The crypto marketplace witnessed a tumultuous 24 hours betwixt Oct. 1 and 2, seeing a monolithic liquidation spike. Around 85% of these liquidations were abbreviated positions, translating to $97.73 cardinal successful shorts liquidated successful conscionable a day. This accelerated question affected 29,510 traders, bringing the full liquidation worth to $114.92 million. The astir important azygous liquidation bid was observed connected Huobi with the BTC-USDT pair, valued astatine $8.39 million.

Major exchanges similar OKX, Binance, and Huobi were astatine the epicenter of these liquidations. They recorded liquidation values of $36.21M, $33.20M, and $27.79M, respectively. CoinEx, mainly, experienced a notable 97.94% of its liquidations successful abbreviated positions. In contrast, different exchanges oscillated betwixt 72% and 96% successful abbreviated liquidations.

| All | $114.56M | $17.05M | $97.51M | 100% | 85.12% |

| OKX | $36.21M | $6.52M | $29.68M | 31.61% | 81.99% |

| Binance | $33.20M | $6.10M | $27.11M | 28.98% | 81.64% |

| Huobi | $27.79M | $1.04M | $26.75M | 24.26% | 96.26% |

| Bybit | $10.94M | $2.98M | $7.96M | 9.55% | 72.79% |

| CoinEx | $4.88M | $100.37K | $4.78M | 4.26% | 97.94% |

| Bitmex | $593.91K | $100.82K | $493.10K | 0.52% | 83.02% |

| Bitfinex | $581.34K | $146.79K | $434.56K | 0.51% | 74.75% |

| Deribit | $367.16K | $68.72K | $298.43K | 0.32% | 81.28% |

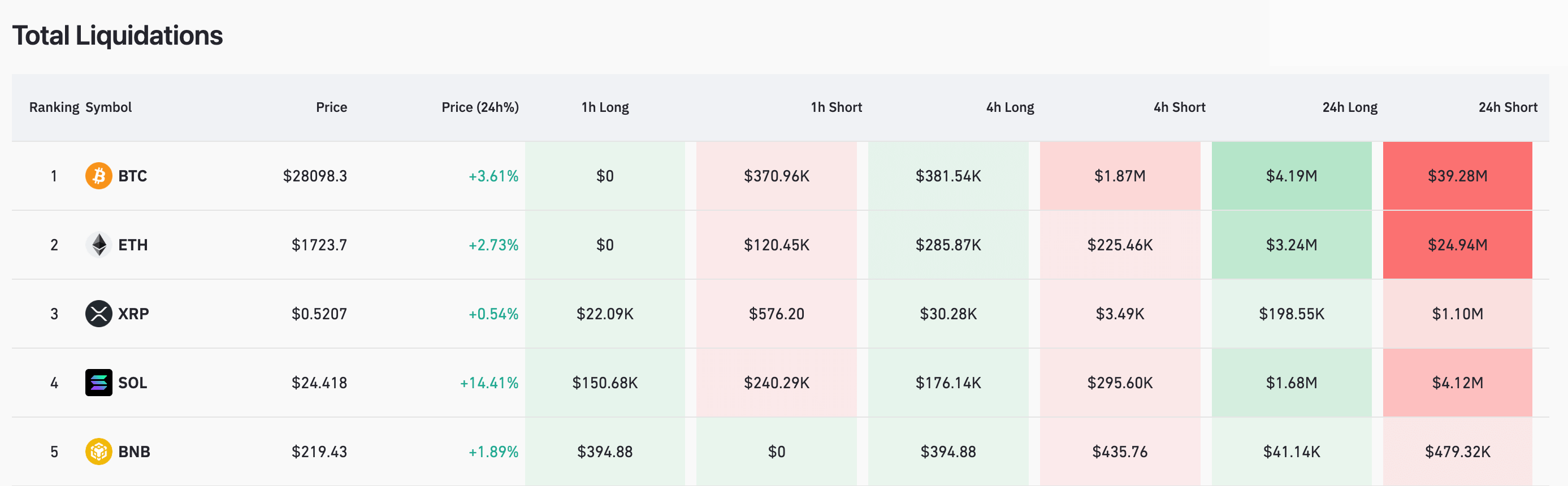

Zooming into idiosyncratic cryptocurrencies, Bitcoin was astatine the forefront of the liquidation charts. Within a specified 4-hour window, Bitcoin saw agelong liquidations amounting to $381.54K and abbreviated liquidations reaching a important $1.87M. Ethereum wasn’t acold behind, with its 24-hour shorts touching a precocious of $4.12M.

Table showing the full crypto liquidations connected Oct. 2, 2023 (Source: CoinGlass)

Table showing the full crypto liquidations connected Oct. 2, 2023 (Source: CoinGlass)Liquidations notation to the compulsory closure of a trader’s presumption erstwhile marketplace conditions determination against their speculation, eroding the collateral they’ve posted. When trading immoderate asset, including cryptocurrencies, traders tin follow 2 superior stances: ‘long’ oregon ‘short.’ In a agelong position, traders are fundamentally betting connected an upward trajectory of an asset’s price. Conversely, a abbreviated presumption is taken with the anticipation that the asset’s terms volition decline.

The mechanics of liquidation travel into play erstwhile the market’s existent question contradicts a trader’s position. For instance, if the marketplace terms rises erstwhile a trader has a abbreviated presumption oregon drops erstwhile they’re long, the presumption is liquidated to forestall further losses. This ensures the trader’s losses don’t transcend their archetypal borderline oregon collateral. The dominance of abbreviated liquidations successful the past 24 hours indicates that galore traders had stake connected Bitcoin’s terms descending, lone to beryllium amazed by its ascent to $28,000.

The surge successful Bitcoin’s terms tin beryllium attributed to respective factors. After consolidating nether $27,000 for implicit a month, Bitcoin broke the interim resistance, aiming for the $28,000 mark. The accrued volatility and humanities information suggesting bullish trends for Bitcoin successful October and November person fueled optimism. The ongoing volatility is expected to stay elevated, perchance expanding the price.

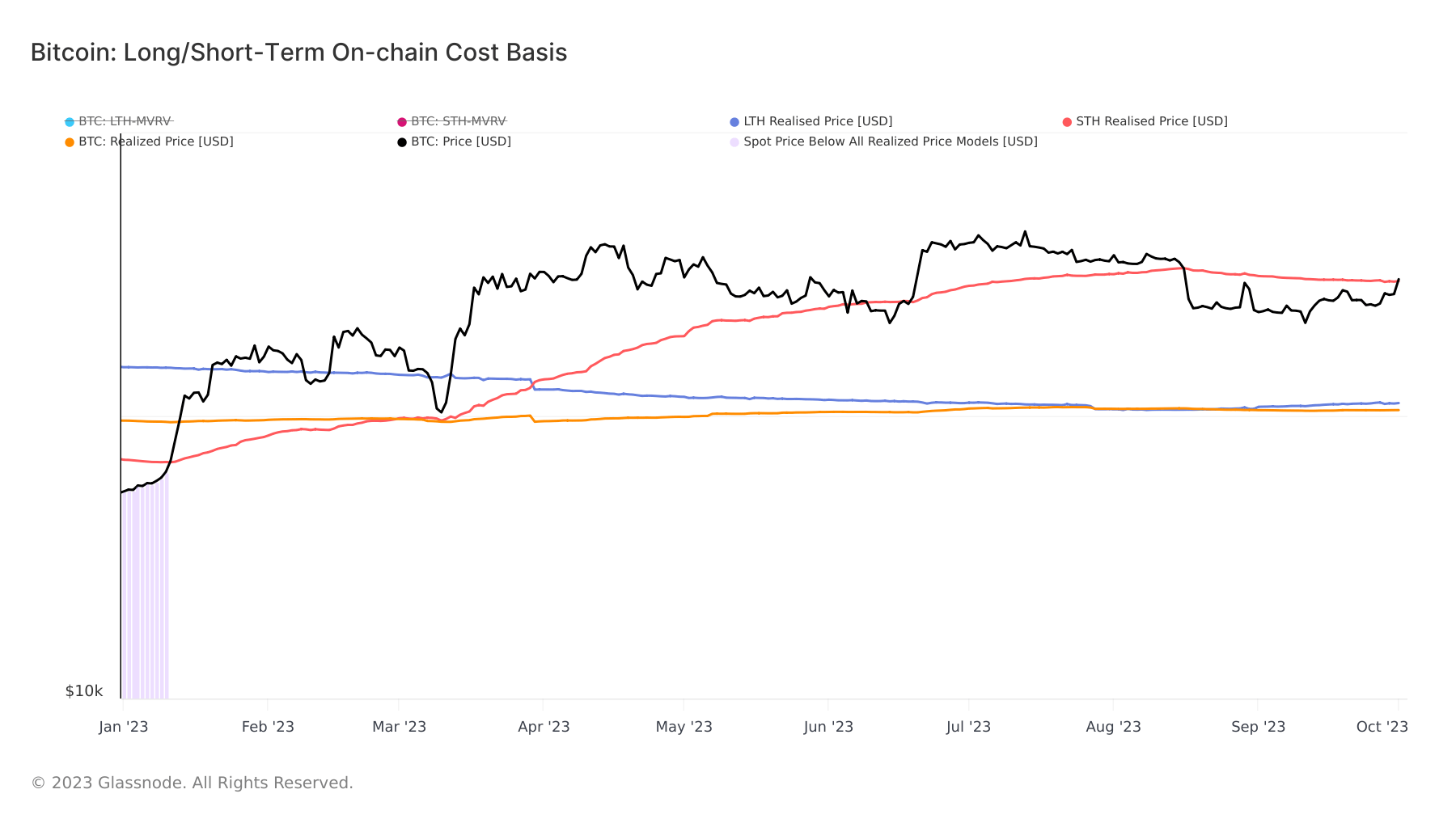

Another important metric successful this communicative is the realized price. Bitcoin has present surpassed the realized terms for short-term holders, which was pegged astatine $27,850 connected Oct. 1. When Bitcoin’s terms exceeds the short-term holder outgo basis, the likelihood of these holders selling their assets to recognize profits escalates.

Graph showing the on-chain outgo ground for semipermanent holders and short-term Bitcoin holders successful 2023 (Source: Glassnode)

Graph showing the on-chain outgo ground for semipermanent holders and short-term Bitcoin holders successful 2023 (Source: Glassnode)Data from Glassnode reinforces this, showing that the short-term holder proviso successful nett surged betwixt Oct. 30 and Oct. 1, with astir 331,450 BTC held by semipermanent holders presently successful profit.

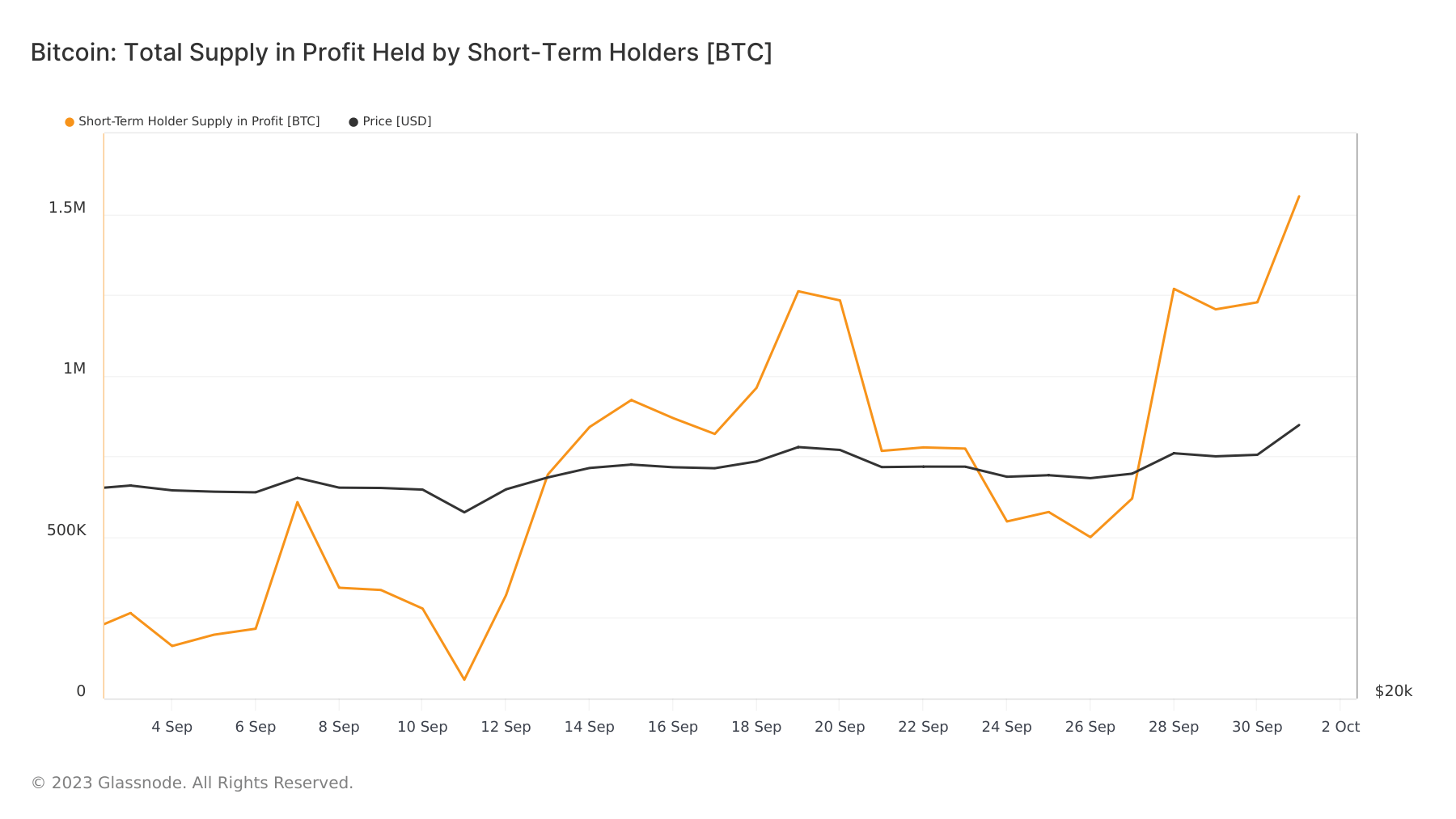

Graph showing short-term holder Bitcoin proviso successful nett from Sep. 2 to Oct. 2, 2023 (Source: Glassnode)

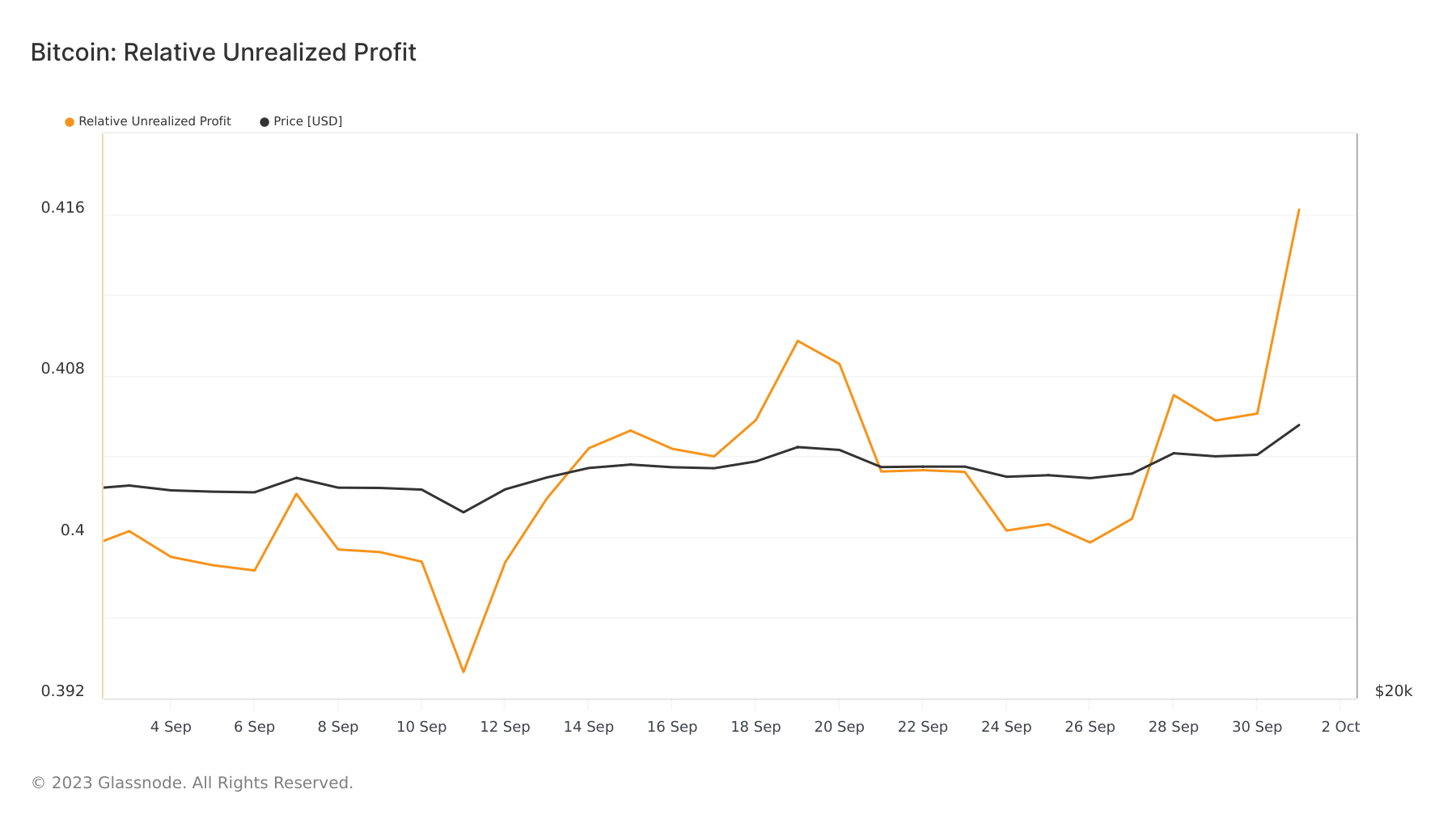

Graph showing short-term holder Bitcoin proviso successful nett from Sep. 2 to Oct. 2, 2023 (Source: Glassnode)The caller liquidations and Bitcoin’s terms question suggest a bullish momentum. The marketplace is witnessing a displacement successful sentiment, with traders becoming progressively optimistic. However, it’s important to enactment that a emergence successful unrealized profits seen successful the marketplace creates a obstruction to Bitcoin’s further growth. With an expanding fig of marketplace participants present sitting connected unrealized gains, expectations of further volatility could propulsion them to merchantability their positions, pushing prices down.

Graph showing Bitcoin’s comparative unrealized nett from Sep. 2 to Oct. 2, 2023 (Source: Glassnode)

Graph showing Bitcoin’s comparative unrealized nett from Sep. 2 to Oct. 2, 2023 (Source: Glassnode)The station Bitcoin’s surge to $28K leads to $114M successful liquidations successful 24 hours appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)