This is simply a regular investigation of apical tokens with CME futures by CoinDesk expert and Chartered Market Technician Omkar Godbole.

Bitcoin: Correction risks mount

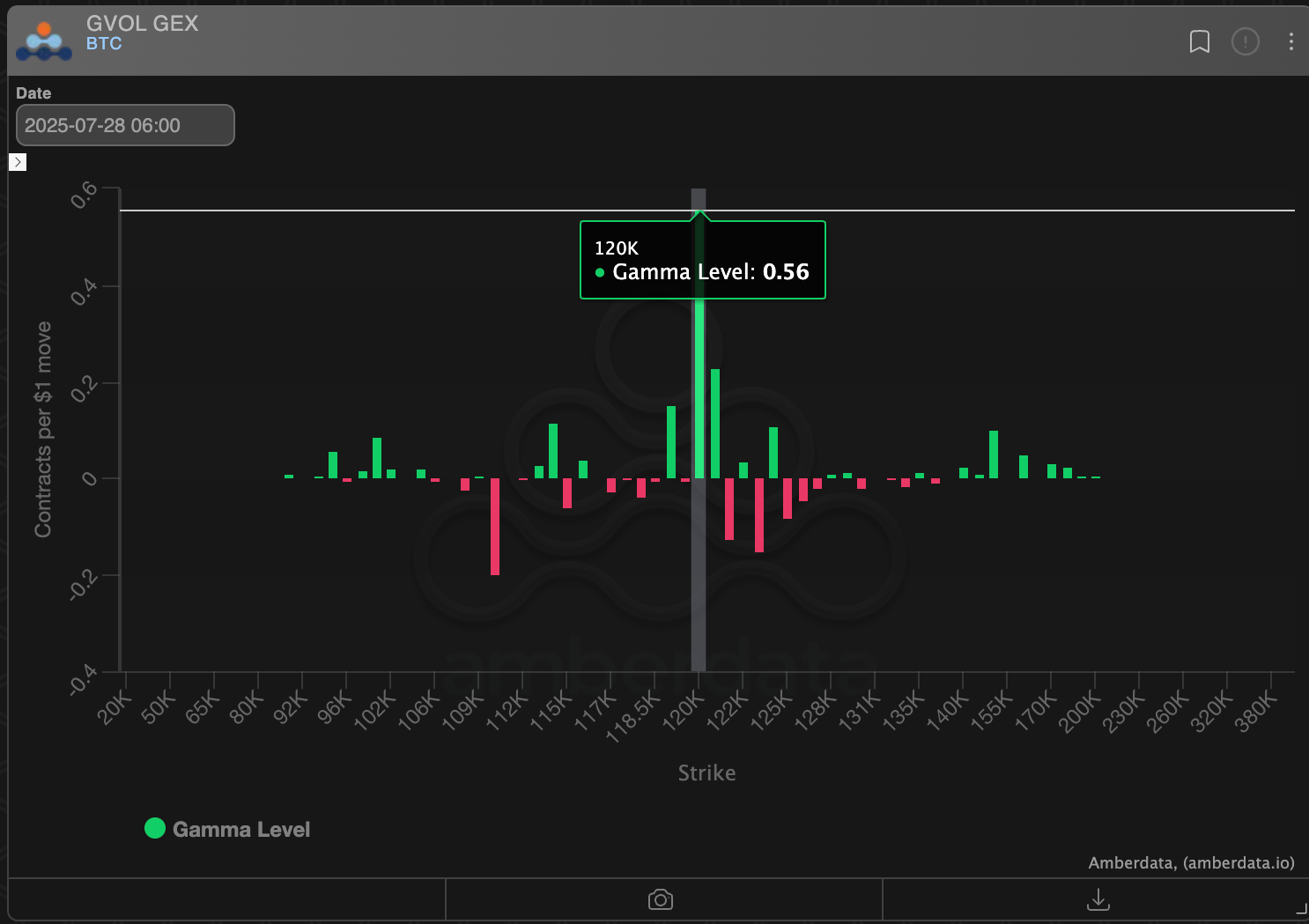

Bitcoin (BTC) continues to commercialized directionless adjacent $120,000 amid information from the Deribit-listed options showing a important affirmative trader gamma astatine the $120,000 and $120,500 strikes. When dealers person a affirmative gamma exposure, they bargain debased and merchantability precocious to rebalance their nett vulnerability to neutral, inadvertently arresting volatility.

The important enactment country betwixt $116,000 and $117,000, validated by some terms charts and on-chain activity, if breached, would apt pave the mode for a retest of the May precocious conscionable beneath $112,000. Conversely, a convincing determination supra $120,000 volition apt bring grounds highs.

That said, the lawsuit for an extended pullback looks strong, arsenic the miniscule 0.12% greenish bar, confirmed connected July 22 connected the three-line interruption illustration with regular configuration, indicates uptrend exhaustion.

- AI's take: On a three-line interruption chart, wherever each barroom signals a confirmed inclination move, the minuscule 0.12% greenish barroom connected July 22 is simply a important warning. It indicates that the beardown uptrend is experiencing terrible exhaustion of buying momentum, suggesting a imaginable imminent consolidation oregon reversal contempt the wide bullish trend.

- Resistance: $120,000, $123,181.

- Support: $116,000-$117,000, $114,700, $111,965.

Ether: Hits 7-Month

Ether (ETH) has risen astir 2% successful the past 24 hours, hitting a seven-month precocious of $3,937 astatine 1 point, which invalidated the indecisive Doji awesome from past week.

The momentum, however, was short-lived, arsenic prices rapidly pulled backmost to $3,880 arsenic of the clip of writing, validating the 14-day RSI, which did not corroborate the caller multi-month precocious successful prices, hinting astatine imaginable bearish divergence and an impending correction. The regular illustration MACD histogram besides teased a bearish cross, with on-chain fundamentals similar Ethereum's autochthonal fees and gross failing to support gait with the rising prices.

The higher debased of $3,510 established connected Thursday remains cardinal support, beneath which, the hazard of an extended descent would increase. On the higher side, the $3,900-$4,100 is the cardinal absorption scope from 2024.

- AI's take: The MACD is flashing an impending antagonistic cross, signaling weakening bullish momentum, portion the RSI shows bearish divergence, failing to corroborate caller terms highs. These indicators collectively constituent to a nonaccomplishment of upward thrust, expanding downside risk.

- Resistance: $4,000, $4100, $4,382.

- Support: $3,770 (daily low), $3,510, $3,000.

XRP: Retreats from support-turned-resistance

XRP (XRP) has reversed the gains from the Asian session, retreating from adjacent the erstwhile support-turned-resistance level astatine $3.35. The pullback appears to person legs, arsenic the hourly chart's RSI has violated the bullish trendline and the MACD histogram has crossed beneath zero, signaling a bearish displacement successful momentum.

This operation favors a retest of the July 24 debased of $2.96, beneath which, the absorption would displacement to the May precocious of $2.65.

The tweezer apical signifier connected the play chart, characterized by consecutive candlesticks with highs astatine $3.65, besides suggests a bearish displacement successful momentum.

- AI's take: XRP's awesome rally has been capped by a important "tweezer top" candlestick pattern, a beardown bearish reversal awesome that warns of imaginable downside from its multi-year highs.

- Resistance: $3.35, $3.65, $4.00.

- Support: $2.96, $2.65, $2.44 (the 200-day SMA)

Solana: Not retired of the woods yet

SOL's (SOL) terms has recovered to commercialized supra the hourly illustration Ichimoku cloud, establishing higher lows to suggest renewed upward momentum and a imaginable retest of $200, the precocious extremity of the ascending channel.

Still, we are not retired of the woods yet, arsenic the tweezer apical enactment astatine $205-$206 connected the regular illustration remains valid. Hence, a determination beneath $184, the higher low, cannot beryllium ruled retired and volition apt pb to an accelerated pullback to the 200-day SMA astatine $163.

- AI's take: Solana's awesome July rally has produced a "Tweezer Top" candlestick signifier astatine its peak, signaling a beardown bearish reversal that suggests important selling unit has entered the market.

- Resistance: $205-$206, $218, $252.

- Support: $184, $163, $126.

3 months ago

3 months ago

English (US)

English (US)