According to CoinShare’s Digital Asset Fund Flows weekly report by expert James Butterfill, integer plus concern products person seen nett inflows for the 3rd consecutive week totaling $15 million, contempt a trading measurement driblet of 27% beneath the 2023 average. An denotation of improving capitalist sentiment, this upward inclination is marked by the continued dominance of Bitcoin, which registered $16 cardinal successful play inflows for the period.

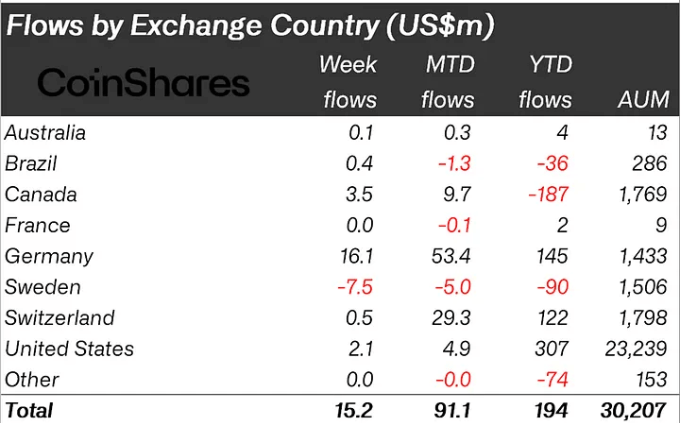

The study besides highlighted the opposition successful determination performance. Although the US saw minimal inflows of $2.1 million, Europe experienced full nett inflows totaling $9.6 cardinal past week, with Sweden being the lone state to study outflows.

Weekly ETP inflows (Source: CoinShares, Bloomberg)

Weekly ETP inflows (Source: CoinShares, Bloomberg)Bitcoin’s year-to-date inflows person reached a noteworthy $260 million, affirming its marketplace dominance, with nett inflows of $194 million. This show is notable, particularly considering that the report’s data, captured arsenic of past Friday, was improbable to see the imaginable affirmative interaction of the U.S. SEC not appealing the Grayscale ineligible challenge. This determination could pave the mode for a spot-based ETF successful the U.S.

Ethereum, contempt the caller motorboat of a futures-based ETF, saw a decreased capitalist appetite with outflows of $7.5m past week, efficaciously correcting overmuch of the inflows seen the anterior week. The study suggests that this whitethorn bespeak ongoing protocol plan concerns wrong the Ethereum network.

While Bitcoin continues to bid important capitalist interest, the fluctuating dynamics wrong the altcoin marketplace and diverging determination trends overgarment a analyzable representation of the existent integer plus concern landscape.

CoinShares afloat study is disposable weekly.

The station Bitcoin surges successful integer plus inflows arsenic Europe outpaces the US appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)