Data analyzed by CryptoSlate showed a grade of narration betwixt Bitcoin tops and bottoms successful narration to those of gold, the S&P 500, and the S&P Case-Shiller Home Price Index (CSHPI).

Bitcoin versus others

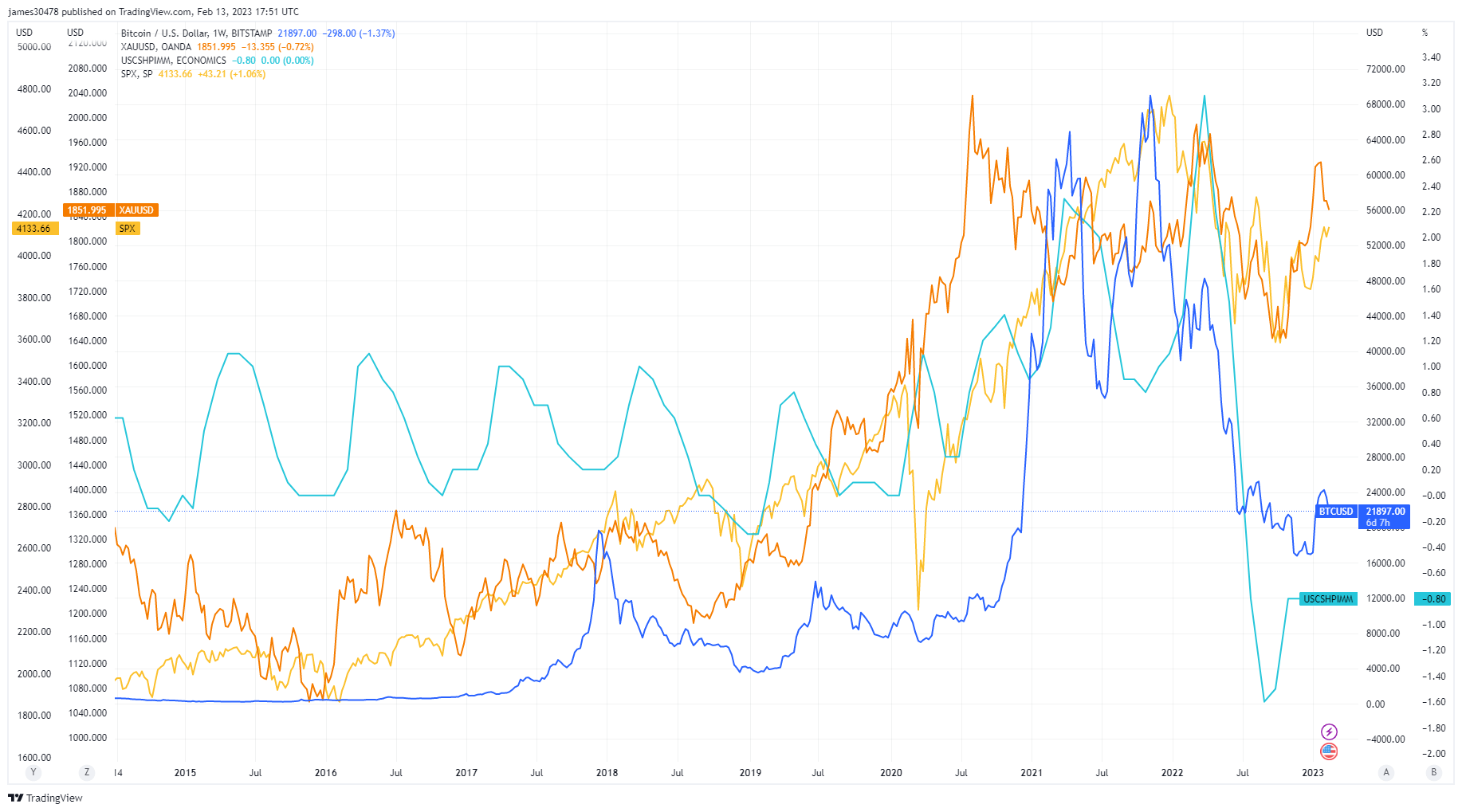

The illustration beneath interlays the terms of BTC, gold, the S&P 500, and CSHPI. It was noted that erstwhile Bitcoin bottomed during the covid clang successful March 2020, the terms of the different 3 assets/indices besides bottomed soon after, but for CSHPI.

Source: TradingView.com

Source: TradingView.comExamining the tops connected an expanded timeframe besides shows mixed results for BTC arsenic a starring indicator. Bitcoin topped $69,000 successful November 2021, the S&P 500 followed by the year-end, followed by the CSHPI, which peaked successful January 2022.

However, golden had topped astatine $2,070 astir August 2020, immoderate 15 months anterior to BTC topping.

Source: TradingView.com

Source: TradingView.comIn summary, the information points to a precocious grade of bottoming correlation betwixt Bitcoin, gold, and the S&P 500, but not U.S. property. The covid play was a achromatic swan lawsuit that would person exerted merchantability unit among liquid plus classes.

Regarding topping, Bitcoin displayed a beardown grade of correlation with the S&P 500 and the CSHPI, but not with gold.

The station Bitcoin’s apical and bottommost correlation with gold, the S&P 500, and US property appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)