Bitcoin’s (BTC) terms concisely reclaimed $31,000 earlier contiguous earlier abruptly plunging beneath $30,000 successful a sell-off that led to losses for traders who held positions successful the market.

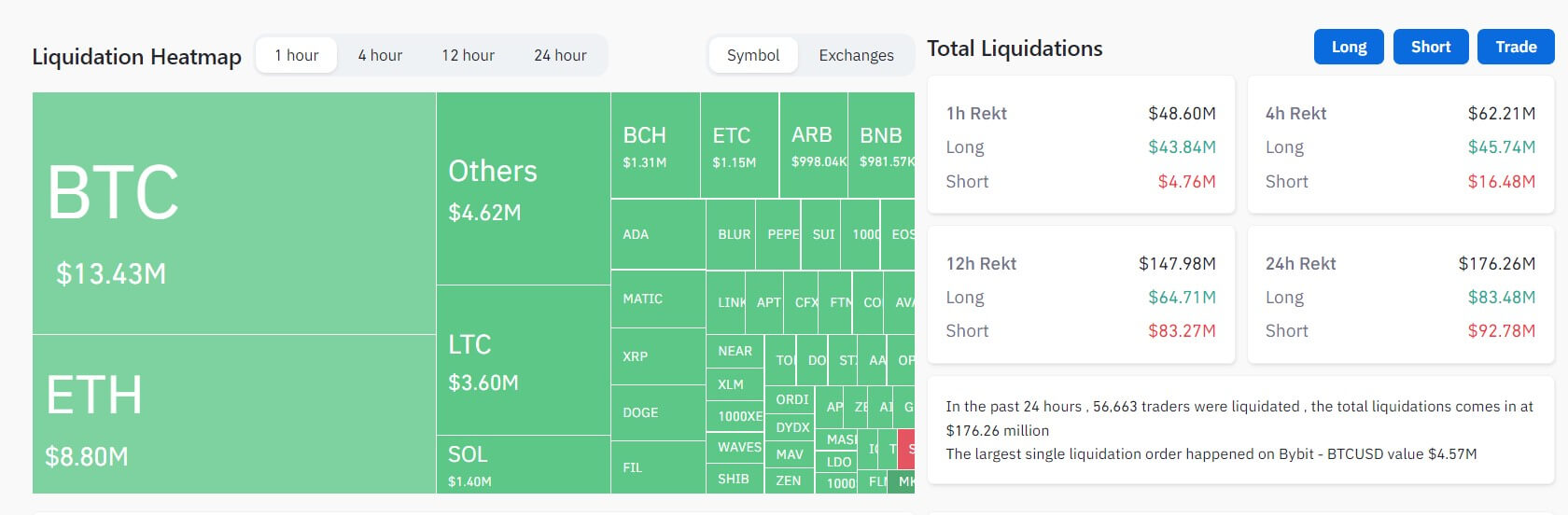

According to Coinglass data, the abrupt terms question wiped disconnected implicit $176 cardinal who held positions successful antithetic integer assets successful the past 24 hours.

Over $170 cardinal liquidated

The crypto marketplace saw $176.26 cardinal liquidated successful the past 24 hours, with much than 56,000 traders impacted by the marketplace volatility.

Data from Coinglass showed that abbreviated traders mislaid $92.78 million, with Bitcoin and Ethereum accounting for implicit $46.22 cardinal of these losses.

Source: Coinglass

Source: CoinglassMeanwhile, agelong traders experienced $83.48 cardinal successful liquidations. The apical 2 integer assets were liable for much than $35.54 cardinal of these losses.

Bitcoin Cash (BCH), which has enjoyed a surge successful worth since it was listed connected EDX Markets connected June 20, saw astir $20 cardinal successful agelong and abbreviated traders’ liquidations, portion Litecoin liquidated implicit $10 million.

Meanwhile, different assets specified arsenic Dogecoin, BNB, Chainlink, XRP, and Solana besides recorded important liquidations.

Source: Coinglass

Source: CoinglassAcross exchanges, astir of the liquidations occurred connected OKX, Binance, and ByBit. These 3 exchanges accounted for implicit 80% of the wide liquidations, with 55% being agelong positions.

The astir important liquidation occurred connected ByBit– BTCUSD, valued astatine $4.57 million.

Sudden crash

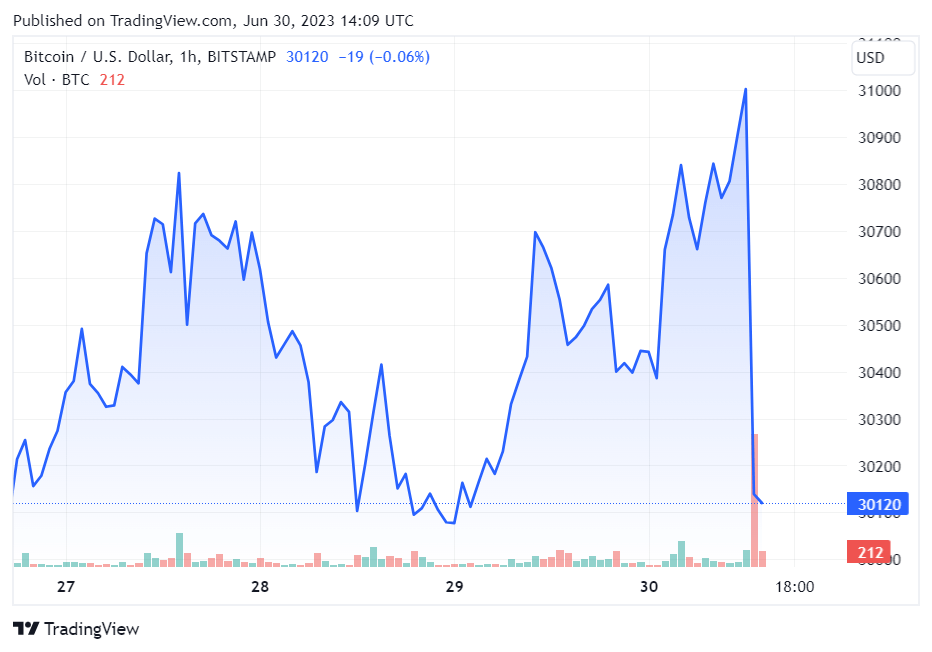

According to CryptoSlate’s data, BTC abruptly crashed by 3.53% connected the 1-hour candle to $29,946 astatine the clip of writing. This abrupt illness coincided with a Wall Street Journal article that reported shortcomings successful the spot Bitcoin ETF applications precocious filed by BlackRock and Fidelity.

Source: Tradingview

Source: TradingviewThe abrupt terms question bucks the flagship integer asset’s positive trend implicit the past month, which has seen it emergence by 15% and highest astatine implicit $31,000.

During this period, the crypto manufacture witnessed a question of organization involvement triggered by BlackRock’s June 15 Bitcoin Spot ETF application. Since then, respective accepted fiscal institutions, including Fidelity and others, person applied arsenic well.

The station Bitcoin’s abrupt plunge beneath $30k triggers $176 cardinal successful liquidations appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)