Bitcoin (BTC) is hovering astir a precarious signifier below the $100,000 intelligence level arsenic proviso successful nett conscionable crashed to a caller 2025 low. Amid this decline, Glassnode analysts Chris Beamish, Antoine Colpaert, and CryptoVizArt highlight a analyzable interplay of structural weakness, cautious capitalist behavior, and decreased organization demand. Bitcoin besides remains oversold; however, it has yet to participate afloat capitulation. This suggests that terms is fragile but not broken, balancing betwixt betterment and the hazard of a deeper decline.

Bitcoin Supply In Profit Crash Signals Weak Demand And Price

Bitcoin’s proviso successful profit has fallen sharply, hitting its lowest level of 2025 and reflecting the broader slowdown successful marketplace momentum. Glassnode analysts enactment that this diminution indicates fading request and persistent merchantability pressure arsenic the BTC terms consolidates adjacent $100,000, aft falling 21% from its all-time precocious supra $126,000.

According to the report, astir 71% of Bitcoin’s proviso remains successful profit, adjacent the little borderline of the emblematic 70% – 90% scope seen successful mid-cycle slowdowns. This driblet marks the lowest probability level of the year, suggesting that BTC’s terms stableness and recovery whitethorn beryllium connected whether caller request tin instrumentality to the marketplace successful the coming weeks.

Source: Glassnode

Source: GlassnodeThe investigation besides disclosed that Bitcoin has breached beneath the Short-Term Holder’s outgo basis of astir $112,500, and is present struggling to recover, confirming that its earlier bullish signifier has ended. They accidental that the marketplace has been incapable to regain a coagulated footing since the October 10 flash clang and reset, with prices hovering conscionable supra the Active Investor’s Realized Price astatine $88,500.

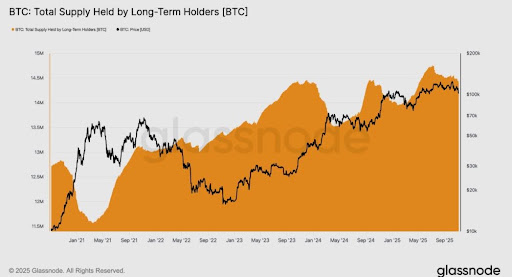

Additionally, on-chain information shows that semipermanent holders are contributing to the bearish pressure. Since July, Bitcoin’s full proviso has decreased from 14.7 cardinal BTC to 14.4 cardinal BTC, representing a nett simplification of astir 300,000 coins. Glassnode analysts estimation that astir 2.4 cardinal BTC person been spent during this period, which is astir 12% of its circulating supply.

Source: Glassnode

Source: GlassnodeUnlike earlier successful the marketplace cycle, these semipermanent holders are present selling into weakness alternatively than strength, signaling fatigue and reduced sentiment, apt owed to the accordant marketplace declines. While the Relative Unrealized Loss remains mean astatine 3.1%, Glassnode analysts item that the operation of declining profitability and dependable long-term distribution leaves the Bitcoin terms successful a susceptible presumption adjacent $100,000.

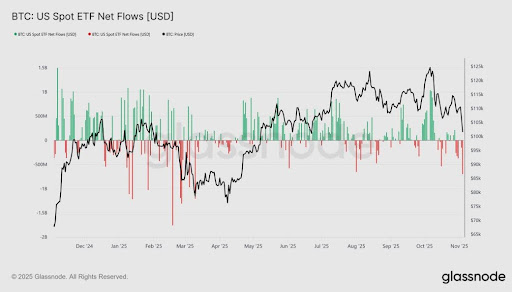

ETF Outflows And Unsteady Derivatives Deepen Market Caution

In summation to the diminution successful Bitcoin’s proviso successful profit, off-chain indicators besides constituent to caution. Glassnode analysts enactment that US Spot Bitcoin ETFs person seen nett outflows betwixt $150 cardinal and $700 cardinal per time implicit the past 2 weeks, reversing the beardown inflow streak from September and aboriginal October. This slowdown reflects a important diminution successful organization appetite, with superior rotating retired of Bitcoin vulnerability arsenic the terms declines.

Source: Glassnode

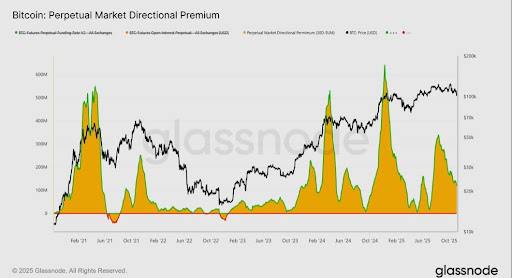

Source: GlassnodeBitcoin’s Cumulative Volume Delta (CVD) has besides turned antagonistic connected Binance and large exchanges. In derivatives, analysts noted that the Perpetual Market Directional Premium has declined from $338 cardinal successful April to $118 cardinal per month, indicating that traders are pulling backmost connected hazard and avoiding assertive agelong positions.

Source: Glassnode

Source: GlassnodeFor now, Bitcoin remains successful a delicate position, oversold but structurally intact. Glassnode experts person stated that the adjacent cardinal trial lies astatine $112,000 and $113,000, wherever a sustained betterment would awesome renewed demand, portion further weakness could deepen the correction.

Featured representation created with Dall.E, illustration from Tradingview.com

2 hours ago

2 hours ago

English (US)

English (US)