While Bitcoin’s terms saw a important summation successful the past 2 weeks, determination was a simultaneous alteration successful the instauration of caller addresses and the transaction number connected the network.

Between Oct. 15 and Oct. 27, Bitcoin’s terms surged from $27,140 to $34,160. Historically, specified terms upticks are accompanied by heightened web activity, arsenic an influx of users engages with the network, either by generating caller addresses oregon initiating transactions. However, successful this period, the 30-day Simple Moving Average (SMA) of caller addresses and transaction number declined.

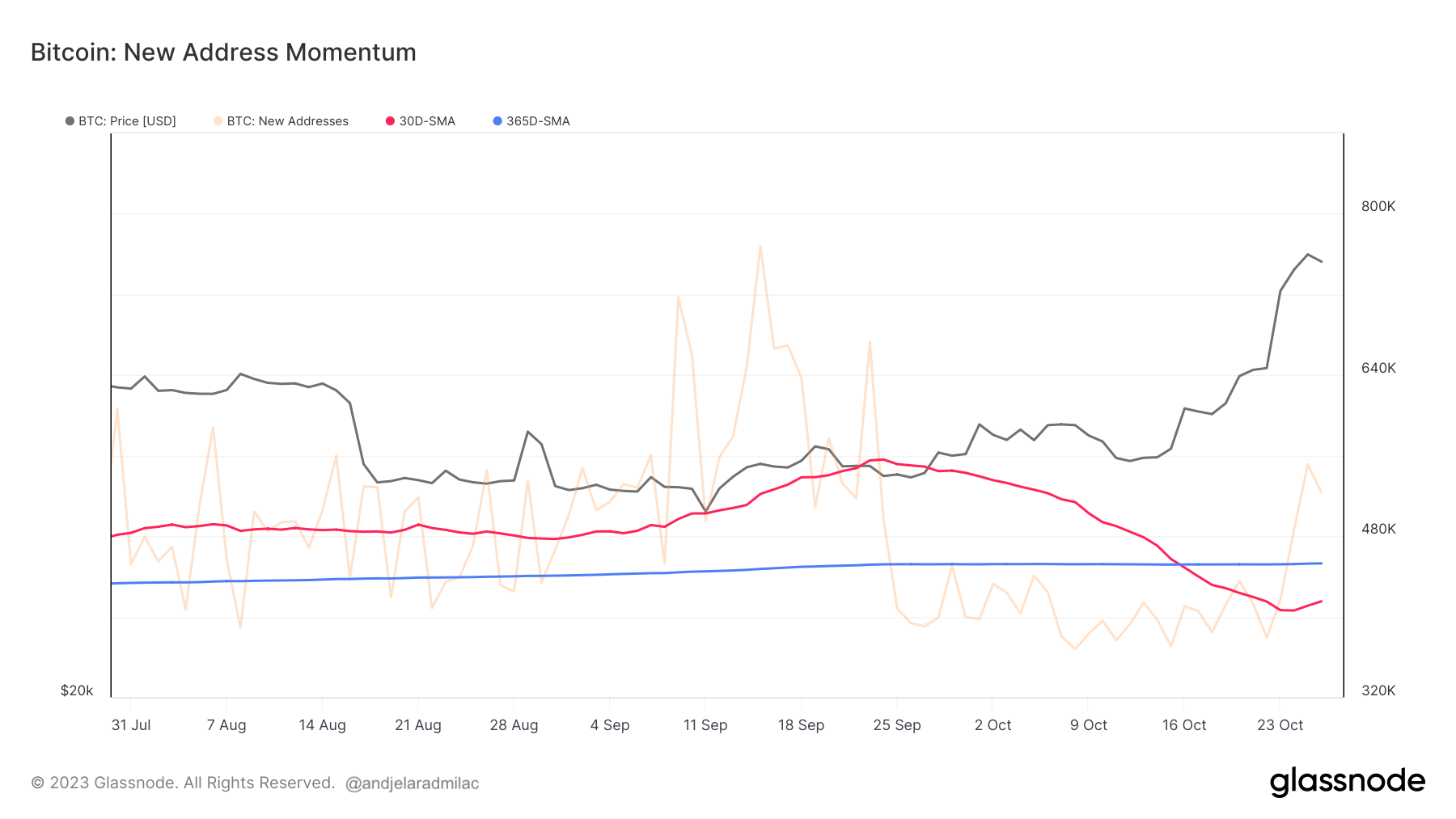

Graph showing the 30-day SMA (red) and 365-day SMA (blue) of caller addresses connected the Bitcoin web from Jul. 30 to Oct. 26, 2023 (Source: Glassnode)

Graph showing the 30-day SMA (red) and 365-day SMA (blue) of caller addresses connected the Bitcoin web from Jul. 30 to Oct. 26, 2023 (Source: Glassnode)Specifically, the 30-day SMA of caller addresses dropped from 457,371 to 415,336, and some metrics saw their 30-day SMA autumn beneath their respective 365-day Daily Moving Average (DMA), persisting successful that state.

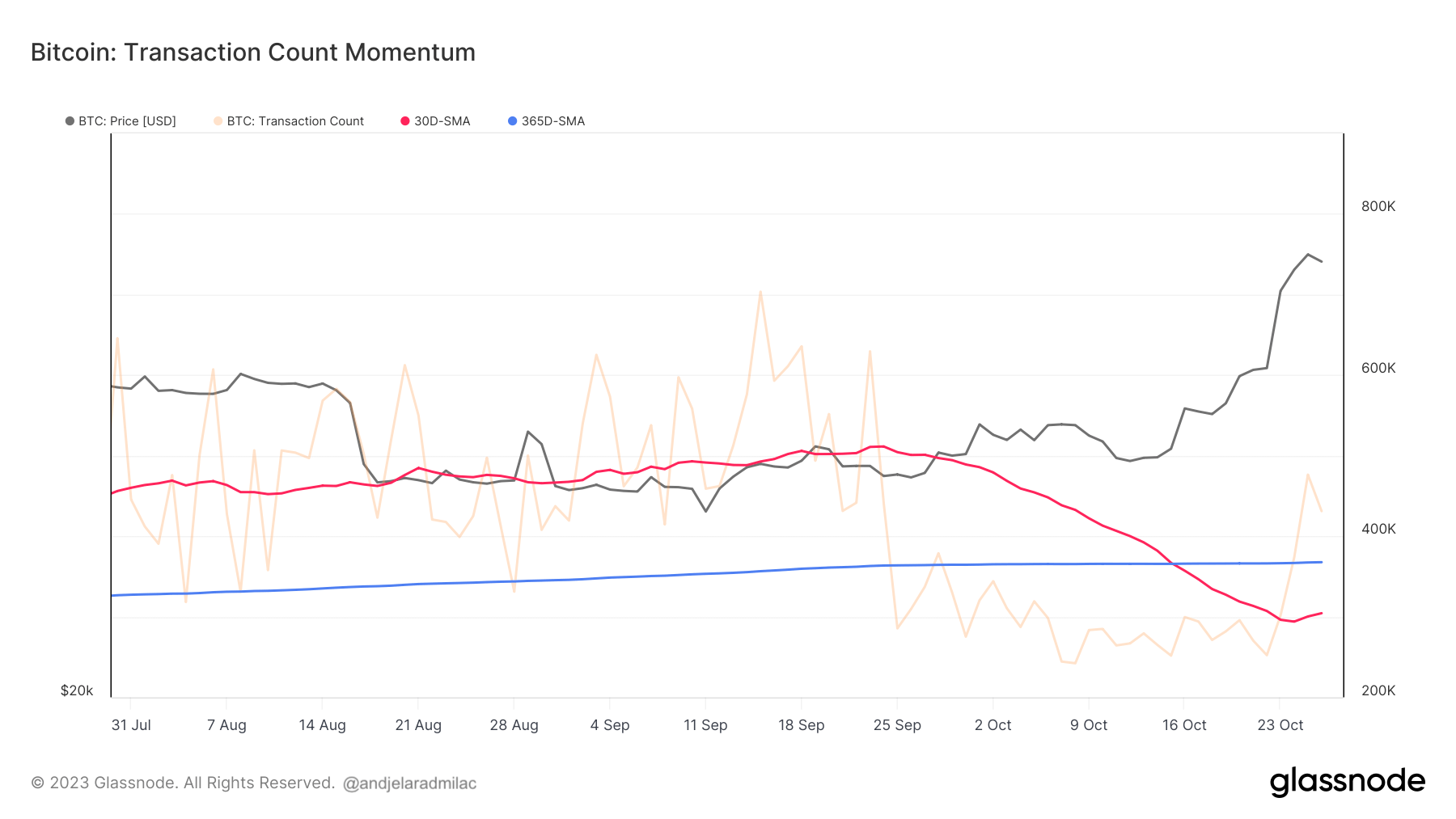

Graph showing the 30-day SMA (red) and 365-day SMA (blue) of the transaction number connected the Bitcoin web from Jul. 30 to Oct. 26, 2023 (Source: Glassnode)

Graph showing the 30-day SMA (red) and 365-day SMA (blue) of the transaction number connected the Bitcoin web from Jul. 30 to Oct. 26, 2023 (Source: Glassnode)In the crypto market, regular metrics often grounds important volatility owed to myriad factors, making them little informative erstwhile considered successful isolation. For instance, regular on-chain enactment tin beryllium influenced by events specified arsenic ample transactions by whales, speech maintenance, oregon short-term quality events. Hence, it’s much insightful to analyse moving averages to summation a clearer representation of the underlying trends. The 30-day (monthly) SMA offers a smoothed practice of a month’s worthy of data, portion the 365-day (yearly) DMA provides a broader perspective, encapsulating a twelvemonth of activity. By comparing the two, we tin place shifts successful the ascendant sentiment and infer whether web enactment is expanding oregon contracting comparative to humanities benchmarks.

The emergence successful Bitcoin’s price, juxtaposed with the dip successful on-chain metrics, suggests that the existent terms movements whitethorn not beryllium underpinned by an equivalent surge successful on-chain usage. One imaginable mentation for this discrepancy is the relation of speculative activity. The upward terms trajectory could beryllium fueled much by speculative trades connected exchanges alternatively than genuine on-chain use. Since centralized exchanges often grip trades off-chain, a spike successful trading measurement would not needfully manifest connected the blockchain.

This speculation could beryllium caused by assorted outer influences. Macroeconomic factors, regulatory developments, oregon quality successful the broader crypto ecosystem mightiness thrust the price, autarkic of Bitcoin’s on-chain metrics. This dynamic suggests that Bitcoin’s worth is influenced by a broader acceptable of factors beyond its web activity.

Additionally, the reduced on-chain enactment mightiness bespeak a behavioral displacement among Bitcoin users. Existing users mightiness beryllium retaining their Bitcoin, hodling successful anticipation of aboriginal appreciation. This signifies a long-term belief successful Bitcoin’s worth proposition and an evolving position connected its relation successful portfolios.

Lastly, technological developments could besides beryllium contributing to the observed trend. The proliferation of second-layer solutions oregon sidechains, similar the Lightning Network, could effect successful less on-chain transactions. These platforms alteration transaction aggregation off-chain, reflecting a displacement successful however transactions are conducted but not needfully a simplification successful wide Bitcoin activity.

The station Bitcoin’s terms surge not reflected by on-chain activity appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)