By Francisco Rodrigues (All times ET unless indicated otherwise)

Bitcoin (BTC) roseate to the highest this month, touching $116,430 and establishing itself much firmly supra the $115,000 level connected renewed request for hazard assets arsenic the implications from Friday's weaker-than-expected jobs marketplace information descend in.

The Federal Reserve is present wide expected to chopped rates by 25 ground points successful September, with the CME’s FedWatch instrumentality weighing a 93.4% accidental of that happening. On Polymarket, traders are somewhat little convinced, seeing a 79% accidental of a cut. Traders are positioning for reductions astatine the pursuing 2 meetings arsenic well.

Add successful beardown net from large companies and a weakening U.S. dollar, and the outlook is looking a small stronger for equities and different hazard assets. The Nikkei 225 roseate 0.65% today, the Euro Stoxx 50 is up 1.2% and the S&P 500 closed up 0.73% connected Wednesday. The Nasdaq Composite closed up 1.2% connected quality of chip tariff exemptions and President Trump signaling helium may name dovish members to the Fed.

In a motion of semipermanent organization interest, the State of Michigan Retirement System (SMRS) said boosted its bitcoin vulnerability through spot ETFs successful the 2nd quarter.

Yet the existent communicative whitethorn beryllium however small BTC is moving. The cryptocurrency’s 30-day implied volatility, arsenic tracked by the BVIV scale from Volmex, has dropped to 36.5%, a level not seen since October 2023, erstwhile bitcoin traded nether $30,000.

The signifier resembles Wall Street's bull markets, wherever implied volatility tends to shrink arsenic optimism grows. In erstwhile cycles, bitcoin's terms and volatility moved successful tandem.

Structured crypto projects that let investors to merchantability out-of-the-money telephone options to make output whitethorn beryllium playing a portion successful reducing the volatility.

Still, geopolitical hazard isn't going to spell away. Trump levied an further 25% tariff connected India implicit its Russian lipid purchases, which could pb to a “mini crunch successful supplies if Delhi draws connected different crude sources instead,” Hargreaves Lansdown said successful an emailed note. That would apt unit OPEC+ members to amp up accumulation to debar a crisis, Hargreaves Lansdown said.

On apical of that, portion bid talks connected Ukraine person been advancing, caller atomic rhetoric suggests there’s a agelong mode to go. Stay alert!

What to Watch

- Crypto

- Aug. 7, 10 a.m.: Circle volition big a webinar, "The GENIUS Act Era Begins," featuring Dante Disparte and Corey Then. The league volition sermon the archetypal U.S. national outgo stablecoin model and its interaction connected crypto innovation and regulation.

- Aug. 15: Record day for the next FTX distribution to holders of allowed Class 5 Customer Entitlement, Class 6 General Unsecured and Convenience Claims who conscionable pre-distribution requirements.

- Aug. 18: Coinbase Derivatives volition launch nano SOL and nano XRP U.S. perpetual-style futures.

- Macro

- Aug. 7, 7 a.m.: The U.K.'s cardinal bank, the Bank of England (BoE), announces its monetary argumentation decision.

- Bank Rate Est. 4% vs. Prev. 4.25%

- Aug. 7, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases June shaper terms ostentation data.

- PPI MoM Prev. -1.29%

- PPI YoY Prev. 5.78%

- Aug. 7, 8 a.m.: Mexico’s National Institute of Statistics and Geography releases July user terms ostentation data.

- Core Inflation Rate MoM Est. 0.3% vs. Prev. 0.39%

- Core Inflation Rate YoY Est. 4.23% vs. Prev. 4.24%

- Inflation Rate MoM Est. 0.28% vs. Prev. 0.28%

- Inflation Rate YoY Est. 3.53% vs. Prev. 4.32%

- Aug. 7, 3 p.m.: Mexico's cardinal bank, Banco de México, announces its monetary argumentation decision.

- Overnight Interbank Target Rate Est. 7.75% vs. Prev. 8%

- Aug. 8: Federal Reserve Governor Adriana D. Kugler's resignation becomes effective, creating an aboriginal vacancy connected the Board of Governors that allows President Trump to nominate a successor.

- Aug. 7, 7 a.m.: The U.K.'s cardinal bank, the Bank of England (BoE), announces its monetary argumentation decision.

- Earnings (Estimates based connected FactSet data)

- Aug. 7: Hut 8 (HUT), pre-market, -$0.07

- Aug. 7: Block (XYZ), post-market, $0.63

- Aug. 7: CleanSpark (CLSK), post-market, $0.30,

- Aug. 7: Coincheck Group (CNCK), post-market, N/A

- Aug. 7: Cipher Mining (CIFR), pre-market, -$0.07

- Aug. 8: TeraWulf (WULF), pre-market, -$0.06

- Aug. 11: Exodus Movement (EXOD), post-market, $0.12

- Aug. 12: Bitfarms (BITF), pre-market, -$0.02

- Aug. 12: Fold Holdings (FLD), post-market, N/A

Token Events

- Governance votes & calls

- Arbitrum DAO is voting to renew its partnership with Entropy Advisors for 2 much years, starting September 2025. The connection includes $6 cardinal successful backing and 15 cardinal ARB for incentives for Entropy to absorption connected treasury management, inducement design, information infrastructure, and ecosystem growth. Voting ends Aug. 7.

- BendDAO is voting connected a plan to stabilize BEND by burning 50% of treasury tokens, restarting lender rewards, and launching monthly buybacks utilizing 20% of protocol revenue. Voting ends Aug. 10.

- 1inch DAO is voting connected a $1.88 cardinal assistance to money its information successful 9 planetary crypto events done precocious 2025. The connection aims to boost developer engagement, turn organization ties and grow adoption crossed ecosystems similar Ethereum and Solana. Voting ends Aug. 10.

- Aug. 7, 12 p.m.: Celo to big a governance call.

- Aug. 8, 11:30 a.m.: Axie Infinity to host a municipality hall connected Discord.

- Unlocks

- Aug. 9: Immutable (IMX) to unlock 1.3% of its circulating proviso worthy $12.66 million.

- Aug. 12: Aptos (APT) to unlock 1.73% of its circulating proviso worthy $48.18 million.

- Aug. 15: Avalanche (AVAX) to unlock 0.39% of its circulating proviso worthy $37.2 million.

- Aug. 15: Starknet (STRK) to unlock 3.53% of its circulating proviso worthy $15.40 million.

- Aug. 15: Sei (SEI) to unlock 0.96% of its circulating proviso worthy $16.52 million.

- Aug. 16: Arbitrum (ARB) to unlock 1.8% of its circulating proviso worthy $36.52 million.

- Aug. 18: Fasttoken (FTN) to unlock 4.64% of its circulating proviso worthy $91.4 million.

- Token Launches

- Aug. 7: TaleX (X) to beryllium listed connected Binance Alpha, BingX, MEXC, and others.

Conferences

The CoinDesk Policy & Regulation conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight. Space is limited. Use codification CDB10 for 10% disconnected your registration done Aug. 31.

- Day 2 of 2: Blockchain Rio 2025 (Rio de Janeiro, Brazil)

- Day 2 of 5: Rare EVO (Las Vegas)

- Day 1 of 2: bitcoin++ (Riga, Latvia)

- Aug. 9-10: Baltic Honeybadger 2025 (Riga, Latvia)

- Aug. 9-10: Conviction 2025 (Ho Chi Minh City, Vietnam)

- Aug. 11: Paraguay Blockchain Summit 2025 (Asuncion)

- Aug. 11-13: AIBB 2025 (Istanbul)

- Aug. 11-17: Ethereum NYC (New York)

- Aug. 13-14: CryptoWinter ‘25 (Queenstown, New Zealand)

Token Talk

By Shaurya Malwa

- The Solana-based Troll memecoin has surged implicit 1,050% successful 2 weeks, jumping from a $16 cardinal to $184 cardinal marketplace cap. It's present ranked No. 32 among each meme tokens, according to CoinGecko.

- But Carlos Ramirez, the creator down the archetypal Trollface meme, says helium wants thing to bash with it, calling the token's hype a "cursed proposition" successful his archetypal interrogation successful a decade.

- Ramirez told Decrypt he’s perpetually offered Troll-related token allocations, but refuses to participate, saying he’d either beryllium stuck holding worthless proviso oregon blamed for a clang if helium sold.

- Still, Ramirez promoted a abstracted Troll token earlier this twelvemonth — and again this week — starring to disorder implicit his stance.

- He criticized the memecoin system arsenic profit-driven and artistically hollow, saying the fiscal incentives undermine authentic look and trim creation to speculation.

- Ramirez added that astatine slightest 30 antithetic Troll tokens person been minted crossed platforms similar Bags, nary with his blessing — a signifier helium sees arsenic exploitative and detached from the archetypal tone of the meme.

- The saga highlights the increasing hostility betwixt viral net civilization and tokenized financialization, particularly arsenic bequest creators propulsion backmost against involuntary meme monetization successful Web3.

Derivatives Positioning

- Bitcoin futures unfastened involvement remains steadfast astatine $78.5 billion, with CME starring astatine $16.24 cardinal (a 21% marketplace share). This confirms persistent organization engagement, particularly arsenic CME’s BTC ground roseate to 3.6% — among the highest crossed venues — hinting astatine spot-driven involvement oregon hedged agelong exposure.

- ETH futures unfastened involvement roseate to $48.18 billion, a 3.57% summation implicit the past week. CME’s ETH OI roseate 4.56% successful the past 24 hours alone, alongside a ground of 2.6%, showing that institutions are re-entering ETH positioning aggressively — apt tied to ETF speculation and method breakout setups.

- Altcoin positioning is backmost successful focus, with XRP OI up 1.6% regular to $7.33 billion. CME's XRP ground is simply a standout astatine 8.4%, acold exceeding different venues and suggesting leveraged agelong appetite oregon premium pricing for compliant exposure. XRP unfastened involvement is present concentrated crossed Bybit and Binance, indicating retail-trader skew.

- Funding rates stay elevated crossed majors, with BTC, ETH, DOGE and XRP each capped astatine the 0.03% regular bounds (about 11% annualized). SOL backing is little assertive astir 0.006%, but the 30-day mean sits astatine the cap, implying longer-term leveraged bias adjacent if short-term flows are cooling.

- The derivatives measurement remains concentrated, with Binance and Bybit collectively holding 29% of BTC OI, portion CME continues to grow. For ETH, CME present accounts for astir 12% of full unfastened interest, a cardinal organization marker that wasn't existent adjacent 2 months ago.

- Risk-reward asymmetry whitethorn beryllium building, arsenic sustained long-heavy funding, rising CME premiums, and comparative flatness successful altcoin unfastened involvement suggest an situation ripe for volatility. The adjacent determination — whether a breakout oregon a flush — is apt to beryllium aggressive, fixed the important directional leverage present successful place.

Market Movements

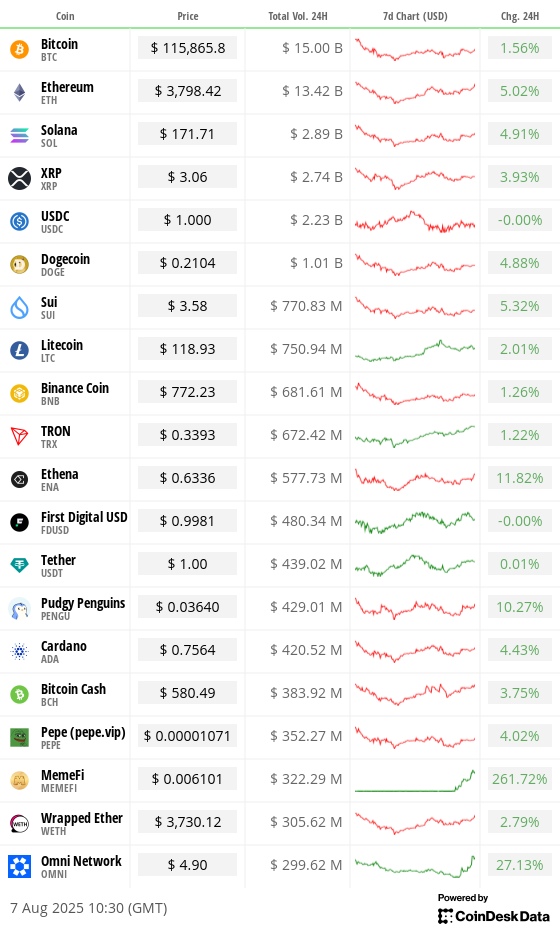

- BTC is unchanged from 4 p.m. ET Wednesday astatine $115,030.54 (24hrs: +1.29%)

- ETH is up 1.41% astatine $3,727.41 (24hrs: +4.97%)

- CoinDesk 20 is up 0.67% astatine 3,846.17 (24hrs: +2.98%)

- Ether CESR Composite Staking Rate is unchanged astatine 2.9%

- BTC backing complaint is astatine 0.0095% (10.4386% annualized) connected Binance

- DXY is unchanged astatine 98.13

- Gold futures are up 0.52% astatine $3,451.20

- Silver futures are up 1.29% astatine $38.39

- Nikkei 225 closed up 0.65% astatine 41,059.15

- Hang Seng closed up 0.69% astatine 25,081.63

- FTSE is down 0.24% astatine 9,142.34

- Euro Stoxx 50 is up 1.72% astatine 5,353.88

- DJIA closed connected Wednesday up 0.18% astatine 44,193.12

- S&P 500 closed up 0.73% astatine 6,345.06

- Nasdaq Composite closed up 1.21% astatine 21,169.42

- S&P/TSX Composite closed up 1.27% astatine 27,920.87

- S&P 40 Latin America closed up 0.89% astatine 2,613.50

- U.S. 10-Year Treasury complaint is up 0.3 bps astatine 4.235%

- E-mini S&P 500 futures are up 0.66% astatine 6,413.00

- E-mini Nasdaq-100 futures are up 0.69% astatine 23,585.00

- E-mini Dow Jones Industrial Average Index are up 0.45% astatine 44,511.00

Bitcoin Stats

- BTC Dominance: 61.6% (-0.20%)

- Ether-bitcoin ratio: 0.03239 (1.13%)

- Hashrate (seven-day moving average): 955 EH/s

- Hashprice (spot): $57.48

- Total fees: 5.88 BTC / $674,584

- CME Futures Open Interest: 138,150 BTC

- BTC priced successful gold: 34.0%

- BTC vs golden marketplace cap: 9.63%

Crypto Equities

- Strategy (MSTR): closed connected Wednesday astatine $383.41 (+2.12%), +0.13% astatine $383.89 successful pre-market

- Coinbase Global (COIN): closed astatine $303.58 (+1.88%), +1.55% astatine $308.28

- Circle (CRCL): closed astatine $161.71 (+5.05%), +2.03% astatine $165

- Galaxy Digital (GLXY): closed astatine $27.34 (-1.23%), +2.63% astatine $28.06

- MARA Holdings (MARA): closed astatine $15.89 (+1.73%), +0.44% astatine $15.96

- Riot Platforms (RIOT): closed astatine $11.66 (+4.76%), +0.69% astatine $11.74

- Core Scientific (CORZ): closed astatine $14.11 (+0.21%), +0.28% astatine $14.15

- CleanSpark (CLSK): closed astatine $11 (+1.57%), +1% astatine $11.11

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $25.73 (+3.54%)

- Semler Scientific (SMLR): closed astatine $35.66 (+2.27%), +1.65% astatine $36.25

- Exodus Movement (EXOD): closed astatine $29.36 (+1.59%)

- SharpLink Gaming (SBET): closed astatine $22.14 (+9.44%), +3.16% astatine $22.84

ETF Flows

Spot BTC ETFs

- Daily nett flows: $91.6 million

- Cumulative nett flows: $53.73 billion

- Total BTC holdings ~1.29 million

Spot ETH ETFs

- Daily nett flows: $35.1 million

- Cumulative nett flows: $9.15 billion

- Total ETH holdings ~5.59 million

Source: Farside Investors

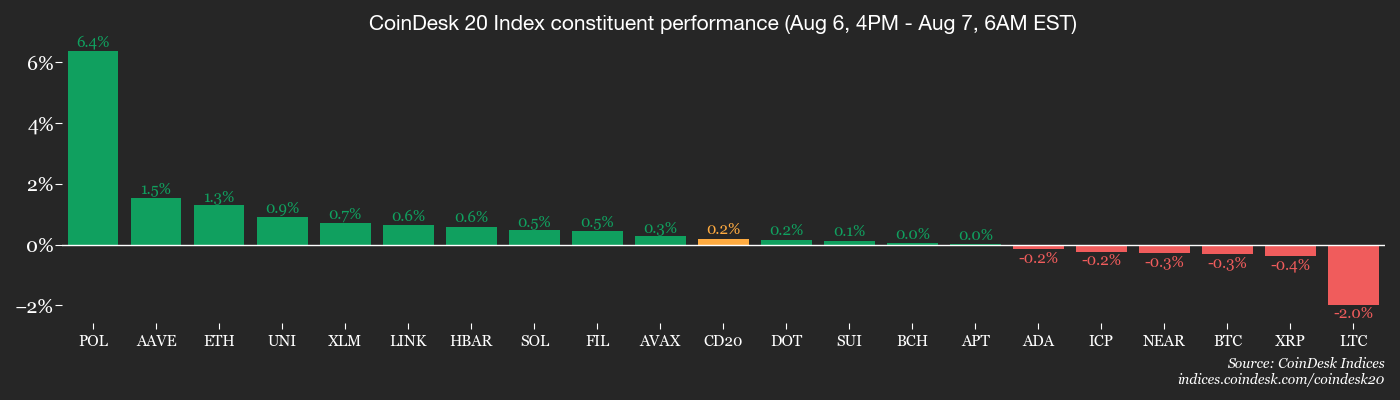

Overnight Flows

Chart of the Day

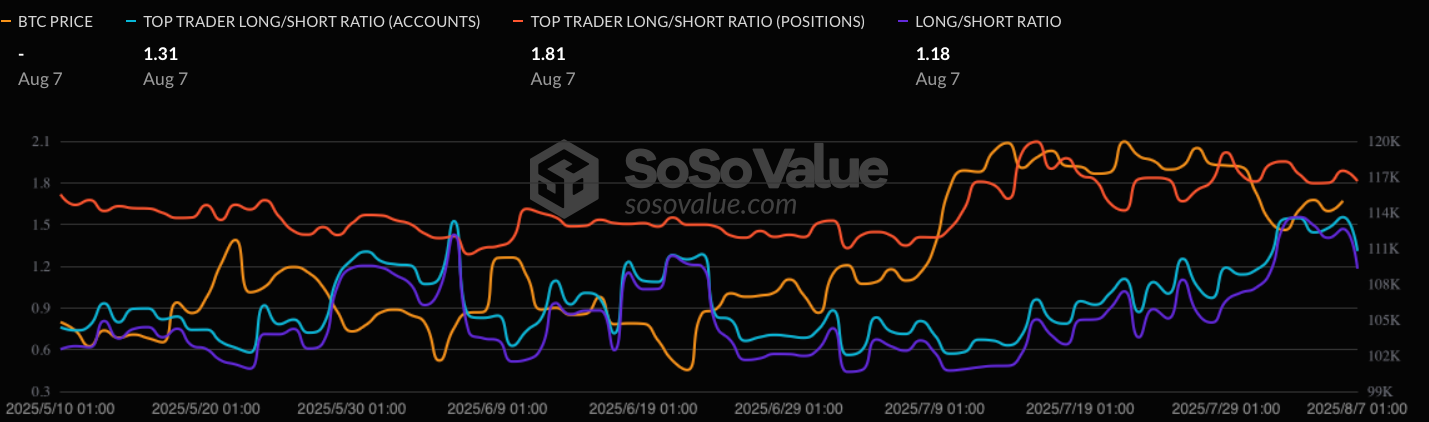

- Top crypto traders — the 20% of users with the highest borderline equilibrium connected Binance — turned bullish connected BTC earlier its caller recovery, with the ratio of agelong to abbreviated positions reaching 1.51, indicating a beardown thin towards longs, SoSoValue information shows.

- While the apical traders’ ratio has since risen to 1.81, the wide market's is astatine 1.18, showing wide bullish sentiment, per SoSoValue data.

While You Were Sleeping

- Bitcoin's Volatility Disappears to Levels Not Seen Since October 2023 (CoinDesk): Despite a 60% rally since November 2024, request for options remains subdued, driving 30-day implied volatility — a gauge of expected terms swings — to its lowest since October 2023.

- Staggering U.S. Tariffs Begin arsenic Trump Widens Trade War (The New York Times): Hours earlier caller levies took effect, Trump floated a 100% tariff connected semiconductors, seemingly brushing disconnected stagflation warnings from economists and concern concerns implicit unsustainable import costs.

- U.S. Trading Partners Race to Secure Exemptions From Trump’s Tariffs (The Wall Street Journal): Several commercialized partners with signed agreements, including the EU, Japan and South Korea, are inactive pressing for sector-specific alleviation portion unresolved presumption proceed to make disorder astir implementation.

- UK Crypto Investors Hail Regulatory Changes arsenic ‘Pivotal Moment’ (Financial Times): U.K. retail investors volition summation entree to 17 bitcoin and ether exchange-traded notes successful October arsenic the country’s fiscal regulator lifts its retail ban. U.S.-listed spot crypto ETFs volition stay inaccessible.

- Exclusive: Rubio Orders US Diplomats to Launch Lobbying Blitz Against Europe’s Tech Law (Reuters): An Aug. 4 classified directive from the U.S. State Department, signed by Marco Rubio, called connected embassy officials to propulsion backmost against Europe’s Digital Services Act and support U.S. tech interests.

- With South Korea's CBDC Plans Dead, KakaoBank Joins Stablecoin Gold Rush (CoinDesk): KakaoBank's CFO highlighted the firm’s preparedness for stablecoin issuance and custody, pointing to its enactment connected Korea’s shelved CBDC aviator and its way grounds handling compliance for crypto exchanges.

In the Ether

3 months ago

3 months ago

English (US)

English (US)