In a caller bid of tweets, Vetle Lunde, Senior Analyst astatine K33 Research, delved heavy into the imaginable ramifications of the US Bitcoin (BTC) spot ETFs. Lunde’s investigation suggests that the broader marketplace mightiness beryllium importantly underestimating the transformative powerfulness of these fiscal instruments.

Lunde’s assertion is rooted successful 5 halfway reasons. He began with a bold proclamation: “The marketplace is incorrect – and dramatically underestimates the interaction of US BTC ETFs (and ETH futures-based ETFs).”

Why The Market Is Wrong On Bitcoin

Firstly, Lunde believes that the existent clime is ripe for the support of US spot ETFs, suggesting that the likelihood person ne'er been much favorable. As NewsBTC reported, Bloomberg experts Eric Balchunas and James Seyffart precocious raised their Bitcoin spot ETF support likelihood pursuing the Grayscale judgement to 75% this year, 95% by the extremity of 2024.

Secondly, Lunde pointed retired that BTC terms has retraced to pre-BlackRock announcement levels. The 3rd crushed revolves astir the imaginable contention and the simultaneous launches of aggregate US spot ETFs. Lunde anticipates that these, if approved, could pb to robust inflows, perchance surpassing the archetypal trading days of some BITO and Purpose.

For context, helium highlighted that Purpose saw inflows of 11,141 BTC, and successful its wake, consequent ETF launches successful Canada resulted successful a whopping 58,000 BTC worthy of inflows wrong a specified 4 months. Given the vastness of the US marketplace compared to Canada, the inflow imaginable is considerably higher.

The 4th crushed Lunde presented is based connected humanities information from the past 4 years. He emphasized a noticeable correlation betwixt beardown BTC concern conveyance inflows and appreciating BTC prices. This narration becomes adjacent much pronounced during periods of utmost inflows, which person historically contributed to important marketplace uplifts.

The past important constituent for Lunde is that connected August 17 the marketplace got escaped of from excess leverage, arsenic NewsBTC reported.

By The Numbers

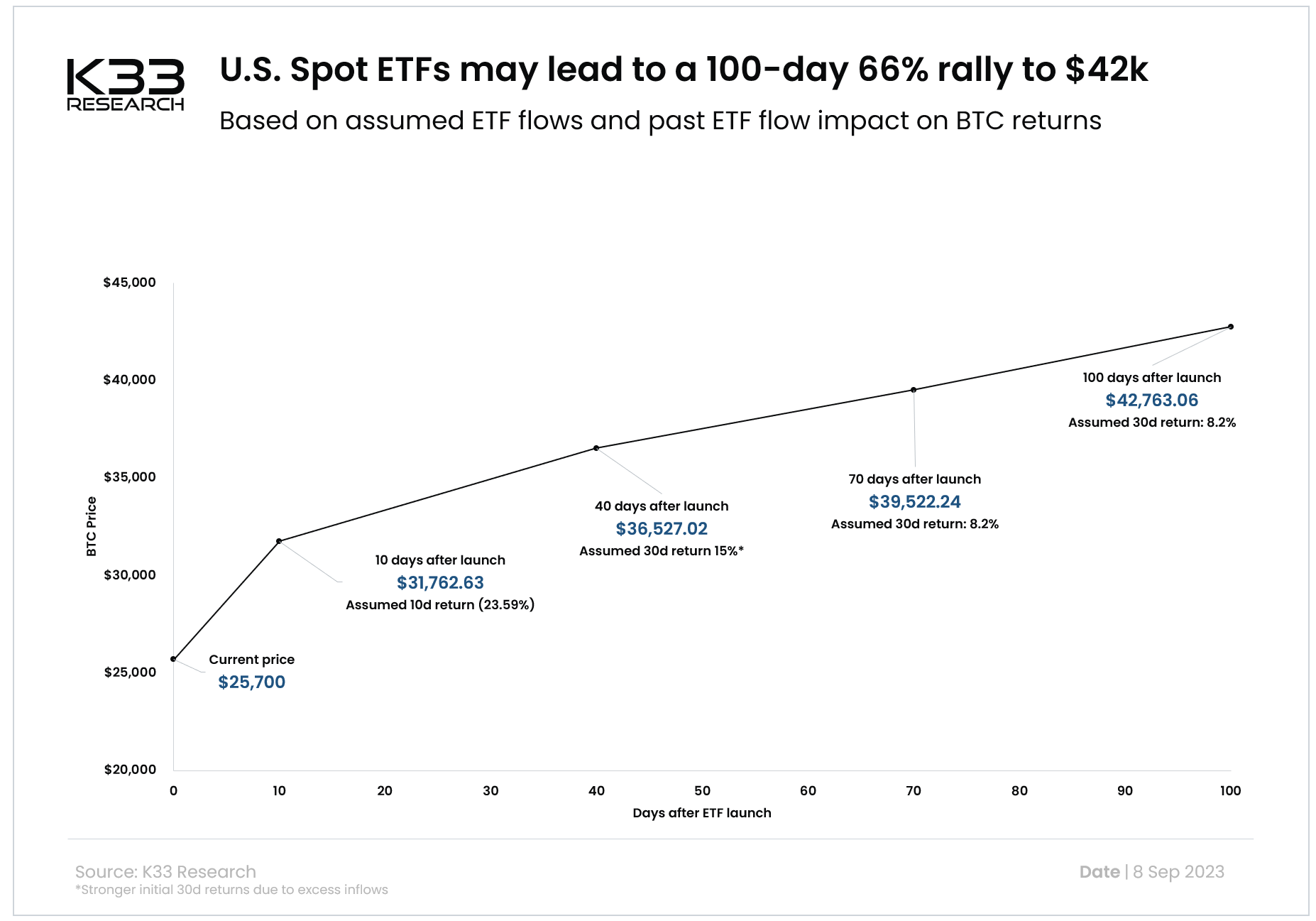

In conclusion, the probe steadfast posits that US BTC spot ETFs could spot astatine slightest 30,000 BTC worthy of inflows successful their archetypal 10 days. Over a span of 4 months, the combined inflows into BTC concern vehicles could scope betwixt 70,000 to 100,000 BTC, driven by US spot ETFs and increasing inflows to ETPs successful different countries.

Based connected these travel assumptions and information from the past 4 years, Lunde suggests a imaginable 66% BTC rally, targeting a terms of $42,000. However, helium besides cautioned that this projection is based connected a “naïve assumption” and doesn’t relationship for different market-moving events.

Bitcoin terms prediction | Source: K33 Research

Bitcoin terms prediction | Source: K33 ResearchAt property time, BTC traded astatine $25,865.

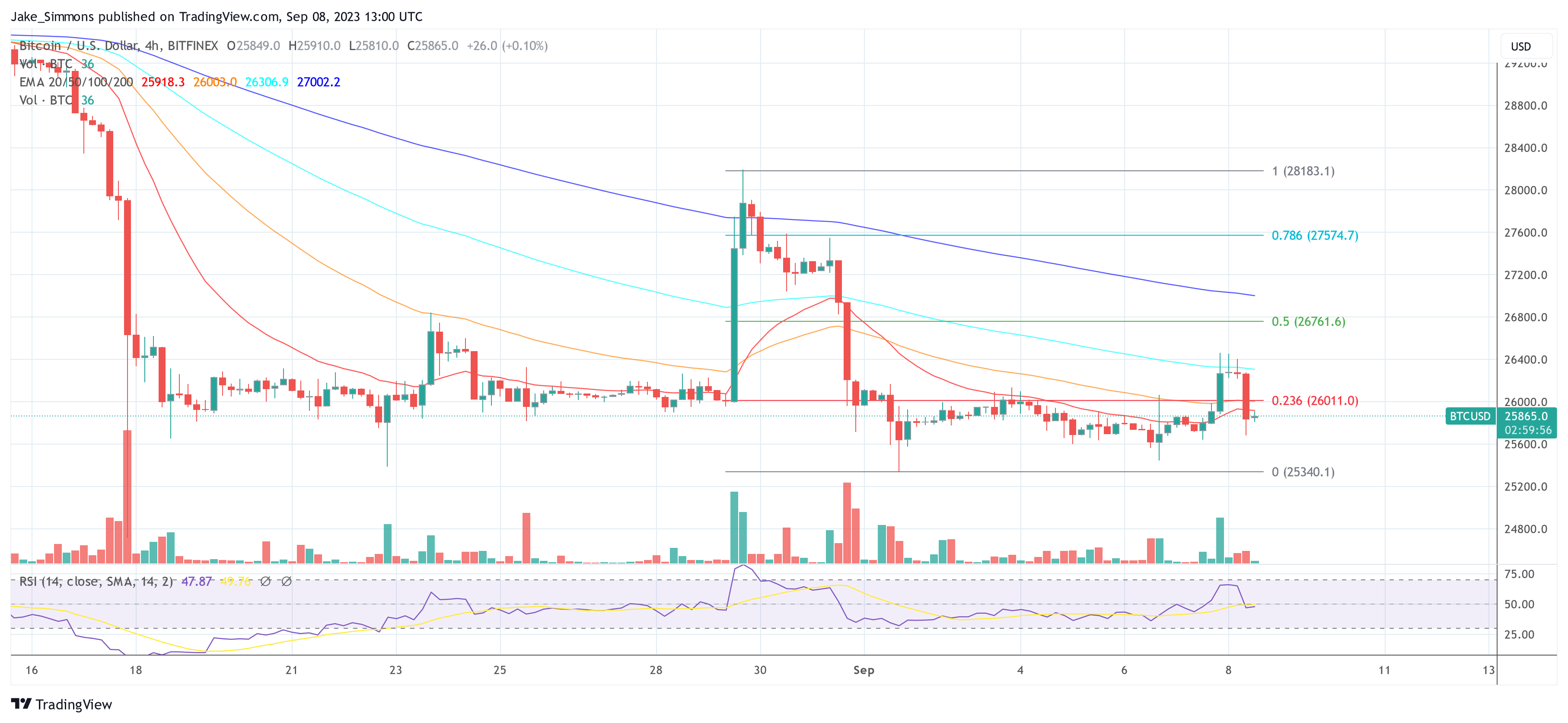

BTC price, 4-hour illustration | Source: BTCUSD connected TradingView.com

BTC price, 4-hour illustration | Source: BTCUSD connected TradingView.comFeatured representation from iStock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)