Bitcoin’s ‘supply past progressive implicit a twelvemonth ago’ is simply a barometer for semipermanent holding trends and marketplace liquidity. This metric reflects the quantity of Bitcoin that has remained dormant, without transactions oregon movements, for implicit a year. Its value lies successful revealing the propensity of investors to clasp their assets for extended periods, a behaviour that straight impacts the liquidity disposable successful the market.

A precocious fig of semipermanent holdings typically indicates a simplification successful the progressive proviso of Bitcoin for trading, thereby influencing the liquidity and, consequently, the volatility successful the market.

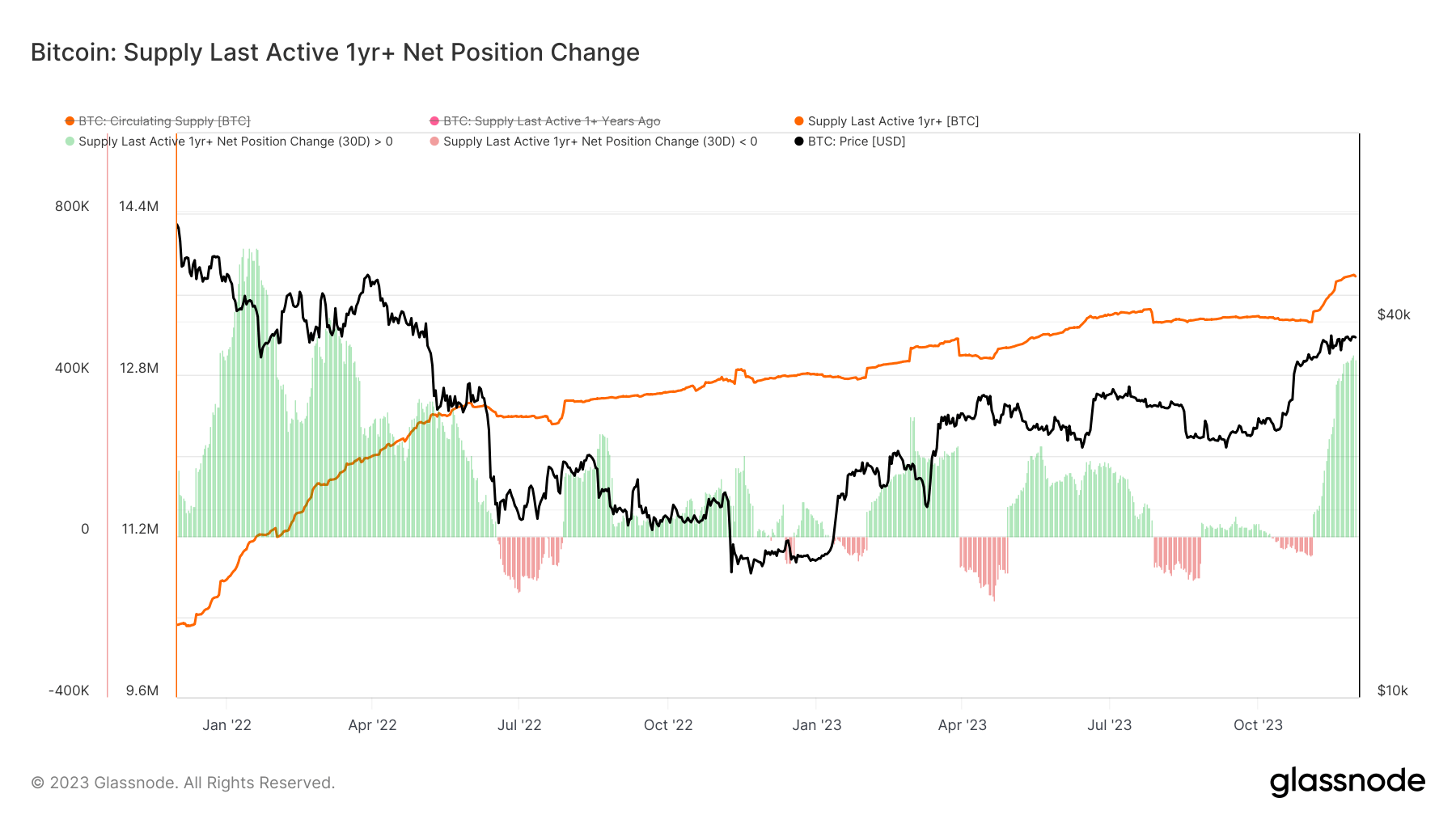

On Nov. 30, the magnitude of Bitcoin that hadn’t been moved oregon transacted for implicit a twelvemonth soared to an all-time precocious of 13.78 cardinal BTC. This milestone is not conscionable a statistical anomaly but a important indicator of the changing contours successful the Bitcoin market.

To contextualize this development, it is indispensable to see the information points implicit the year. On Nov. 9, 2022, during the illness of FTX and the consequent marketplace frenzy, the proviso past progressive implicit a twelvemonth agone was recorded astatine 12.73 cardinal BTC. This fig saw a marginal summation to 12.8 cardinal BTC by Jan. 1, 2023, arsenic traders dilatory stopped moving their coins and the marketplace cooled.

However, by Nov. 3, 2023, it had escalated to 13.32 cardinal BTC, mounting the signifier for the record-breaking fig observed astatine the extremity of November. This accordant summation underscores a increasing propensity among Bitcoin holders to follow a semipermanent concern approach.

Graph showing Bitcoin’s proviso past progressive implicit a twelvemonth agone and its nett presumption alteration from December 2021 to December 2023 (Source: Glassnode)

Graph showing Bitcoin’s proviso past progressive implicit a twelvemonth agone and its nett presumption alteration from December 2021 to December 2023 (Source: Glassnode)The accusation of this inclination is manifold. Primarily, it signals a beardown inclination among a important information of Bitcoin investors to clasp onto their assets, perchance owed to a content successful the semipermanent appreciation of Bitcoin oregon arsenic a strategy to usage Bitcoin arsenic a store of value. This inclination towards holding reduces the progressive trading supply, perchance starring to decreased liquidity successful the market. Lower liquidity, successful turn, tin effect successful accrued terms volatility, arsenic each transaction carries much value successful determining marketplace prices.

A notable facet of this inclination is the 30-day nett presumption alteration arsenic of Nov. 30, 2023, wherever an summation of +447,228 BTC to the proviso past progressive implicit a year. This was the highest 30-day alteration since May 19, 2022, which starkly contrasts with the -43,417 BTC alteration recorded connected Nov. 3, 2023. Such fluctuations item periods of capitalist indecision and varied responses to marketplace events.

Some whitethorn construe the summation successful semipermanent holding arsenic a bullish indicator, suggesting a robust content successful Bitcoin’s aboriginal contempt marketplace fluctuations. Alternatively, it could beryllium viewed arsenic a awesome of reduced involvement among short-term traders, but Bitcoin’s rising terms defies this trend.

As we look ahead, the continuous emergence successful the Bitcoin supply, past progressive implicit a twelvemonth ago, could bespeak a maturation successful the market’s attack to Bitcoin, moving distant from speculative short-term trading towards a much investment-focused mindset. This displacement could pb to a much unchangeable marketplace successful the agelong term, albeit with the trade-off of reduced liquidity and higher volatility successful the abbreviated term.

The station Bitcoin’s proviso past progressive implicit a twelvemonth agone reached ATH appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)