The alleged $100,000 <a href="https://www.coindesk.com/markets/2024/12/02/xrp-replaces-tether-as-3rd-largest-cryptocurrency-while-btc-faces-384-m-sell-wall" target="_blank">sell wall</a> for bitcoin (BTC} is becoming a hard seed to crack, with $384 cardinal disposable for merchantability betwixt the existent terms and that six-figure milestone. A look astatine the proviso data, though, suggests gathering unit for an upward move.

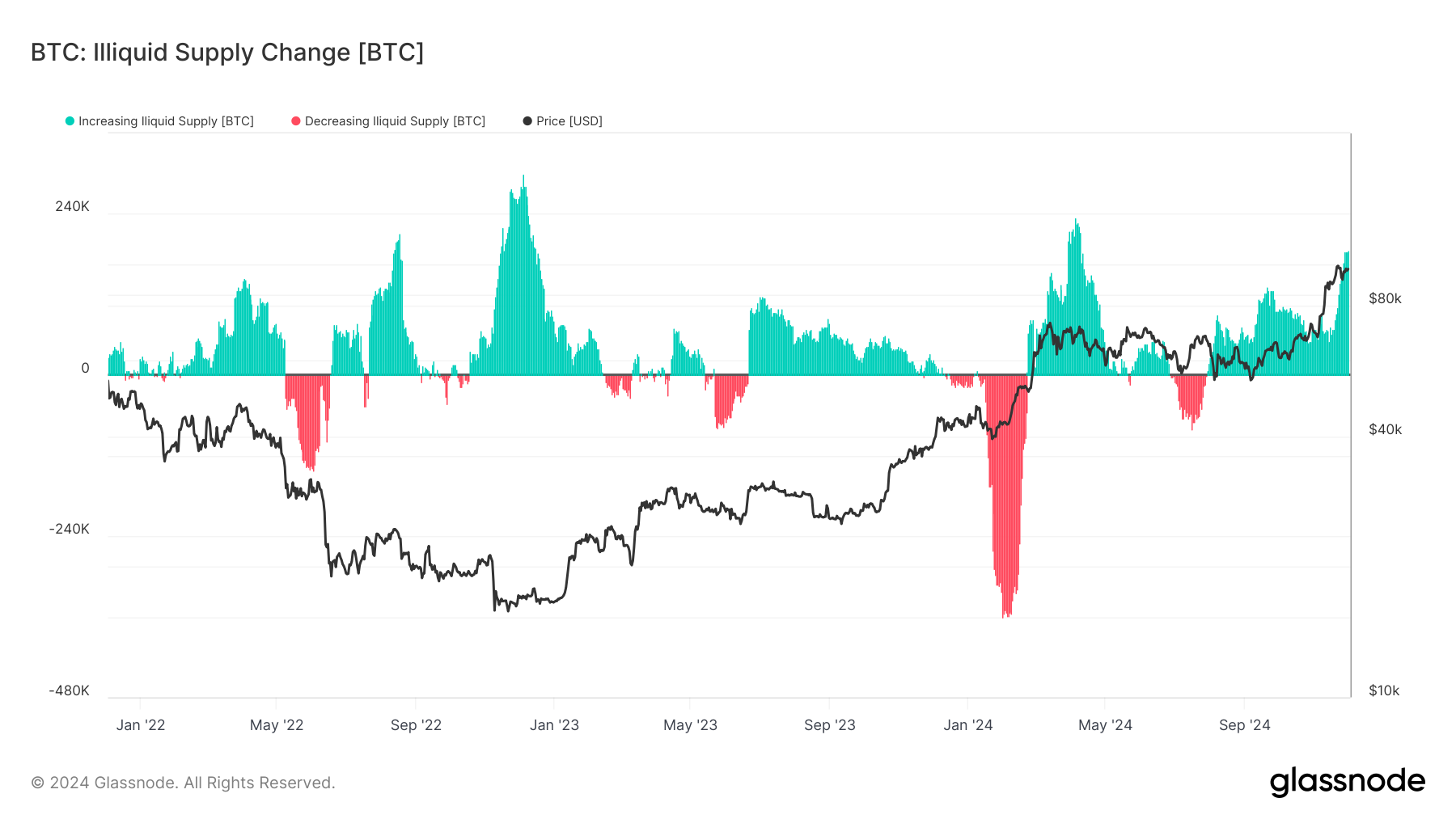

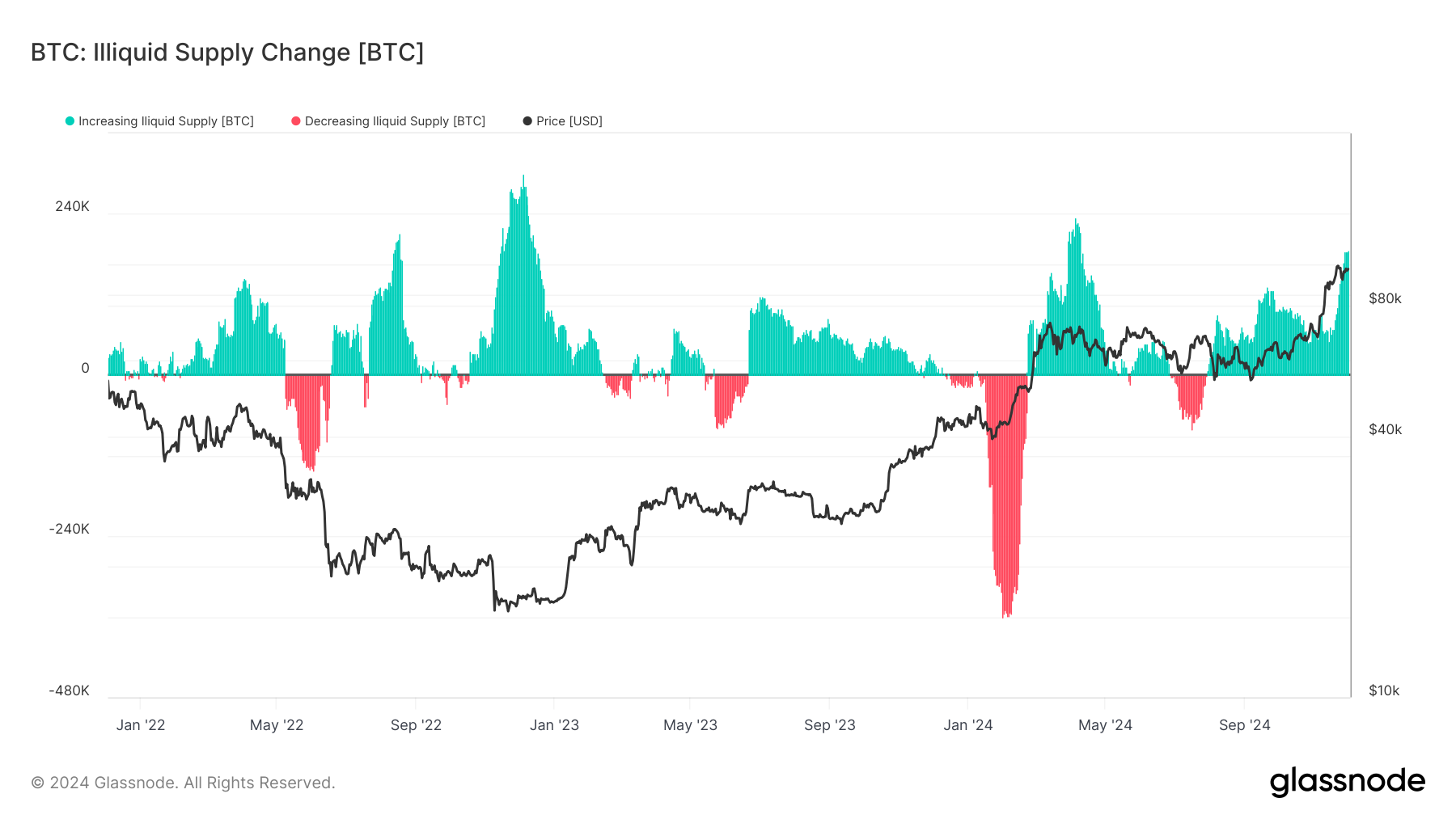

"Illiquid supply" refers to the magnitude of bitcoin that is owned by semipermanent holders (LTHs) that is not actively traded. According to Glassnode data, illiquid proviso has risen by much than 185,000 tokens implicit the past 30 days and deed an all-time precocious of 14.8 cardinal BTC, oregon 75% of the full circulating proviso of conscionable nether 20 cardinal (only 21 cardinal bitcoin tin ever exist). That 185,000 is the 2nd highest 30-day alteration this twelvemonth and suggests the main behaviour for investors astatine the infinitesimal is holding not trading.

Previous probe by <a href="https://www.coindesk.com/markets/2024/11/26/bitcoin-long-term-holders-have-163-k-more-btc-to-sell-history-indicates-van-straten" target="_blank">CoinDesk</a> shows that income by LTHs are approaching their end. Since Nov. 26, LTHs arsenic a radical person been accumulating, adding much than 2,000 BTC to their stacks. This could mean that the play of realizing profits is coming to an extremity for this cohort, perchance taking further merchantability unit from the market.

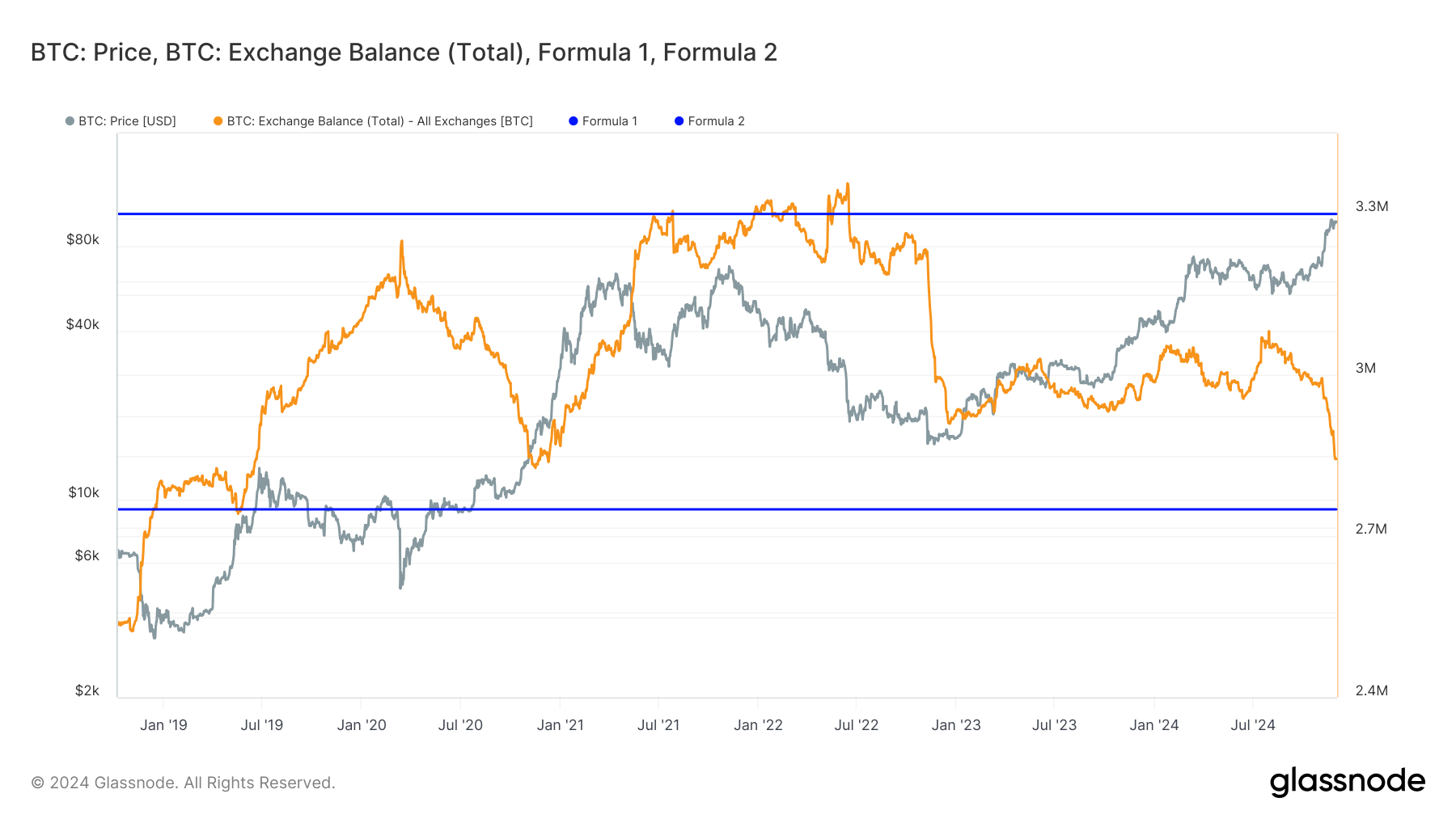

Coins are rapidly leaving exchanges

Since the opening of this latest bull tally successful aboriginal November, bitcoin tokens person been exiting exchanges astatine a accelerated rate. This has ended a astir two-year inclination of bitcoin connected exchanges astatine astir dependable levels, an encouraging motion of further capitalist demand.

Zooming retired implicit a five-year period, however, shows a somewhat little encouraging representation arsenic bitcoin connected exchanges remains successful a comparatively constrictive scope of 2.7 cardinal to 3.3 cardinal tokens.

For a much sustainable bull run, BTC volition request to support leaving exchanges — a motion of continuing capitalist appetite alternatively than request from the derivatives broadside which is simply a often motion of leverage.

"Bitcoin's illiquid proviso has reached a caller all-time precocious portion speech balances deed a caller multi-year low," <a href="https://x.com/Andre_Dragosch/status/1863449513848877120" target="_blank">said Andre Dragosch</a>, caput of probe astatine Bitwise. "Almost 75% of proviso is deemed 'illiquid' portion little than 14% of proviso remains connected exchanges," helium continued. "Bitcoin's proviso scarcity continues to intensify."

8 months ago

8 months ago

English (US)

English (US)