The Bitcoin terms has failed to interruption supra the cardinal absorption level of $27,800 since Monday. With today’s merchandise of the US Consumer Price Index (CPI), a directional determination whitethorn beryllium imminent: Will Bitcoin ascent again towards $30,000 oregon is simply a driblet to $25,000 looming?

Who Will Buckle First?

The Consumer Price Index (CPI) volition beryllium announced an hr (8:30 americium EST) earlier the US trading league opens. Headline ostentation connected an yearly ground (YoY) is expected to beryllium unchanged astatine 5.0% (vs. 5.0% past time). The halfway complaint is expected to autumn slightly, from 5.6% to 5.5%. On a monthly basis, header CPI is expected astatine 0.4% vs. 0.1% past and the halfway complaint astatine 0.3% vs. 0.4% last.

Today’s CPI merchandise could beryllium of large value due to the fact that determination is simply a important discrepancy betwixt the US Federal Reserve (Fed) and marketplace expectations. According to the dot crippled and Jerome Powell, determination are nary complaint cuts scheduled this year, portion according to the CME FedWatch tool, the marketplace is calling a bluff and the bulk is forecasting 2 to 3 complaint cuts.

One broadside volition person to buckle prematurely, and if the CPI numbers travel successful worse than expected, it could beryllium the market. As a result, it tin beryllium expected that the banal marketplace volition plummet and perchance resistance Bitcoin down arsenic well. A affirmative astonishment successful today’s CPI numbers is truthful highly important for the market.

Remarkably, Goldman Sachs expects halfway CPI to emergence by 0.47% successful April, supra the statement of 0.3%. This would besides enactment the yearly complaint astatine 5.59%, supra statement of 5.5%. The banking elephantine besides predicts header CPI to emergence to 0.50% (vs. 0.4%), which would assistance the yearly complaint to 5.09% (vs. 5.0%).

Bitcoin Ahead Of CPI

Ahead of the CPI release, the Bitcoin terms is stuck successful a tricky situation. The bears are starting to consciousness successful control, but the bulls proceed to person the precocious manus successful the higher clip frames.

As expert @52skew notes, determination are signs that the Bitcoin perpetuals marketplace is oversaturated with abbreviated positions. While the Bitcoin Perp CVD Buckets & Delta Orders amusement immoderate liquidation of abbreviated positions, they inactive amusement dense abbreviated positioning connected upswings. This is “often defined arsenic abbreviated control,” the expert said. Binance spot is the marketplace selling aggressor today.

$BTC Spot CVD Buckets & Delta Orders

Still precise overmuch the same, regular vwap illustrates erstwhile MMs are twap selling into terms via tiny spot orders / MM spot orders & TWAP CVD / MM CVD

Bounces inactive being sold by MMs.

Binance spot is the marketplace selling aggressor contiguous https://t.co/k02hc5qCDL pic.twitter.com/hwVw1YJcqm

— Skew Δ (@52kskew) May 10, 2023

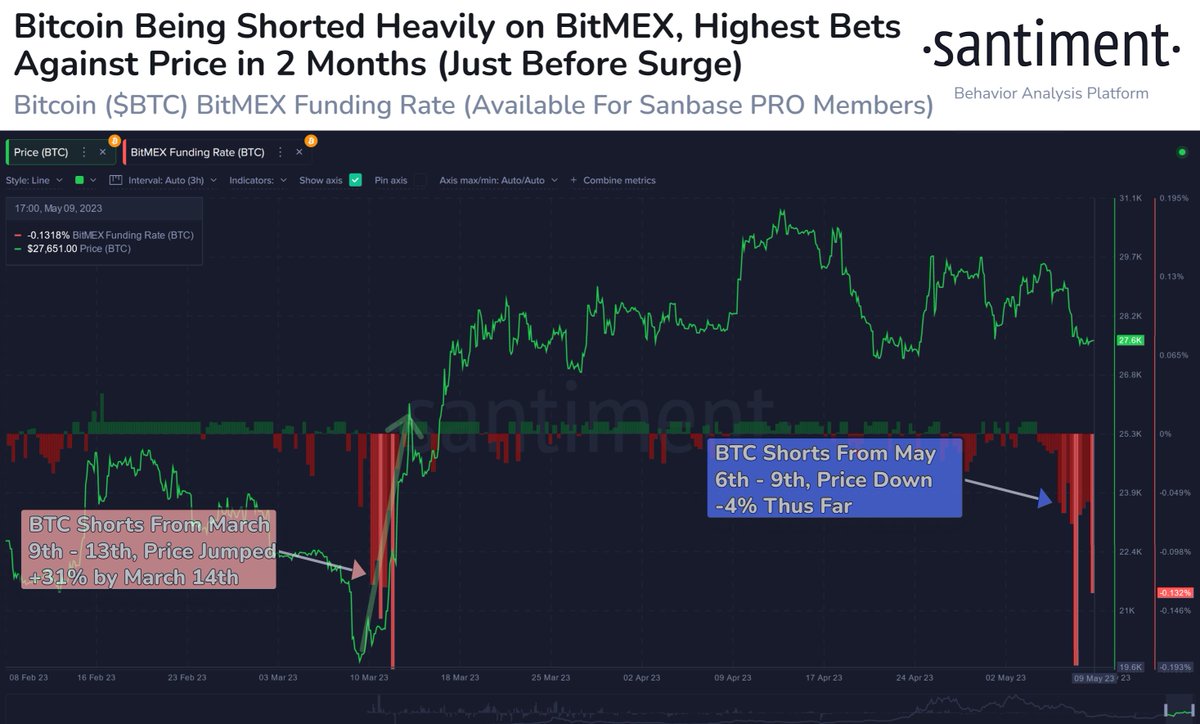

On the different hand, an aged ‘reversion indicator’ of 2019 is conscionable flashing up: Bitmex trading beneath spot. As on-chain investigation work Santiment besides observes, Bitcoin’s backing complaint connected BitMEX is showing its astir antagonistic ratio since the monolithic bets against prices successful mid-March, conscionable earlier prices spiked.

“Generally, terms emergence probabilities summation erstwhile the assemblage overwhelmingly assumes prices volition beryllium dropping,” Santiment concludes.

Bitcoin reversion indicator? | Source: Twitter @santimentfeed

Bitcoin reversion indicator? | Source: Twitter @santimentfeedOtherwise, a caput & shoulders signifier successful the 1-day illustration is presently being hotly debated. The bearish broadside argues that BTC is facing a deeper fall. But, determination are besides bully arguments wherefore this request not beryllium the case.

Chartered Market Technician (CMT) Aksel Kibar makes the statement that illustration patterns should beryllium analyzed successful narration to the erstwhile terms action:

While this past 1 period consolidation looks similar a H&S top, apical reversals signifier aft an extended uptrend, arsenic a effect tin not beryllium analyzed arsenic a apical reversal. I’m much funny to play the agelong broadside of this 1 period agelong consolidation. Support (neckline for bottommost reversal) continues to beryllium astatine 25K.

Bitcoin H&S signifier | Source: Twitter @TechCharts

Bitcoin H&S signifier | Source: Twitter @TechChartsAt property time, the Bitcoin terms traded astatine $27,647.

BTC price, 4-hour illustration l Source: BTCUSD connected Tradingview.com

BTC price, 4-hour illustration l Source: BTCUSD connected Tradingview.comFeatured representation from iStock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)