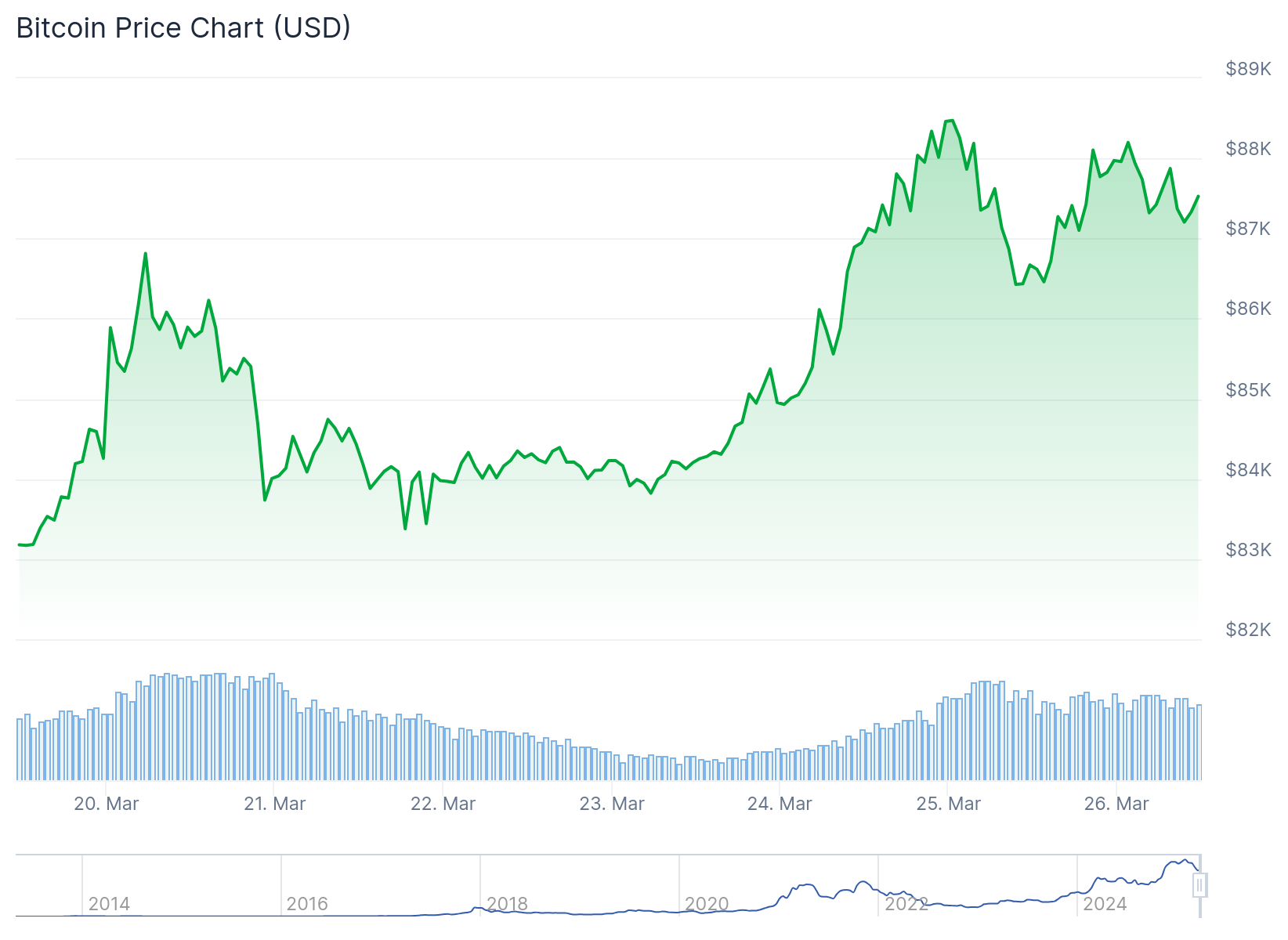

Bitcoin's (BTC) betterment looks to person tally retired of steam with an emergence of a treble apical bearish reversal signifier connected the abbreviated duration terms charts.

BTC peaked adjacent $87,400 past week, with prices pulling backmost to astir $84,000 connected Friday and staging a betterment to supra $87,000 earlier stalling again. This series of 2 salient peaks astatine astir the aforesaid level, separated by a trough, hints astatine a classical treble apical formation. This bearish signifier often signals the extremity of an uptrend.

The treble apical signifier typically requires confirmation done a decisive driblet beneath the "neckline," the enactment level betwixt the 2 peaks, which lies astatine astir $86,000.

Should this occur, BTC could diminution toward $75,000 oregon little successful the abbreviated term. However, semipermanent charts proceed to bespeak the plus remains successful an ascending range.

Traders reacted positively to the U.S. Federal Reserve’s dovish stance connected ostentation and a cooldown successful concerns astir the upcoming U.S. tariffs, which person supported gains successful the past week.

However, the deficiency of altcoin correlation with BTC’s caller moves hints that the existent terms enactment mightiness deficiency wide marketplace support, raising the anticipation of a “fakeout” rally.

A imaginable driblet successful BTC volition apt dispersed implicit to large tokens, denting caller gains and hopes of a lasting rally. Dogecoin (DOGE), heavy influenced by marketplace sentiment and speculative trading, could spot amplified losses if bitcoin’s bearish signifier plays out, portion XRP mightiness spot reduced momentum, particularly fixed its sensitivity to marketplace sentiment and regulatory developments.

Solana could beryllium peculiarly delicate owed to its caller volatility and method indicators — with it coming adjacent to forming a “death cross” (a bearish awesome wherever the 50-day moving mean crosses beneath the 200-day) successful mid-April, a signifier that historically leads to deeper losses.

For now, bitcoin hovers successful a captious zone. A play adjacent beneath $84,000 could corroborate the bearish treble apical scenario, portion a propulsion supra $87,500 mightiness invalidate it, perchance reigniting bullish momentum.

5 months ago

5 months ago

English (US)

English (US)