Bitcoin seems to person established coagulated enactment astatine the $37k level, demonstrated by its swift betterment pursuing a dip to $35,000 upon quality astir Binance’s SEC fine. While this rebound represents a 122% summation since the opening of the year, determination has been comparatively minimal organisation of BTC during this period.

A person introspection of the Bitcoin proviso held some by short-term and semipermanent holders shows a wide accumulation inclination crossed the board. This inclination lone seems to person accrued with Bitcoin’s spike supra $37,000, indicating a determination among each holders to bargain much BTC.

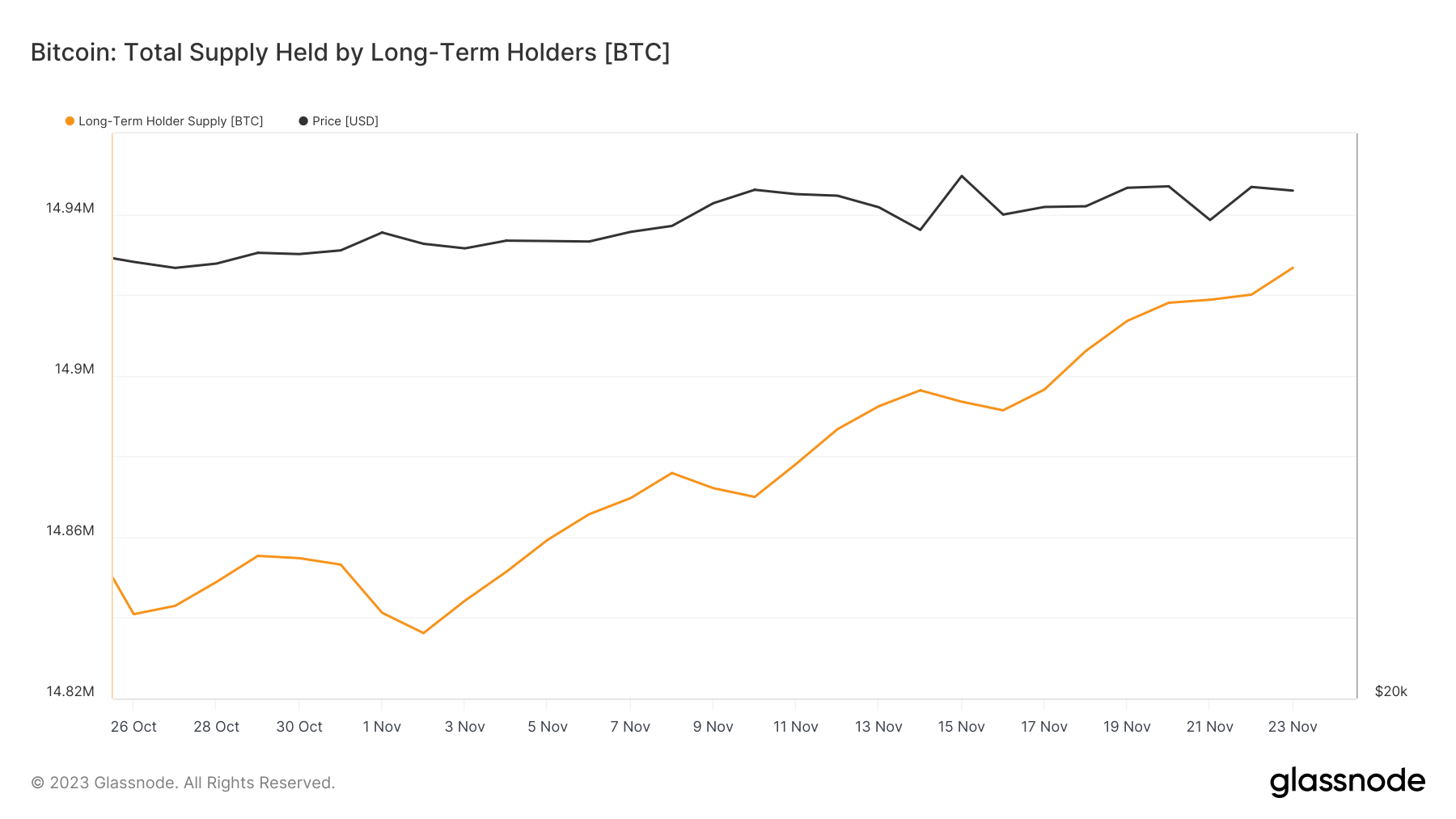

Glassnode information connected semipermanent holders has been peculiarly telling implicit the past year. This cohort, known for their endurance successful the market, has seen their holdings turn consistently, particularly arsenic Bitcoin’s terms surpassed the $37,000 mark. The summation successful semipermanent holder proviso shows beardown assurance successful Bitcoin’s aboriginal prospects among these investors.

Graph showing the semipermanent holder Bitcoin proviso from oct. 26 to Nov. 23, 2023 (Source: Glassnode)

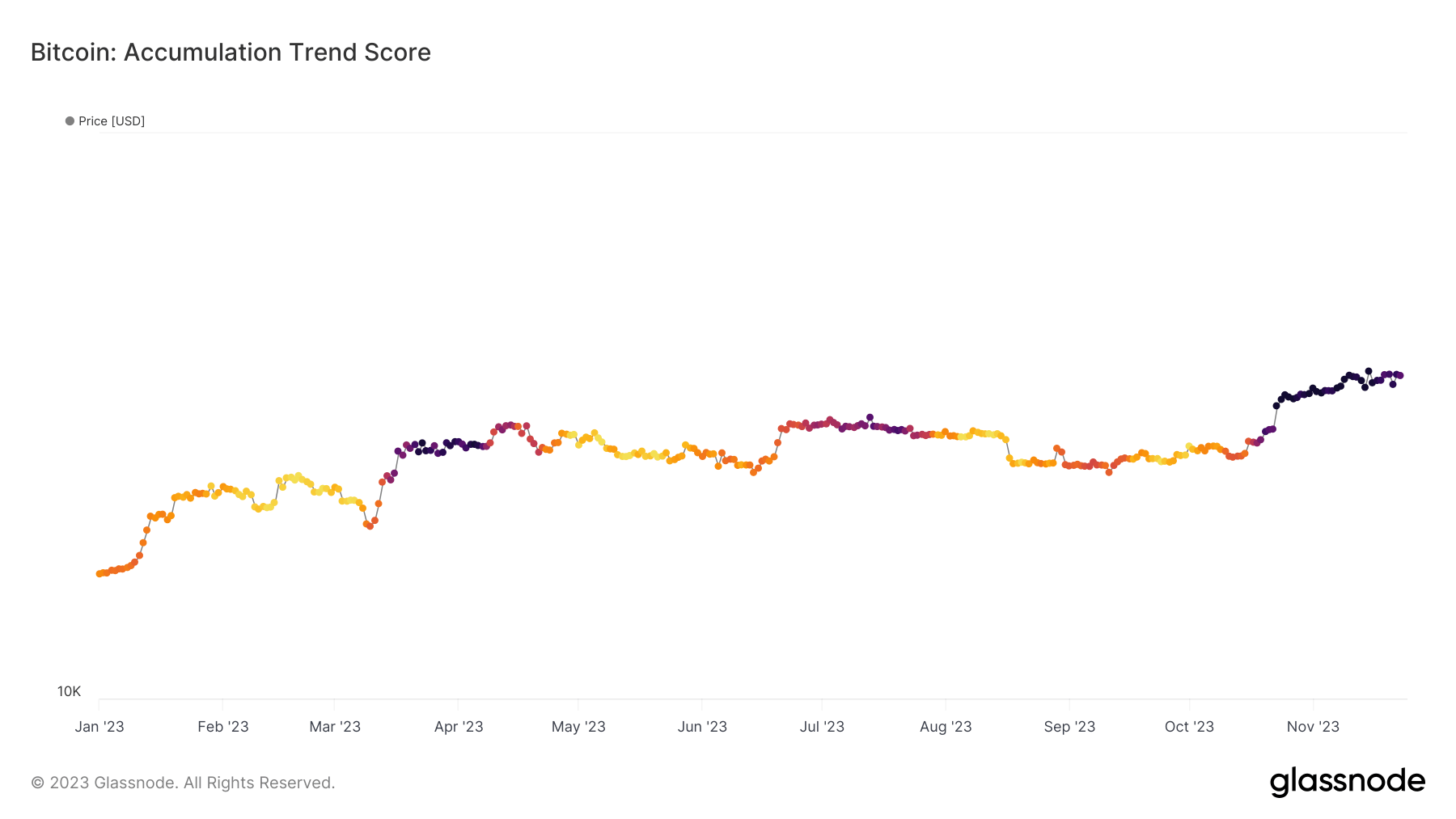

Graph showing the semipermanent holder Bitcoin proviso from oct. 26 to Nov. 23, 2023 (Source: Glassnode)The Bitcoin accumulation inclination people further supports this thesis. This metric, which gauges the grade of accumulation enactment wrong the market, has shown affirmative signs. An summation successful this people mostly indicates heightened capitalist involvement successful acquiring much Bitcoin, often a bullish awesome successful the market. In this case, the inclination score’s emergence alongside climbing prices confirms that semipermanent holders are not conscionable holding onto their assets but actively expanding their positions.

Graph showing the Bitcoin accumulation inclination people successful 2023 (Source: Glassnode)

Graph showing the Bitcoin accumulation inclination people successful 2023 (Source: Glassnode)Over the past year, determination has been a important diminution successful short-term holder supply. Apart from distribution, this could bespeak that a important portion of short-term holder proviso has transitioned into the hands of semipermanent holders, arsenic investors clasp their coins beyond the 155-day threshold that typically differentiates short-term from semipermanent supply.

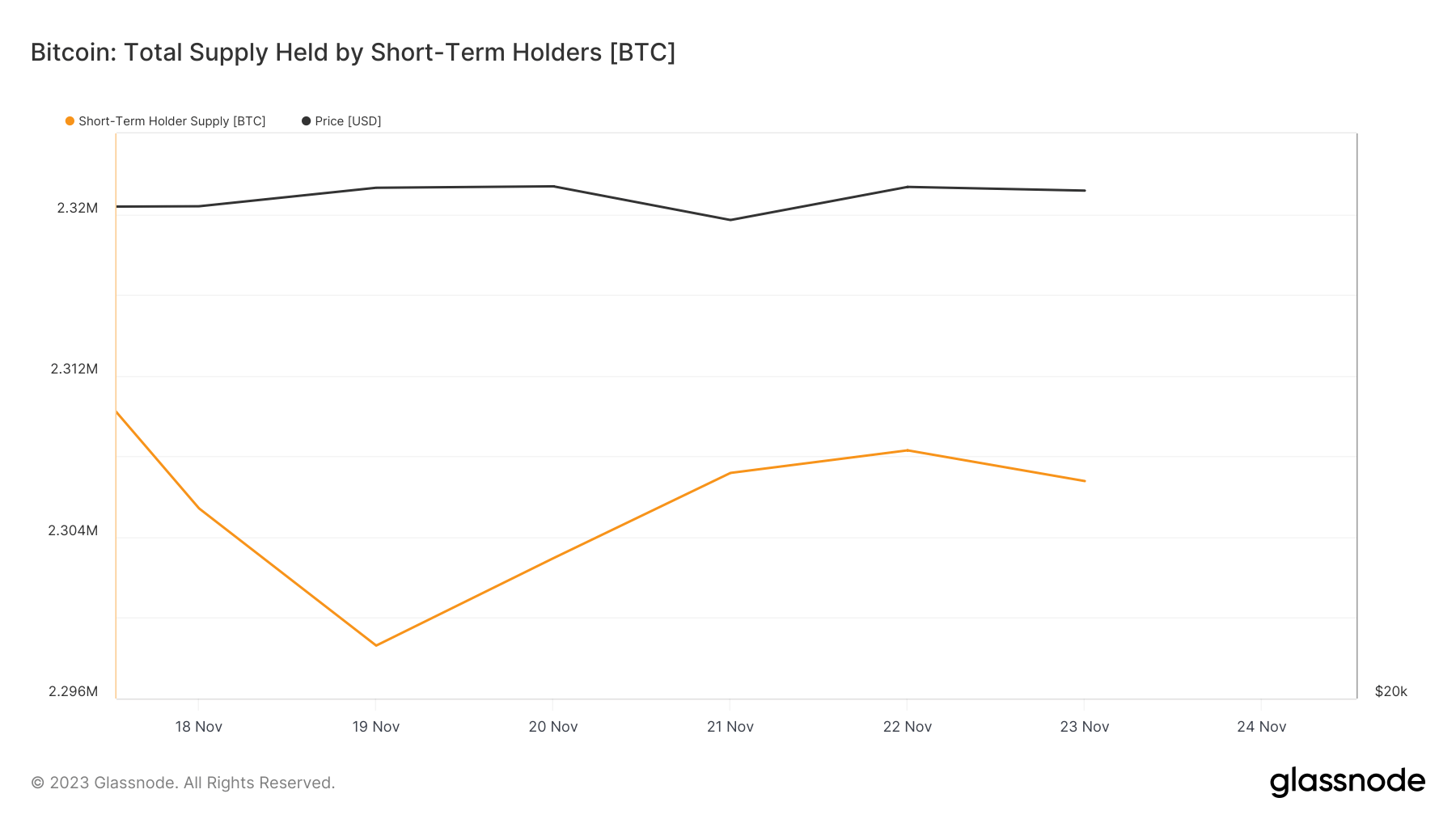

However, the past 5 days person seen an uptick successful short-term holder supply. This caller summation suggests that Bitcoin’s escalating terms has attracted caller investors, keen connected capitalizing connected its growth. Monitoring short-term holder proviso is important arsenic it often reflects the market’s contiguous absorption to terms movements and tin beryllium an aboriginal indicator of changing marketplace sentiments.

Graph showing the short-term holder Bitcoin proviso from Nov. 18 to Nov. 23, 2023 (Source: Glassnode)

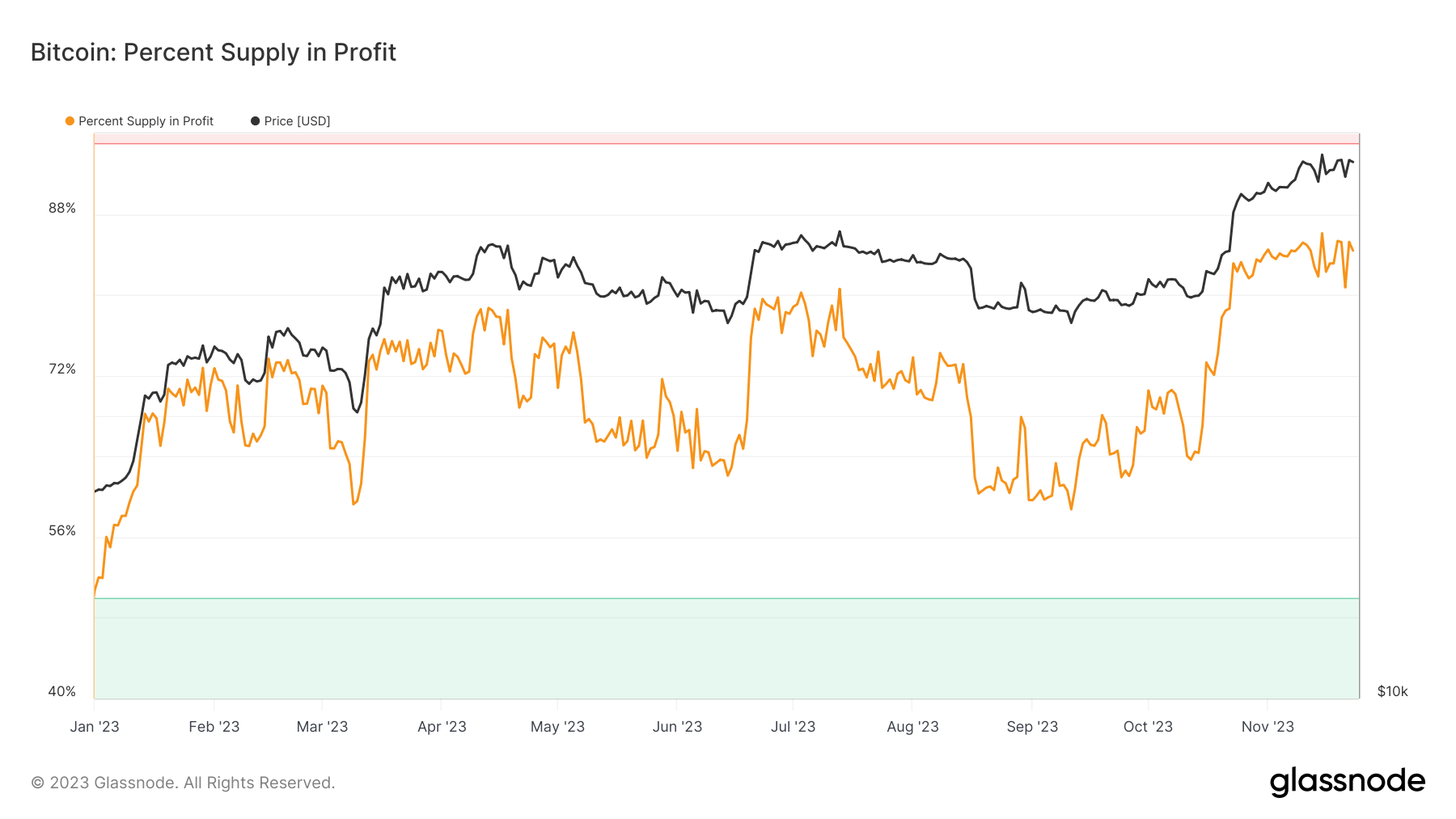

Graph showing the short-term holder Bitcoin proviso from Nov. 18 to Nov. 23, 2023 (Source: Glassnode)This accumulation has led to a important spike successful unrealized profits for Bitcoin holders. As of Nov. 23, 84.38% of Bitcoin’s proviso is successful a authorities of profit. This metric is pivotal arsenic it represents the imaginable selling unit oregon holding powerfulness wrong the market. Historically, precocious levels of unrealized profits person been precursors to bull rallies, arsenic they bespeak beardown marketplace assurance and a inclination for holders to await further terms appreciation earlier distributing their coins to recognize profits.

Graph showing the percent of Bitcoin’s proviso successful nett successful 2023 (Source: Glassnode)

Graph showing the percent of Bitcoin’s proviso successful nett successful 2023 (Source: Glassnode)The station Bitcoin’s resilience astatine $37k backed by beardown accumulation trend appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)