The crypto marketplace offers a unsocial position connected plus valuation done the conception of realized capitalization. For Bitcoin, the realized headdress provides invaluable penetration into its economical footprint and capitalist sentiment.

Traditionally, marketplace capitalization is calculated by multiplying the existent marketplace terms of an plus by its full circulating supply. While this method offers a speedy overview of Bitcoin’s market value, it doesn’t ever contiguous an close picture. Many coins whitethorn beryllium inactive oregon lost, and a important fig could beryllium held by semipermanent investors, each contributing to a disparity betwixt the theoretical marketplace headdress and the existent economical worth successful circulation.

The realized headdress addresses this discrepancy. It values each portion of Bitcoin based connected the terms astatine which it was past transacted alternatively than the existent marketplace price. This attack offers a much granular and realistic presumption of the market’s economical health.

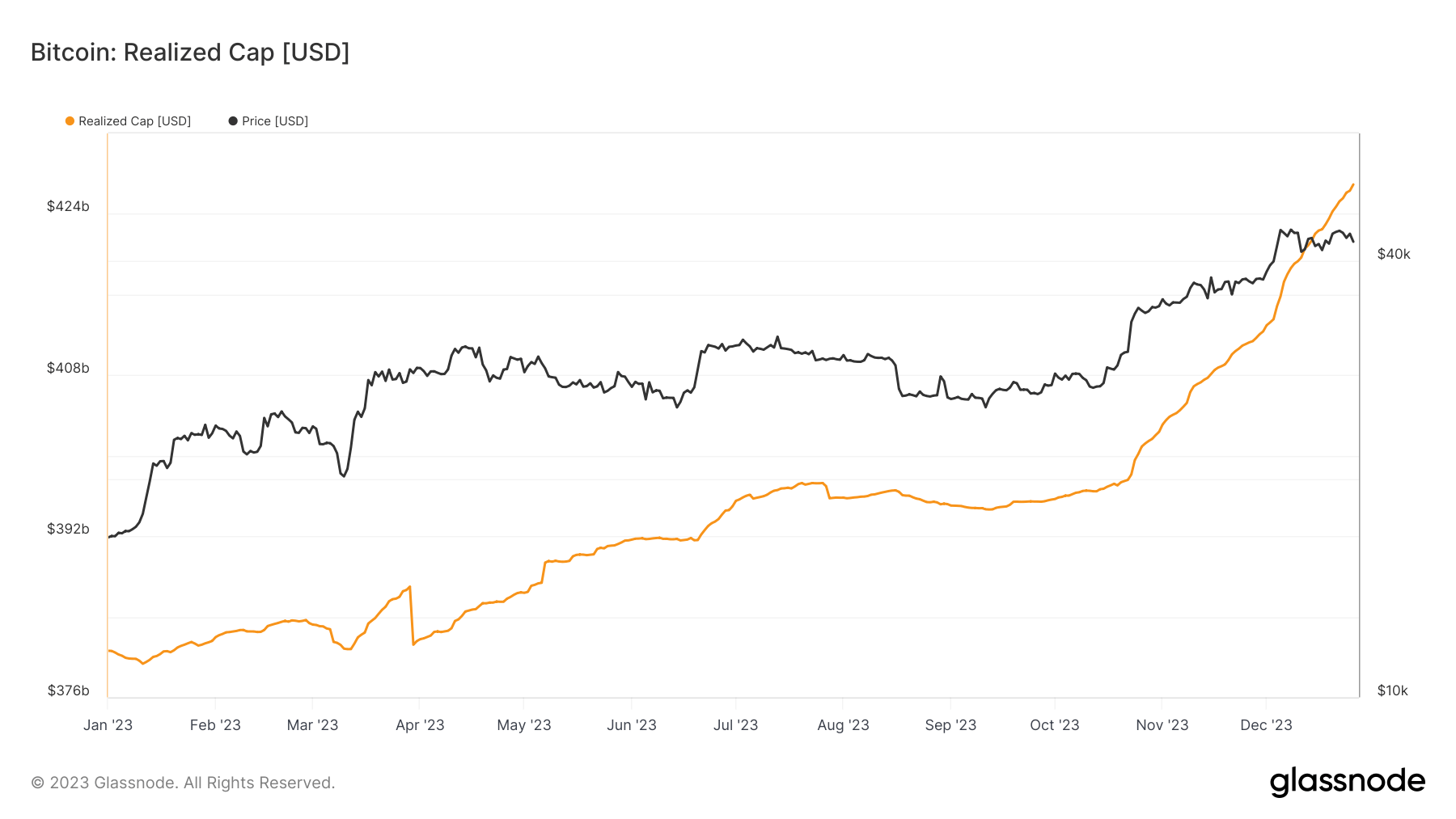

In 2023, Bitcoin’s realized headdress accrued from $380.62 cardinal astatine the opening of the twelvemonth to $426.93 cardinal connected Dec. 26, marking a important 12.15% increase.

Graph showing Bitcoin’s realized headdress successful 2023 (Source: Glassnode)

Graph showing Bitcoin’s realized headdress successful 2023 (Source: Glassnode)This upward trajectory was peculiarly evident successful the second portion of the year. Between Oct. 22, erstwhile the realized headdress was $397.59 billion, and Dec. 26, the realized headdress roseate by 7.37%. This summation aligns with a rally successful Bitcoin’s price, surpassing $30,000 and reaching yearly highs of astir $42,500.

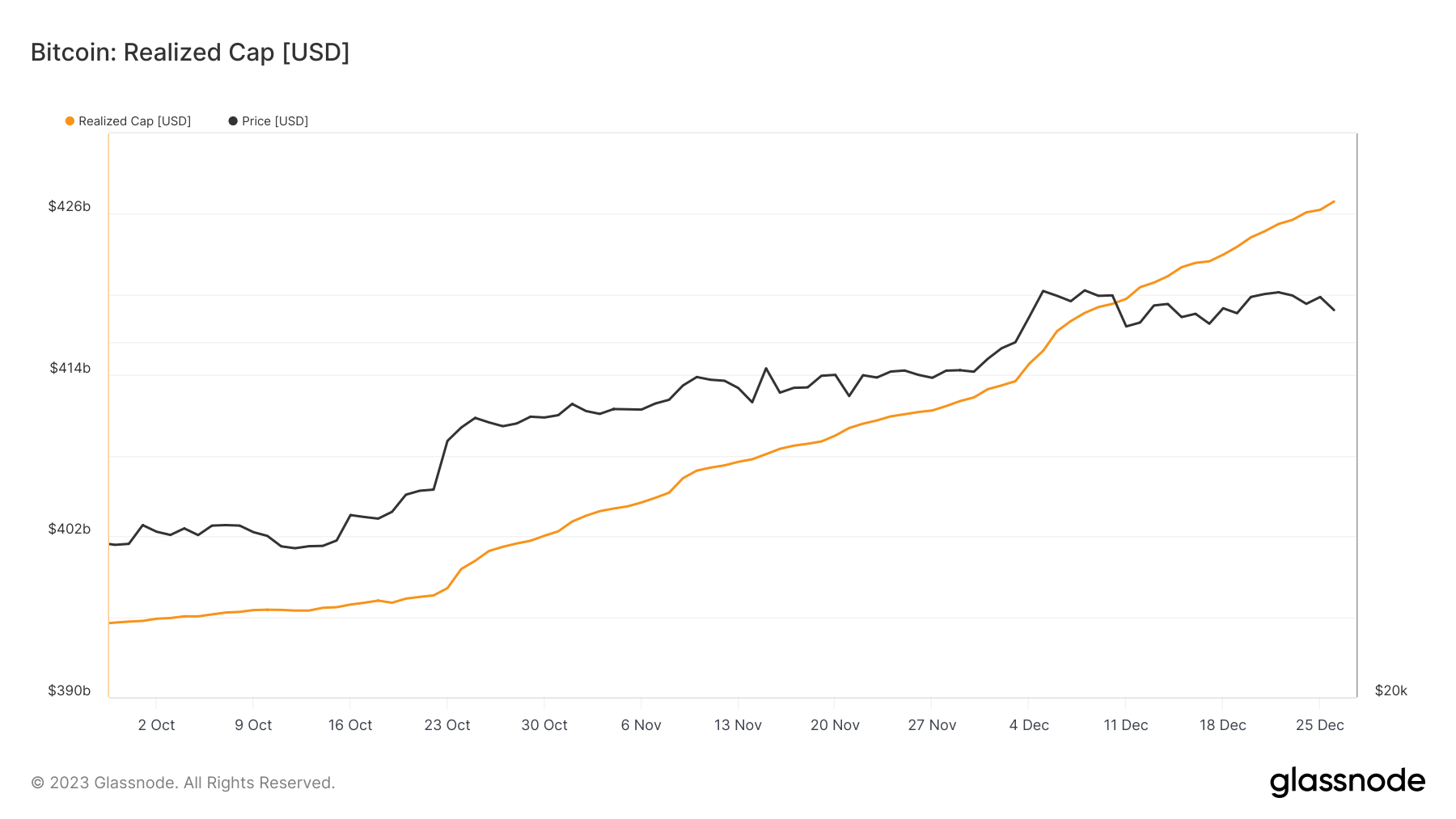

Graph showing Bitcoin’s realized headdress from Oct. 1 to Dec. 26, 2023 (Source: Glassnode)

Graph showing Bitcoin’s realized headdress from Oct. 1 to Dec. 26, 2023 (Source: Glassnode)The important summation successful Bitcoin’s terms has spurred heightened trading activity, reflected successful accrued superior inflows and dynamic shifts successful the market.

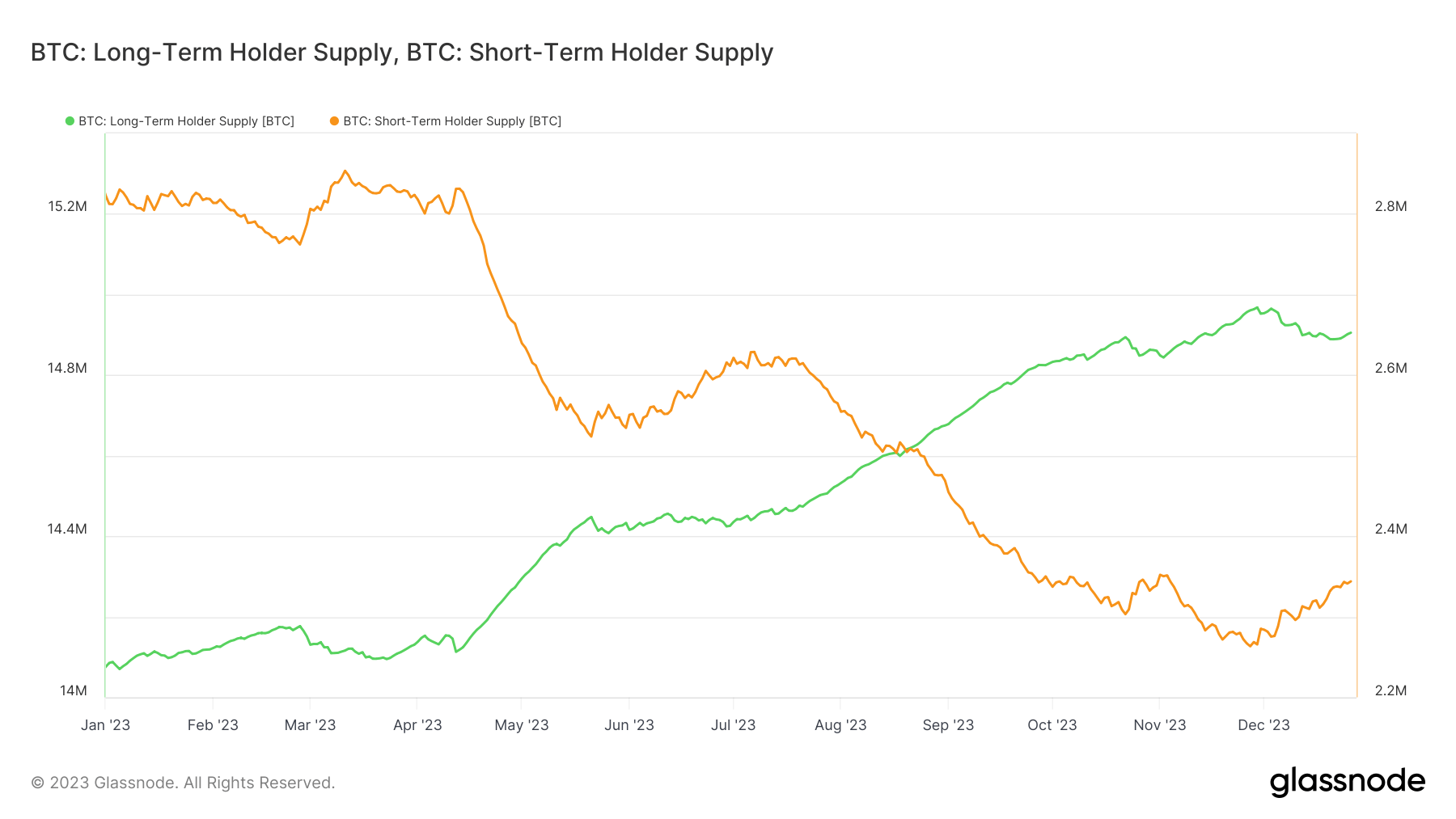

The organisation of Bitcoin holdings among short-term and semipermanent holders provides further context. A alteration successful the proviso held by short-term holders suggests a modulation towards a marketplace dominated by semipermanent investors. These individuals person held Bitcoin for implicit 155 days and are progressively contributing to the asset’s superior influx.

The emergence successful Bitcoin’s realized headdress and the changing holder creation person respective implications for the market. Primarily, the summation successful realized headdress suggests a increasing economical relevance of Bitcoin, with a much important magnitude of superior being invested implicit time. This displacement indicates a maturation of Bitcoin arsenic an concern vehicle, reflecting broader acceptance and stabilization successful the market.

Graph showing the Bitcoin proviso held by semipermanent holders (green) and short-term holders (orange) successful 2023 (Source: Glassnode)

Graph showing the Bitcoin proviso held by semipermanent holders (green) and short-term holders (orange) successful 2023 (Source: Glassnode)Furthermore, the predominance of semipermanent holders indicates a bullish sentiment among investors, signaling a content successful Bitcoin’s semipermanent worth proposition. This inclination could perchance pb to reduced marketplace volatility, arsenic semipermanent holders are little apt to merchantability successful effect to short-term terms fluctuations.

The station Bitcoin’s realized headdress shows increasing economical footprint appeared archetypal connected CryptoSlate.

1 year ago

1 year ago

English (US)

English (US)