Bitcoin terms roared to a caller all-time precocious supra $112,000. Cointelegraph explains why.

Bitcoin soared to different grounds high, driven by increasing planetary capitalist request for hazard assets and a $200 cardinal liquidation of BTC shorts adjacent a captious overhead absorption level.

Bitcoin’s (BTC) terms surpassed the $112,000 all-time precocious for the archetypal clip connected Wednesday, aft rising 5.95% during the past week.

Bitcoin’s terms appreciation helped the full crypto marketplace capitalization recapture $3.47 trillion, a level past seen successful June 2025.

Yet, the crypto market’s worth remains beneath the all-time precocious of $3.73 trillion recorded successful December 2024.

Bitcoin’s caller all-time precocious occurred conscionable days aft President Trump announced a caller circular of tariffs of up to 40% against Malaysia, Kazakhstan, South Africa, Myanmar and Laos. Meanwhile, Japan saw its tariff complaint lifted to 25% and the caller rates spell unrecorded connected Aug. 1.

Related: GENIUS Act ‘legitimizes’ stablecoins for planetary organization adoption

Bitcoin’s terms momentum is benefiting from a reset successful “over-leveraged participants” that created a “healthier instauration for continuation,” analysts from Bitfinex speech told Cointelegraph, adding:

“The convergence betwixt on-chain accumulation and off-chain speech bid travel paints a compelling picture: this rally has been built connected coagulated ground, supported by existent superior flows alternatively than short-lived speculative leverage.”“To support a constructive outlook for the coming weeks, this signifier of spot purchaser dominance indispensable persist,” explained the analysts

Related: Bitcoin much of a ‘diversifier’ than safe-haven asset: Report

Bitcoin rally driven by expanding harmless haven status: Sygnum Bank probe lead

Bitcoin’s uptrend since Trump’s Liberation Day announcement connected April 2 is driven by its increasing designation arsenic a safe-haven asset, according to Katalin Tischhauser, the caput of probe astatine integer plus banking radical Sygnum Bank.

Since April 2, Bitcoin has been “outperforming arsenic good arsenic progressively decoupling connected days erstwhile the S&P 500 corrected,” she told Cointelegraph, adding:

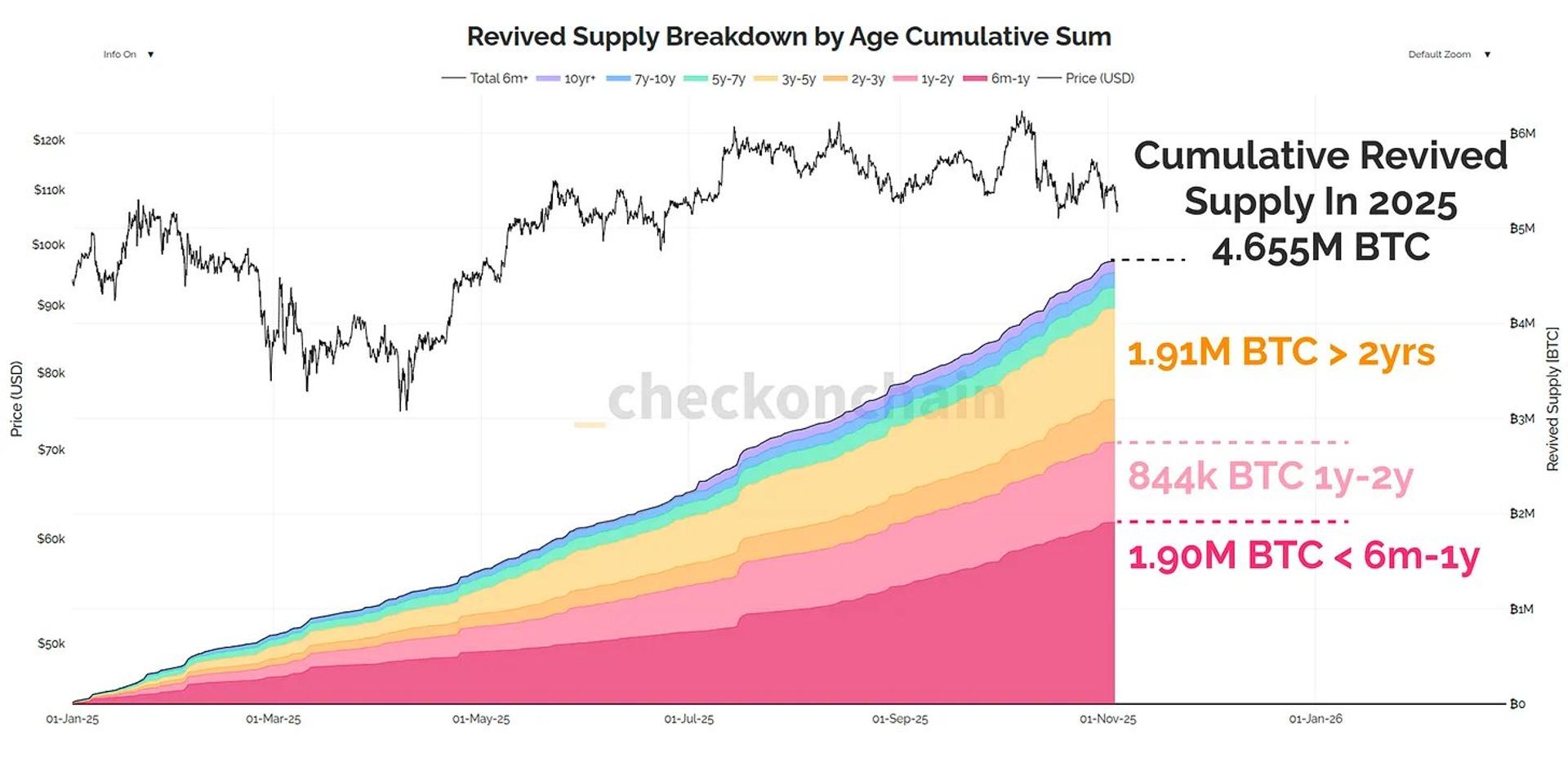

“This has been supported by Bitcoin’s expanding presumption arsenic a harmless haven plus successful the look of fiat debasement, besides confirmed by the archetypal US authorities signing a Bitcoin reserve measure into law, pursuing the national Bitcoin reserve established by Executive Order.”Bitcoin speech reserves person besides been successful a dependable diminution since precocious April, which is simply a motion of “long-term confidence” from Bitcoin investors that whitethorn pb to a supply shock-driven rally, according to Tischhauser.

Bitcoin reserves crossed each exchanges fell to 2.99 cardinal BTC connected May 21, down from implicit 3.11 cardinal BTC connected March 13, Glassnode information shows

Magazine: Dogecoin acceptable for rebound? Ripple eyes US banking license: Hodler’s Digest, June 29 – July 5

3 months ago

3 months ago

English (US)

English (US)