Key takeaways:

Over $313 cardinal successful Bitcoin bearish positions were liquidated, signaling conditions for a abbreviated squeeze.

Gold’s momentum highlights investors’ hunt for alternatives arsenic involvement complaint chopped expectations summation traction.

Bitcoin (BTC) flirted with the $121,000 level connected Thursday, marking its highest constituent successful 7 weeks. Bulls stay confident, noting that existent conditions are acold stronger than they were successful mid-August erstwhile BTC concisely touched $124,000.

Beyond easing recession fears and gold’s supportive momentum, Bitcoin derivatives suggest traders were caught disconnected guard, a setup that often creates the conditions for a abbreviated squeeze.

In contrast, golden had stalled adjacent $3,400 for astir 2 months anterior to mid-August, erstwhile Bitcoin surged to its grounds high. At the time, planetary commercialized tensions were intensifying arsenic the impermanent 90-day China import tariff simplification by the United States expired connected Aug. 12, fueling expectations of looming inflationary pressure.

Reduced ostentation risks and golden returns favour Bitcoin gains

The astir caller US Personal Consumption Expenditures Price Index, released Friday, showed a 2.9% summation from August, successful enactment with expert forecasts. With ostentation nary longer viewed arsenic a pressing concern, traders gained assurance that the US Federal Reserve (Fed) would support its people toward further involvement complaint cuts.

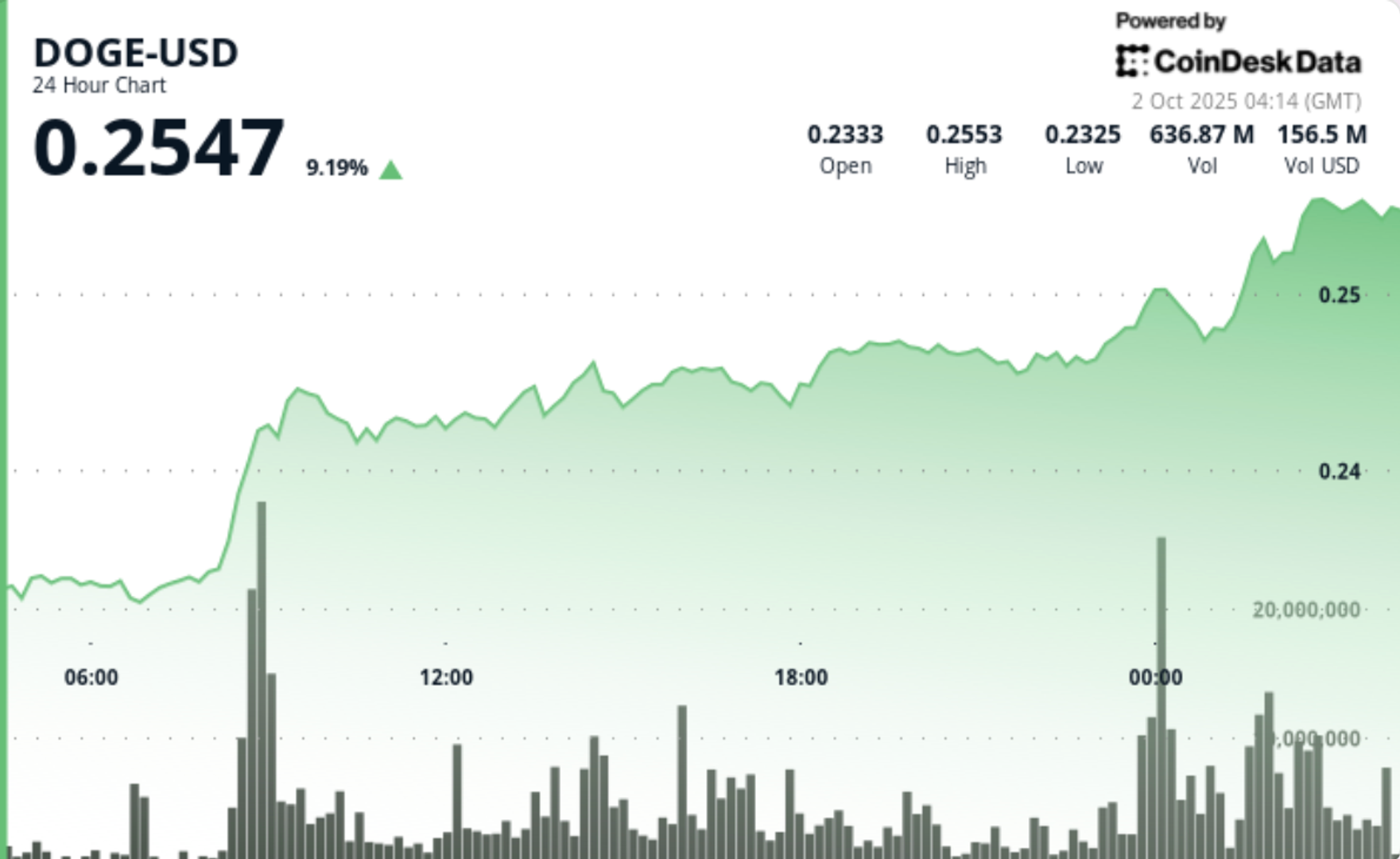

Traders who bought Bitcoin supra $120,000 successful August ended up disappointed, arsenic import tariffs failed to negatively impact the US commercialized equilibrium oregon retail sales, astatine slightest successful the abbreviated term. Bitcoin’s October beforehand has coincided with a 16% rally successful golden prices implicit six weeks, portion World Gold Council data points to dependable accumulation by cardinal banks.

According to the CME FedWatch tool, the implied probability of the US Federal Reserve lowering rates to 3.50% oregon beneath by January 2024 present stands astatine 40%, compared with 18% successful mid-August. Investors whitethorn invited inflation’s existent trajectory, but ongoing labour marketplace weakness could situation the caller S&P 500 all-time high, peculiarly amid uncertainty tied to the US authorities shutdown.

On Monday, US Federal Reserve Vice Chair Philip Jefferson voiced interest implicit the labour market, informing that it “could acquisition stress” if near unsupported. Jefferson attributed the unit to US President Donald Trump’s trade, immigration, and different policies, according to Reuters. He added that these effects “will further amusement successful coming months,” prompting traders to look for alternate hedge instruments.

Bitcoin derivatives and reduced AI assemblage concerns trim merchantability pressure

In the 3 days starring to Bitcoin’s all-time precocious successful mid-August, traders were pricing astir adjacent likelihood of upward and downward terms moves, according to derivatives data. Today, however, the aforesaid BTC options indicator signals a mean fearfulness of correction, with enactment (sell) options trading astatine a premium compared with telephone (buy) options.

More than $313 cardinal successful leveraged abbreviated (sell) Bitcoin futures positions were liquidated betwixt Wednesday and Thursday, according to CoinGlass data. This further confirms that the rally supra $120,000 caught markets by surprise, reducing the likelihood of dense profit-taking successful futures markets if bullish momentum holds.

Related: Bitcoin connected TV: How shows similar South Park power crypto

Another origin easing short-term risks was OpenAI’s palmy stock merchantability astatine a grounds $500 cardinal valuation. The artificial quality assemblage had been facing heightened scrutiny pursuing US export restrictions connected precocious AI chips to China and Meta’s determination to frost hiring successful its AI division.

With investors showing stronger condemnation successful coming involvement complaint cuts successful the US and perceiving little hazard of a banal marketplace correction, Bitcoin’s way toward $125,000 and higher appears progressively plausible. Meanwhile, gold’s dependable momentum highlights traders’ increasing penchant for alternatives to accepted enslaved and equity markets.

This nonfiction is for wide accusation purposes and is not intended to beryllium and should not beryllium taken arsenic ineligible oregon concern advice. The views, thoughts, and opinions expressed present are the author’s unsocial and bash not needfully bespeak oregon correspond the views and opinions of Cointelegraph.

2 hours ago

2 hours ago

English (US)

English (US)