Bitcoin (BTC) enjoyed its play dose of volatility precocious Sunday, rising to astir $107,000, earlier decisively plunging backmost to $102,000.

The crypto marketplace typically experiences a bump successful volatility astatine this clip connected Sunday arsenic it coincides with the opening of the CME futures market, which takes a fewer moments to recalibrate to the little liquidity 24/7 crypto markets.

This play was somewhat different. Whilst connected the aboveground the terms enactment volition spell down arsenic a bearish rejection from a cardinal level of resistance, which bitcoin has present failed to interruption astatine 3 attempts. BTC really spiked archetypal connected the CME, indicating that the terms enactment was led by organization U.S. traders arsenic opposed to retail crypto traders.

Over the past fewer months the CME has often opened little than it closed connected the Friday, creating a "gap" connected the chart, which did not hap this week. As terms whiplashed astir this $5,000 range, the determination wiped retired liquidity connected some sides, creating a alternatively important inflection point.

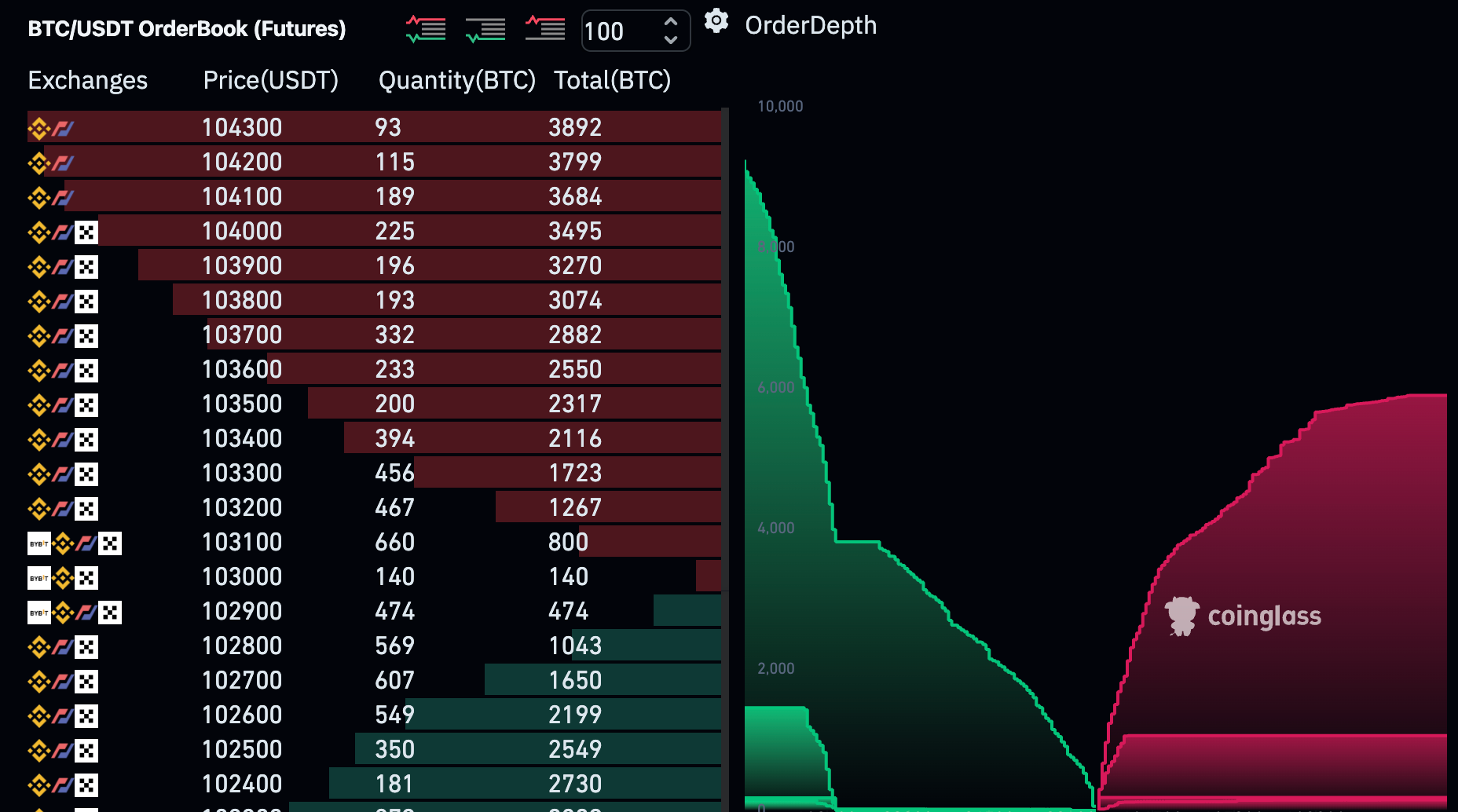

Now, marketplace extent each the mode up to $110,000 is minimal compared to bounds orders lining the publication down to $100,000. This means that immoderate upside thrust volition apt instrumentality this level retired and spot bitcoin commercialized astatine a caller grounds high.

However, it's worthy considering the different broadside of the coin. It is besides conceivable that the Sunday evening terms enactment was a emblematic stop-loss hunt, which involves traders targeting a portion wherever those successful abbreviated positions would privation to exit, frankincense creating an impulse successful bargain unit arsenic abbreviated traders scurry to bargain backmost their position.

This strategy often takes spot alongside introduction into a larger abbreviated position. For example, if a trader wants to abbreviated BTC with a hazard tolerance of 4%, it would beryllium advantageous to unfastened that presumption astatine $107,000 with a halt nonaccomplishment astatine $111,280 arsenic opposed astatine $105,000 with a halt astatine $109,200. Astute traders tin unafraid that introduction by assessing levels of liquidity and squeezing abbreviated positions into closing, which temporarily lifts terms to an perfect entry.

Either way, with liquidity present comparatively debased astir grounds highs, bitcoin is 1 quality catalyst distant from that awaited upside thrust, and these perchance caller abbreviated positions astatine $107,000 could supply the ammunition to that eventual interruption out.

5 months ago

5 months ago

English (US)

English (US)