Understanding Bitcoin’s (BTC) valuation against assorted currencies isn’t simply a substance of numbers — it’s astir grasping planetary economical tides, gauging capitalist sentiment, and pinpointing geopolitical fluctuations. By juxtaposing Bitcoin against antithetic fiat currency trading pairs, we summation insights into determination economical health, capitalist behavior, and imaginable macroeconomic shifts.

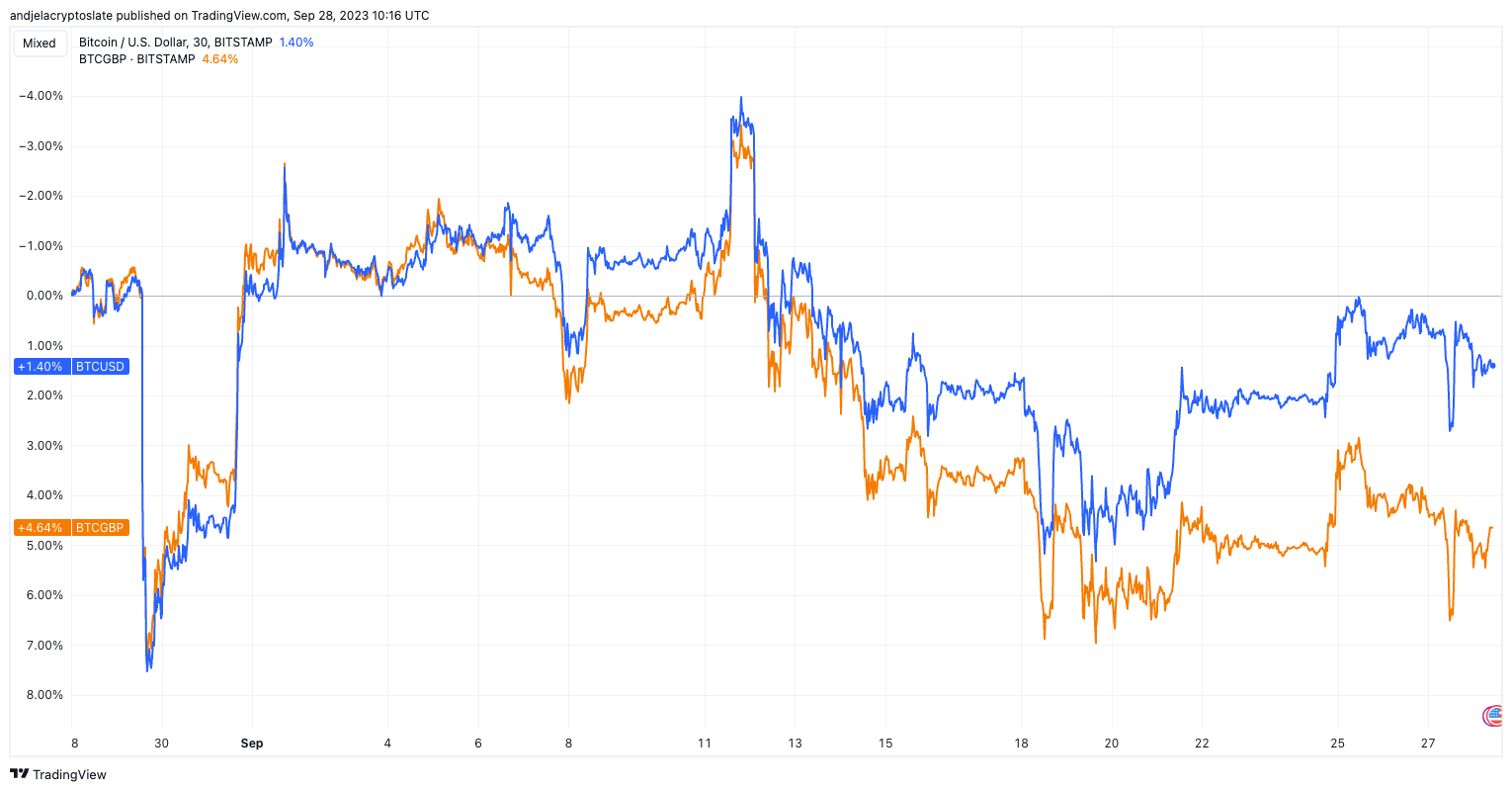

Recent marketplace trends constituent to a important variance successful the trajectory of the BTCUSD and BTCGBP trading pairs. Over the past 30 days, portion some pairs person seen growth, the BTCGBP brace has consistently outperformed its USD counterpart.

Graph comparing the BTCUSD and BTCGBP trading pairs connected Bitstamp from Aug. 28 to Sep. 28, 2023 (Source: TradingView)

Graph comparing the BTCUSD and BTCGBP trading pairs connected Bitstamp from Aug. 28 to Sep. 28, 2023 (Source: TradingView)This divergence mightiness not conscionable beryllium a effect of accrued Bitcoin request successful the UK, but besides an indicator of the pound’s comparative weakness against some the USD and Bitcoin. Several factors mightiness beryllium driving this heightened involvement successful Bitcoin among GBP users. The declining GBP could beryllium propelling investors towards Bitcoin arsenic an alternate store of value, hedging against further depreciation. Also, with the existent planetary economical outlook, Bitcoin progressively appears arsenic a refuge against accepted currency fluctuations.

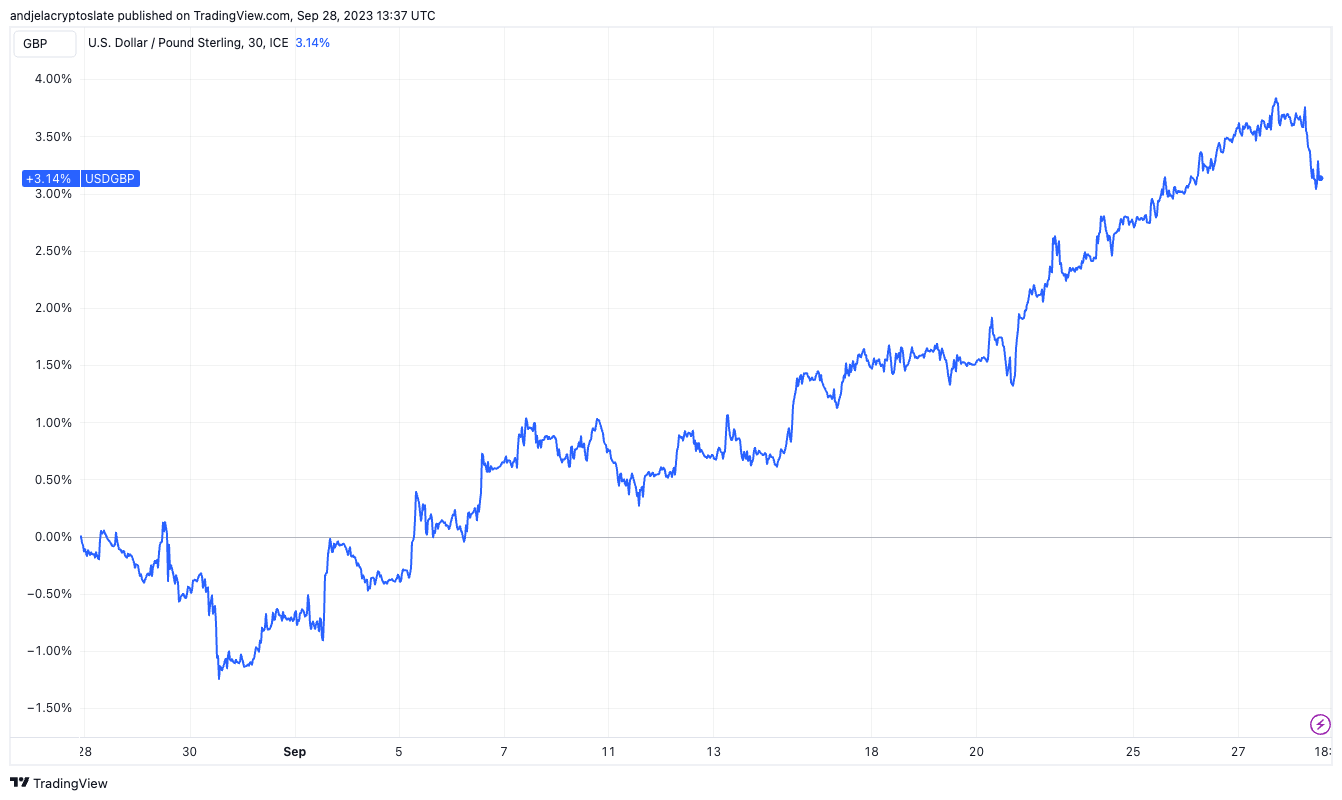

Diving deeper into the currency charts, USDGBP shows a pronounced summation of 3.08% implicit the past month, signifying the US dollar’s strengthening against the British pound. Conversely, the GBPUSD inclination indicates a depreciation of the lb against the dollar. This isn’t conscionable a month’s aberration but seems to beryllium symptomatic of deeper economic undercurrents.

Graph showing the USDGBP trading brace connected overseas exchanges from Aug. 28 to Sep. 28, 2023 (Source: TradingView)

Graph showing the USDGBP trading brace connected overseas exchanges from Aug. 28 to Sep. 28, 2023 (Source: TradingView)The lb is presently experiencing 1 of its astir important monthly decreases against the dollar. Its vulnerability successful the marketplace has been evident, particularly arsenic it seeks stableness amidst wide fiscal turbulence. Moreover, the dollar’s ascent to a notable precocious against large currencies, including the pound, further underscores the challenges faced by the GBP.

Several underlying factors lend to the pound’s existent decline. There’s a discernible inclination of investors moving distant from riskier assets, and the lb hasn’t been spared. Additionally, the UK grapples with escalating ostentation rates, prompting speculations astir the Bank of England’s prospective measures. Warnings astir the imaginable stagnation of the UK’s system person emerged, and determination are evident signs of renewed economical stress, suggesting a perchance tumultuous fiscal aboriginal for the nation.

A weakening GBP typically signals concerns astir the UK’s economical health. Investors, wary of marketplace turbulence, mightiness progressively crook to cryptocurrencies similar Bitcoin arsenic alternate concern avenues. The shifting dynamics successful the GBP’s show against large currencies and Bitcoin mightiness bespeak a broader trend: cryptocurrencies are not conscionable speculative assets but are steadily becoming integral to planetary fiscal strategies.

As the GBP faces headwinds, Bitcoin’s allure successful the UK seems to beryllium increasing.

The station Bitcoin sees rising request successful the UK arsenic British lb struggles appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)