Bitcoin’s proviso past progressive little than a period agone has plummeted to an 8-year low. This often overlooked metric provides indispensable insights into the market’s existent dynamics and is utile erstwhile analyzing humanities trends.

Bitcoin’s proviso dynamics are adjuvant erstwhile analyzing the market, arsenic they supply a model into the trading behaviour of its immense idiosyncratic base. Bitcoin’s proviso past progressive little than a period agone has historically been the astir volatile portion of its supply, representing the bulk of day-to-day transaction activity. Its movement, oregon deficiency thereof, tin beryllium an indicator of broader marketplace trends.

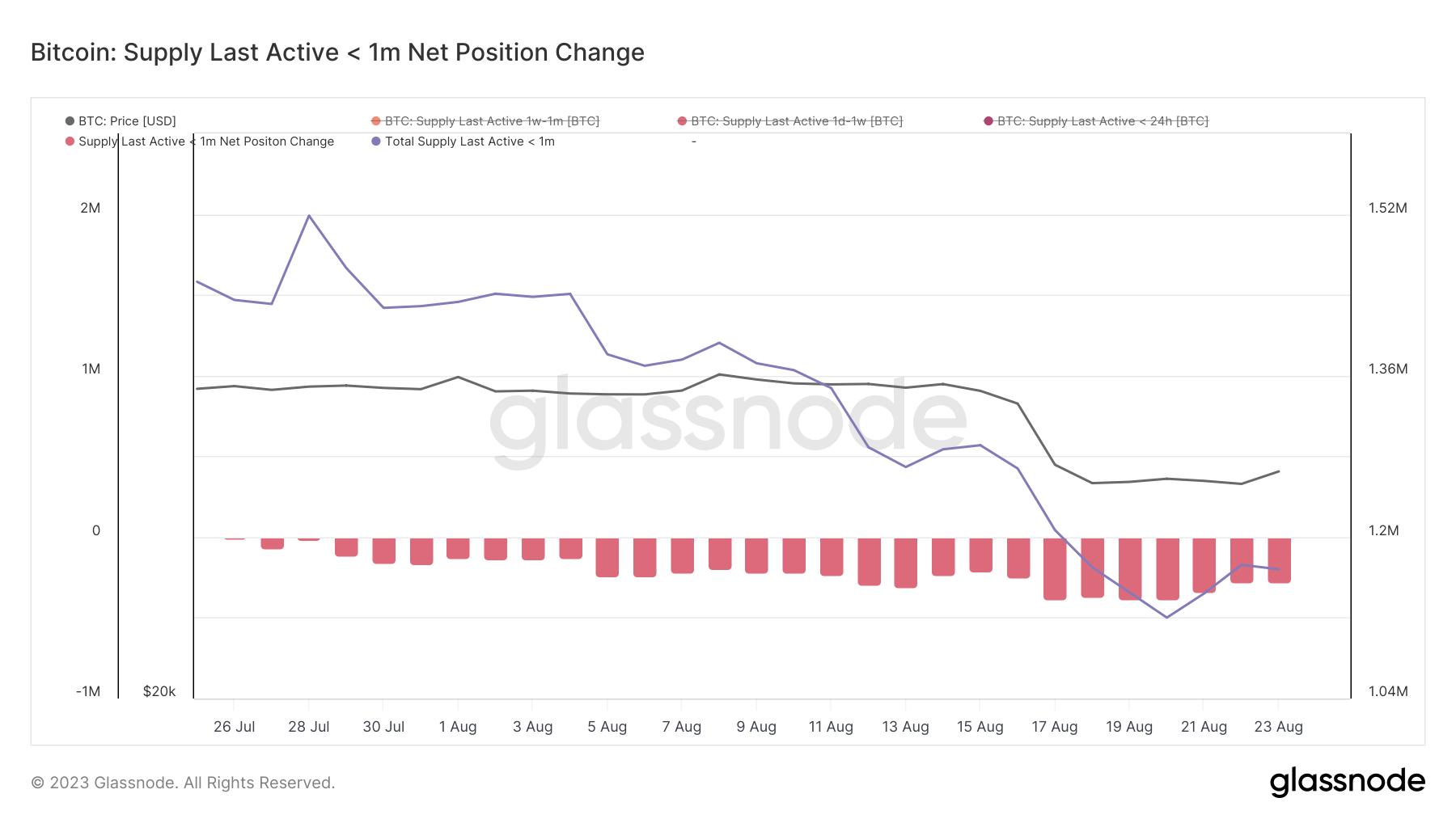

On Aug. 20, the full proviso of Bitcoin past progressive little than a period agone dropped to 1.12 cardinal BTC. This represents a notable diminution from the 1.28 cardinal BTC it recorded connected Aug. 14. During that time, Bitcoin’s terms dropped from $29,400 to $26,200.

Graph showing the full proviso of Bitcoin past progressive little than a period agone successful August 2023 (Source: Glassnode)

Graph showing the full proviso of Bitcoin past progressive little than a period agone successful August 2023 (Source: Glassnode)The accelerated diminution culminated successful the proviso reaching its lowest constituent successful 8 years.

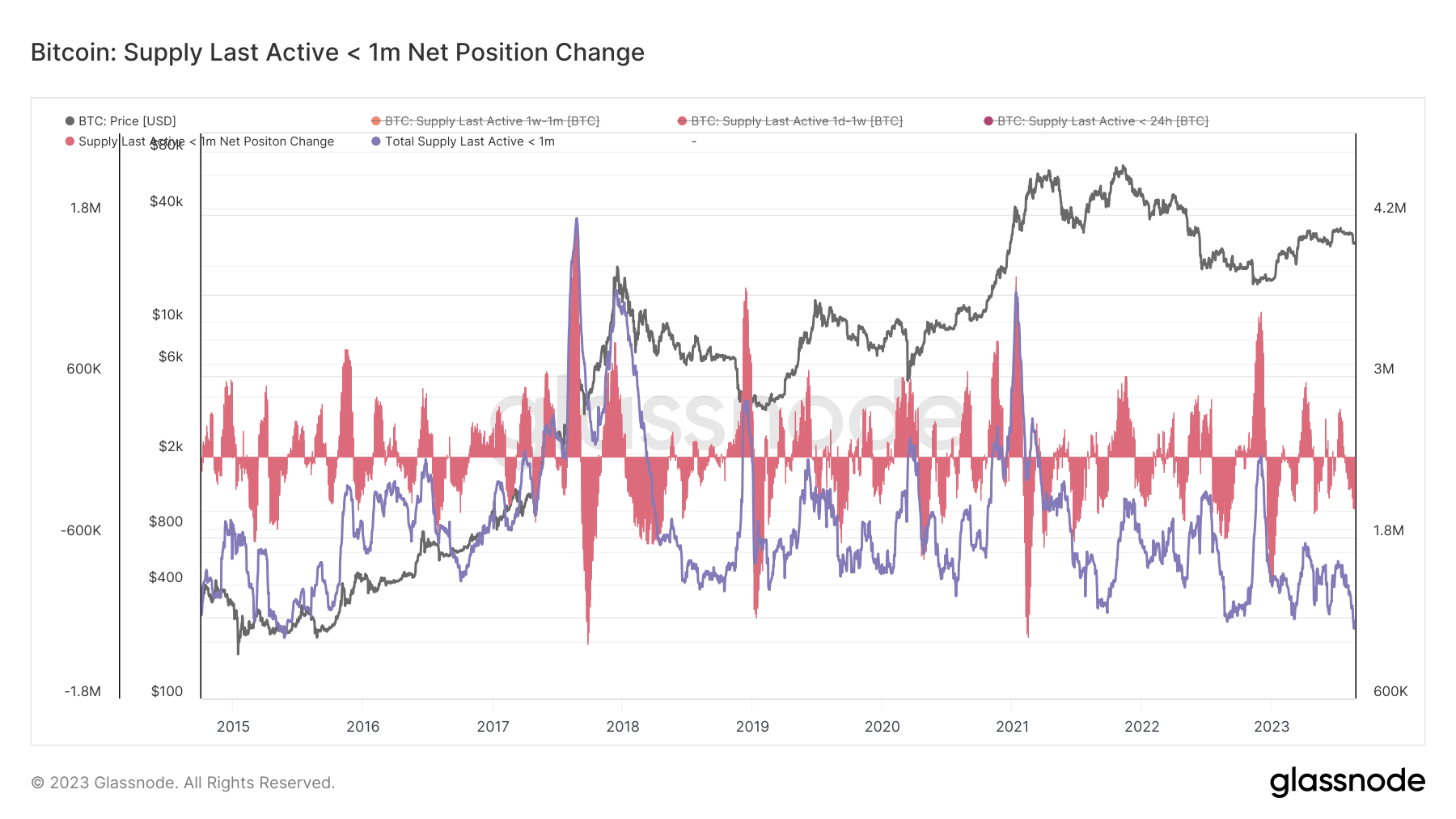

Graph showing the full proviso of Bitcoin past progressive little than a period agone from 2015 to 2023 (Source: Glassnode)

Graph showing the full proviso of Bitcoin past progressive little than a period agone from 2015 to 2023 (Source: Glassnode)Data from Glassnode further revealed that the proviso past progressive little than 3 months agone besides experienced a flimsy dip, moving from 2.79 cardinal BTC connected August 14th to 2.75 cardinal BTC by August 23rd.

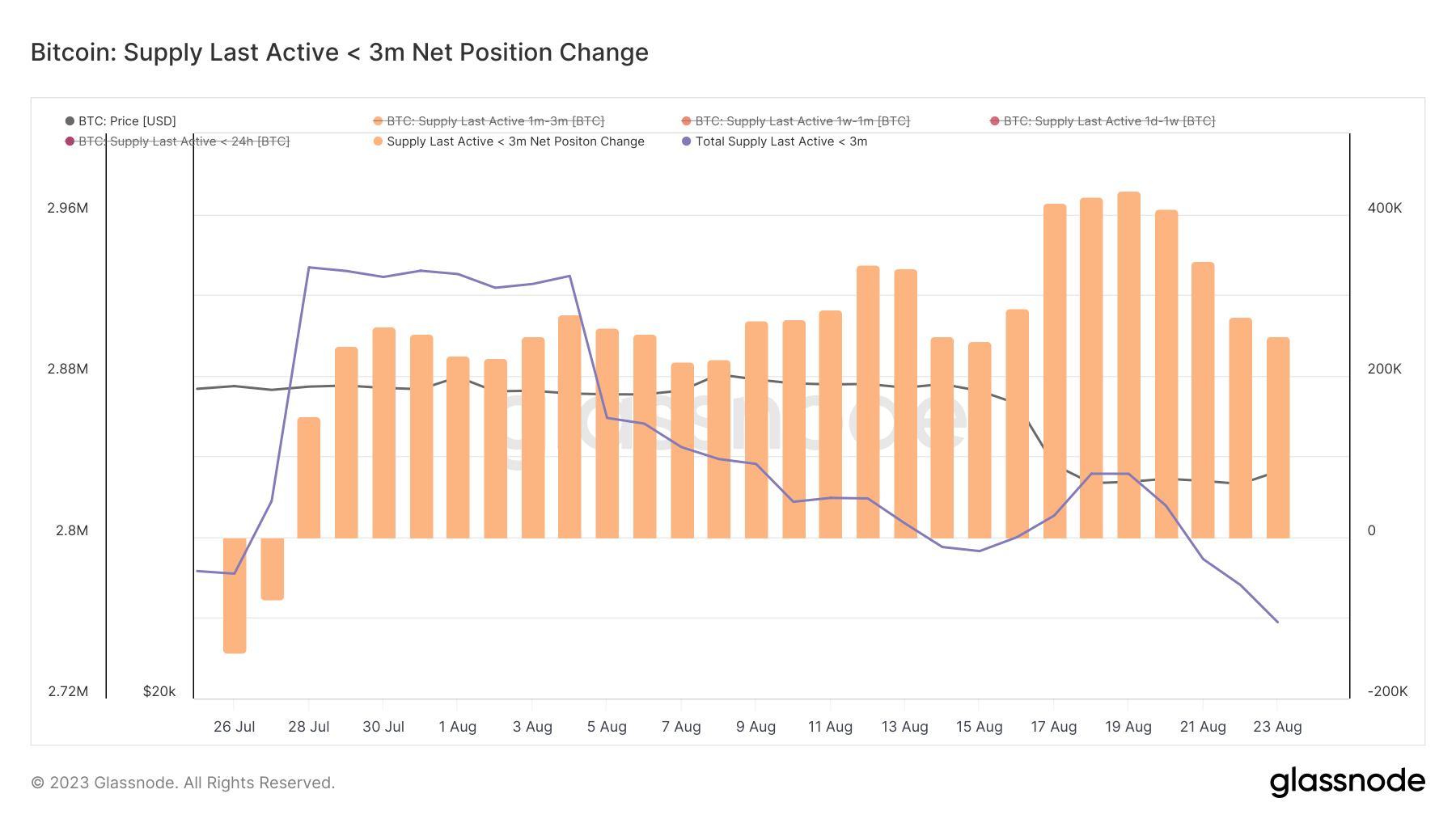

Graph showing the proviso past progressive little than 3 months agone successful August 2023 (Source: Glassnode)

Graph showing the proviso past progressive little than 3 months agone successful August 2023 (Source: Glassnode)Interestingly, the proviso past progressive much than 6 months agone remained comparatively stable, adjacent arsenic Bitcoin’s terms faced a slump. This stableness successful the longer-term progressive proviso suggests that portion short-term traders mightiness beryllium adjusting their positions, semipermanent holders stay unfazed by the terms fluctuations.

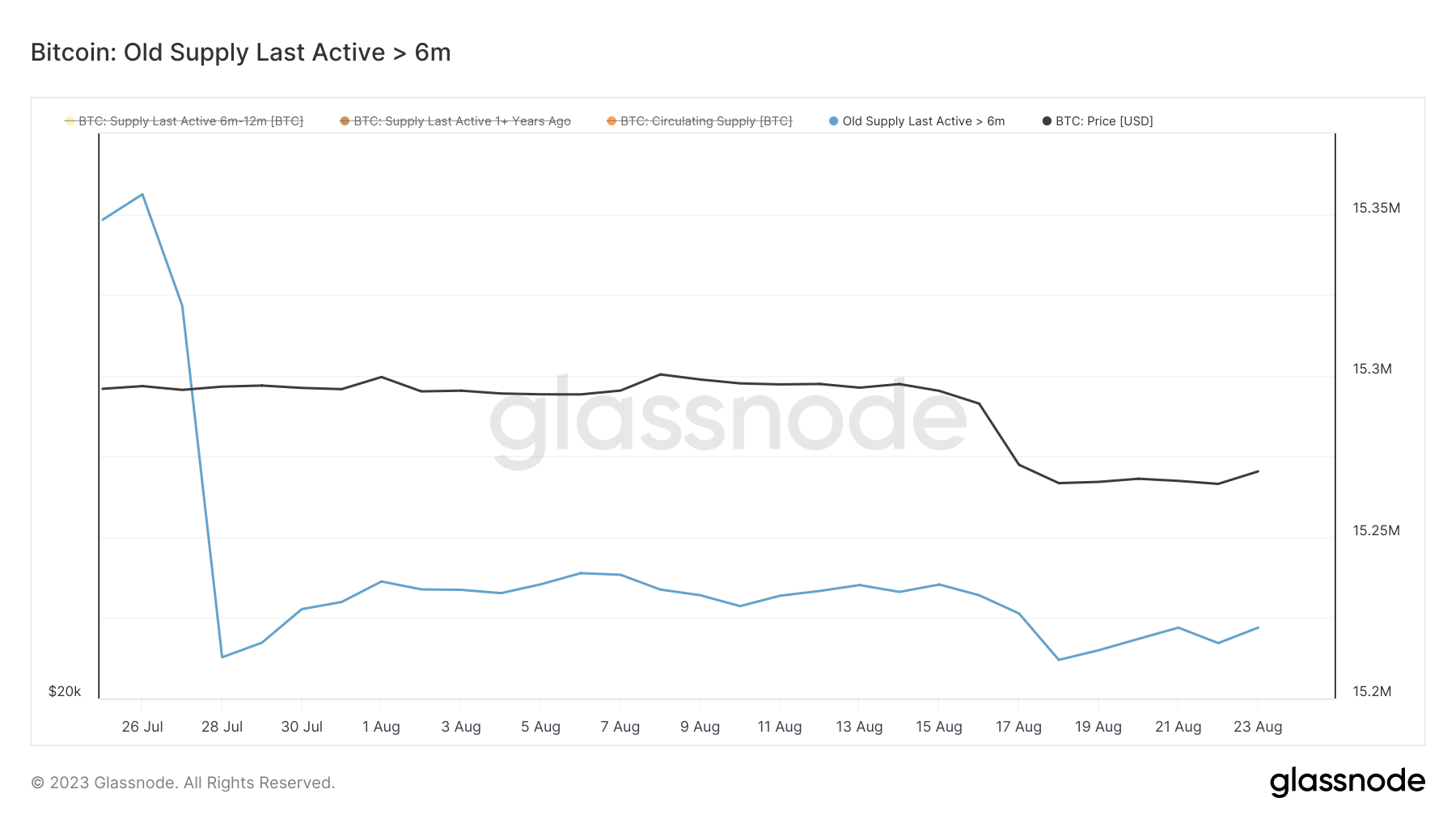

Graph showing the proviso past progressive much than 6 months agone successful August 2023 (Source: Glassnode)

Graph showing the proviso past progressive much than 6 months agone successful August 2023 (Source: Glassnode)The important alteration successful “hot coins” points to a alteration successful day-to-day trading activity. Fewer coins moving suggests that traders and investors are moving from actively transacting with BTC to holding the coins.

In 2023, the marketplace has seen a wide correlation betwixt the alteration successful the proviso of these blistery coins and drops successful Bitcoin’s price. Conversely, an summation successful this proviso often correlated with an summation successful Bitcoin’s price.

The existent inclination of decreased Bitcoin enactment could beryllium interpreted successful respective ways. It mightiness suggest a stabilization successful the market, with less participants actively trading BTC. It could besides suggest marketplace stagnation, with imaginable traders sitting connected their BTC awaiting clearer signals earlier making moves.

However, determination person been immoderate anomalies successful this trend.

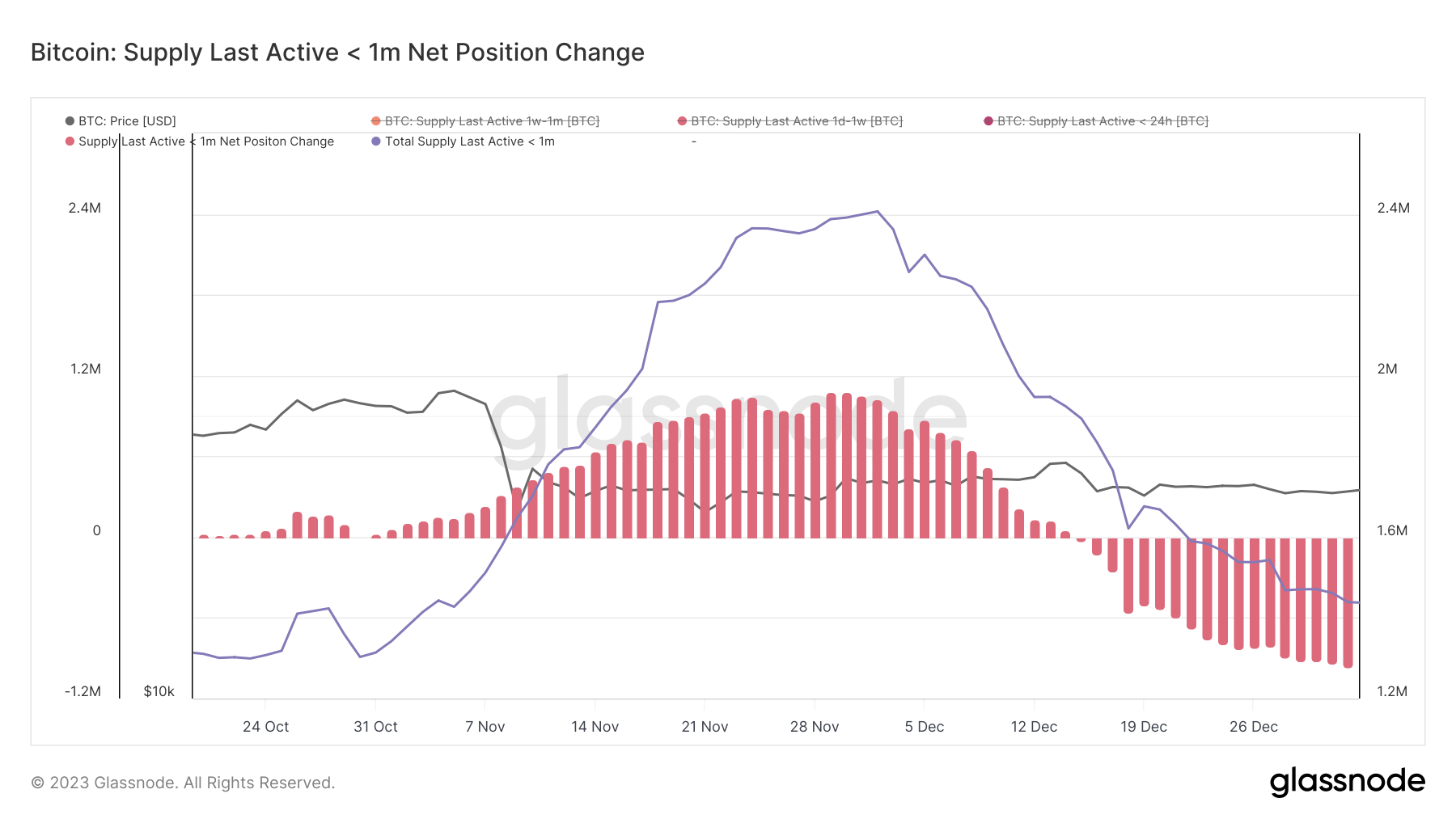

November 2022 saw a interruption successful this correlation during the illness of FTX. At the time, a crisp surge successful blistery coins occurred portion Bitcoin’s terms saw a important downturn.

Graph showing the full proviso of Bitcoin past progressive little than a period agone from October 2022 to December 2022 (Source: Glassnode)

Graph showing the full proviso of Bitcoin past progressive little than a period agone from October 2022 to December 2022 (Source: Glassnode)The information that blistery coins surged during this clip could bespeak panic selling and a unreserved to determination funds retired of FTX and related platforms, starring to a crisp spike successful activity. As the terms continued dropping contempt the summation successful proviso movement, it could bespeak a prevailing antagonistic sentiment and deficiency of assurance successful the marketplace astatine the time.

The station Bitcoin’s astir progressive proviso hits 8-year low appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)