Bitcoin's BTC put-call ratio has jumped up of Friday's multi-billion-dollar options expiry connected Deribit, but its accepted bearish mentation whitethorn not archer the afloat communicative this time.

The put-call unfastened involvement ratio refers to the ratio of progressive enactment contracts to progressive telephone contracts astatine a fixed time. An summation successful the put-call ratio indicates a bias towards enactment options, offering extortion against downside risks, and is interpreted arsenic representing a bearish marketplace sentiment.

However, the latest spike is astatine slightest partially driven by "cash-secured puts" – a yield-generation and BTC accumulation strategy. The strategy involves selling (writing) enactment options, a determination analogous to selling security against terms drops successful instrumentality for a tiny upfront premium.

At the aforesaid time, the writer keeps capable currency (in stablecoins) connected the sidelines to bargain BTC arsenic obligated if the prices diminution and the purchaser decides to workout the close to merchantability BTC astatine the predetermined higher price.

The premium collected by penning the enactment enactment represents a output with the imaginable for BTC accumulation if the enactment purchaser exercises the option.

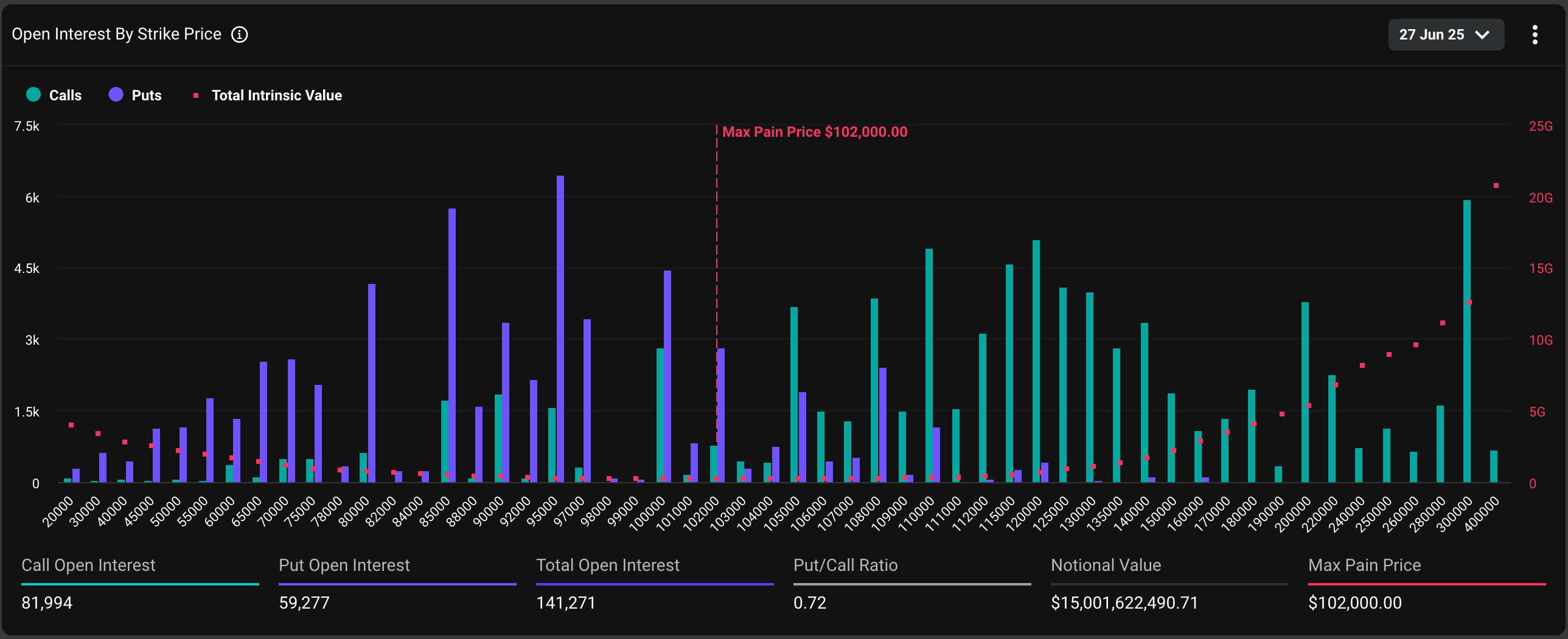

"The put/call ratio has risen to 0.72 — up from conscionable supra 0.5 successful 2024— indicating a increasing involvement successful enactment options, often structured arsenic cash-secured puts," Lin Chen, caput of concern improvement - Asia astatine Deribit, told CoinDesk.

Options expiry worthy $14 cardinal looming

On Friday, astatine 08:00 UTC, a full of 141,271 BTC options contracts, worthy implicit $14 billion, representing much than 40% of the full unfastened involvement volition expire connected Deribit, according to information root Deribit Metrics.

Of the full owed for settlement, 81,994 contracts are calls, portion the remainder are enactment options. On Deribit, 1 options declaration represents 1 BTC.

Chen said that astir 20% of expiring calls are "in-the-money (in profit)," meaning that a ample fig of marketplace participants clasp calls astatine strikes that are beneath BTC's existent spot marketplace complaint of $106,000.

"This suggests telephone buyers person performed good this cycle, aligning with the persistent inflows into BTC ETFs," Chen noted.

Holders of in-the-money (ITM) calls are already profitable and whitethorn take to publication profits oregon hedge their positions arsenic expiry nears, which tin adhd to marketplace volatility. Alternatively, they mightiness rotation implicit (shift) positions to the adjacent expiry.

"As this is simply a large quarterly expiry, we expect heightened volatility astir the event," Chen said.

Broadly speaking, astir of calls are acceptable to expire out-of-the-money oregon worthless. Notably, the $300 telephone has the highest unfastened interest, a motion traders apt hoped for an outsized terms rally successful the archetypal half.

The max symptom for the expiry is $102,000, a level wherever enactment buyers would endure the most.

Focus connected $100K-$105K range

Latest marketplace flows bespeak expectations for back-and-forth trading, with a flimsy bullish bias arsenic we attack the expiry.

According to information tracked by starring crypto marketplace shaper Wintermute, the latest flows are skewed neutral, with traders selling straddles —a volatility bearish strategy — and penning calls astir $105,000 and shorting puts astatine $100,000 for the June 27 expiry.

"For #BTC options, flows skew neutral with straddle/call selling astir 105K and abbreviated puts astatine 100K (27 Jun), pointing to expectations of choky terms enactment into expiry. Selective telephone buying (108K–112K, Jul/Sep) adds a capped bullish tilt. IV remains elevated," OTC table astatine Wintermute, told CoinDesk successful an email.

Read more: Bitcoin Could Spike to $120K, Here Are 4 Factors Boosting the Case for a BTC Bull Run

4 hours ago

4 hours ago

English (US)

English (US)