Data from Glassnode reveals the Bitcoin proviso has been observing a displacement from wallets based successful America to those successful Asia recently.

Bitcoin Supplies Held By Asian And US Investors Have Gone Opposite Ways Recently

According to information from the on-chain analytics steadfast Glassnode, an absorbing dichotomy has formed betwixt the antithetic determination supplies of the cryptocurrency recently.

Glassnode has divided the Bitcoin addresses into antithetic regions based connected the hours they person been making transactions in. “Geolocation of Bitcoin proviso is performed probabilistically astatine the entity level,” notes Glassnode. An “entity” present refers to 1 oregon much wallets that are nether the power of a azygous capitalist (or an capitalist group).

“The timestamps of each transactions created by an entity are correlated with the moving hours of antithetic geographical regions to find the probabilities for each entity being located successful the US, Europe, oregon Asia,” explains the analytics firm.

The 3 main regions are the US (13:00 to 01:00 UTC), Europe (07:00 to 19:00 UTC), and Asia (00:00 to 12:00 UTC). In the discourse of the existent discussion, however, lone the supplies based successful the US and Asia are relevant.

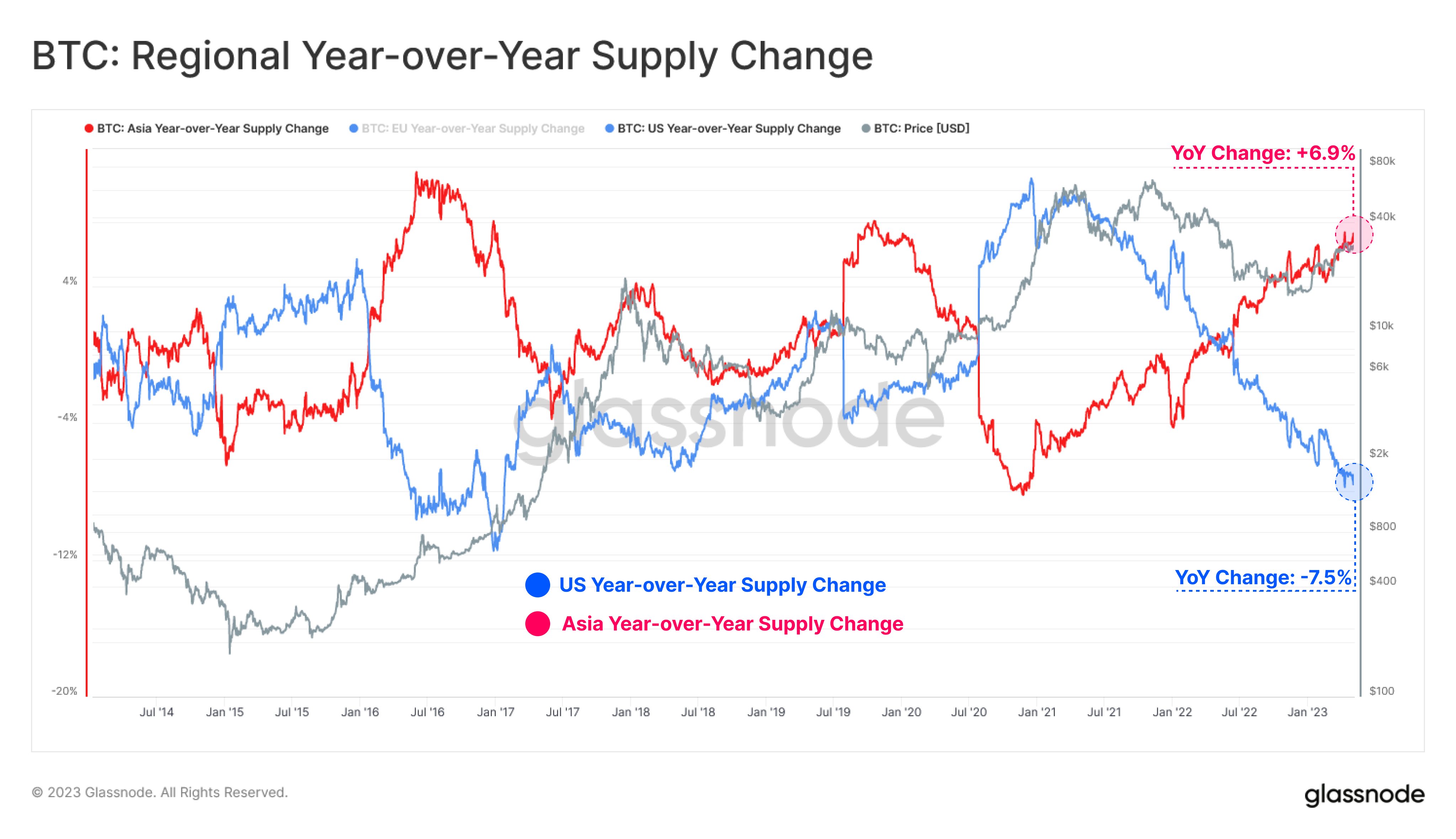

Here is simply a illustration that shows the inclination successful the year-over-year proviso alteration successful these 2 determination Bitcoin supplies implicit the past fewer years:

As displayed successful the supra graph, the Bitcoin proviso held by the US investors was increasing faster and faster successful the leadup to and during the bull run successful the archetypal fractional of 2021 arsenic the year-over-year alteration was perpetually going up.

The alteration slowed down successful the 2nd fractional of the year, but inactive remained positive, suggesting that the proviso was inactive growing, albeit astatine a slower pace. In 2022, however, the proviso started decreasing, arsenic the bear market took implicit and the LUNA and 3AC crashes took place.

The year-over-year alteration of the US-based BTC proviso has continued to turn much antagonistic since past and contiguous stands astatine a worth of -7.5%, suggesting that the proviso has shrunken by 7.5% since May 2022.

The Asian Bitcoin supply, however, has displayed a precise contrasting behavior, arsenic it started going up conscionable arsenic the American investors started shedding their holdings.

Interestingly, the gait astatine which the proviso held by the Asian traders has transformed is astir precisely the aforesaid arsenic what the balances of the US-based wallets saw (although, of course, the alteration has been successful the other direction).

Currently, the year-over-year alteration successful the Asian proviso stands astatine +6.9%. The information that the Asian investors person bought a akin magnitude to what the US holders person sold suggests a nonstop transportation of coins betwixt the 2 supplies.

Now, arsenic for wherefore this continued modulation of proviso has taken place, the main crushed is apt to beryllium the information that the US has been tightening up regulations related to the cryptocurrency assemblage recently.

One of the astir salient examples of this has been the regulatory crackdown that Coinbase has observed from the Securities and Exchange Commission (SEC) recently.

BTC Price

At the clip of writing, Bitcoin is trading astir $28,200, down 1% successful the past week.

Featured representation from iStock.com, charts from TradingView.com, Glassnode.com

2 years ago

2 years ago

English (US)

English (US)