Bitcoin's (BTC) feeble bounce this week ran retired of state connected Thursday, with prices slipping backmost beneath $110,000 and immoderate marketplace watchers informing of a deeper pullback.

The largest cryptocurrency fell 2.2% implicit 24 hours to $109,500, erasing fractional the gains it made from the weekend's debased of $107,000 arsenic it topped $112,600 connected Wednesday. Ether (ETH), Solana's SOL (SOL) and Cardano's ADA (ADA) each fell much than 3% implicit the past 24 hours.

Digital plus treasury stocks besides bled. The largest firm BTC proprietor Strategy (MSTR) dropped 3.2% and is 30% down since July. Japan-based MetaPlanet (3355) mislaid 7% and trades 60% little than its June high, portion KindlyMD (NAKA) slid different 9% and is present down 75% since mid-August. Ether-focused vehicles BitMine (BMNR) and SharpLink Gaming (SBET) dropped 8%-9%.

How debased BTC could fall?

Worries astir further downside are increasing louder, with immoderate observers pointing to September historically being 1 of bitcoin’s and and the broader crypto market's weakest months.

At the aforesaid time, gold, the old-school harmless haven and ostentation hedge, broke retired to caller records supra $3,500 pursuing a multimonth consolidation, seemingly sucking superior from riskier plays.

A caller study from Bitfinex noted that BTC has entered its 3rd consecutive week of retracement from the August all-time precocious of $123,640. Historically, bull-market corrections averaged astir 17% peak-to-trough, suggesting the marketplace is nearing the emblematic bounds of its drawdowns, the study said.

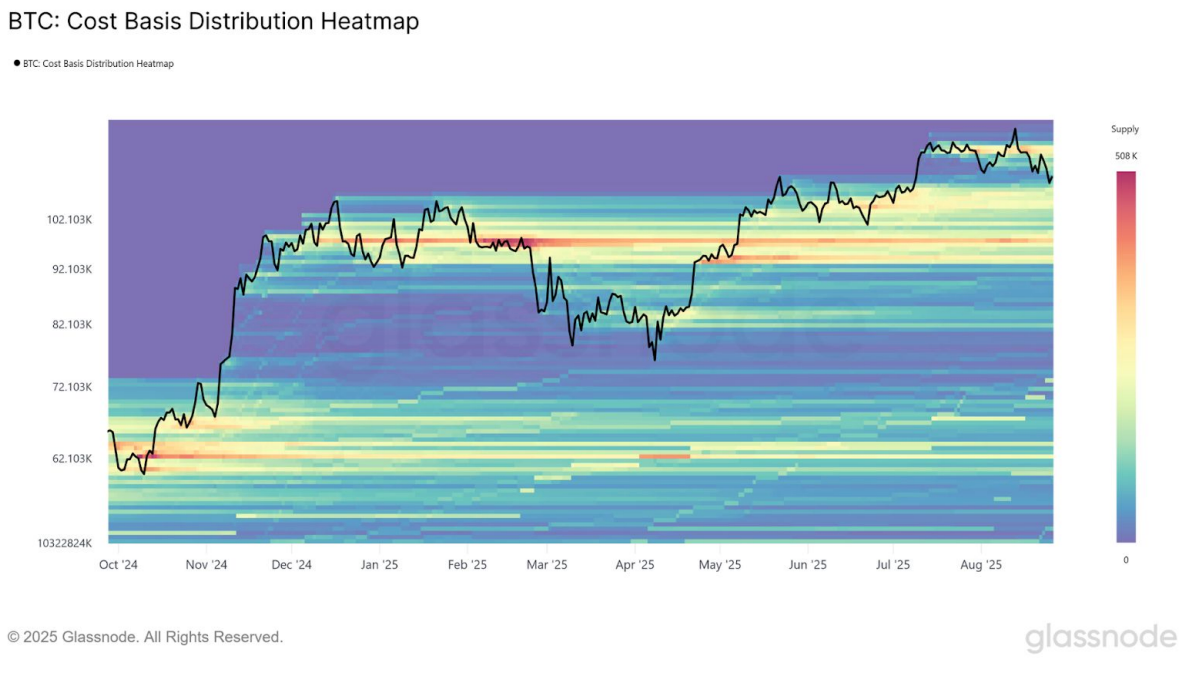

However, there's a hazard of a deeper pullback, the analysts warned. The short-term holder realized price, a gauge of newer investors’ outgo ground of buying BTC, presently sits adjacent $108,900, little than 1% beneath BTC's existent price. If that level fails arsenic support, it could unfastened the mode to a deeper retracement, with a dense proviso clump betwixt $93,000 and $95,000 apt providing a durable floor, the study said.

Joel Kruger, marketplace strategist of LMAX Group, remains much optimistic.

September has usually been a period of consolidation up of stronger fourth-quarter performance, helium said, adding that this year’s correction mightiness beryllium shallower if ETF inflows, firm treasury allocations and regulatory tailwinds materialize.

Read more: Bitcoin Options Tilt Bearish Ahead of Friday's Expiry: Crypto Daybook Americas

UPDATE (Sept. 4, 16:00 UTC): Adds BTC proviso clump chart.

2 months ago

2 months ago

English (US)

English (US)