Bitcoin slipping to $29,200 followed a two-month trading play successful which BTC retained a tight range betwixt $30,000 and $31,000.

The driblet was substantial, causing the astir important liquidation event successful caller weeks, accounting for astir $85 million. This displacement was peculiarly unexpected fixed Bitcoin’s antecedently robust support level of $30,000.

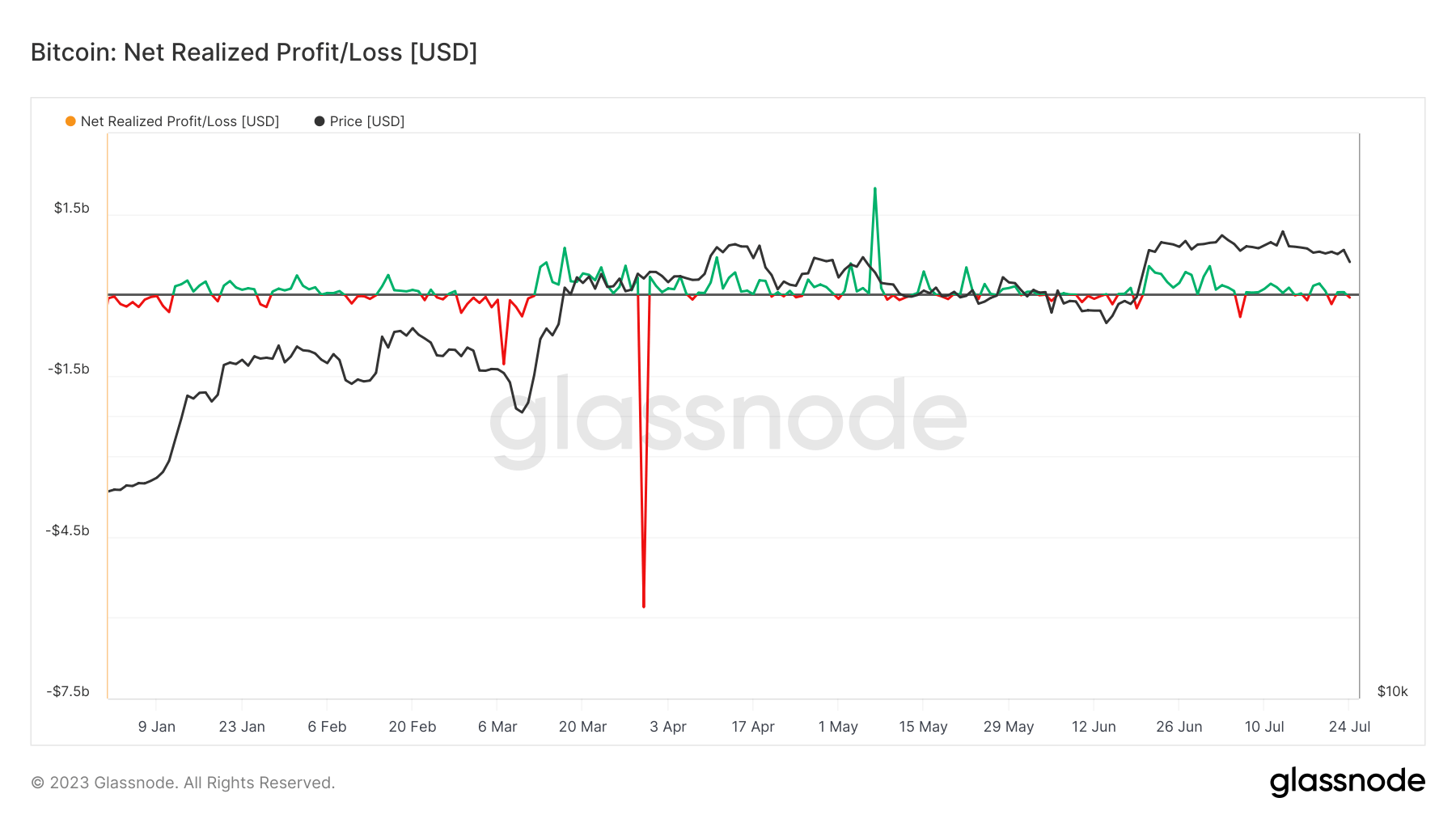

To unpack Bitcoin’s terms slump, we usage the conception of nett realized profit/loss, which refers to the quality betwixt the terms of each on-chain coins erstwhile they were past moved and the terms erstwhile they were created.

The value of this metric is multifold—it offers insights into marketplace sentiment, trader behavior, and fiscal performance. According to on-chain data, this marketplace downturn resulted successful a nett realized nonaccomplishment of much than $49.6 million.

The Bitcoin marketplace has witnessed respective important nonaccomplishment realizations successful 2023. The astir important 1 occurred connected March 30, culminating successful losses worthy $5.8 billion—the astir important nonaccomplishment realization lawsuit successful Bitcoin’s history. Despite these important losses, the marketplace has remained connected a profit-realizing trajectory for astir of the year.

Graph showing Bitcoin’s nett realized profit/loss ratio successful 2023 (Source: Glassnode)

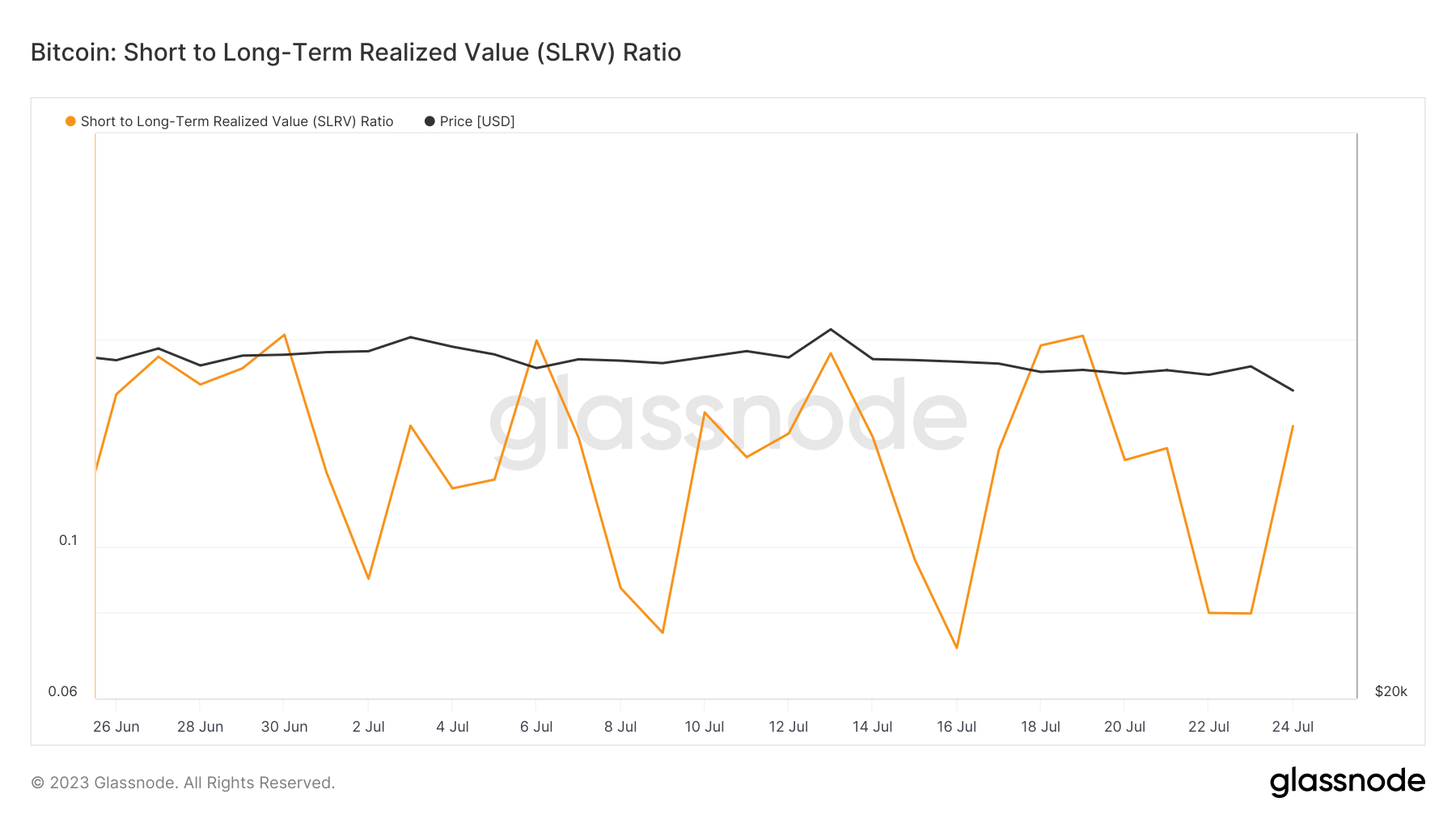

Graph showing Bitcoin’s nett realized profit/loss ratio successful 2023 (Source: Glassnode)The Short to Long-Term Realized Value (SLRV) ratio provides different captious lens to measure Bitcoin’s performance.

It measures the proportionality of realized worth from short-term holders (those holding Bitcoin for little than 155 days) to semipermanent holders (those holding Bitcoin for much than 155 days).

A rising SLRV ratio signals that short-term holders, often much speculative, are realizing value. Conversely, a decreasing ratio indicates that semipermanent holders are realizing much value, suggesting a much unchangeable market.

Of notable value is the information that the SLRV ratio experienced a melodramatic upswing connected June 24, leaping from 0.07 to 0.14.

Graph showing Bitcoin’s SLRV ratio from June 24 to July 24 (Source: Glassnode)

Graph showing Bitcoin’s SLRV ratio from June 24 to July 24 (Source: Glassnode)The abrupt spike successful the SLRV ratio points to an summation successful speculative behaviour by short-term traders who are realizing their values. Given the discourse of caller marketplace movements, this could beryllium interpreted arsenic a effect to the marketplace downturn. Traders, particularly those with shorter clip horizons, could beryllium closing their positions to chopped losses oregon instrumentality profits, thereby exerting downward unit connected the Bitcoin price.

The station Bitcoin sees realized losses arsenic it dips beneath $30K appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)