China commercialized tensions, but headwinds persist that could headdress further upside, analytics steadfast CryptoQuant cautioned.

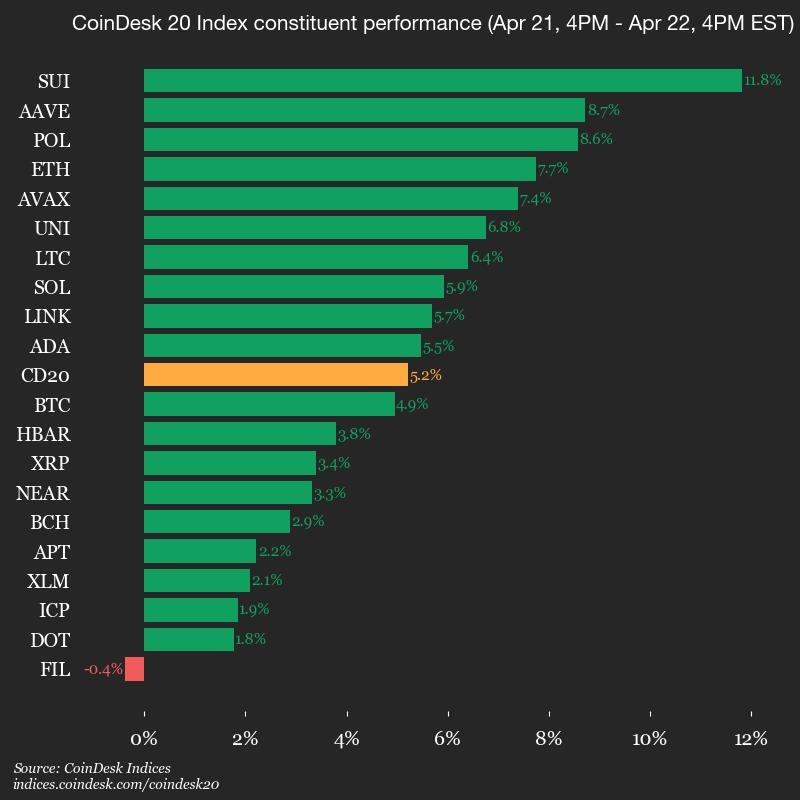

The largest crypto by marketplace capitalization deed $91,700 successful the U.S. afternoon, its strongest terms since aboriginal March. Altcoins followed BTC higher, with Ethereum's ether (ETH) rising 8% implicit the past 24 hours supra $1,700, and dogecoin (DOGE) and Sui's autochthonal token (SUI) gaining 8.6% and 11.7%, respectively. The broad-market crypto benchmark CoinDesk 20 Index precocious 5.2%.

Markets were buoyed by remarks from U.S. Treasury Secretary Scott Bessent, who reportedly told investors astatine a closed-door JPMorgan lawsuit that the tariff standoff with China was unsustainable. Bessent said de-escalation would travel “in the precise adjacent future,” characterizing existent conditions arsenic a “trade embargo.” However, helium cautioned that a much broad woody betwixt the 2 nations could instrumentality adjacent years.

Stocks recovered from yesterday's decline, with the S&P 500 and the tech-heavy Nasdaq finishing the league 2.5% and 2.7% higher, respectively. Gold, meanwhile, sharply reversed from its grounds terms of $3,500 during the time and was down 1%.

"As superior rotates into safe-haven and inflation-hedging assets, BTC and golden are proving to beryllium cardinal beneficiaries of the exodus from USD risk," analysts astatine hedge money QCP Capital said successful a Telegram broadcast.

They highlighted rejuvenating inflows to spot U.S.-listed BTC ETFs and the instrumentality of the alleged Coinbase terms premium, suggesting request from American organization investors. BTC ETF booked implicit $381 cardinal nett inflows connected Monday adding to Thursday's $107 million, according to Farside Investors data.

But not each signs constituent to a sustained breakout.

Despite the terms jump, on-chain information points to fragility beneath the surface, CryptoQuant analysts said successful a Tuesday report. Bitcoin’s evident request has decreased by 146,000 BTC implicit the past 30 days—an betterment from the crisp driblet successful March, but inactive negative. CryptoQuant's request momentum metric, which tracks caller capitalist interest, has deteriorated further to its the astir bearish level since October 2024, the study noted.

Market liquidity remains soft, with the study utilizing USDT's marketplace headdress maturation arsenic a proxy for crypto liquidity. USDT grew $2.9 cardinal implicit the past 2 months, beneath its 30-day average. Historically, BTC rallies coincided with USDT maturation supra $5 cardinal and supra inclination — a threshold not yet met.

Adding to the caution, bitcoin is present facing a cardinal absorption portion betwixt $91,000 and $92,000 astatine astir the "Trader’s On-chain Realized Price" metric, a level that has often served arsenic absorption successful bearish conditions. CryptoQuant's on-chain bull people classified existent marketplace conditions arsenic bearish, suggesting a intermission oregon pullback could travel if sentiment weakens.

3 months ago

3 months ago

English (US)

English (US)