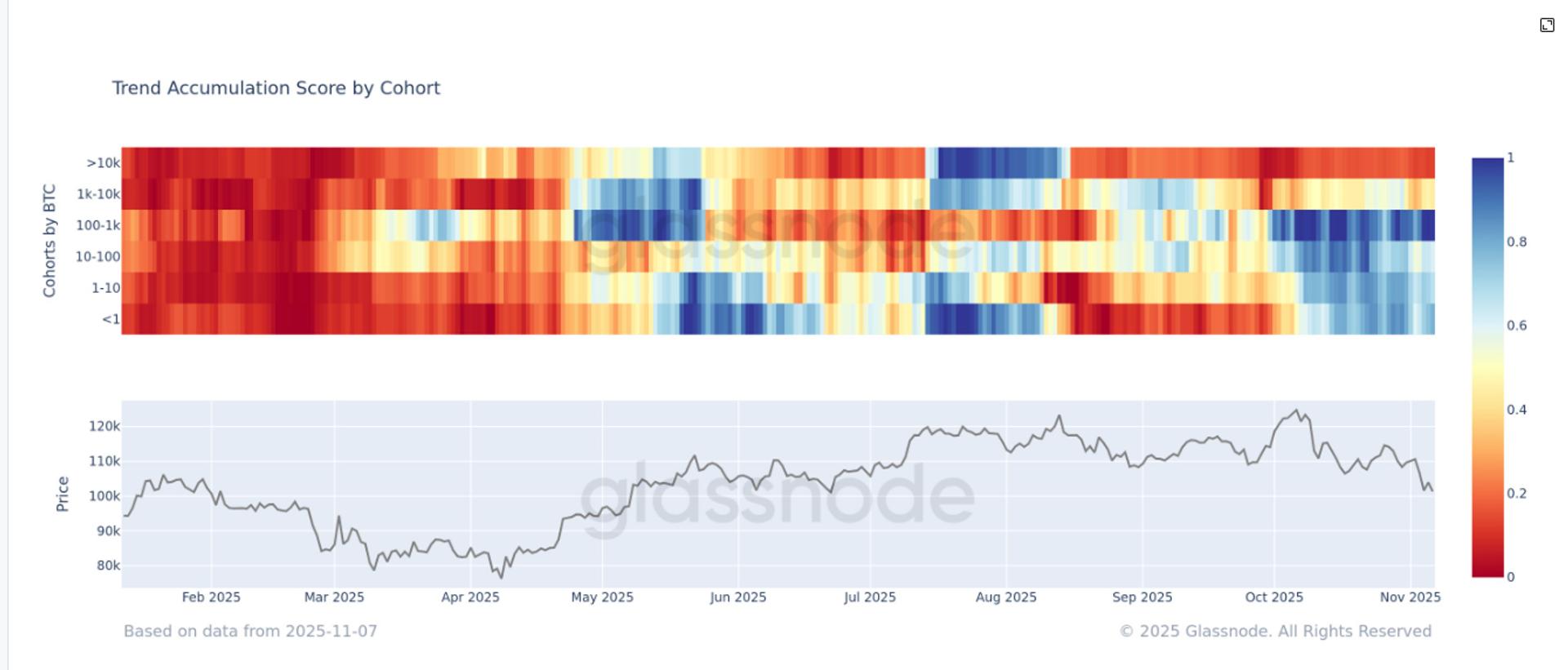

A Bitcoin sentiment metric fell to carnivore marketplace lows this week, but clever counter-traders whitethorn construe this arsenic a risk-on, go-long accidental for BTC.

Bitcoin (BTC) sits successful 1 of its slightest bullish phases since January 2023. According to Bitcoin’s “bull people index,” capitalist sentiment is showing its lowest speechmaking successful 2 years.

Bitcoin bull people index. Source: CryptoQuant

CryptoQuant’s “Crypto Weekly Report” newsletter explained that “bull people index” readings that beryllium beneath 40 for extended periods summation the likelihood of a carnivore market. The bull people remained supra 40 passim 2024, lone dipping beneath this threshold successful February 2025, arsenic identified successful the illustration above.

However, implicit the past 24 hours, Bitcoin terms has displayed resilience erstwhile compared against the monolithic losses seen successful the US banal market. On April 3, Bitcoin closed the time with a greenish candle, portion the S&P 500 was down 4.5%, a historical first.

The S&P 500 and Dow Jones extended their diminution connected April 4, dropping 3.87% and 3.44%, respectively, portion Bitcoin held dependable adjacent the breakeven point.

Related: Arthur Hayes loves tariffs arsenic printed wealth symptom is bully for Bitcoin

Is Bitcoin adjacent a risk-on phase?

Data from CryptoQuant indicates that Bitcoin’s Value Days Destroyed (VDD) metric presently sits astir 0.72, suggesting that Bitcoin terms is successful a transitional phase. Since 2023, specified periods person preceded either terms consolidation oregon renewed accumulation earlier a bullish breakout.

Bitcoin worth days destroyed. Source: CryptoQuant

The Bitcoin VDD metric tracks the question of semipermanent held coins, and it has signaled a notable marketplace inclination since precocious 2024. The metric peaked astatine 2.27 connected Dec. 12, signaling assertive profit-taking and this dynamic matched the highs seen successful 2021 and 2017. However, VDD dropped to 0.65 successful April, reflecting a cooling-off play wherever profit-taking has subsided.

This opens the anticipation of a “risk-on” marketplace for Bitcoin. In fiscal terms, a "risk-on" script occurs erstwhile investors clasp higher-risk assets similar cryptocurrencies, often driven by optimism and mean reversions successful trends.

Amid ongoing marketplace uncertainty that has been fueled by the US-led commercialized war, Bitcoin could unexpectedly summation from these tense conditions.

Speaking connected Bitcoin and the crypto market’s imaginable arsenic a hedge against accepted marketplace volatility, crypto trader Jackis said,

Similarly, the Crypto Fear & Greed Index also exhibited a “fear” class with a people of 28 connected April 4. The scale registered an "extreme fear" people of 25 connected April 3, suggesting that the existent terms whitethorn contiguous a compelling buying opportunity.

Crypto Fear & Greed Index. Source: alternative.me

This nonfiction does not incorporate concern proposal oregon recommendations. Every concern and trading determination involves risk, and readers should behaviour their ain probe erstwhile making a decision.

7 months ago

7 months ago

English (US)

English (US)