Realized headdress offers a unsocial position connected marketplace behavior, representing the travel of superior successful and retired of Bitcoin (BTC). The realized headdress is calculated by applying terms stamps to each Bitcoin astatine the clip of its past transaction, offering a much nuanced presumption of the marketplace worth than the accepted marketplace cap.

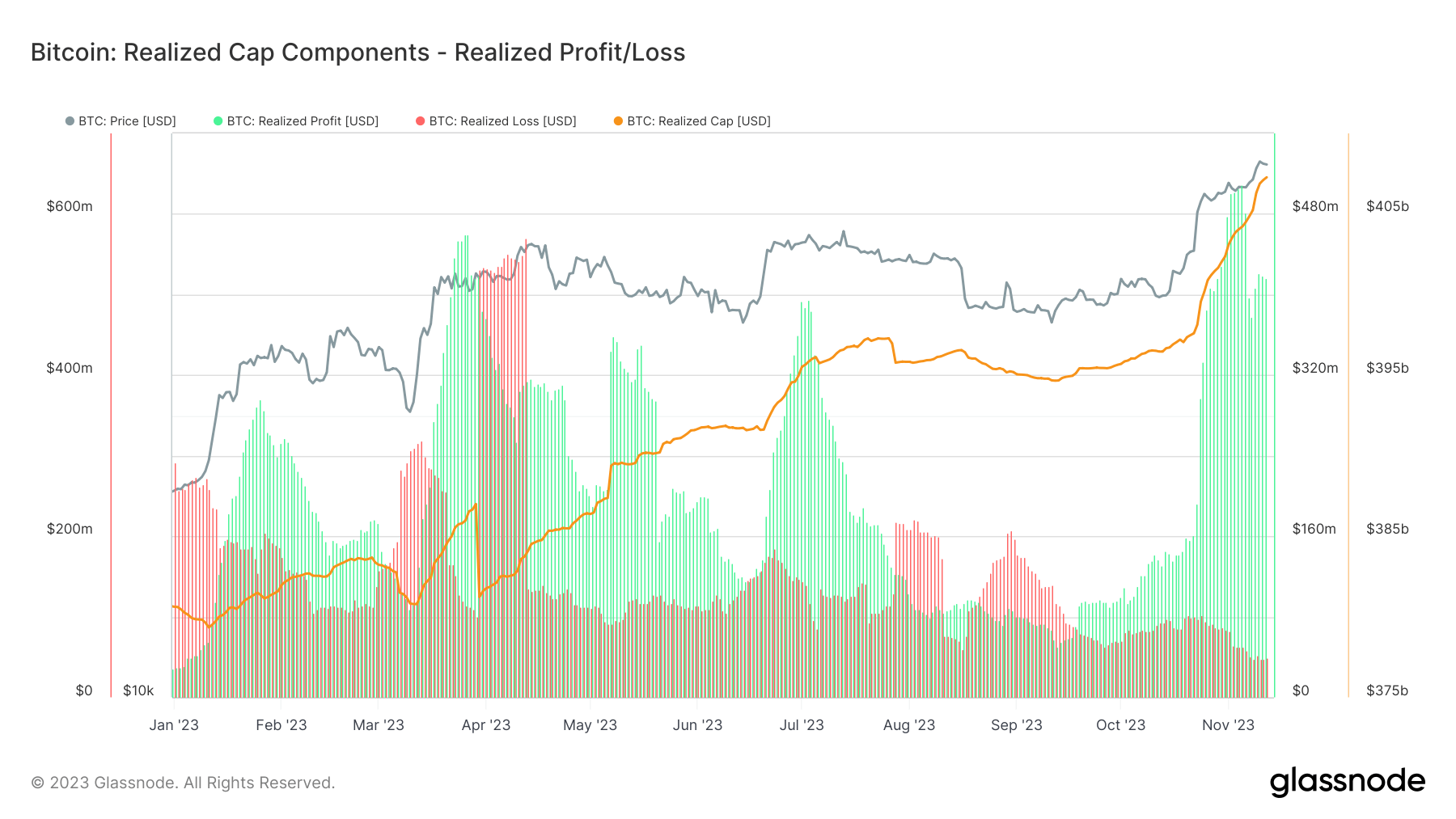

At the opening of the year, Bitcoin’s realized headdress stood astatine $380 billion, with its terms hovering conscionable nether $17,000. By Oct. 13, 2023, the realized headdress accrued to $396 billion, alongside a terms emergence to $26,800.

By Nov. 12, BTC had surged to $37,000, and the realized headdress reached $407 billion, indicating a important inflow of superior into Bitcoin.

The displacement successful realized profits and losses provides penetration into marketplace sentiment. While realized profits person been outpacing realized losses since mid-September, it wasn’t until Oct. 26 that the quality betwixt them accrued astir fivefold.

The year-to-date precocious for realized profits was recorded connected Nov.5, with Bitcoin holders taking implicit $509 cardinal successful profits. This contrasts with the mean regular realized losses, which person been declining, dropping from astir $80 cardinal successful mid-October to $49 cardinal connected Nov. 12. On the aforesaid day, realized profits stood astatine a robust $416 million.

Graph showing the realized profits, realized losses, and the realized headdress for Bitcoin successful 2023 (Source: Glassnode)

Graph showing the realized profits, realized losses, and the realized headdress for Bitcoin successful 2023 (Source: Glassnode)The summation successful realized profits indicates that investors are uncovering lucrative exit points, portion the alteration successful realized losses points to a simplification successful panic selling oregon distressed exits from the market. This inclination is further bolstered by the upcoming Bitcoin halving successful April 2024, an lawsuit historically associated with a tightening of Bitcoin proviso and consequent terms appreciation.

Assessing the disposable proviso besides provides discourse to these trends. With the short-term holder proviso astatine multi-year lows and a important information of the proviso being classified arsenic illiquid, it is evident that a important information of Bitcoin is being held for the agelong term. This displacement towards semipermanent holding, particularly among organization investors and done products similar GBTC, underscores a maturing marketplace and a increasing designation of Bitcoin arsenic a store of value.

The diminution successful realized losses and the summation successful realized profits bespeak a marketplace little prone to panic and much driven by strategical decisions. As the adjacent halving approaches, the marketplace volition apt witnesser further tightening of supply, perchance starring to accrued valuations and much profit-taking.

The station Bitcoin’s realized profits surge arsenic marketplace braces for 2024 halving appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)