The Bitcoin mining manufacture serves arsenic a captious barometer for marketplace wellness and direction. Among the assorted tools employed to analyse this captious sector, hash ribbons basal retired for their nuanced insights into the authorities of Bitcoin miners.

Hash Ribbons are a method indicator that compares 2 moving averages of Bitcoin’s hash rate: the 30-day elemental moving mean (30D-SMA) and the 60-day treble moving mean (60D-DMA).

The hash complaint represents the full computational powerfulness utilized to process and validate transactions connected the Bitcoin network. Measured successful hashes per 2nd (H/s), it straight indicates the network’s information and the miners’ activity.

Analyzing Bitcoin hash rate

Tracking the 30-day elemental moving mean (30D-SMA) and the 60-day treble moving mean (60D-DMA) of the hash complaint provides insights into short-term and semipermanent trends successful mining activity.

The 30D-SMA offers a presumption of the caller mining landscape, reflecting short-term fluctuations, portion the 60D-DMA smooths retired those fluctuations to uncover underlying trends. Together, these metrics signifier the Hash Ribbons, helping to place imaginable miner capitulation oregon recovery.

When the 30D-SMA falls beneath the 60D-DMA, it signals a play of acute miner income stress, known arsenic a antagonistic inversion. Conversely, a affirmative inversion occurs erstwhile the 30D-SMA rises supra the 60D-DMA, indicating a betterment play and accrued profitability for miners.

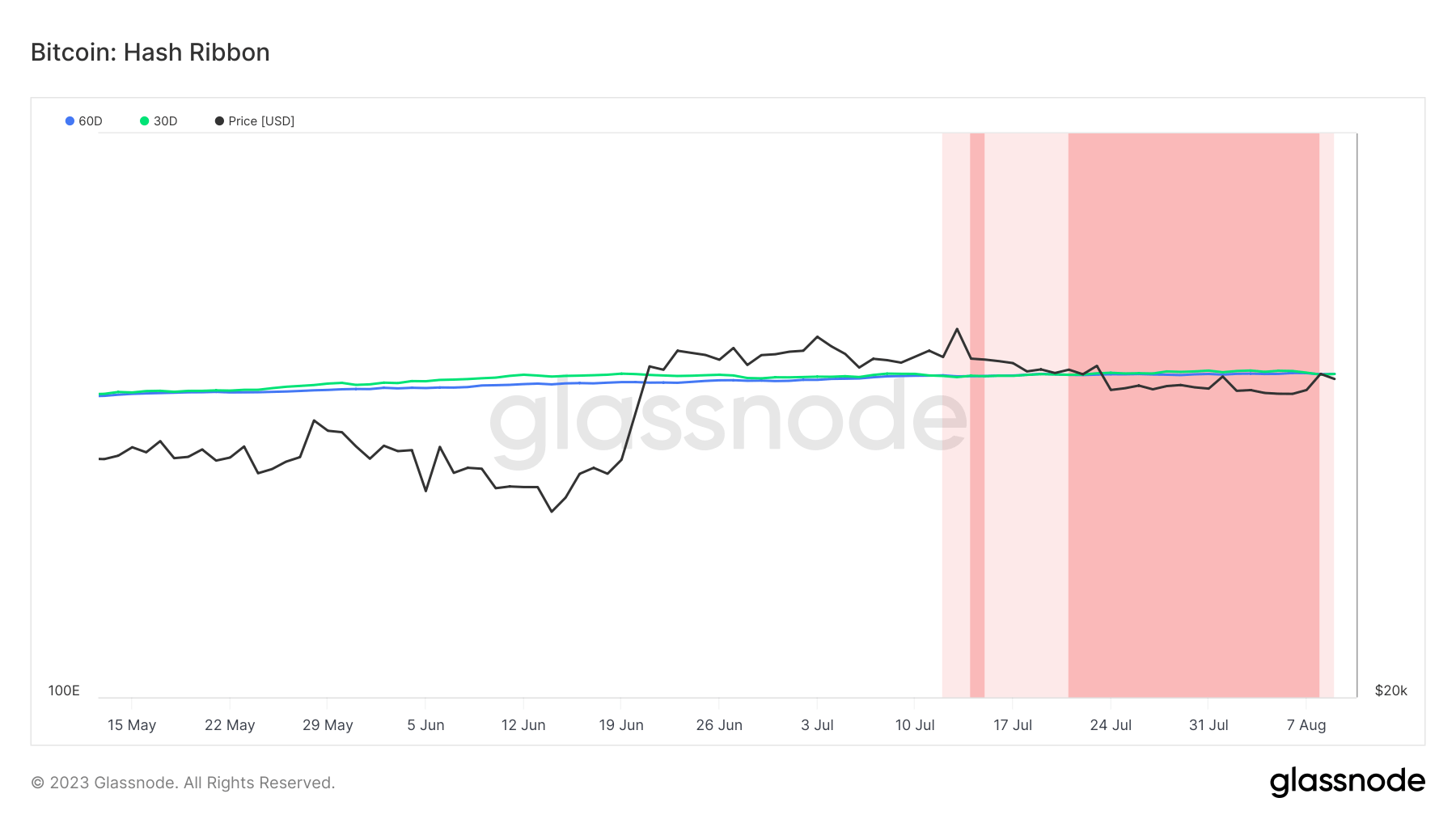

Since July 2023, the hash ribbons person been astir wholly flat, with the 30D-SMA and the 60D-DMA touching and having astir the aforesaid values.

This level signifier indicates a balanced and stagnant signifier successful the Bitcoin mining industry. It has mirrored a deficiency of wide absorption successful Bitcoin’s price, with the cryptocurrency trading betwixt $28,000 and $30,000 successful a choky range.

Graph showing Bitcoin hash ribbons from May 13 to Aug. 9, 2023 (Source: Glassnode)

Graph showing Bitcoin hash ribbons from May 13 to Aug. 9, 2023 (Source: Glassnode)What it means

The implications of this equilibrium are multifaceted. On the 1 hand, the stableness successful the mining manufacture suggests a deficiency of important stress, which tin beryllium seen arsenic a affirmative motion for the wide wellness of the Bitcoin network.

On the different hand, the lack of wide momentum successful either absorption reflects a marketplace successful a authorities of uncertainty, perchance awaiting a catalyst to move.

The existent level signifier observed successful the hash ribbons mightiness bespeak a consolidation phase, suggesting that the marketplace is holding. However, it’s besides important to enactment that specified patterns whitethorn precede a important marketplace breakout oregon breakdown.

Historically, prolonged periods of choky trading ranges accompanied by level hash ribbons often pb to important terms movements erstwhile a wide absorption was established.

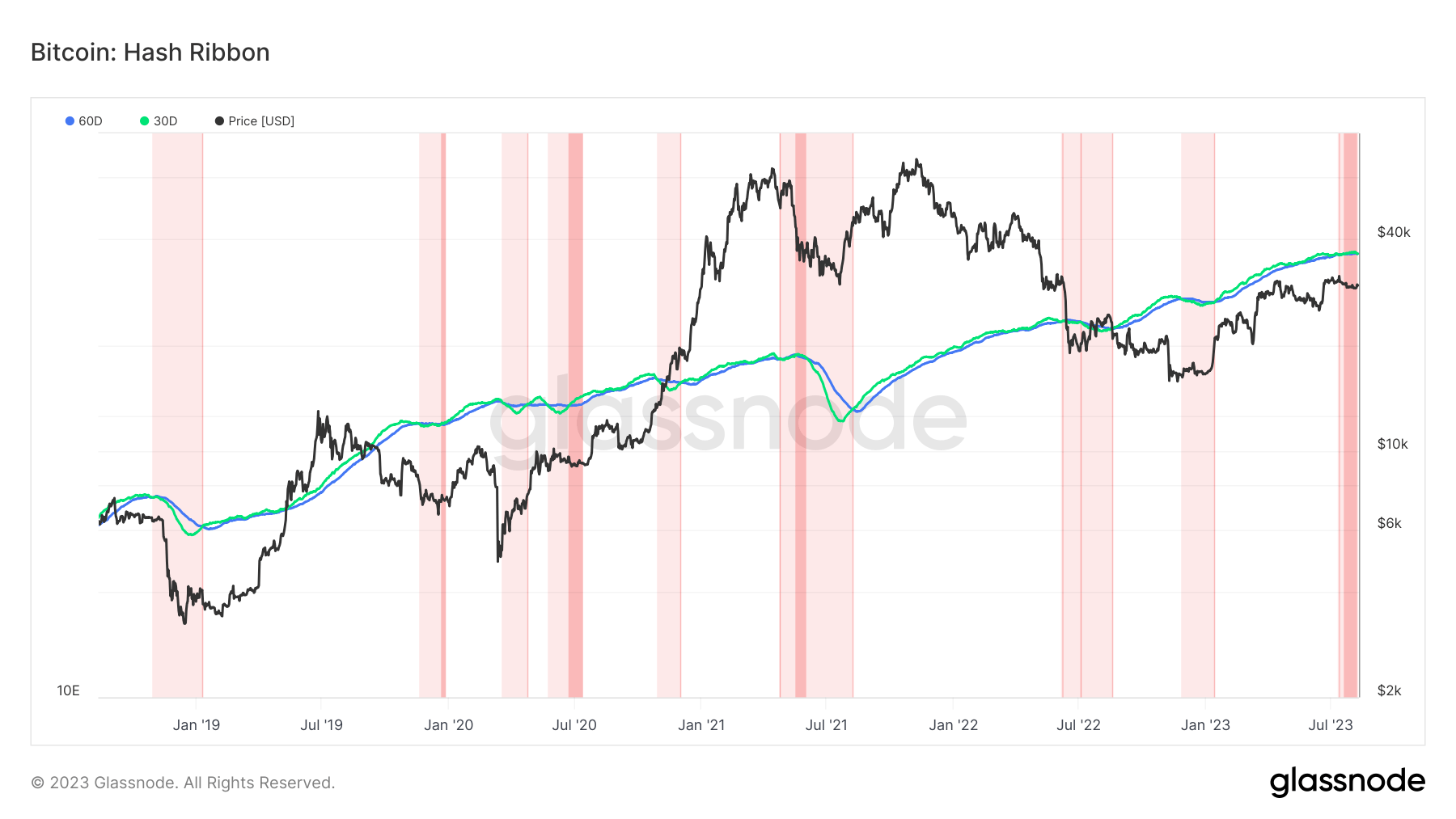

Graph showing Bitcoin hash ribbons from August 2018 to August 2023 (Source: Glassnode)

Graph showing Bitcoin hash ribbons from August 2018 to August 2023 (Source: Glassnode)The station Bitcoin’s choky trading scope mirrored by level hash ribbons signals impending marketplace movement appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)