Bitcoin (BTC) has been trading successful an excruciatingly choky scope conscionable beneath $120,000, but the rally is rapidly losing momentum arsenic the marketplace enters what has historically been a brushed period for the crypto, a study from 10x Research warned.

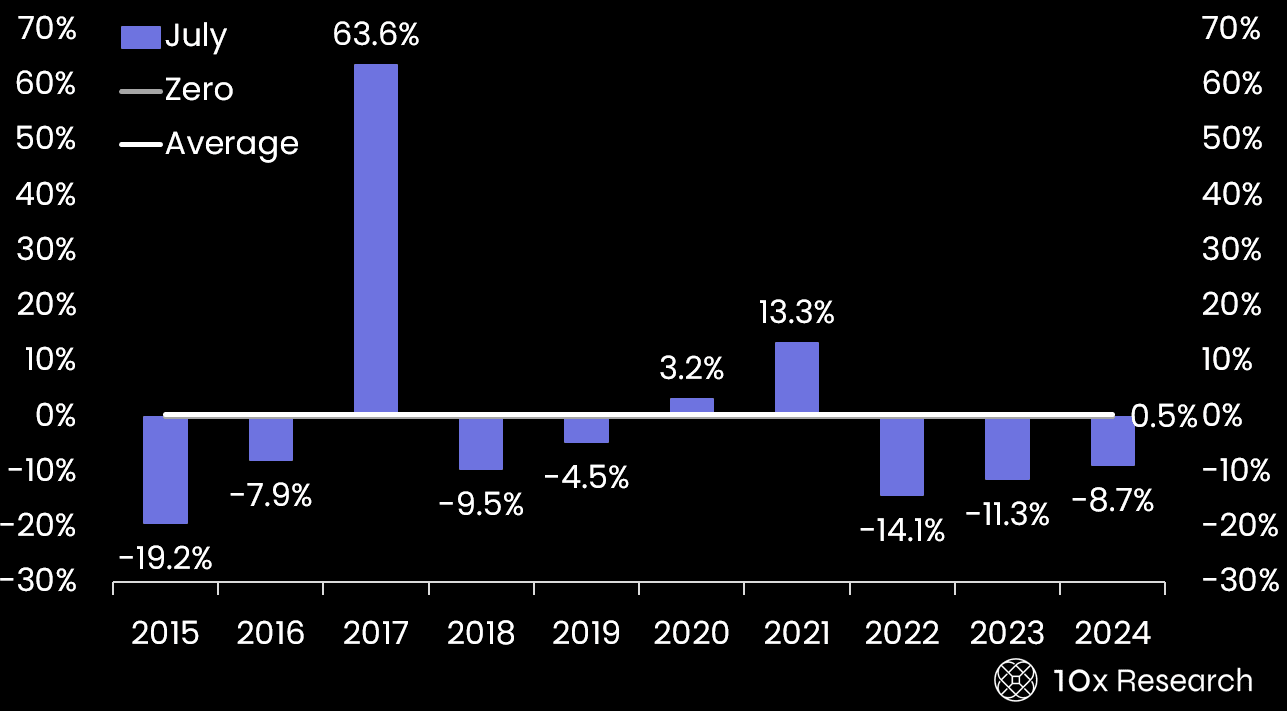

August has been bitcoin's weakest period implicit the past decade, with lone 3 affirmative years and others delivering 5–20% losses, the study noted.

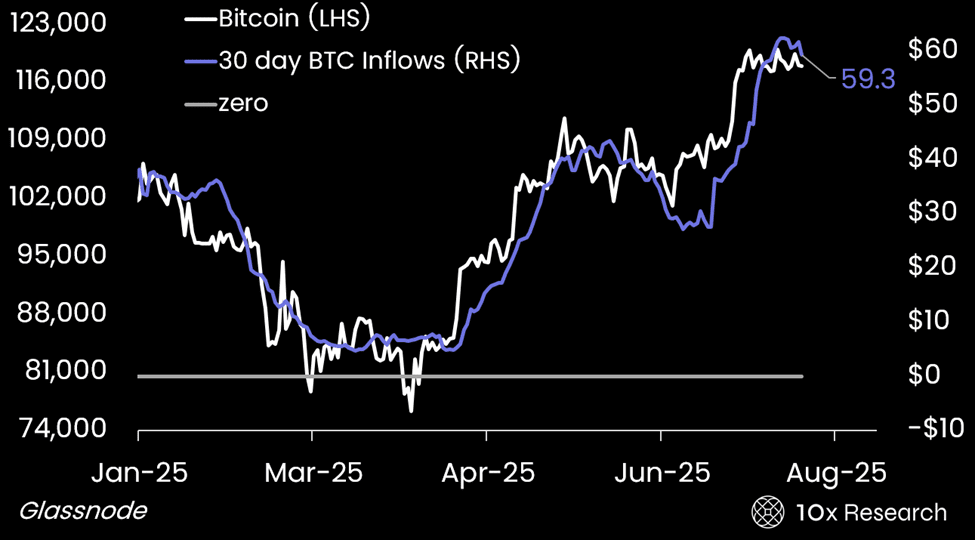

The study besides flagged a slowdown successful superior flows into the Bitcoin network, a cardinal operator of terms enactment this year. Total cumulative inflows into the web present transcend $1 trillion, with $206 cardinal arriving successful 2025.

But the 30‑day rolling mean slipped from $62.4 cardinal to $59.3 billion, that could people the commencement of a consolidation phase, the study said, mirroring past peaks successful this metric similar successful Q1 and Q4 2024.

“Time is moving short, and contempt billions successful superior inflows from firm treasuries, the existent terms interaction has been amazingly muted,” wrote Markus Thielen, co-founder and pb expert astatine 10x. “This raises the anticipation that adjacent with continued support, the marketplace whitethorn autumn abbreviated of delivering the benignant of upside galore are hoping for.”

The study forecasts a apt interruption beneath $117,000, with enactment astatine $112,000 and a deeper level astir the $106,000–$110,000 threshold.

Still, BTC bulls whitethorn cling to the anticipation that the outlier August gains happened successful 2013, 2017 and 2021, during Bitcoin's post-halving years coinciding with roaring bull markets.

And 2025 mightiness beryllium a twelvemonth conscionable similar those.

Read more: BTC Faces Golden Fibonacci Hurdle astatine $122K, XRP Holds Support astatine $3

3 months ago

3 months ago

English (US)

English (US)