The relation of Bitcoin miners goes beyond artifact validation — they are cardinal successful shaping the marketplace done their BTC balances. Historically, these balances person been intimately tied to Bitcoin’s terms movements, making them a cardinal metric for marketplace analysis.

Bitcoin’s caller surge past the $40,000 people was met with important enactment from miners. At the opening of December, Bitcoin was priced astatine $38,680. By Dec. 8, it climbed to a highest of $44,200 earlier consolidating astatine astir $41,200 connected Dec. 11. Despite this consolidation, the astir 8% summation implicit 10 days signals a bullish marketplace phase.

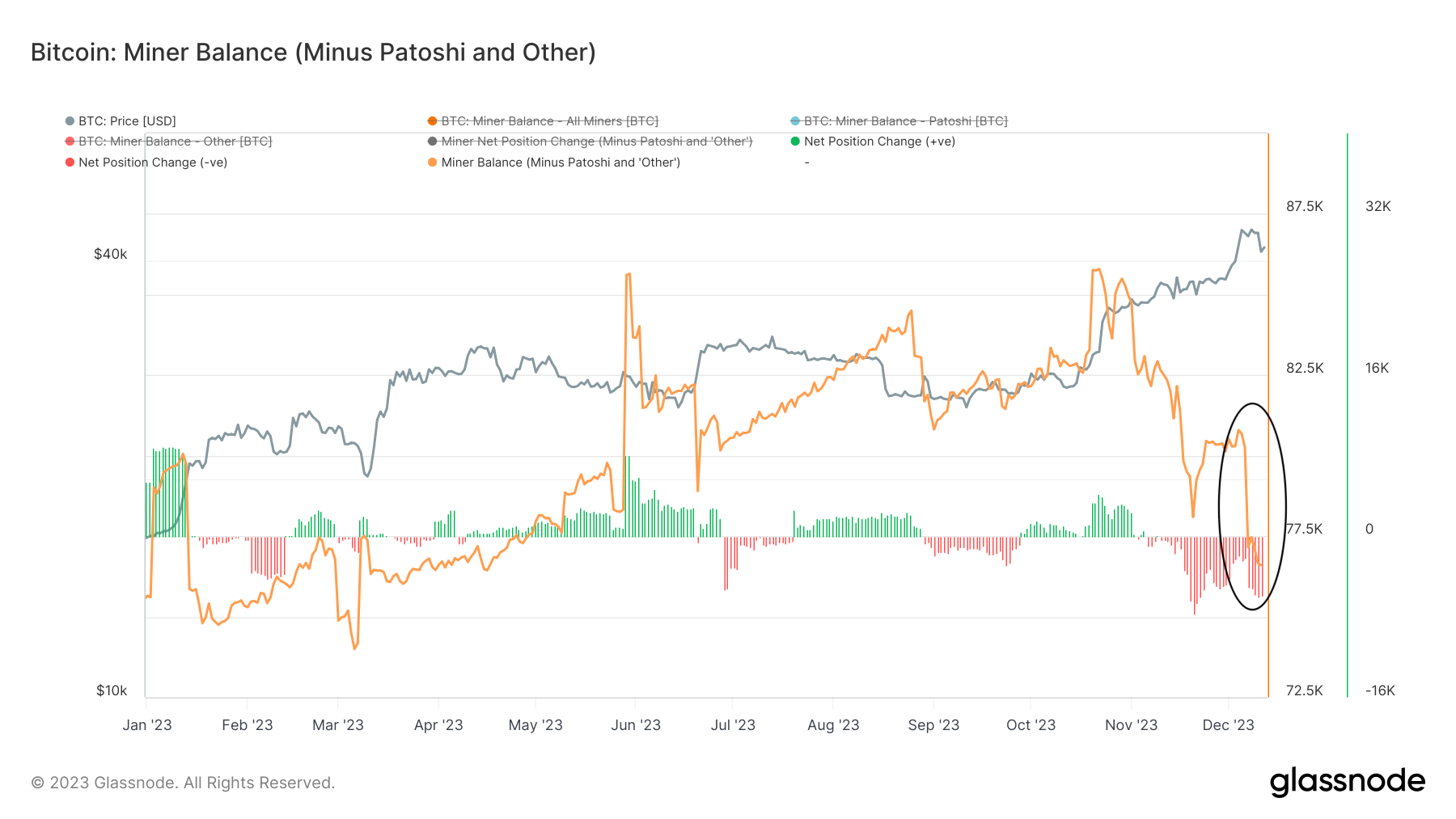

As Bitcoin’s terms rallied, a noticeable diminution was observed successful miner balances. From 80,520 BTC connected Dec. 1, the equilibrium dropped to 76,602 BTC by Dec. 11, reaching its lowest constituent since April. This simplification of 3,918 BTC, oregon astir 4.86%, suggests a strategical effect from miners, apt aiming to capitalize connected the rising prices by selling disconnected their holdings.

Graph showing the Bitcoin miner equilibrium and its 30-day nett presumption alteration successful 2023 (Source: Glassnode)

Graph showing the Bitcoin miner equilibrium and its 30-day nett presumption alteration successful 2023 (Source: Glassnode)While determination are assorted reasons wherefore miners mightiness trim their balances, operational costs are often astatine the forefront. The latest negative mining trouble adjustment whitethorn person offered miners an opportune infinitesimal to unafraid profits amidst escalating prices.

The fluctuation successful miner balances mirrors the adaptive quality of the Bitcoin mining sector. During carnivore markets, miners thin to accumulate revenue from artifact rewards and fees, betting connected aboriginal terms recovery. However, successful bull runs, they often liquidate holdings, aiming to maximize profits from their operations.

The existent inclination of expanding Bitcoin prices coupled with decreasing miner balances points to a marketplace signifier characterized by miner assurance successful the price stability oregon anticipation of further growth. Yet, this diminution successful miner balances besides raises a emblem of caution. A important sell-off by miners could summation marketplace supply, perchance exerting downward unit connected prices if not balanced by capable demand.

As miners respond to marketplace conditions, their behaviour provides invaluable insights into the market’s wellness and aboriginal trajectory. It is simply a reminder of the request for continuous monitoring of assorted on-chain metrics to grasp the evolving scenery of Bitcoin’s marketplace fully.

With the existent marketplace conditions, miners look to beryllium cautiously optimistic, perchance signaling a affirmative sentiment successful the broader market. However, the imaginable interaction of accrued proviso owed to miner sell-offs should not beryllium underestimated.

The station Bitcoin surge triggers miner sell-off appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)