Monitoring the percent of Bitcoin’s proviso successful nett offers important insights into marketplace trends and imaginable movements. This metric calculates the proportionality of existing Bitcoins presently held astatine a worth higher than their acquisition price. Its value lies successful providing a snapshot of wide marketplace profitability, revealing whether astir holders are successful a authorities of summation oregon loss. Spikes successful this metric often correlate with marketplace optimism, portion drops tin bespeak expanding unit to sell, often preceding marketplace downturns.

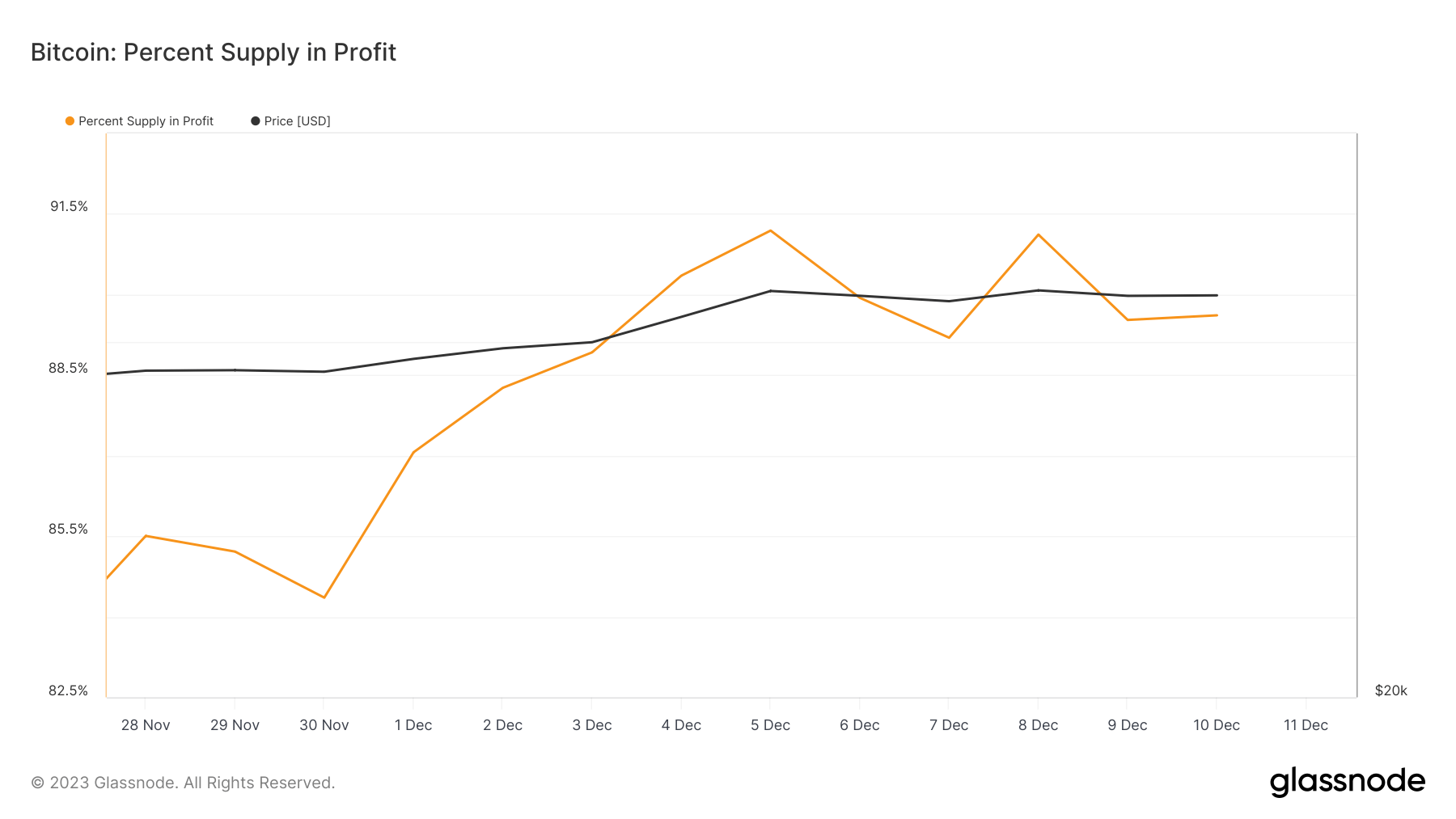

On Dec. 8, 2023, a important marketplace milestone was achieved arsenic Bitcoin’s proviso successful nett exceeded 91.1%, with its terms surging implicit $44,000. This marked a momentous signifier of marketplace prosperity unseen since aboriginal November 2021. Such a precocious percent of Bitcoin successful nett typically signals a wide bullish sentiment, arsenic astir investors clasp assets astatine a worth exceeding their archetypal investment.

However, this highest was followed by a swift correction implicit the weekend, with Bitcoin’s terms retreating beneath $42,000. This displacement resulted successful the proviso successful nett dwindling to 89.6%, illustrating a important profit-taking lawsuit successful the market. This simplification suggests that traders, perchance anticipating a much melodramatic decline, were keen to unafraid their gains. Such behaviour often indicates a marketplace poised astatine a captious juncture, with investors wary of a imaginable autumn beneath pivotal intelligence levels similar $40,000.

Graph showing the percent of Bitcoin’s proviso successful nett from Nov. 28 to Dec. 11, 2023 (Source: Glassnode)

Graph showing the percent of Bitcoin’s proviso successful nett from Nov. 28 to Dec. 11, 2023 (Source: Glassnode)While earthy information connected Bitcoin’s proviso successful nett provides contiguous insights, it tin often beryllium misleading owed to its susceptibility to regular marketplace fluctuations. To garner a much close and semipermanent perspective, analyzing the 50-day moving mean (MA) of this metric is much instructive. The 50-day MA smooths retired short-term volatility, offering a clearer representation of underlying marketplace trends. When the percent of Bitcoin’s proviso successful nett consistently hovers supra this average, it mostly reflects a bullish marketplace sentiment. Conversely, persistently debased figures beneath the MA tin hint astatine bearish trends.

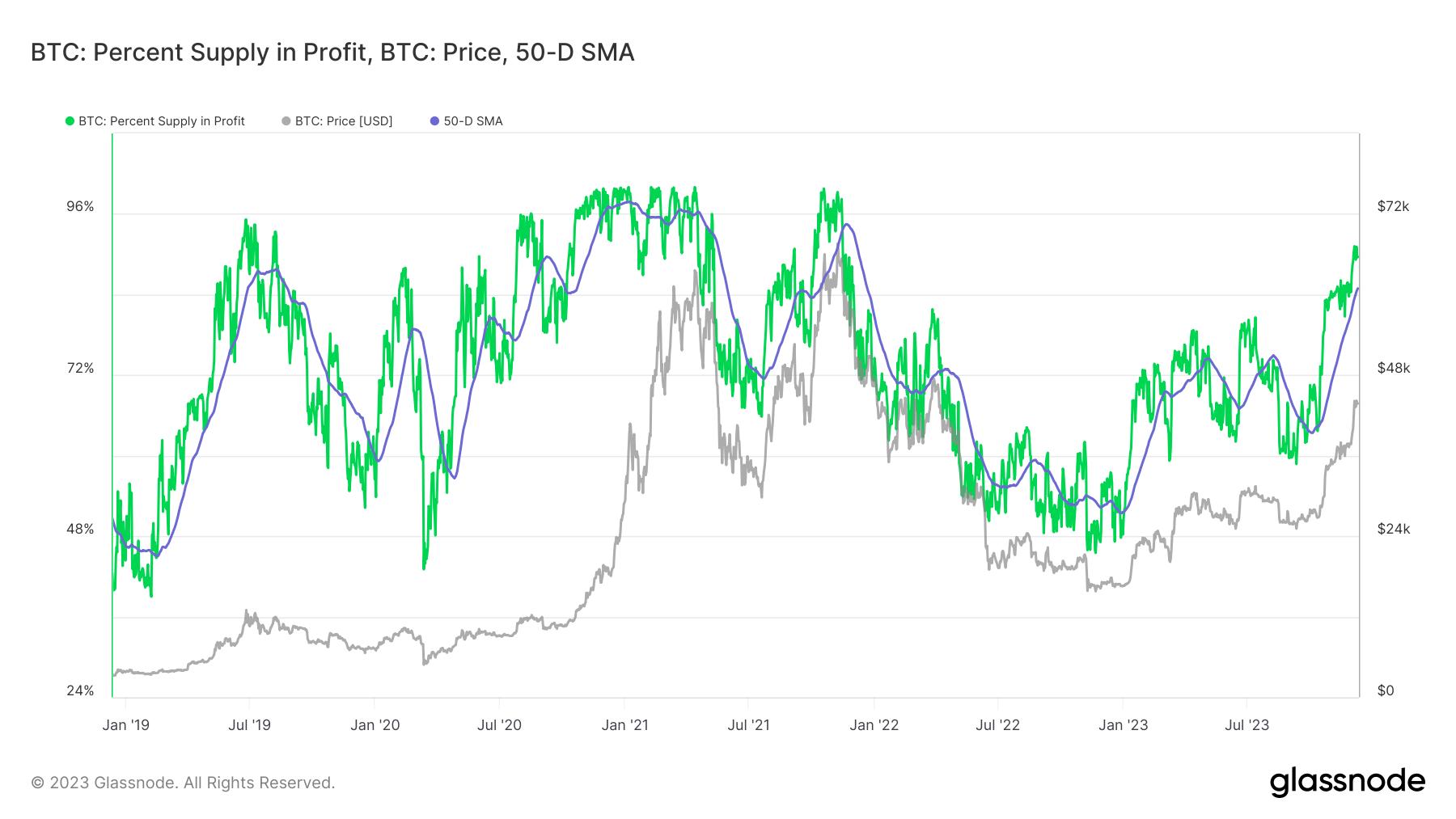

Graph showing the 50-day moving mean (MA) of the percent of Bitcoin’s proviso successful nett from December 2018 to December 2023 (Source: Glassnode)

Graph showing the 50-day moving mean (MA) of the percent of Bitcoin’s proviso successful nett from December 2018 to December 2023 (Source: Glassnode)Since aboriginal October, the 50-day MA for Bitcoin’s proviso successful nett has witnessed a marked increase. It rebounded from a debased of 63.3% successful aboriginal October to 84.91% by Dec. 11, aft a diminution from 74.9% successful aboriginal August. Notably, the proviso successful nett has remained supra its 50-day MA since Oct. 14, underscoring a sustained bullish outlook among investors.

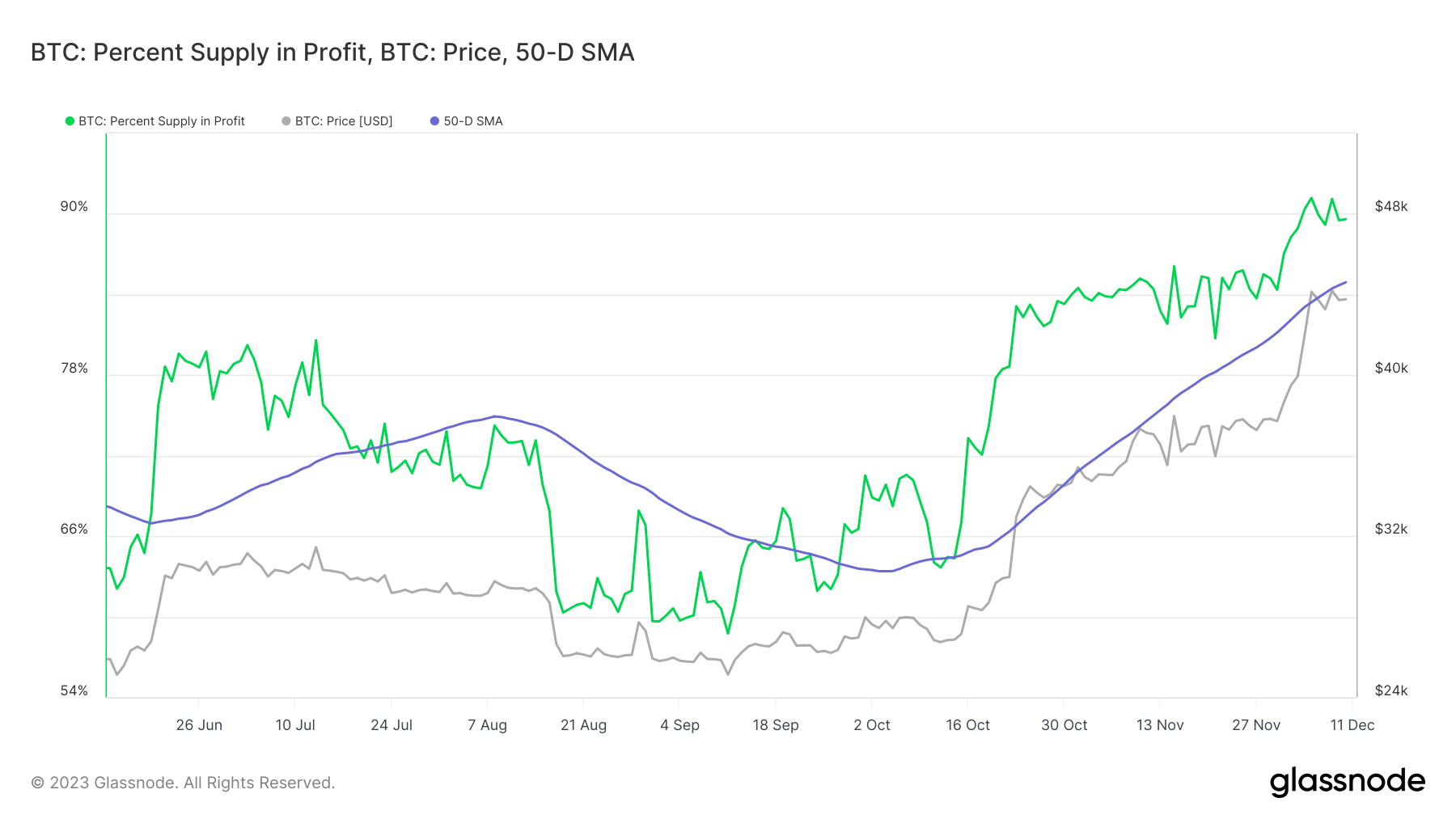

Graph showing the 50-day moving mean (MA) of the percent of Bitcoin’s proviso successful nett from June 13 to Dec. 11, 2023 (Source: Glassnode)

Graph showing the 50-day moving mean (MA) of the percent of Bitcoin’s proviso successful nett from June 13 to Dec. 11, 2023 (Source: Glassnode)This persistent elevation supra the 50-day MA is simply a beardown indicator of marketplace confidence. It suggests that the overarching sentiment remains affirmative contempt short-term corrections and volatility. Investors are seemingly unfazed by impermanent downturns, maintaining their holdings successful anticipation of aboriginal gains.

The station Bitcoin’s proviso successful nett shows bullish sentiment contempt volatility appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)